Are you curious about how an amortization schedule can reshape your understanding of loans? This nifty tool lays out the payment structure over time, breaking down how much of each installment goes towards interest and the principal. By grasping this concept, you'll feel empowered to make more informed financial decisions and better manage your debt. So, let's delve into the details and explore how an amortization schedule can work for youâkeep reading to find out more!

Loan Details and Terms

An amortization schedule outlines the repayment timeline for loans, detailing the breakdown of each payment over time. A typical loan amount (e.g., $250,000) may span a 30-year term, with a fixed interest rate (for example, 4.5% per annum). The schedule reveals how monthly payments (around $1,266) consist of both principal and interest. In the early years, a significant portion of each payment goes toward interest, while the later years shift focus towards principal repayment. Key elements include the total interest paid over the loan term (approximately $185,000) and remaining balance after each period, helping borrowers understand their financial commitment clearly.

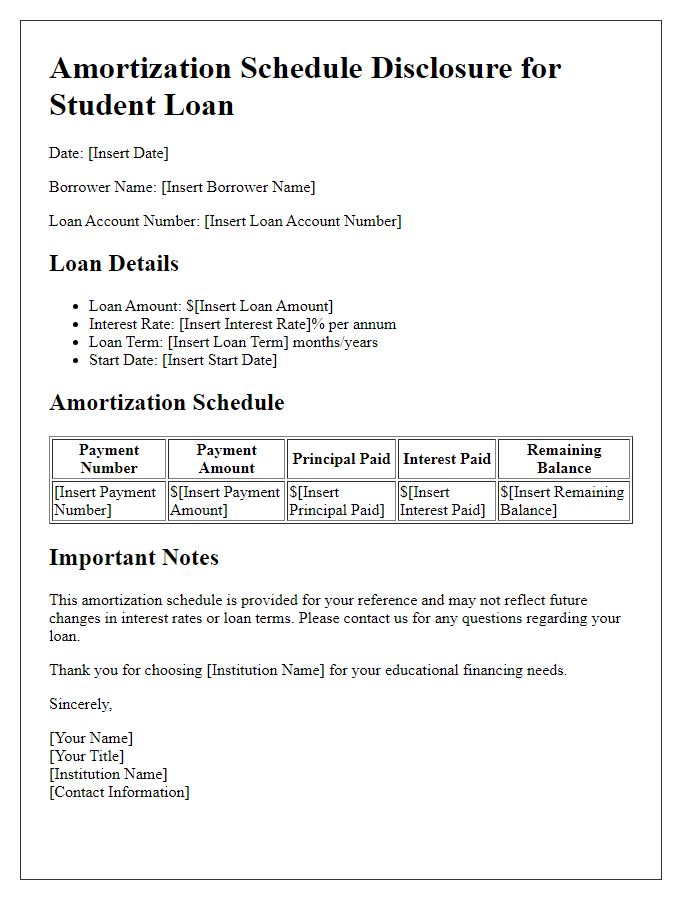

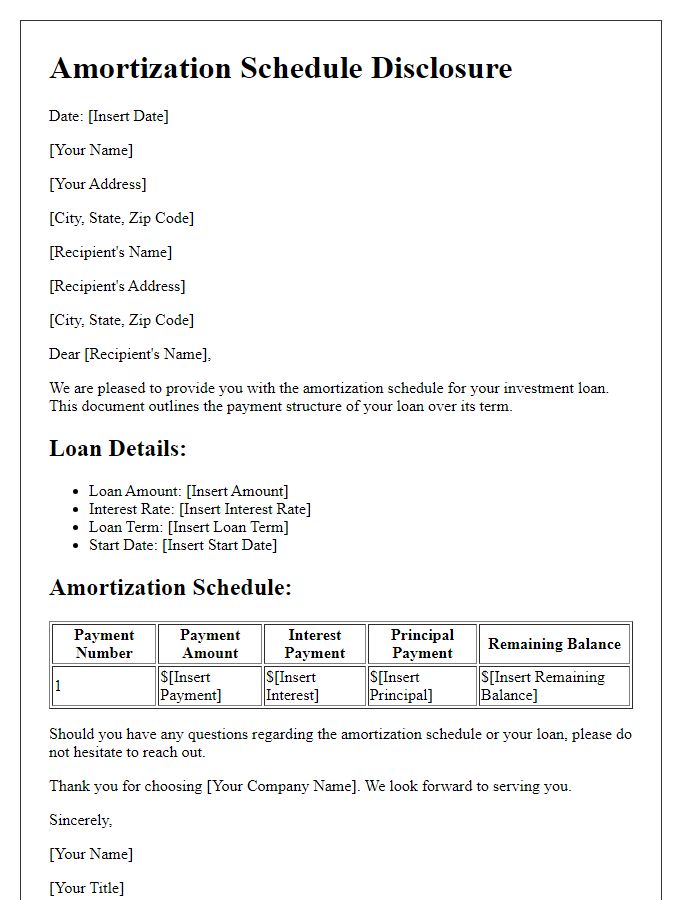

Amortization Schedule Outline

An amortization schedule provides a detailed breakdown of loan repayment details for borrowers, commonly utilized in mortgage loans or auto loans. Each entry in the schedule includes the payment number, date of payment, principal amount, interest amount, remaining balance, and total payment, allowing borrowers to track their repayment progress and interest costs over time. For instance, a typical mortgage of $300,000 at a 4% annual interest rate over 30 years will feature monthly payments of approximately $1,432.25. The schedule reflects that in the early years, a larger portion of each payment is allocated towards interest, with the principal repayment gradually increasing as the loan matures. This clear outline assists borrowers in understanding their financial commitments throughout the loan's duration, facilitating better financial management and planning.

Interest Rate Information

