Are you considering converting your shared finances into a joint account? Making this transition can simplify budgeting and enhance transparency between partners. It's a significant step that can foster trust and teamwork in your financial journey. Join us as we explore the benefits and process of converting to a joint account, and read more to find out how to get started!

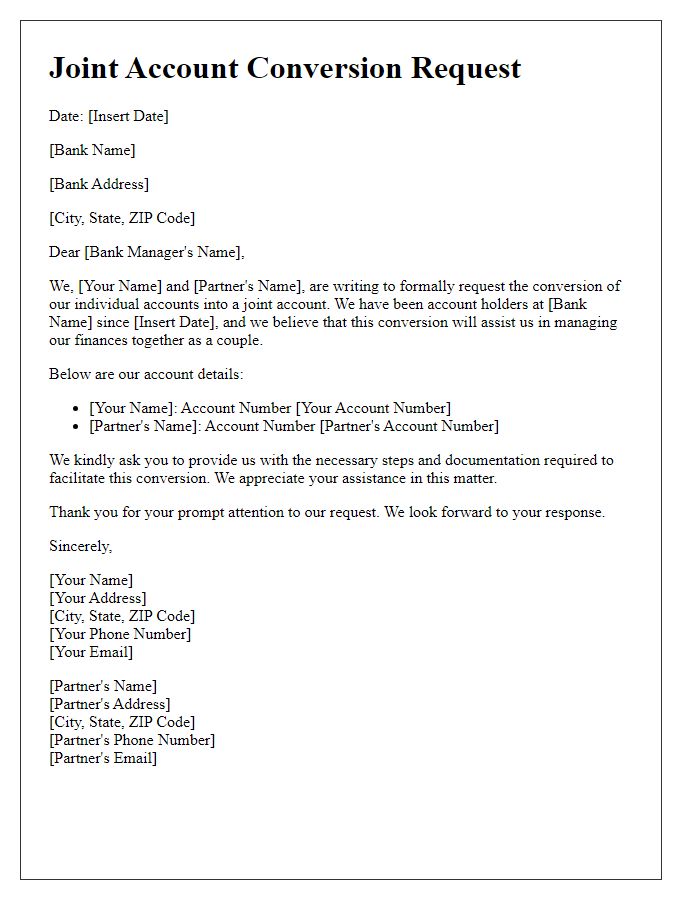

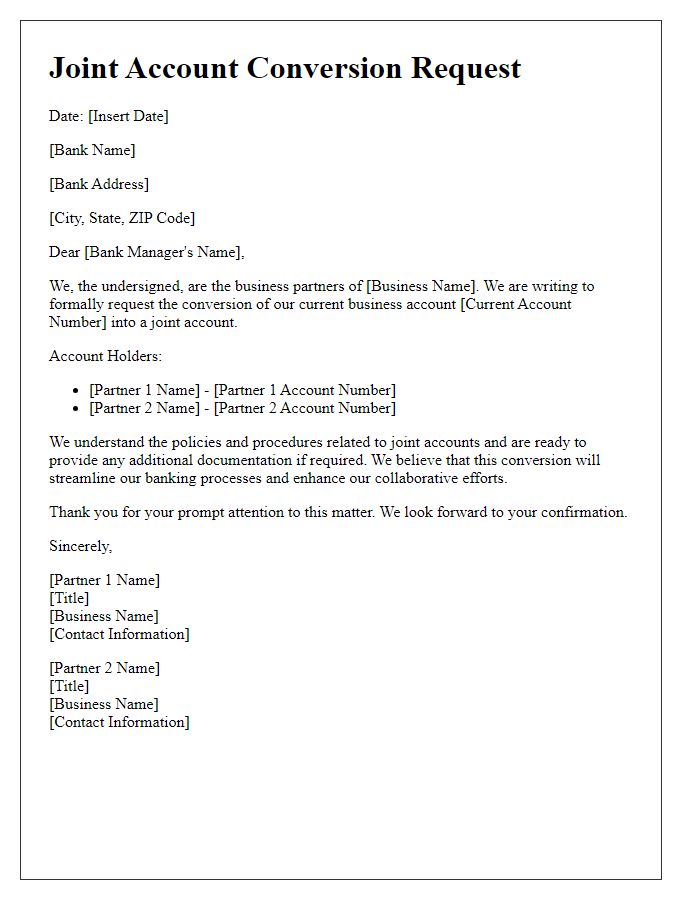

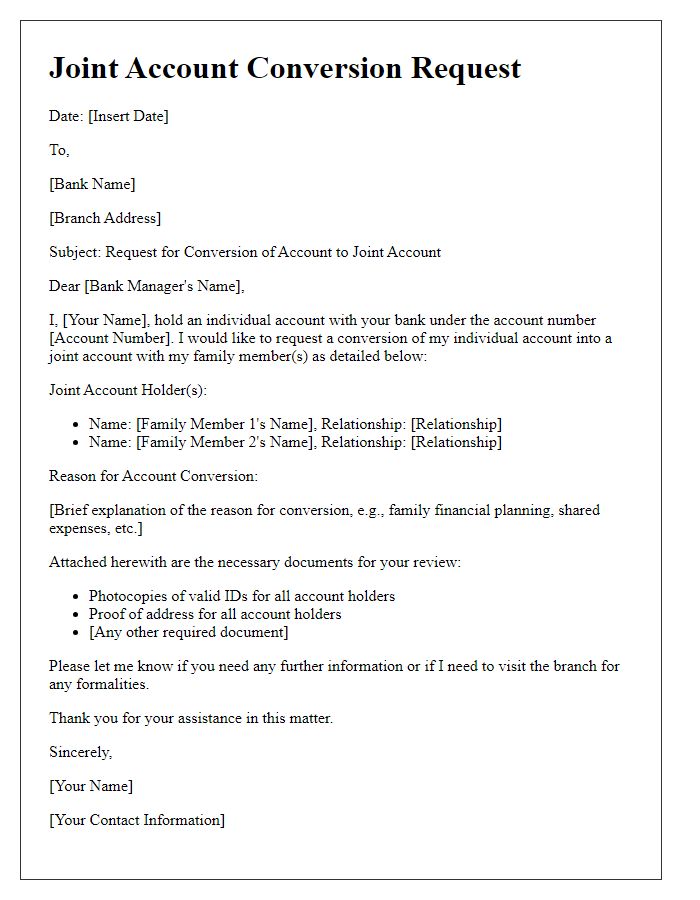

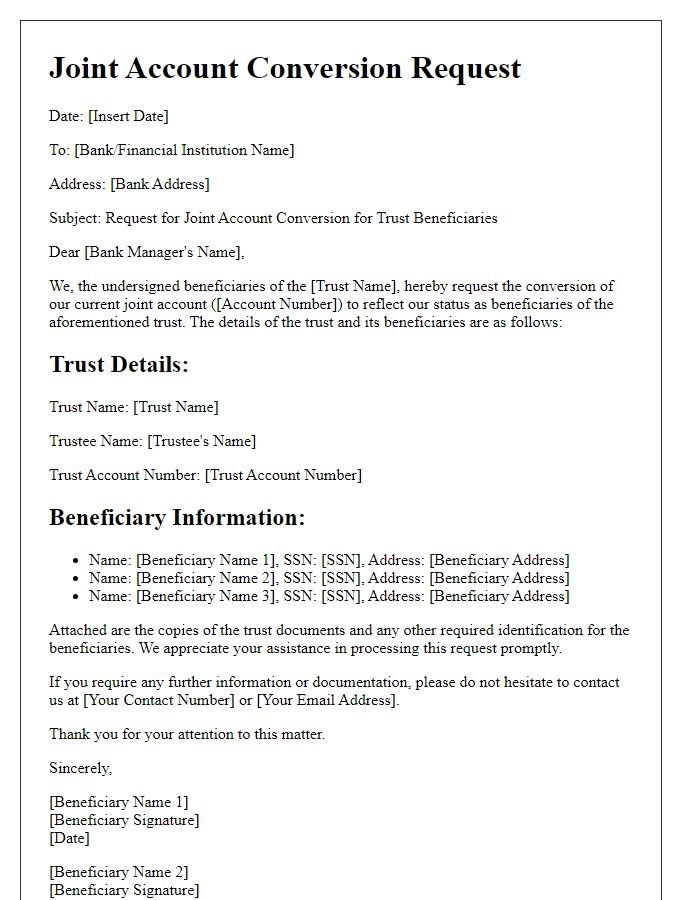

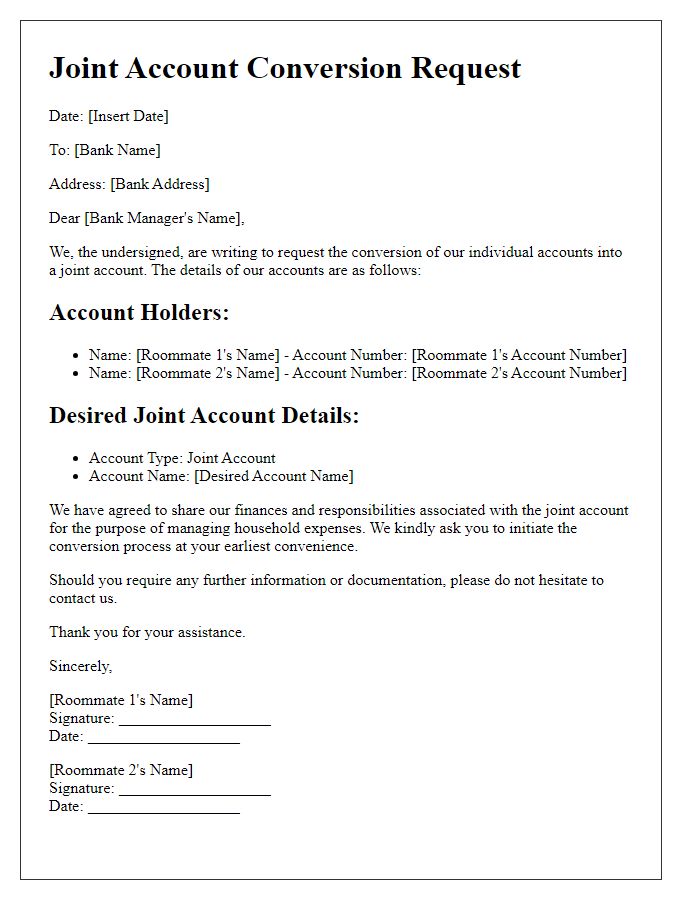

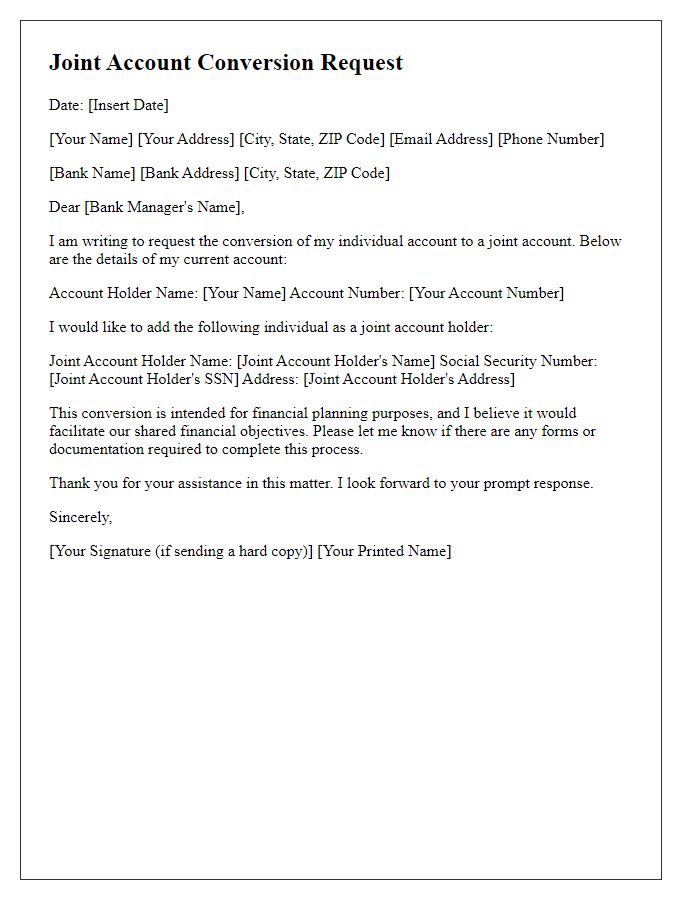

