Are you considering a second mortgage but feeling unsure about where to start? You're not alone; many homeowners find themselves in this position, seeking additional funds for renovations, education, or debt consolidation. The process can seem daunting, but with the right information and guidance, it can be a smooth journey to financial empowerment. Read on to explore the ins and outs of securing a second mortgage and discover how it can work for you!

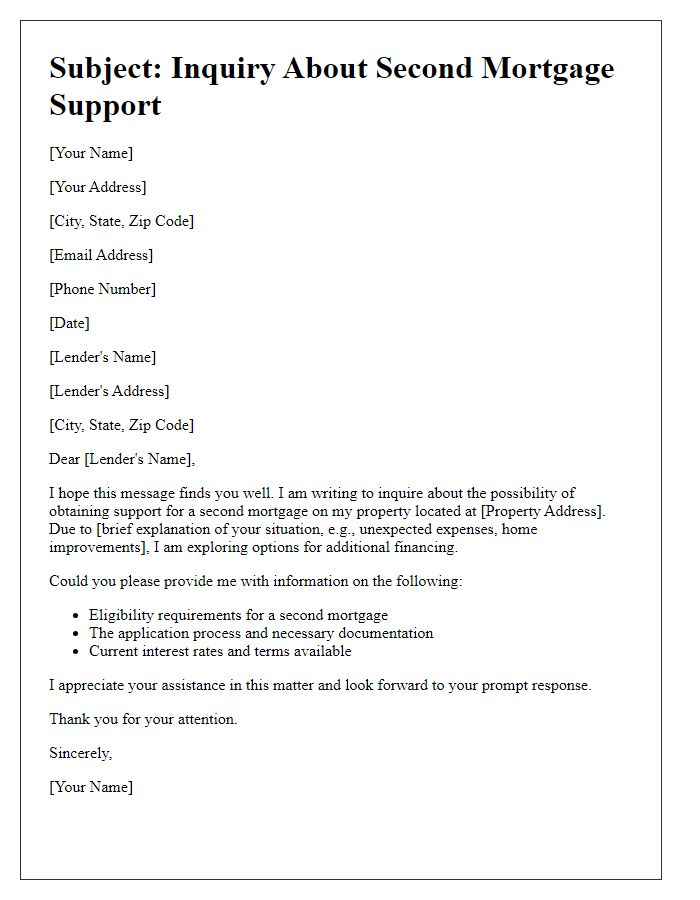

Personal and Financial Details

When seeking a second mortgage, individuals must gather essential personal and financial details to facilitate the inquiry process. Key personal information includes full name, social security number (typically a nine-digit sequence), and current address, which should include city and zip code for precise identification. Financially, applicants should compile income details such as monthly gross income (from employment or other sources), total monthly debt obligations that encompass expenses like credit cards and car loans, and existing mortgage information, highlighting the remaining balance and payment history. Additionally, assets including savings accounts, investments, and property valuations are crucial for assessment by lenders in evaluating the mortgage application. Understanding credit scores, usually ranging from 300 to 850, and providing relevant documentation like tax returns and bank statements will support the inquiry for favorable second mortgage options.