The annual percentage rate (APR) of 5.5% plays a crucial role in determining the interest amount associated with loan repayments. Monthly installments for the loan, amounting to $1,500, are calculated using the amortization schedule, which outlines how each payment contributes to both principal and interest. The initial loan balance of $100,000 is set for a term of 30 years. This long-term mortgage structure includes 360 total payments, with early payments impacting the overall interest paid. Additionally, factors like property taxes and insurance premiums may affect total monthly costs, but the core interest rate remains a primary determinant of repayment planning.

Payment Breakdown and Due Dates

An amortization schedule provides a detailed breakdown of loan payments, including principal and interest allocations. For a $100,000 loan with a 30-year term at a 4% annual interest rate, the monthly payment amounts to approximately $477. This schedule outlines each payment over 360 months, detailing the allocation where initial payments consist of mostly interest (approximately 60% during the first year). Gradually, as the loan matures, the principal portion increases, achieving a balance reduction from $100,000 to $0 by the end of the term. Due dates are typically set for the first of each month, allowing borrowers to plan their finances accordingly. Understanding this payment schedule enables borrowers to anticipate their financial obligations throughout the loan's life.

Contact Information for Queries

Contact information is essential for assisting individuals with queries regarding their amortization schedule disclosures. The preferred method to reach out includes direct phone lines, such as (555) 123-4567, which allows for immediate assistance. Additionally, an email address, customer.service@loancompany.com, provides an alternative for non-urgent inquiries. Office hours typically span from 9 AM to 5 PM (EST) Monday through Friday. Physical locations may also be available for in-person consultations at the main office address, 123 Finance Blvd, Suite 100, Springfield, USA. All provided channels enable effective communication regarding loan details, repayment terms, and fiscal responsibilities.