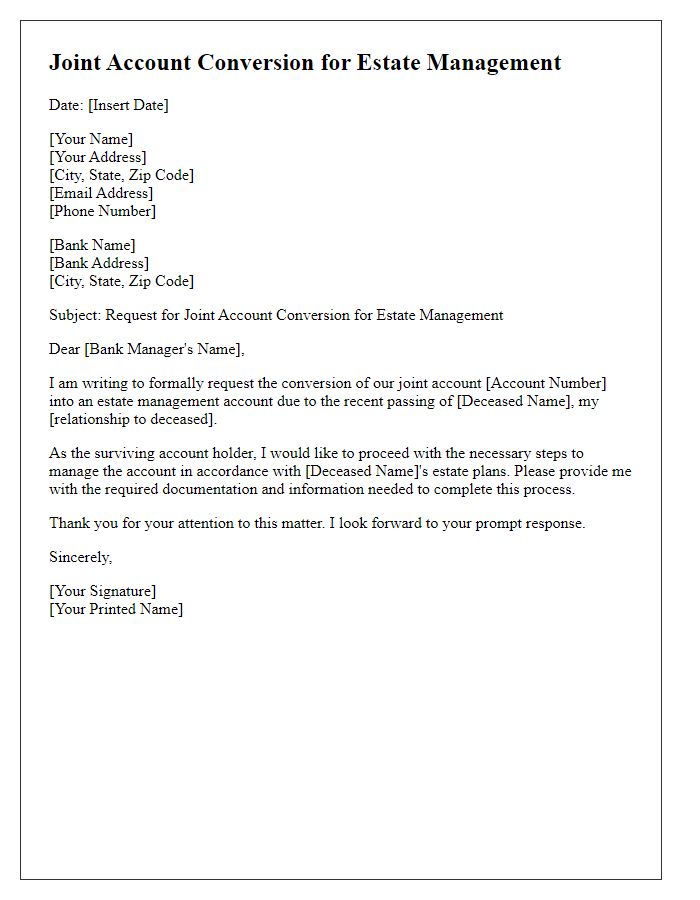

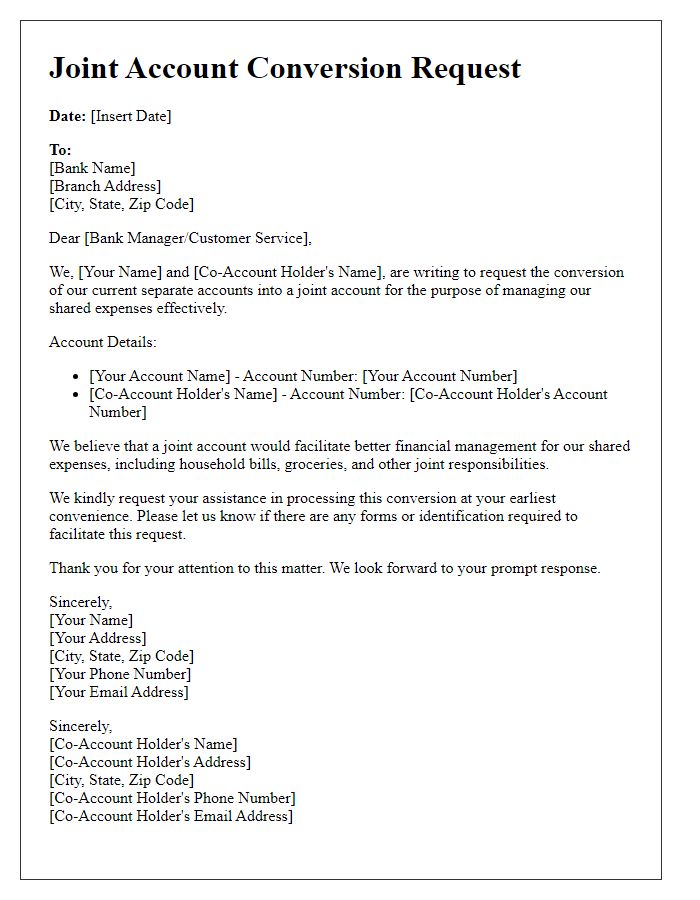

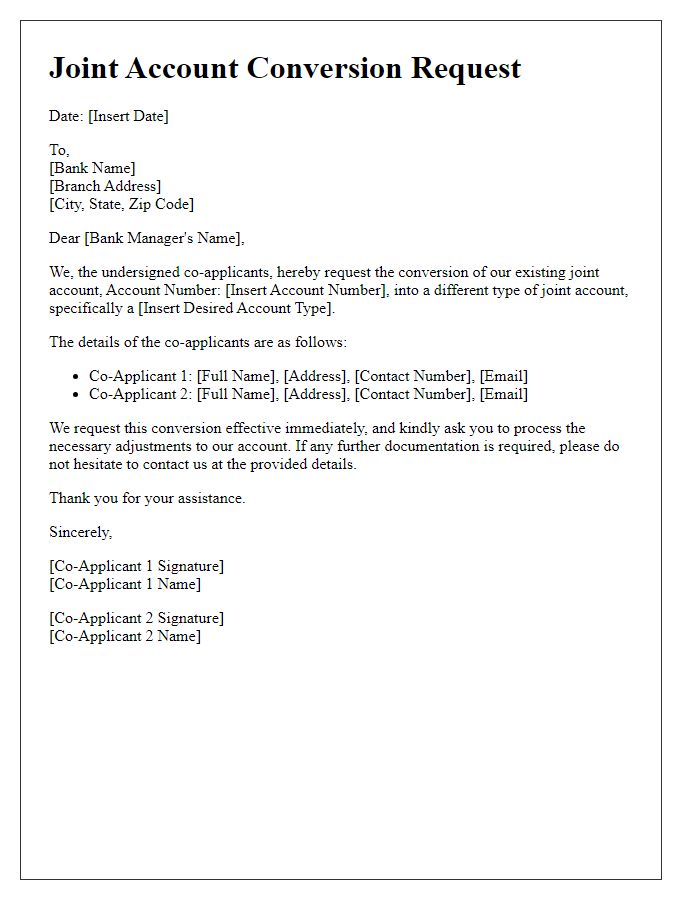

Account holder names and contact information.

Joint account conversion necessitates detailed records of account holder names and contact information. Primary account holders typically provide their full names (first, middle, last), current residential addresses, email addresses, and phone numbers. Financial institutions may require identification numbers such as Social Security Numbers (SSN) or Tax Identification Numbers (TIN) for verification purposes. It is vital to include any necessary documentation such as proof of address or identification to facilitate a smooth transition to a joint account. Communication preferences should also be noted, indicating how each holder wishes to receive account notifications, whether by email, SMS, or traditional mail.

