Are you wondering how to navigate the process of requesting a refund from your escrow account? It can feel a bit overwhelming, but understanding the steps can make it much simpler. In this article, we'll break down everything you need to know about writing an effective letter for your escrow account refund, ensuring you have all the necessary details covered. So, grab a cup of coffee and let's dive into the essential tips and templates that will help you secure your funds with ease!

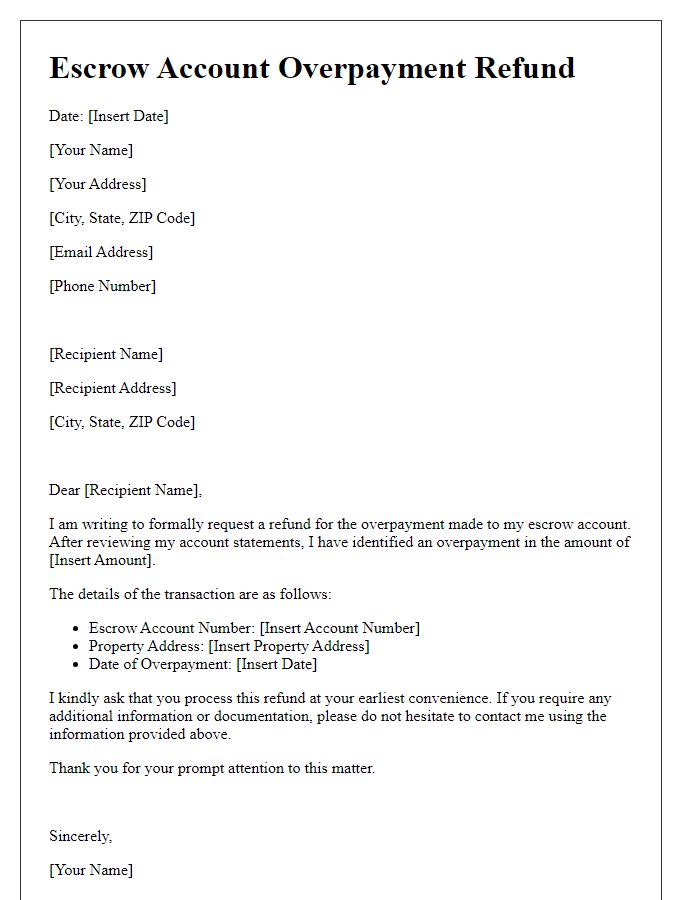

Reason for Refund Request

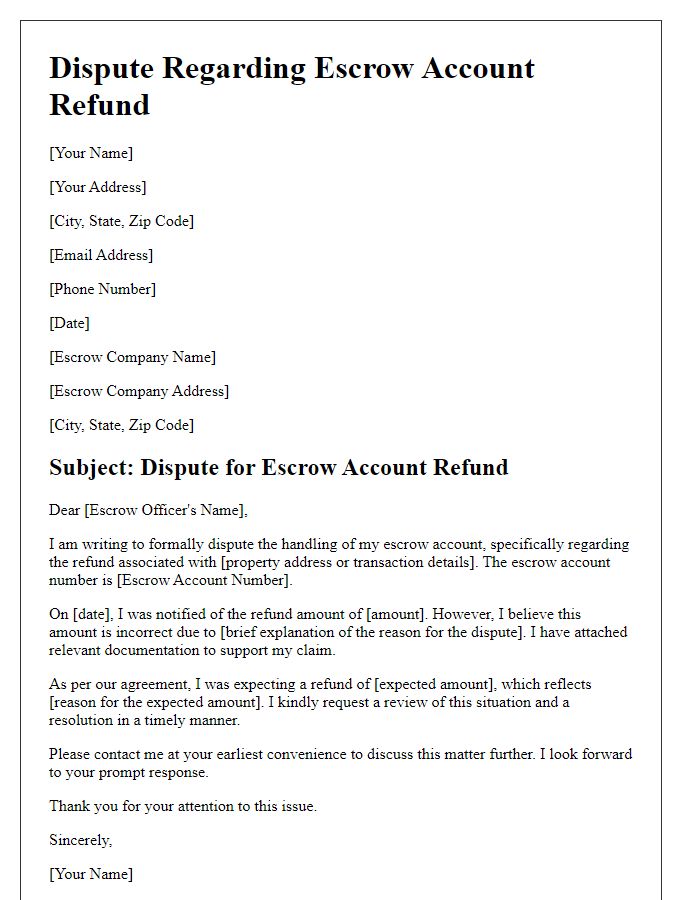

Escrow accounts, often utilized in real estate transactions, may require refunds under various circumstances such as contract disputes, transaction failures, or premature escrow closures. For instance, if a buyer withdraws from a purchase agreement before the closing date, funds held in the escrow account (potentially ranging from thousands to hundreds of thousands of dollars) may need to be returned to the buyer. In cases of disputes, mediation may occur, and if resolved favorably, a portion or the entirety of the escrow funds may be refunded. Additionally, if an inspection reveals significant issues (e.g., structural damage exceeding $15,000), the buyer can request the release of funds for repairs or to cover a portion of the costs. Statutory regulations often dictate the timelines and procedures for processing refunds, typically requiring completion within a specified period (often 30 days).

