Tax season can be a stressful time for many, but understanding your tax assessment notice doesn't have to be. This important document outlines your property's assessed value and how it impacts your tax obligations, serving as a friendly reminder of your civic duties. Taking the time to review and comprehend your notice can help you avoid surprises and make informed decisions. If you want to dive deeper into how to navigate your tax assessment notice effectively, keep reading for our insightful tips and guidelines!

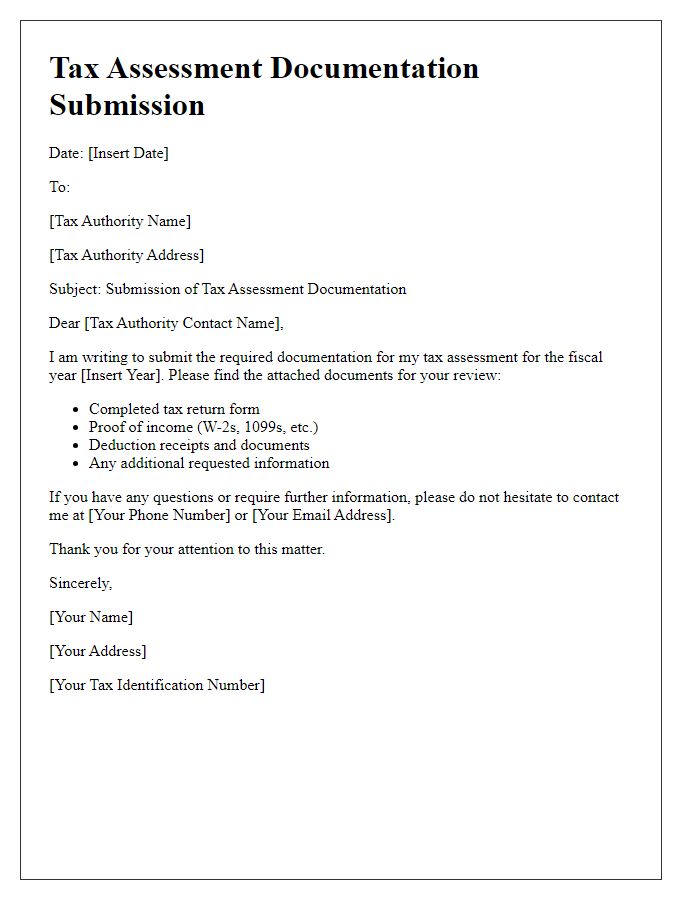

Header Information

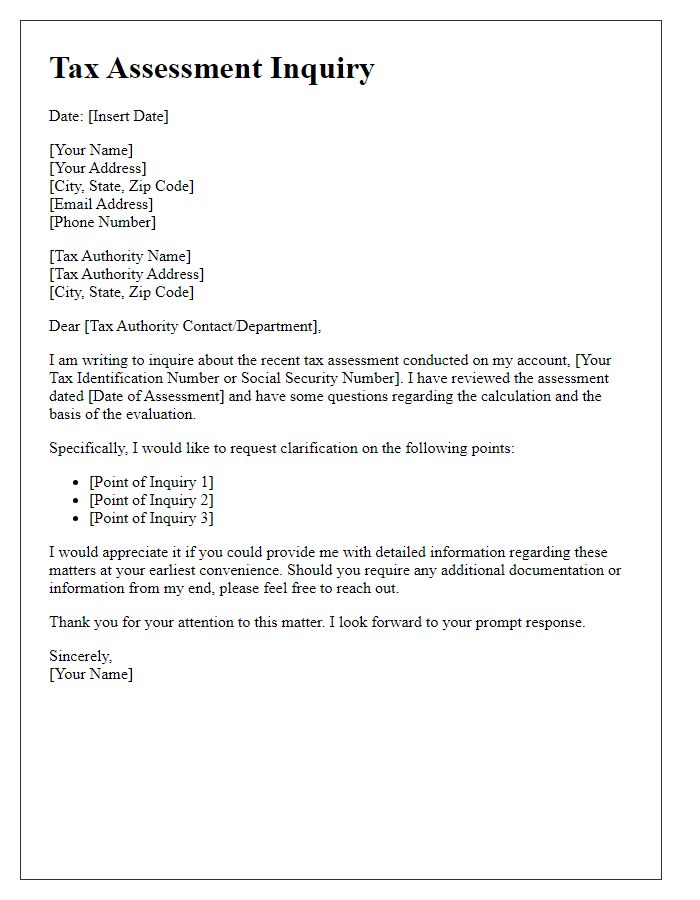

The tax assessment notice header typically contains essential information including the taxpayer's name, address, and identification number. It also features the tax authority's name (such as the Internal Revenue Service in the United States), along with their address and contact information for inquiries. The date of the notice is included to indicate when the assessment was issued. Additionally, the notice number or reference