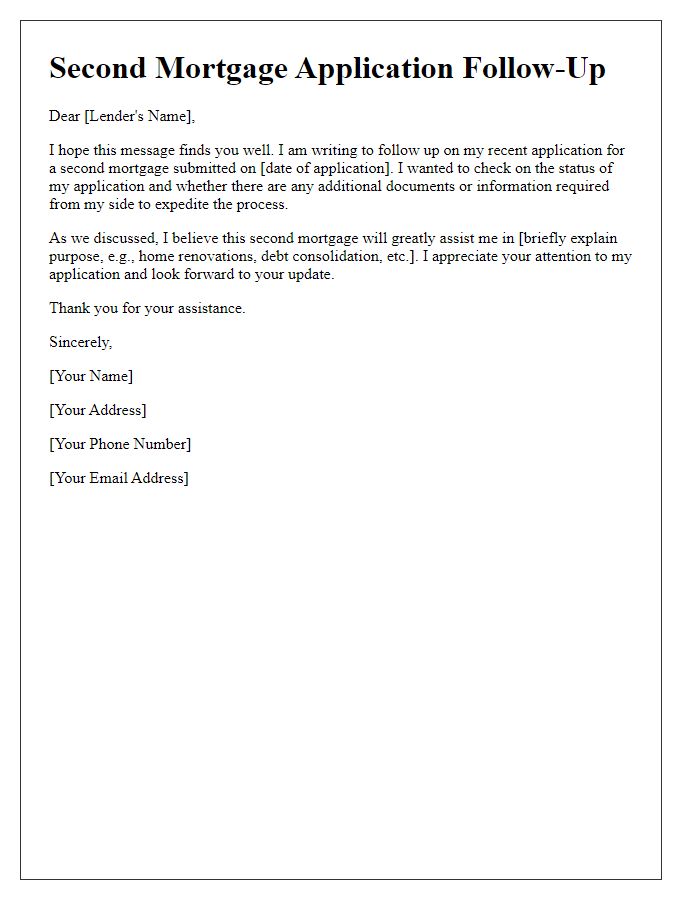

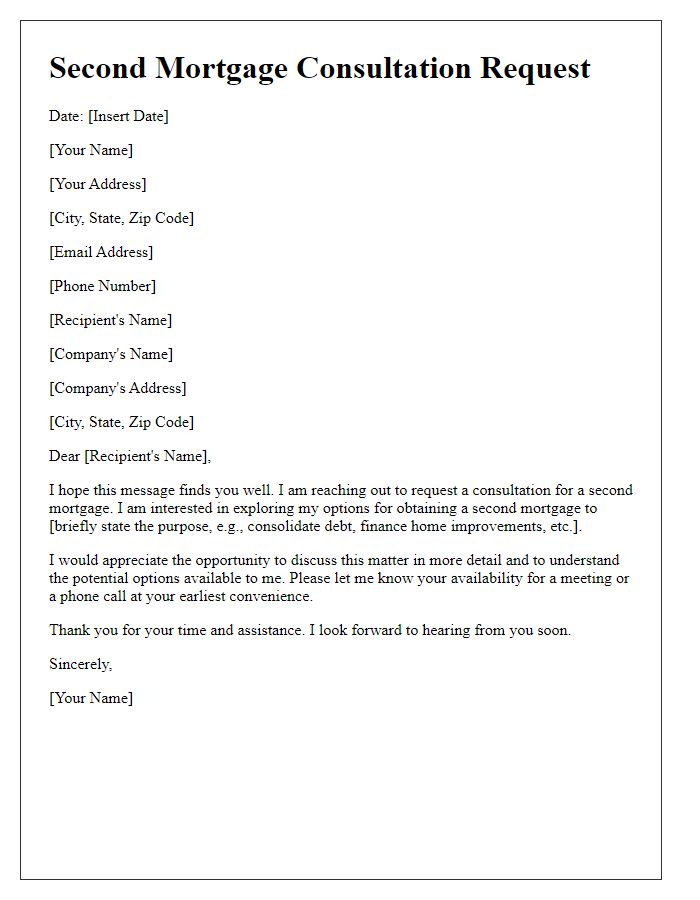

Purpose of the Second Mortgage

A second mortgage serves various purposes for homeowners seeking additional financing. Commonly, funds from a second mortgage can be utilized for home renovations, such as kitchen or bathroom remodels, which can significantly increase property value. Additionally, many individuals use second mortgages to consolidate high-interest debt, such as credit card balances, which can lead to lower monthly payments and reduced financial stress. Some homeowners may also leverage a second mortgage to finance major life events, such as a child's education or medical expenses, providing necessary funds without liquidating investments. Furthermore, a second mortgage can support investment opportunities, allowing homeowners to tap into their property's equity to invest in real estate or other ventures. Understanding these diverse purposes underscores the flexibility and utility of second mortgages in meeting both financial and personal goals.

