Are you feeling overwhelmed by unexpected interest charges on your financial statements? You're not aloneâmany people face this frustrating situation, and understanding how to effectively seek reimbursement can make a significant difference. In this article, we'll guide you through a simple letter template designed to address interest overcharges, ensuring you approach the matter with clarity and confidence. Ready to reclaim what's rightfully yours? Let's dive into the details!

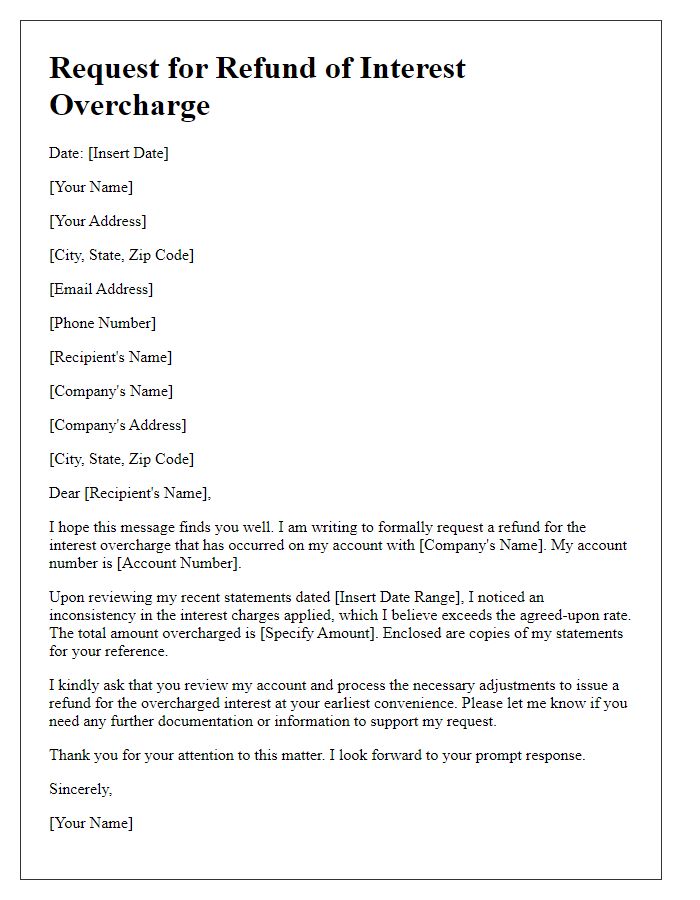

Account Information

Account information regarding interest overcharge reimbursement typically includes critical details such as the account number associated with the loan, client's name, contact information (address, email, phone number), and the date of the initial loan agreement. Specific instances of overcharges should be documented, including dates of transactions, amounts overcharged, and supporting documents like billing statements or payment history. It is essential to reference relevant financial regulations, such as the Truth in Lending Act, which governs interest rate disclosures, ensuring compliance and transparency in the reimbursement request process.