Letter Template For Amortization Schedule Disclosure Samples

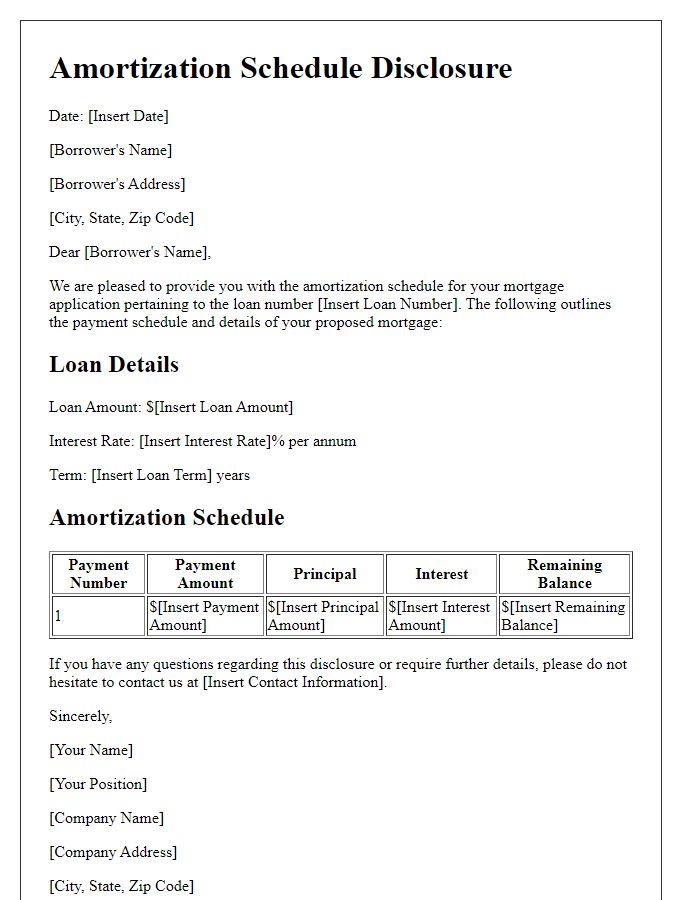

Letter template of Amortization Schedule Disclosure for Mortgage Application

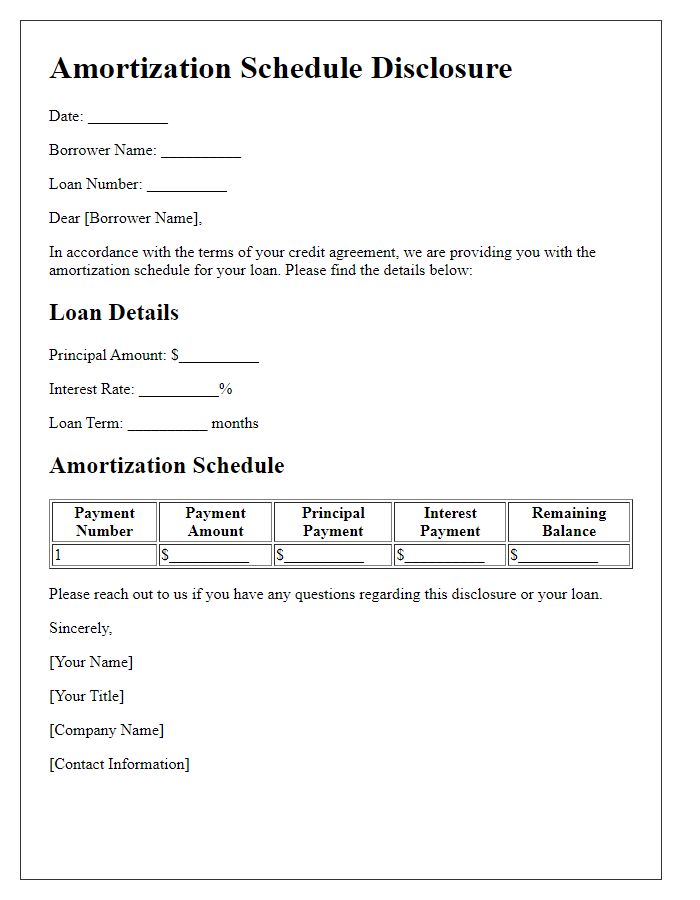

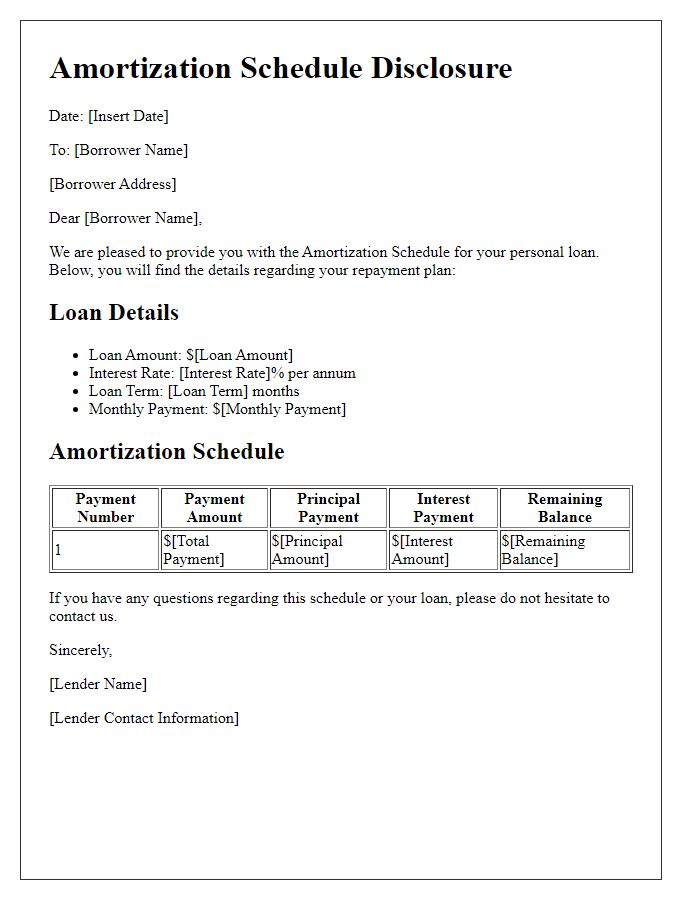