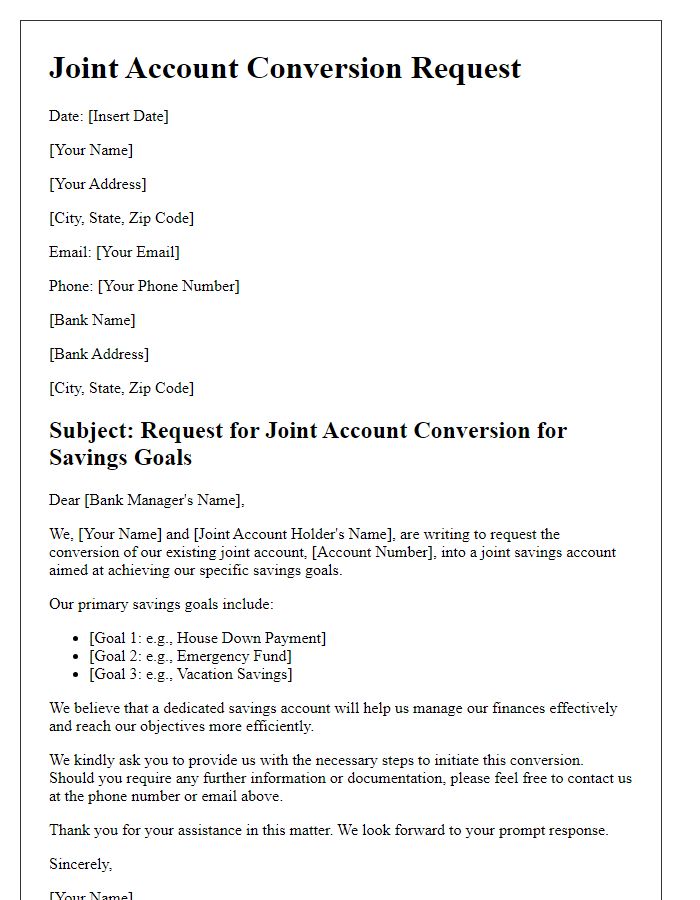

Joint account purpose and benefits.

A joint account refers to a bank account shared by two or more individuals, allowing all account holders equal access to account funds and transactions. One primary purpose of a joint account is to facilitate shared financial responsibilities, making it an ideal choice for couples, family members, or business partners. Benefits include simplified budgeting, as all contributions and expenses can be tracked in one place. Additionally, joint accounts often yield lower fees compared to individual accounts and can offer competitive interest rates at banks like Chase or Bank of America. This type of account promotes transparency in financial matters, fostering trust among account holders as they manage shared financial goals, such as saving for a home or planning a family vacation. Furthermore, in an emergency, joint account accessibility ensures that all parties can access funds promptly, providing a safety net in times of financial need.

Current individual account details.

Current individual accounts, such as checking and savings accounts at Wells Fargo, typically feature specific details, including account numbers (format: 123456789) and holders' names (e.g., John Smith). For joint account conversion, individuals need to provide pertinent documentation, such as identification (driver's license, passport) and Social Security Numbers (nine-digit format: XXX-XX-XXXX). The transition process may also require signatures from all parties involved, indicating mutual consent for shared financial responsibility, and completing bank forms to initiate the account merge. Ensuring clarity about joint account terms, such as transaction limits and ownership percentages, is vital for a smooth transition.

Authorization and consent statement.

A joint account conversion can streamline finances for couples or business partners, enabling easier management of shared expenses. Parties involved must provide an authorization and consent statement to ensure that both individuals agree to the transition process. This statement typically includes personal identification details such as full names (for example, John Smith and Jane Doe), account numbers (like 123-456-789), and signatures. Specific bank names, such as Bank of America or Chase, may be referenced to clarify the institution overseeing the conversion. Furthermore, the statement outlines the rights and responsibilities of both account holders, including shared access to funds and the requirement of mutual consent for withdrawals or closing the account, establishing clear communication guidelines for managing finances collaboratively.

Signatures and date.

To initiate the conversion of a personal bank account to a joint account, account holders must provide necessary signatures and the date on a designated form from the financial institution, such as Bank of America or Chase. The form typically includes sections for both account holders to affirm their agreement, along with the required signatures to authorize the change. Additionally, the date of signing (e.g., October 1, 2023) is crucial, as it marks the official transition date for account ownership. Ensure accurate completion of all fields to facilitate a smooth conversion process.

Comments