Hey there! If you've ever been curious about the underwriting process, you're in the right place. Underwriting is a crucial step in evaluating risk and determining the terms of financial agreements, and understanding it can empower you in your financial journey. So, let's dive deeper into what an underwriting review notification entails and how it can impact your plansâread on!

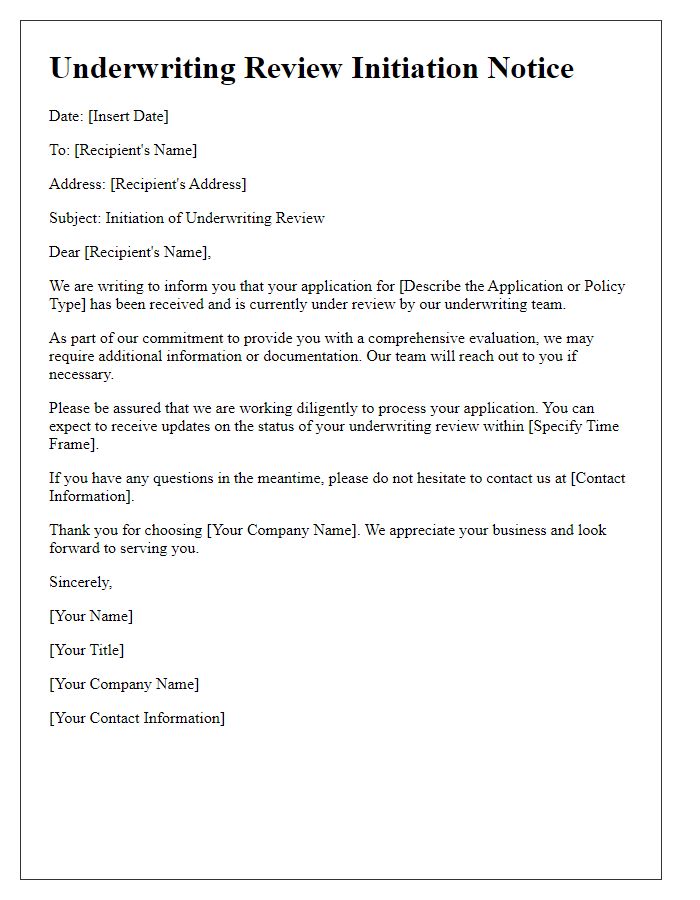

Subject Line and Greeting

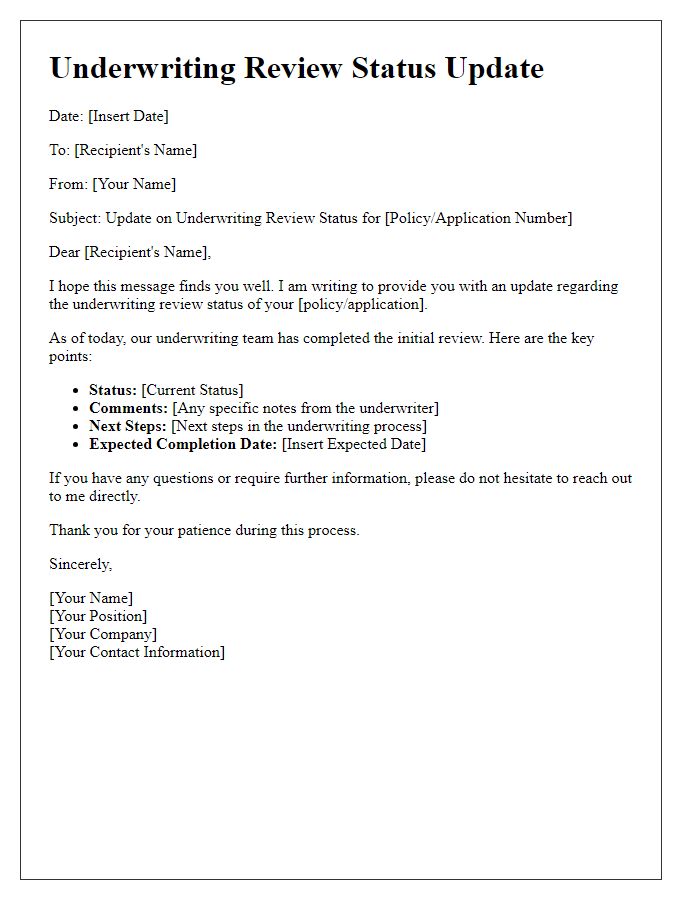

Underwriting review notifications are crucial for maintaining transparency during the loan or insurance application process. The subject line should succinctly convey the message's purpose, such as "Important: Underwriting Review Notification for Your Application." A professional greeting could begin with "Dear [Applicant's Name]," adding a personal connection to the communication while maintaining formality. This sets an appropriate tone for discussing sensitive financial matters, ensuring recipients feel informed and respected throughout their review process.