code may be present, facilitating easier tracking and correspondence regarding the specific assessment. The document often highlights the tax year or period being assessed for clarity.

Taxpayer Identification

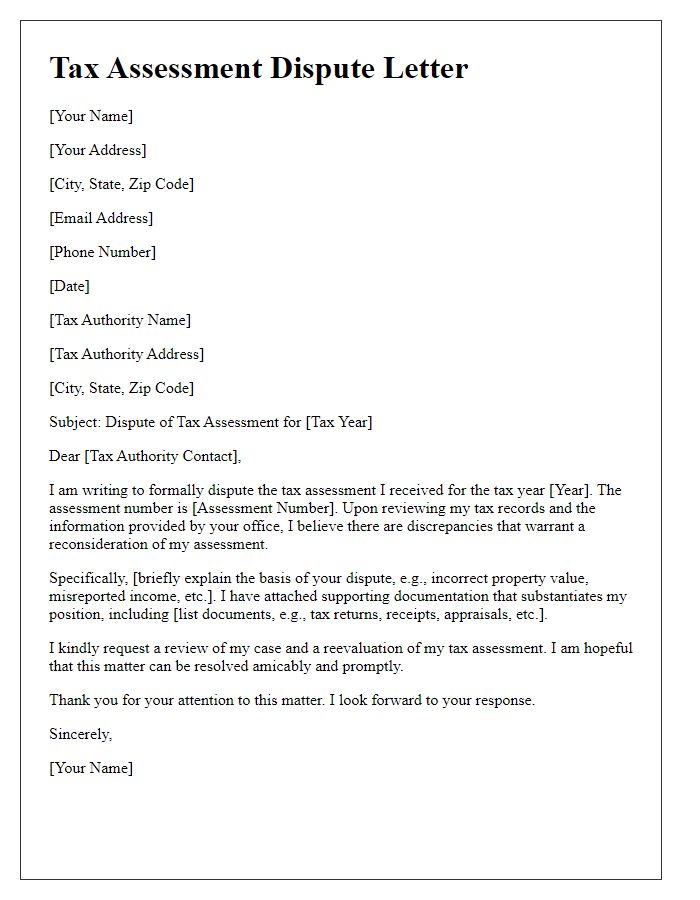

A tax assessment notice provides critical financial information relevant to individuals or entities regarding their tax liabilities. The document typically includes taxpayer identification numbers (TINs), which serve as unique identifiers in tax records. Taxpayer Identification Numbers can include Social Security Numbers (SSNs) for individuals or Employer Identification Numbers (EINs) for businesses. Details within the notice outline assessed values, taxable income figures, and applicable tax rates, reflecting local regulations in specific jurisdictions such as counties or states. Accurate verification of the TIN is essential to avoid discrepancies in tax filings. Timely acknowledgment of the assessment can prevent penalties or legal issues arising from noncompliance with tax obligations.