Letter template of Amortization Schedule Disclosure for Credit Agreement

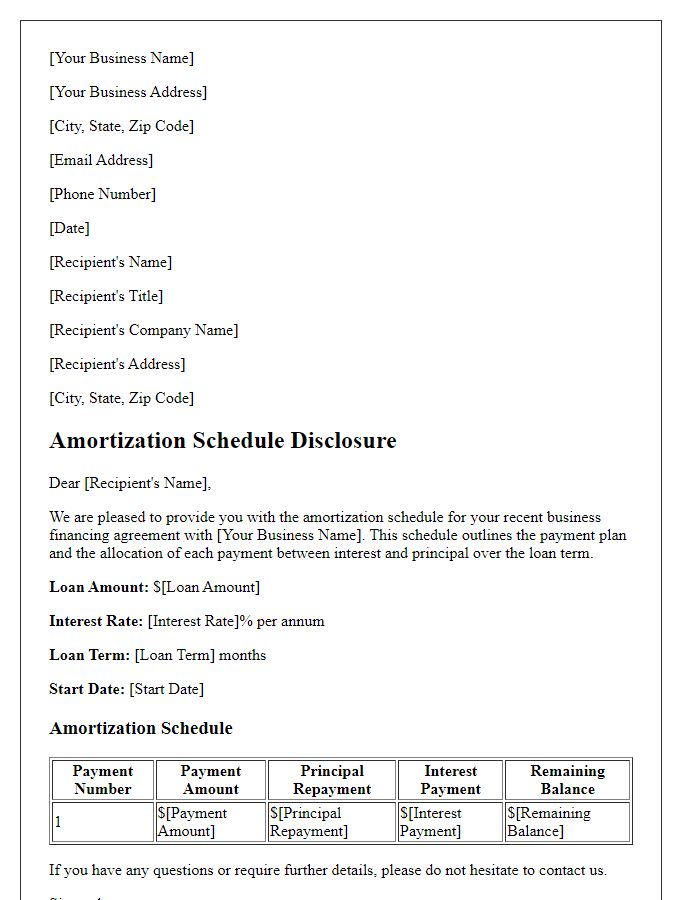

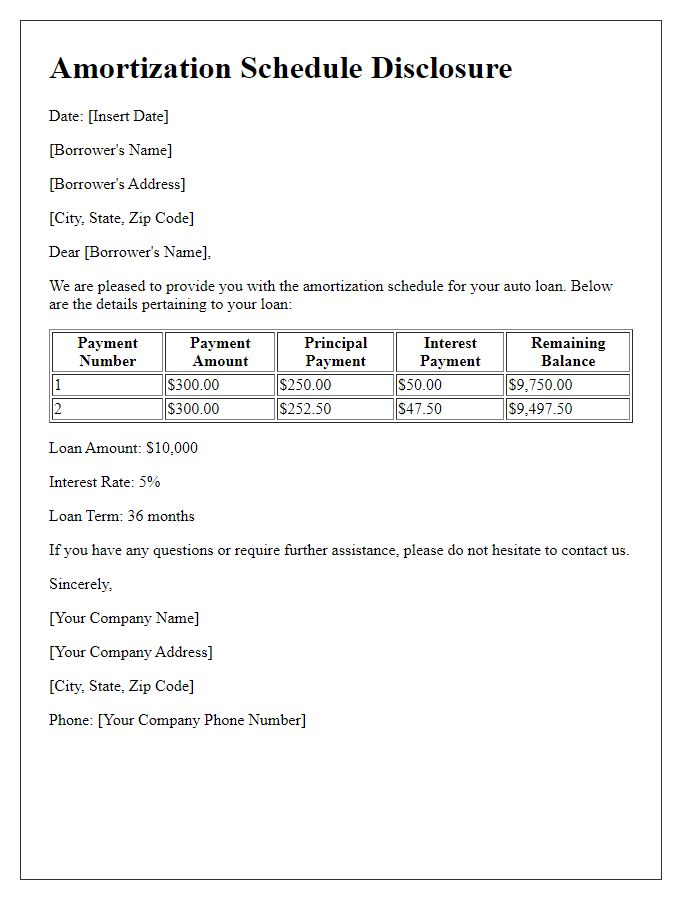

Letter template of Amortization Schedule Disclosure for Business Financing