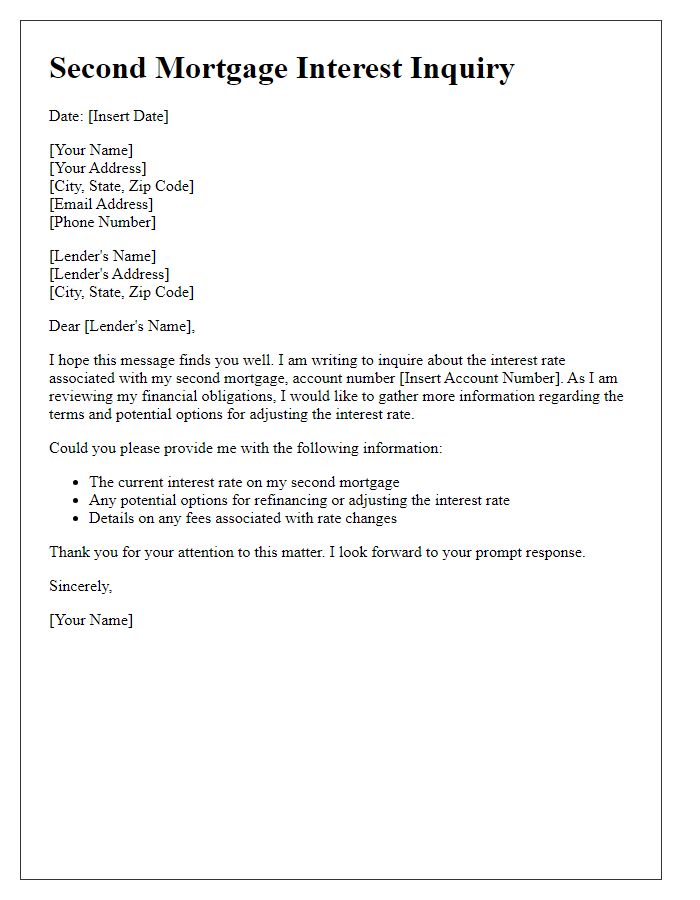

Loan Amount and Terms Desired

When considering a second mortgage, potential borrowers often seek specific loan amounts to meet their financial needs. The desired loan amounts typically range from $20,000 to $100,000, depending on the borrower's equity in their primary residence. Loan terms usually vary, with common durations being 10, 15, or 20 years, which aim to provide flexibility in repayment options. Interest rates may fluctuate based on market conditions and the borrower's credit score, often falling between 7% and 12%. Understanding these factors is crucial in determining an appropriate monthly payment and overall financial impact associated with the second mortgage.

Collateral and Property Details

A second mortgage inquiry requires careful attention to collateral assessments and property specifics in the context of real estate transactions. Essential collateral can include residential homes, commercial properties, or investment real estate, providing the lender additional security. The property details demanded typically encompass the location, such as ZIP Code 90210, square footage, market value (often determined through a comparative market analysis), and any existing liens. The current loan amount, interest rate, and payment terms of the first mortgage also hold importance when analyzing the second mortgage's feasibility. Additional property features, like age, condition, and neighborhood amenities, can significantly influence the lent amount and terms offered by financial institutions.