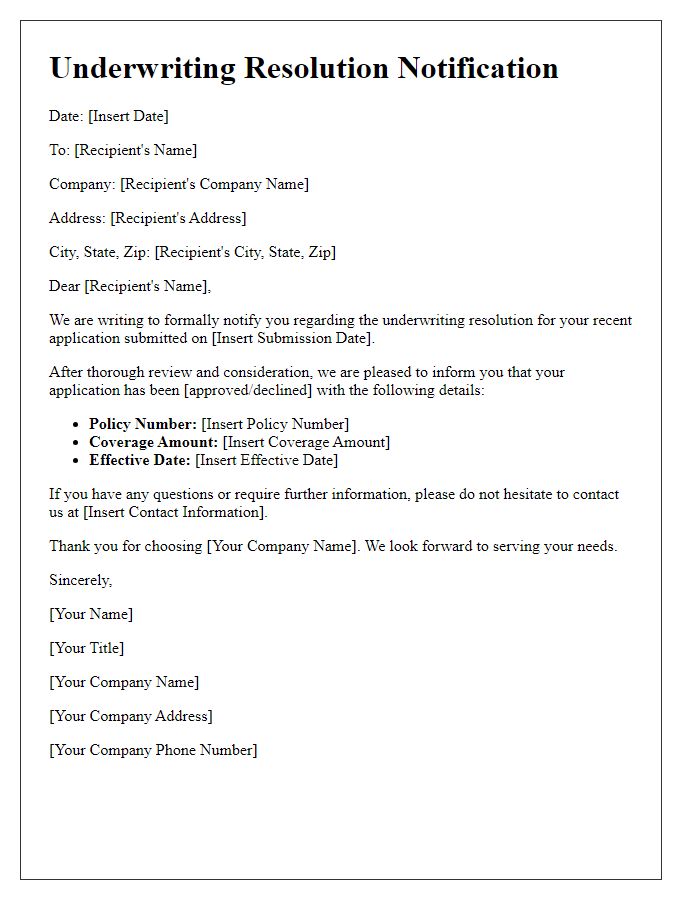

Purpose of the Notification

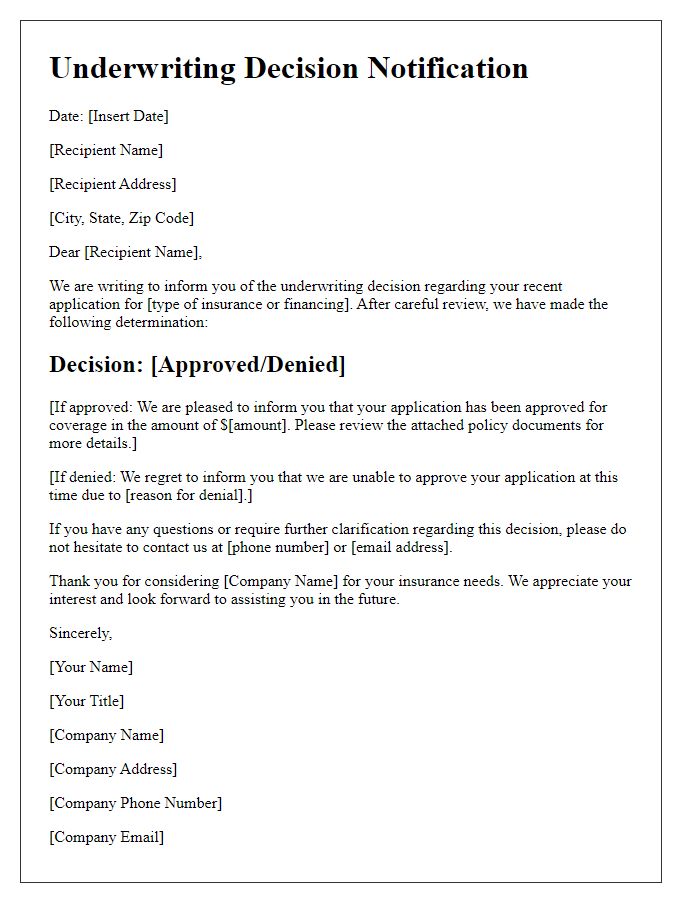

Underwriting review notifications are crucial in the insurance industry, specifically during the policy evaluation process. This notification informs applicants of the status of their underwriting applications, which typically involves an assessment of risk and eligibility for coverage. Various factors are considered during this review, including the applicant's medical history, financial stability, and lifestyle choices, all essential for determining appropriate premiums. This communication is particularly important in sectors such as life insurance or health insurance, where timely responses can significantly impact the applicant's peace of mind and financial planning. Clear notifications help maintain transparency, promote positive relationships between insurers and clients, and facilitate efficient processing of applications.

Review Findings and Details

The underwriting review findings detailed a comprehensive analysis of the applicant's financial profile, including credit score metrics, debt-to-income ratios, and asset evaluations. The review process, which took place over two weeks, involved scrutinizing documentation such as bank statements, tax returns from the previous three years, and employment verification letters. Key metrics highlighted include a credit score of 720, which is considered good (above the industry standard of 620), and a debt-to-income ratio of 28%, falling below the recommended threshold of 36%. Additional information from local real estate market trends indicates a stable appreciation rate of 5% annually for properties in the applicant's area, which is favorable for overall investment viability. The findings will influence the final decision on approval and terms of the loan.