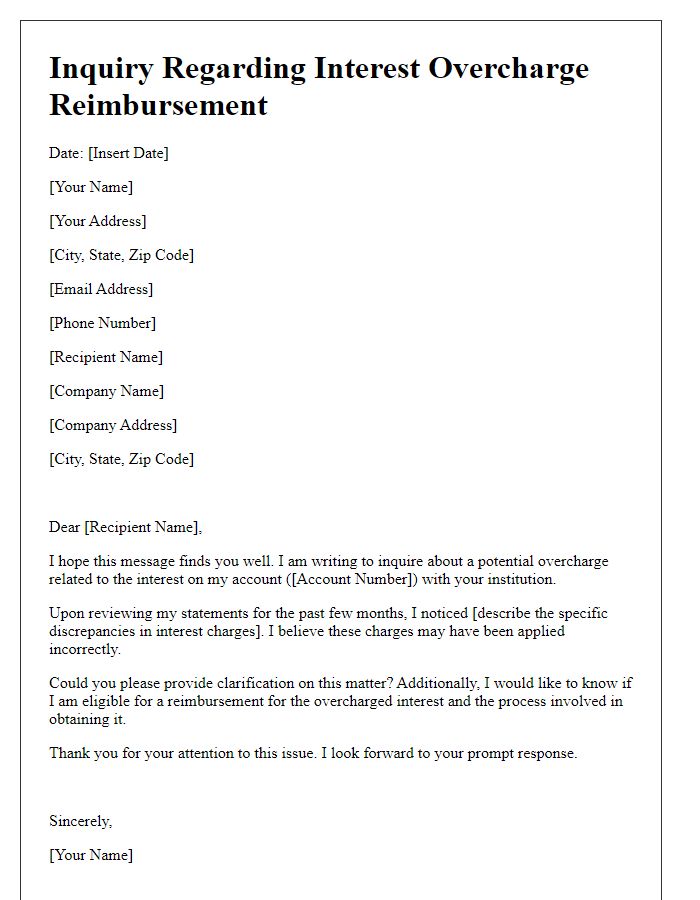

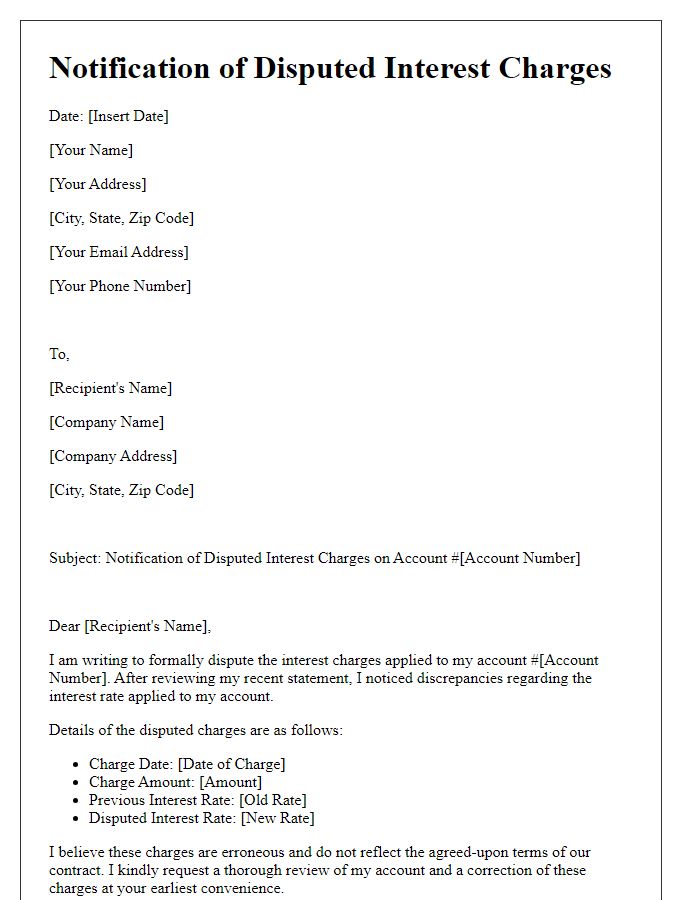

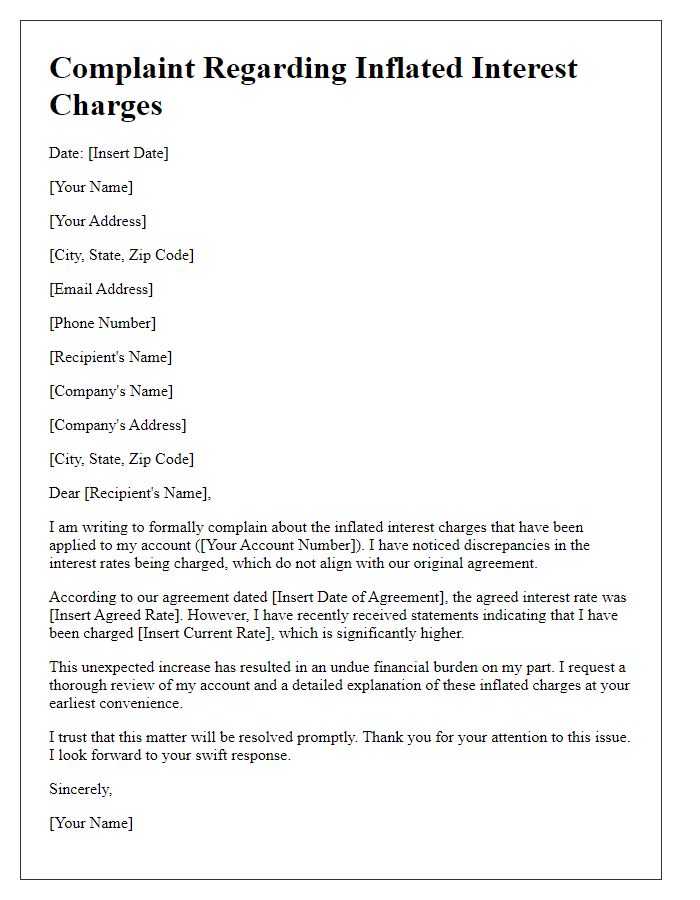

Overcharge Details

Interest overcharge reimbursement often arises from discrepancies between billed interest rates and actual agreements made with financial institutions. For example, if a borrower receives a credit card bill indicating a 25% annual interest rate but their original agreement specified 20%, this 5% discrepancy represents an overcharge. Institutions like Bank of America or Wells Fargo can generate these overcharges, especially if their billing systems miscalculate due dates or fail to account for timely payments. Such overcharges can accumulate substantially over time, with example cases showing amounts ranging from $50 to over $2,000, depending on the amount borrowed and the duration of the overcharge. Consumers in these situations should gather documentation, including statements and agreements, to support their claims effectively during the reimbursement process.

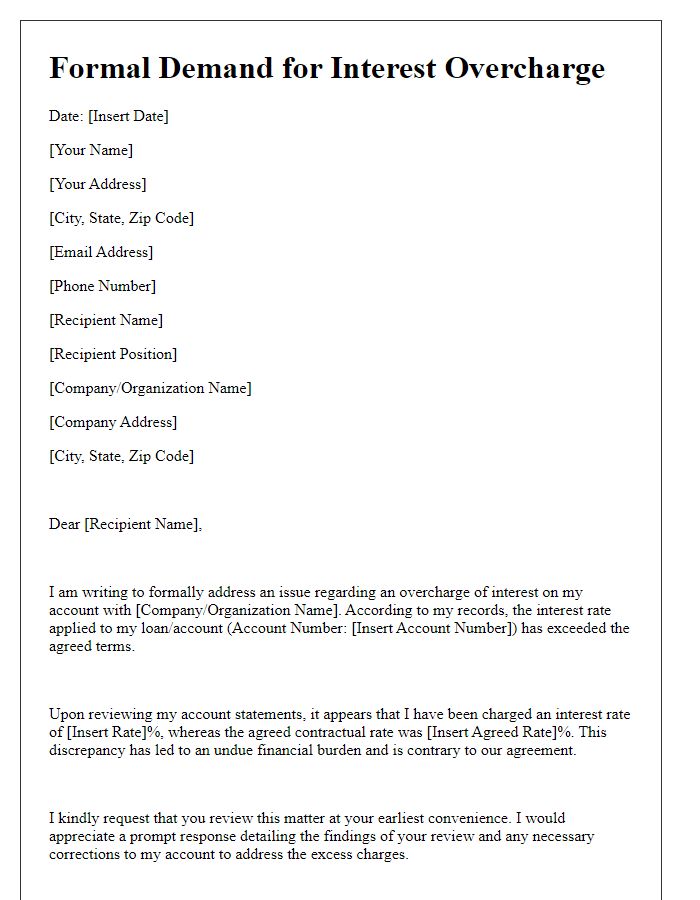

Legal References

Interest overcharge reimbursement claims often rely on established legal frameworks to support consumers seeking restitution. Various statutes, such as the Truth in Lending Act (TILA), govern the disclosure of loan terms, including interest rates, protecting borrowers from misleading practices. Additionally, state laws may regulate interest rate limits, commonly referred to as usury laws, which cap the maximum permissible interest rate lenders can charge, typically ranging from 6% to 36% depending on jurisdiction. Cases like **Brown v. Lee**, highlight the enforcement of these laws, showing courts' willingness to restore consumers' rights against unjust charges. Financial entities must adhere to accurate reporting and transparent communication regarding fees and interest, failing which they may face legal actions for breaches under the Fair Debt Collection Practices Act (FDCPA). Documentation, such as payment receipts and loan agreements, serve as essential evidence when pursuing a reimbursement claim in both informal negotiations and formal legal settings.