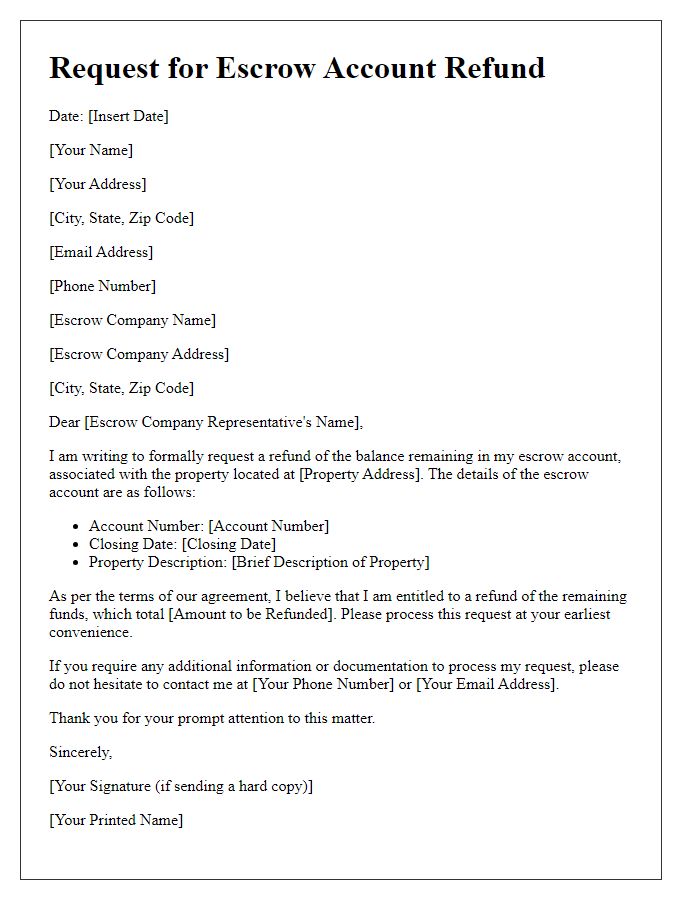

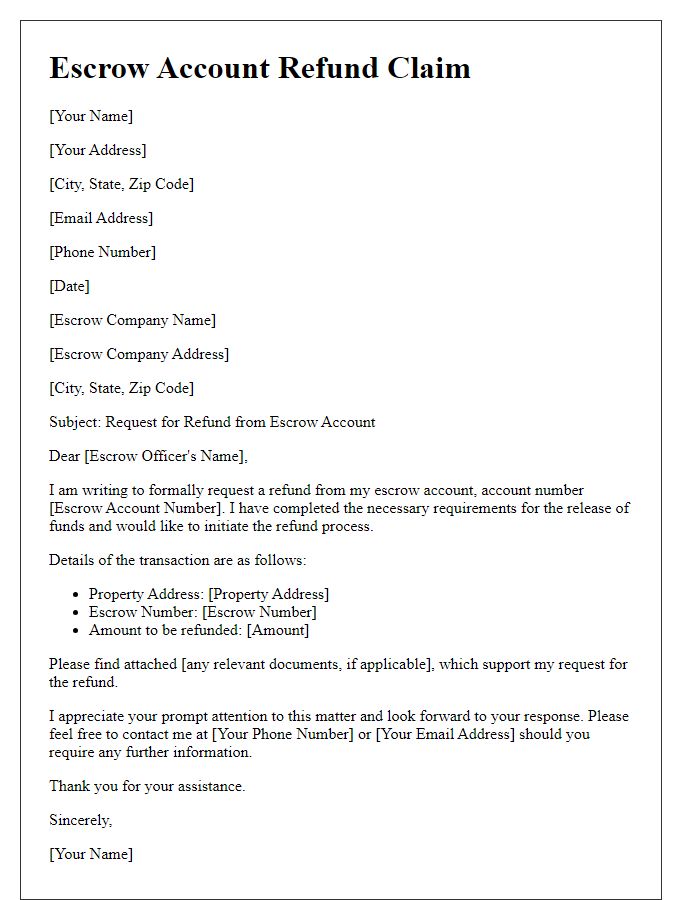

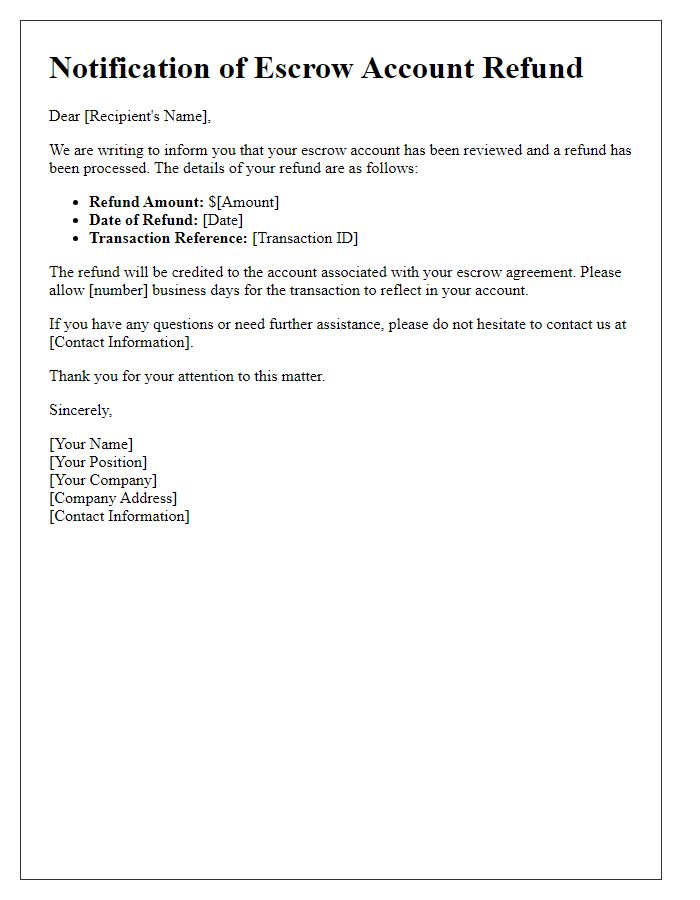

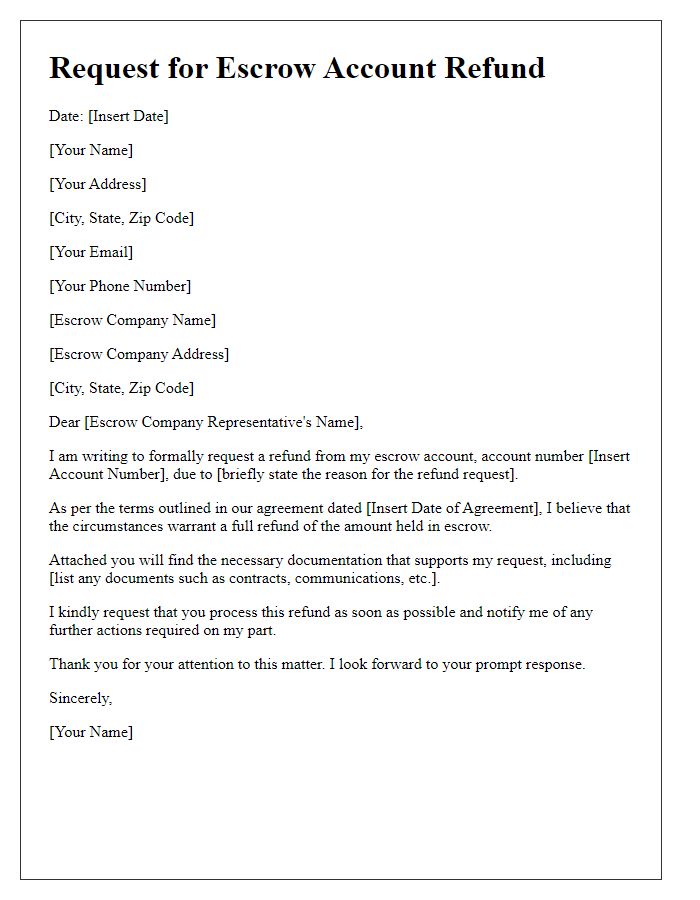

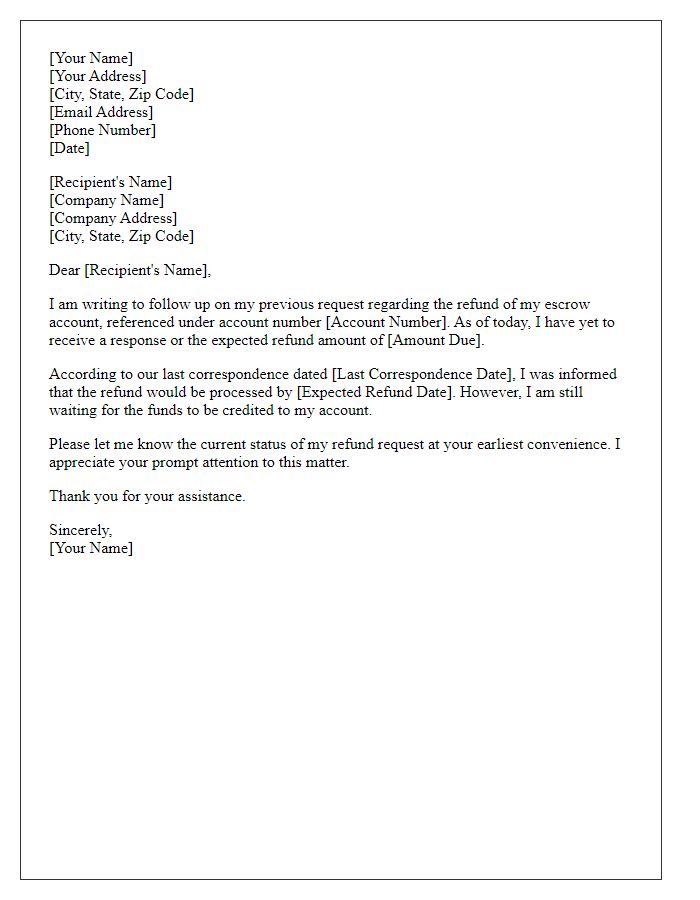

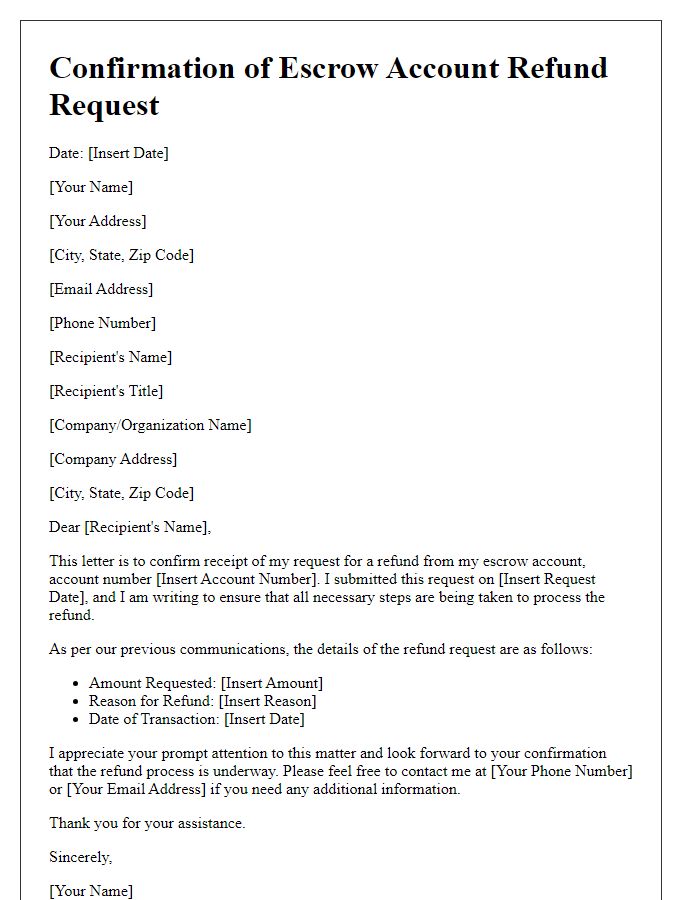

Escrow Account Details

An escrow account serves as a financial arrangement where a third party holds funds during a transaction, often related to real estate or online sales. In the scenario of a refund, the specific details of the escrow account, including account number, transaction date (such as the date of the initial deposit), parties involved (the buyer and seller), and the amount held in escrow need to be highlighted. The refund process often requires verification of terms and conditions set forth at the time of the transaction. Documentation, such as the agreement outlining the escrow terms, may also be necessary to facilitate the return of funds, ensuring compliance with legal standards and protecting the interests of all parties involved.

Amount Requested

An escrow account refund involves returning funds held in trust, often related to real estate transactions, security deposits, or purchase agreements. The requested amount typically corresponds to the surplus funds after obligations have been met, such as purchasing or selling a property in a specific location, like Los Angeles, California. For example, if an escrow account held $10,000 for a housing transaction and the final costs amounted to $8,000, a refund of $2,000 is requested. Ensuring all parties agree on the terms, including timelines and conditions for the refund, is crucial for a smooth resolution. Providing supporting documentation like closing statements or receipts may be necessary to facilitate the refund process.