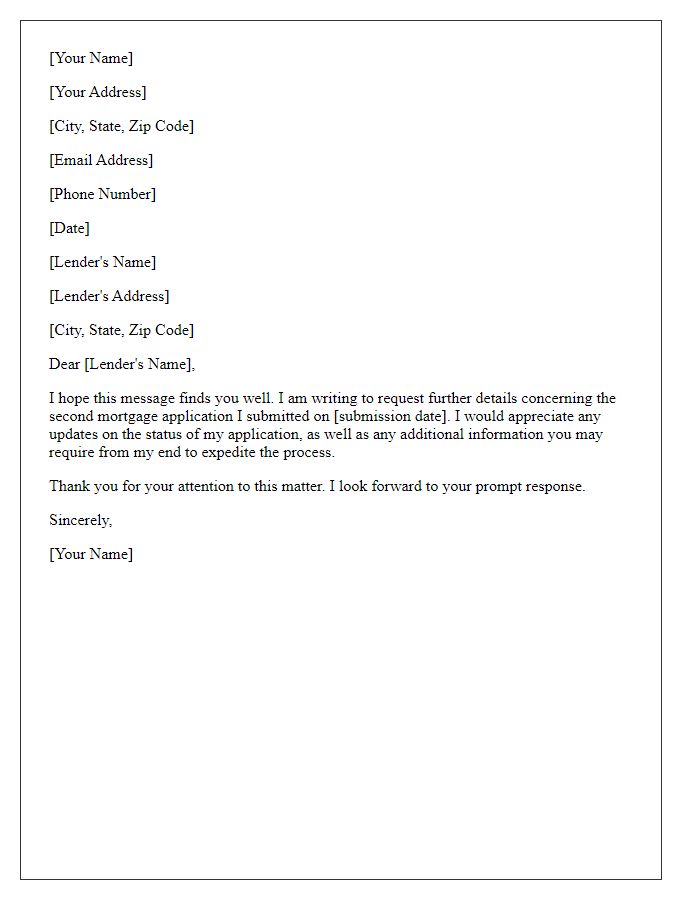

Contact Information and Availability

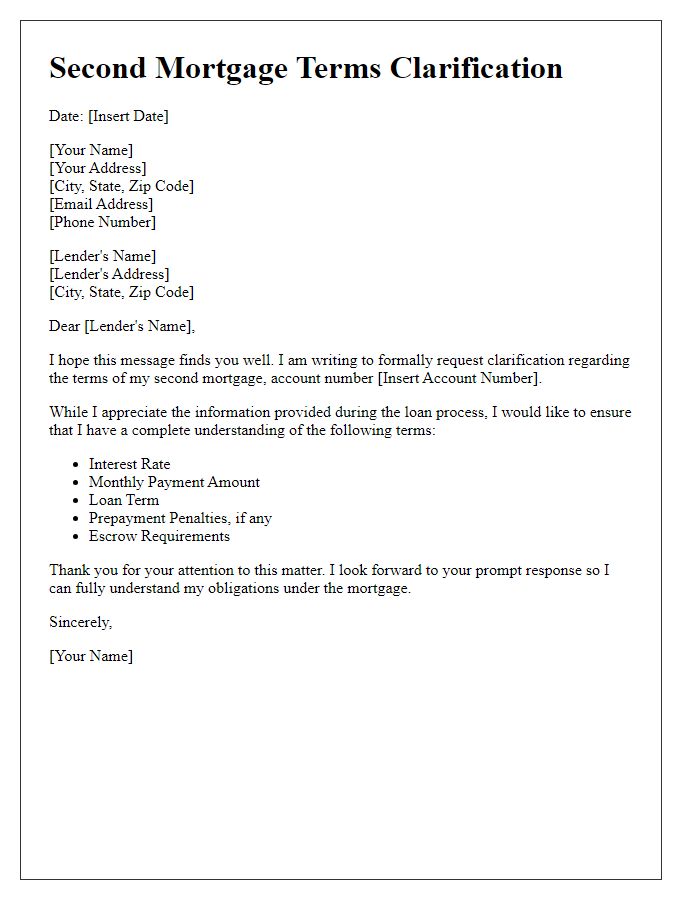

Inquiries regarding second mortgages often require precise information and timely responses. Prospective borrowers need to provide personal details, such as full name and address, to facilitate the application process. Financial institutions require contact information including email address and phone number for effective communication throughout the mortgage approval journey. Availability for discussions or meetings must be communicated, typically indicating weekdays or weekends, to streamline the scheduling of appointments with mortgage specialists. Each institution may have different requirements for documentation, such as income verification and credit history, which significantly impacts eligibility for second mortgages and interest rates.

Comments