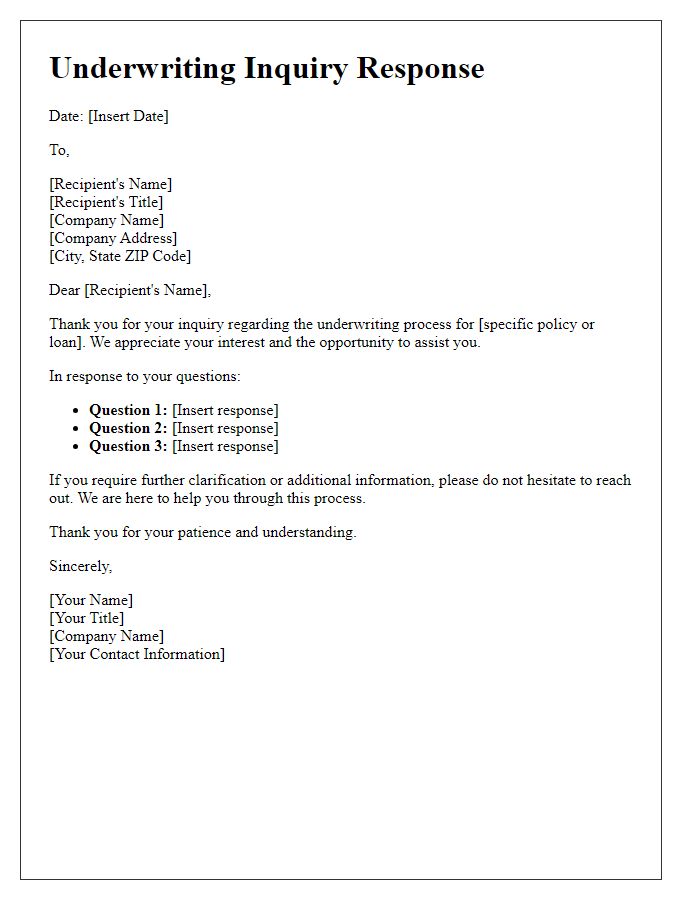

Necessary Actions or Next Steps

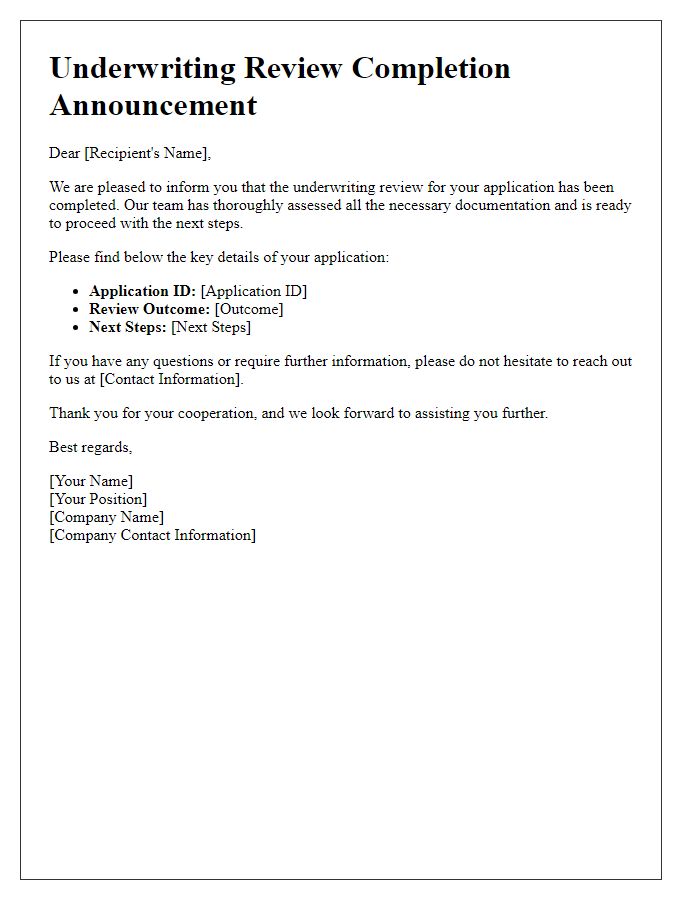

Underwriting review notifications require a clear outline of actions and next steps for borrowers, particularly those applying for mortgage loans or insurance policies. Effective communication should include essential details about the underwriting process, typically lasting 5-10 business days, and highlight any required documentation such as proof of income or asset statements. Notifications should specify potential contingencies, like the need for further appraisal evaluations in real estate transactions, which may impact loan approval timelines. Additionally, borrowers should be informed about the importance of maintaining communication with their assigned underwriter, often located at a regional office, to address inquiries that may arise during the review process. Finally, notify borrowers about the final decision, expected resolution timelines, and the potential for appeals in case of unfavorable outcomes.

Contact Information and Closing Remarks

Underwriting review notifications serve as crucial communication in the lending process. These notifications often contain essential contact information, including names, phone numbers, and email addresses of the underwriting team members. Accurate details facilitate prompt and effective communication between parties involved, such as borrowers and lenders. Closing remarks typically summarize the next steps in the underwriting process, including timelines for decisions or additional documentation requirements. A clear and concise notification can significantly enhance borrower understanding, reducing anxiety related to approvals or potential denials in high-stakes mortgage applications.

Comments