Assessment Summary

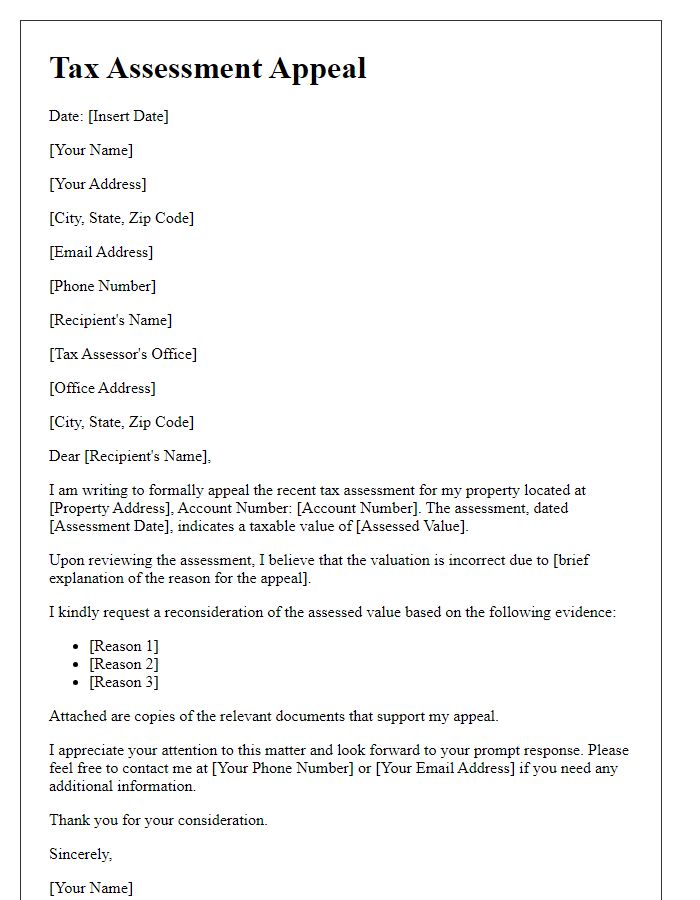

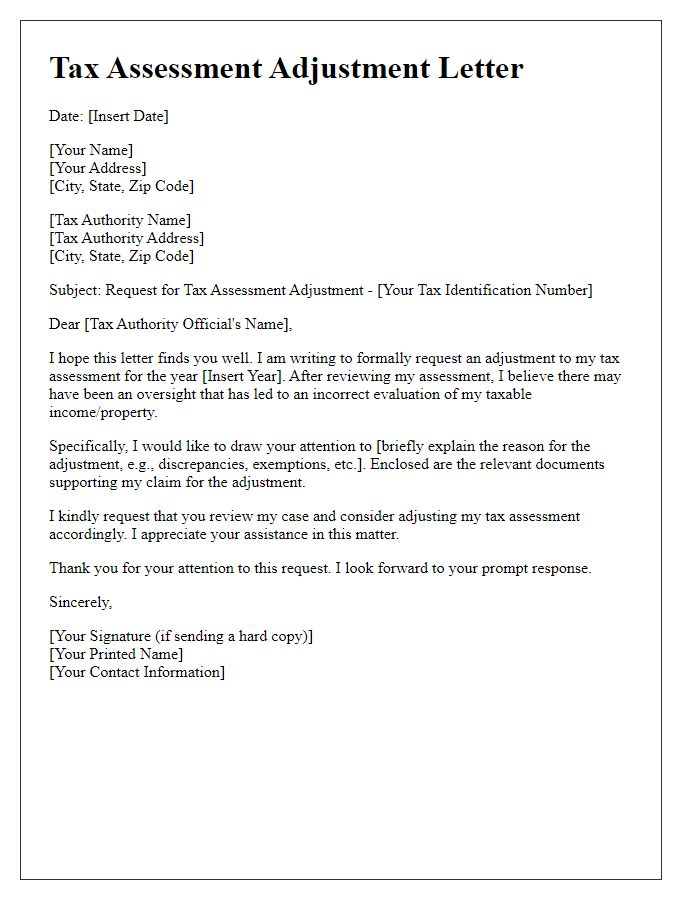

The Tax Assessment Notice provides essential information regarding an individual or entity's tax liability for the fiscal year. This summary includes the assessed income amount, deductions allowed, and taxable income figure, which can impact the overall tax obligation owed to local or federal authorities. Key dates, such as the filing deadline of April 15th for individuals in the United States, should be noted for compliance purposes. Additionally, penalties for late payments, typically around 5% of the unpaid tax per month, emphasize the importance of timely submissions. Understanding the nuances of tax brackets, which may range from 10% to 37% based on income levels, is crucial for accurate financial planning and assessment agreement processes.

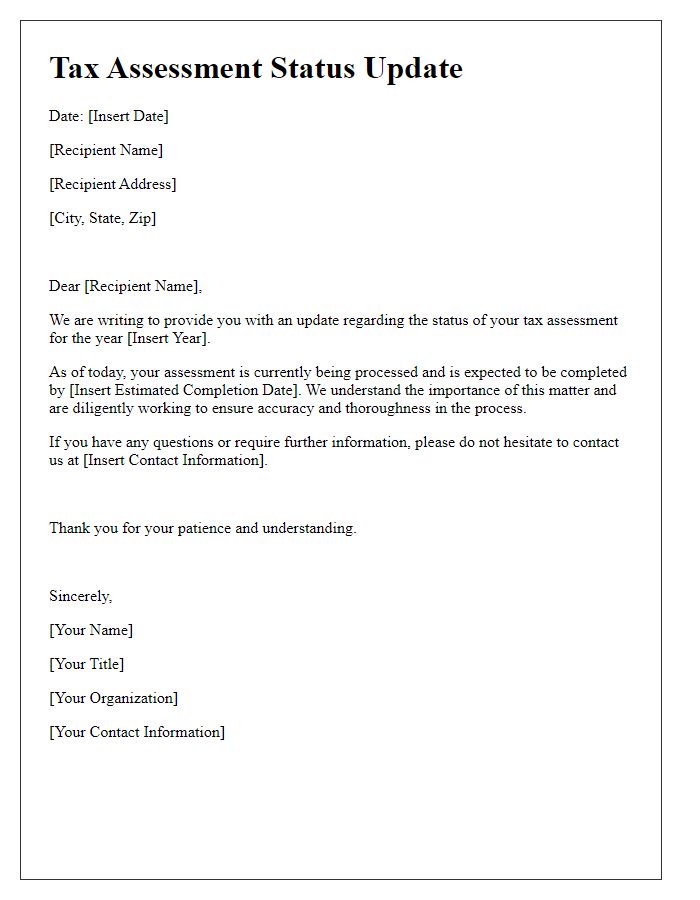

Payment Instructions

Tax assessment notices require clear and informative payment instructions to ensure timely compliance. When preparing payment instructions, include relevant details such as the amount due, payment deadline (typically 30 days from the assessment date), and accepted payment methods (credit card, electronic funds transfer, or check). Specify the address for mailing payment, the online portal for electronic submissions, and provide a unique reference number linked to the taxpayer's assessment for tracking. Additionally, list consequences of late payment, such as penalties or interest rates, which may increase the total amount owed. Ensure instructions are accessible and user-friendly to facilitate prompt payment and minimize confusion.

Contact Information

Tax assessment notices serve as critical communications regarding an individual's or business's tax obligations. These notices typically include essential contact information, such as the name of the tax authority (e.g., Internal Revenue Service for the United States), mailing address (often with specific city and state designations), email address, and a dedicated phone number for inquiries (e.g., 1-800-829-1040 for IRS in the USA). The details ensure proper communication regarding tax assessments, helping taxpayers to clarify issues or discrepancies and ensuring compliance with deadlines established in the notice. Moreover, specific office hours may be listed to facilitate efficient contact between taxpayers and agents for resolution of potential disputes or questions.

Comments