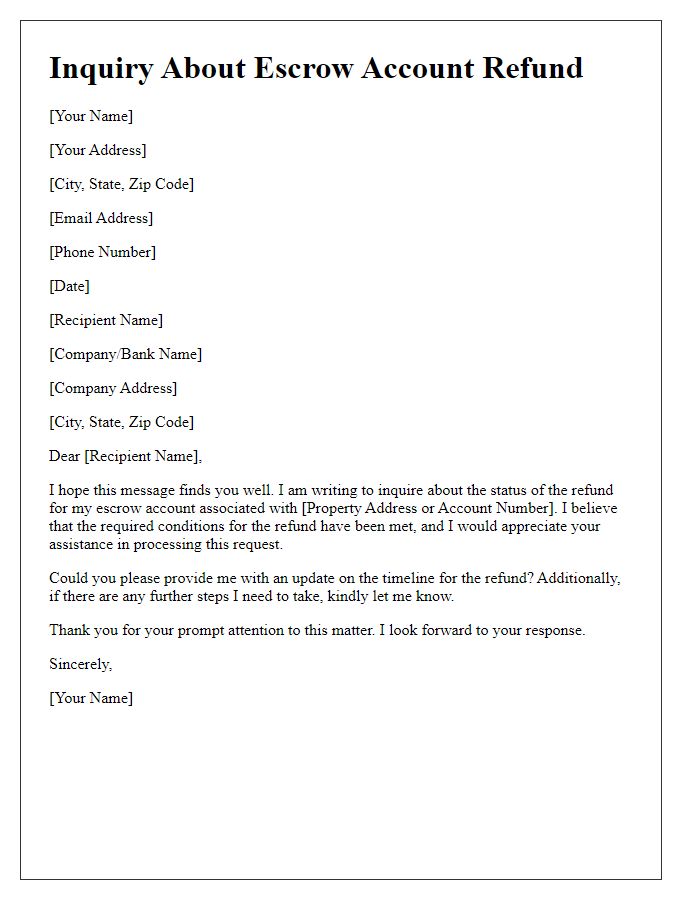

Contact Information

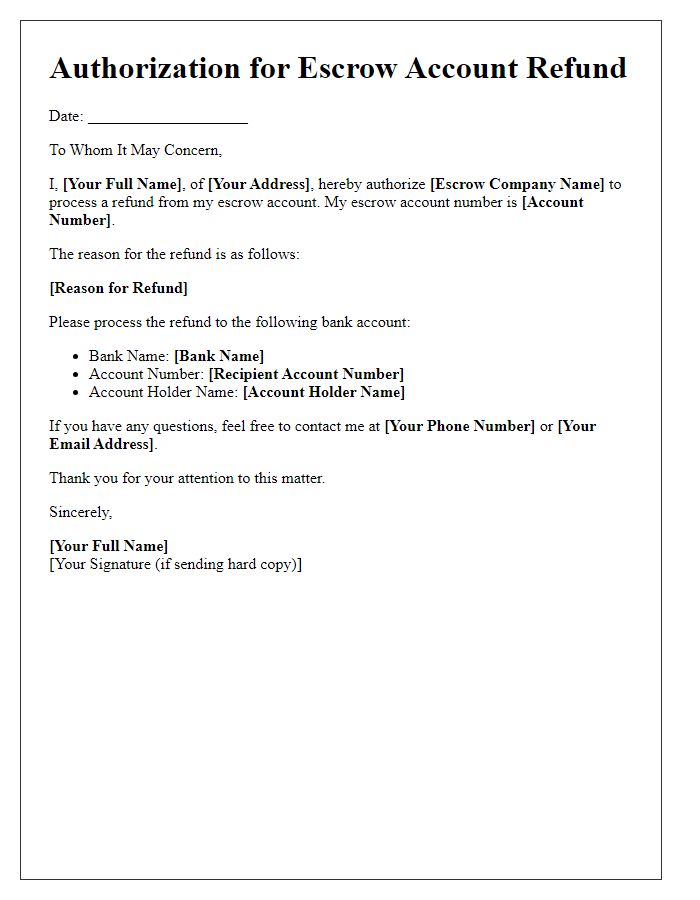

An escrow account refund process involves the retrieval of funds that were held in trust, typically influenced by real estate transactions or other contractual agreements. The initial account holder's information, usually comprising full names, addresses, and contact numbers, must be clearly outlined for processing. The escrow company, often a designated third party, also requires specific details, including the company's name, address, and contact person. Providing the original escrow agreement date and transaction ID ensures accurate identification of the funds held. Additionally, relevant bank account information for the refund deposit, such as account numbers and routing details, is essential to facilitate a smooth transaction and avoid delays with financial institutions.

Signature and Authorization

An escrow account refund process often requires specific documentation, including a signature and authorization to release funds. This process typically involves providing the escrow agent (a neutral third party managing the funds) with verification of identity and a formal request for fund disbursement. Typically, documents include a signed request form detailing the amount to be refunded and account information, including account number and transaction reference. Notarization may also be required for further verification, ensuring the legitimacy of the request. Timely responses from all parties involved can expedite the refund process, particularly in jurisdictions with specific regulatory requirements related to property transactions or financial settlements.

Comments