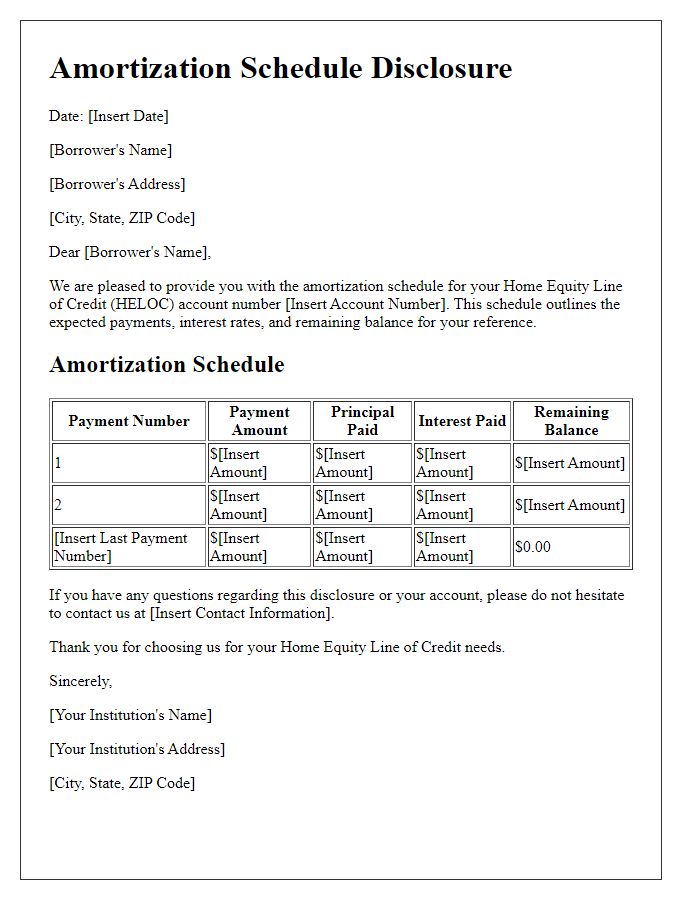

Letter template of Amortization Schedule Disclosure for Home Equity Line of Credit

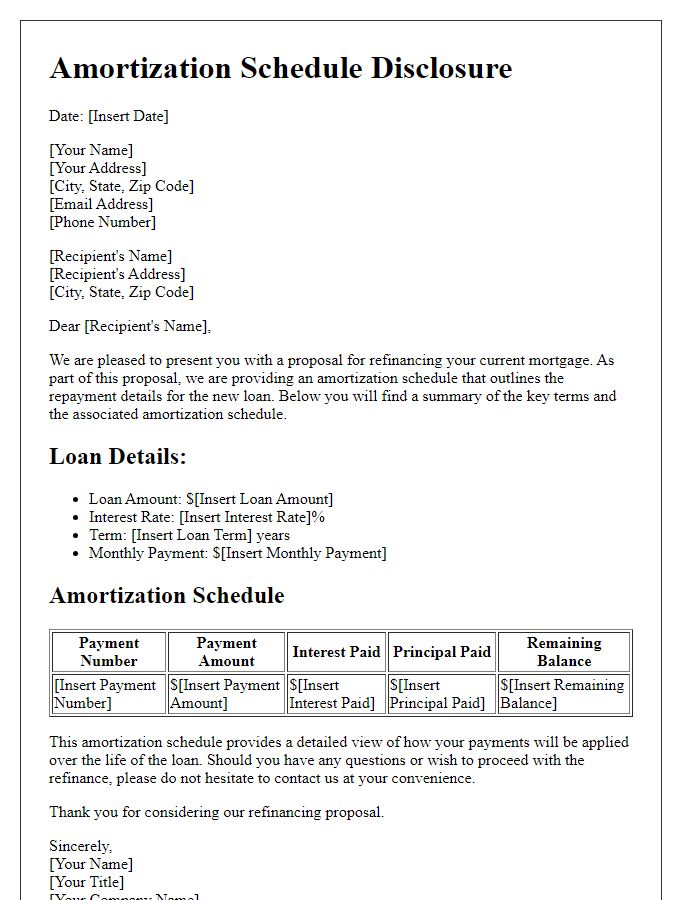

Letter template of Amortization Schedule Disclosure for Refinance Proposal

Comments