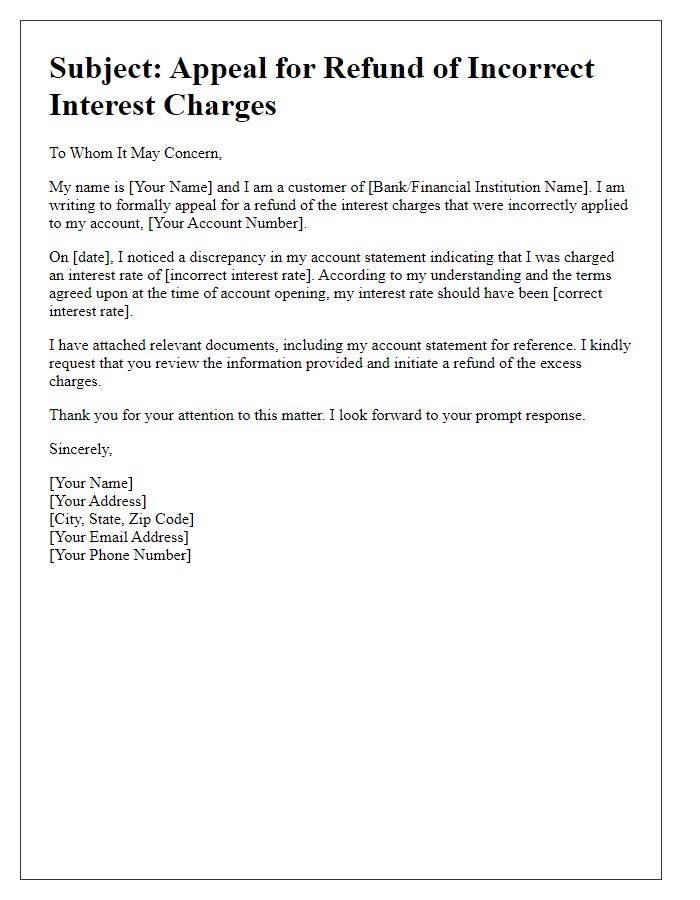

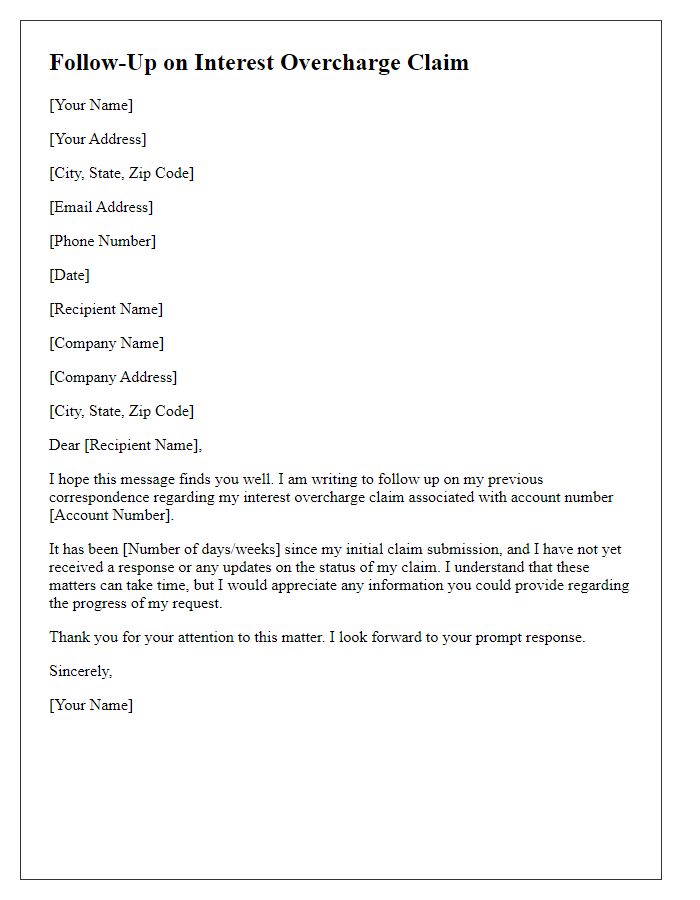

Requested Action

The request for interest overcharge reimbursement arises when financial institutions inadvertently charge excessive interest on loans or credit accounts. In 2022, a borrower found that their credit card issuer, XYZ Bank, imposed an interest rate of 29.99%, exceeding the agreed-upon rate of 24.99%. The total overcharge amounted to $350 over six months, significantly impacting the individual's financial situation. Documentation, including account statements from January to June, illustrates the discrepancies and supports the reimbursement request. Contacting customer service or submitting formal complaints via regulatory bodies can expedite the resolution process and ensure the accurate application of interest rates according to initial agreements.

Contact Details

Interest overcharge reimbursement requests require specific details to ensure a smooth process. Relevant account information includes account number (typically 10-12 digits), dates of overcharges (specific billing statements or transaction dates), and a breakdown of the overcharged amounts (itemized list totaling the reimbursement figure). It is essential to include personal identification such as name, address (including city and state), and contact information (phone number and email) to facilitate communication. Additionally, documentation such as billing statements (showing discrepancies) may be necessary to support the claim.

Comments