Are you feeling a bit overwhelmed by the prospect of changing your adjustable-rate mortgage? You're not aloneâmany homeowners find themselves navigating the complexities of interest rates and payment schedules. Understanding the ins and outs of your mortgage options can empower you to make the best decision for your financial future. So, let's dive into the details and explore how you can approach this important change!

Current Loan Information

Adjustable-rate mortgages (ARMs) can fluctuate based on the index and margin that determine interest rates. Current loan information typically includes the principal amount (e.g., $250,000), initial interest rate (e.g., 3%), adjustment frequency (e.g., annually), and the index used (such as the LIBOR or SOFR). Homeowners should also note the initial fixed period (e.g., 5 years) and the maximum lifetime cap on interest rates (often 5% above the initial rate), which safeguards against excessive increases. Changes in the loan terms can significantly affect monthly payments, demonstrating the importance of understanding these components in long-term financial planning.

Interest Rate Adjustment Details

Adjustable rate mortgages (ARMs) feature interest rates that fluctuate based on market conditions, typically tied to indexes like the London Interbank Offered Rate (LIBOR). As of the upcoming adjustment period set for May 2024, borrowers should anticipate potential changes based on recent economic trends. The initial interest period of five years will conclude, transitioning to the adjustable period that could result in an interest rate adjustment anywhere from 2% to 5% depending on market volatility, which has been influenced by inflation rates hovering around 3% in recent months. Borrowers can review their current payment schedules, keeping in mind that changes may impact monthly payment amounts significantly, potentially increasing by several hundred dollars depending on the rate fluctuations. It's crucial to prepare for this adjustment by analyzing personal financial situations and exploring possible refinancing options if necessary.

Payment Schedule Update

Adjustable-rate mortgages (ARMs) can significantly impact monthly payment calculations based on index fluctuations, typically tied to benchmarks like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). As interest rates rise or fall, borrowers may experience changes in payments every adjustment period, usually annually after an initial fixed-rate period. A payment schedule update will detail these alterations, including the new interest rate, adjusted monthly payment amount, and potential changes in the loan term. Important documentation, such as the original mortgage agreement from the lender, should be reviewed to fully understand the implications of the adjustments on overall borrowing costs. Financial institutions often provide a breakdown of payment allocations to principal and interest, ensuring transparency for homeowners regarding their financial obligations moving forward.

Contact Information for Inquiries

Adjustable rate mortgages (ARMs) provide borrowers with the possibility of lower initial interest rates compared to fixed-rate mortgages. Standard terms (commonly 5/1, 7/1, or 10/1) indicate the fixed-rate period before adjustments begin. Contact information (email or phone number) is vital for inquiries regarding payment changes, lender policies, or market conditions influencing rates. The frequency of adjustments, typically annually after the fixed period ends, can significantly impact monthly payments, thus requiring clear communication channels for borrowers to seek clarification or assistance. Understanding the adjustment index (such as LIBOR or SOFR) affects the calculation of future interest rates.

Important Dates and Deadlines

Important dates and deadlines for adjustable rate mortgage (ARM) changes are crucial for borrowers managing their finances. The initial interest rate period, typically lasting five, seven, or ten years, outlines key timing for potential adjustments. The first adjustment date occurs after the initial period ends, and each subsequent adjustment happens annually or biannually, depending on the specific ARM terms. The annual percentage rate (APR) caps, such as a 2% or 5% lifetime cap, provide borrowers with insight into potential rate increases. Notification deadlines for changes must align with loan servicer policies, often requiring at least 45 days advance notice before rate adjustments. Understanding these dates can help homeowners in regions like California or Texas navigate their payment fluctuations effectively.

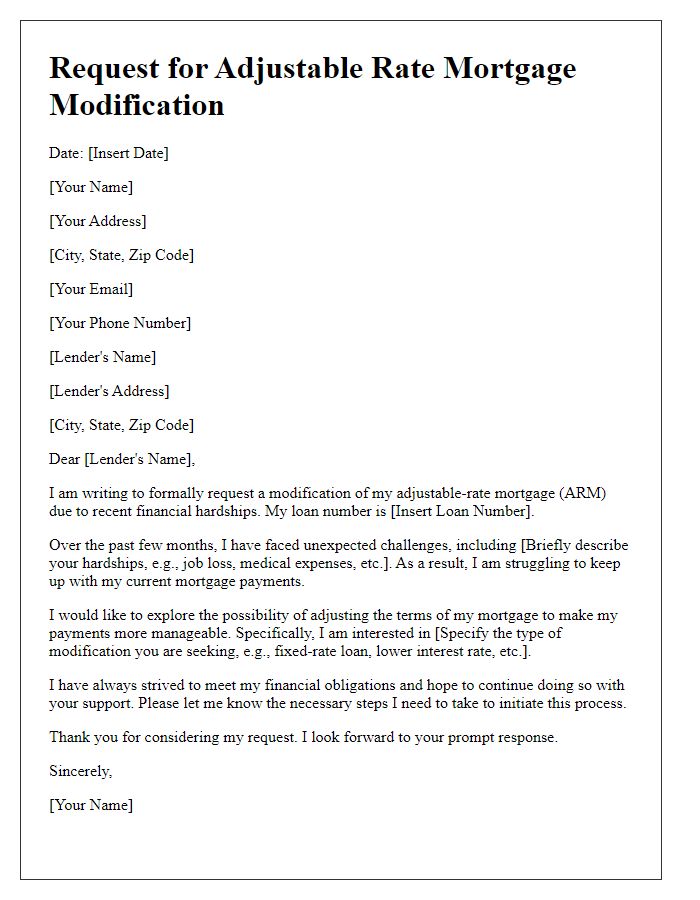

Letter Template For Adjustable Rate Mortgage Change Samples

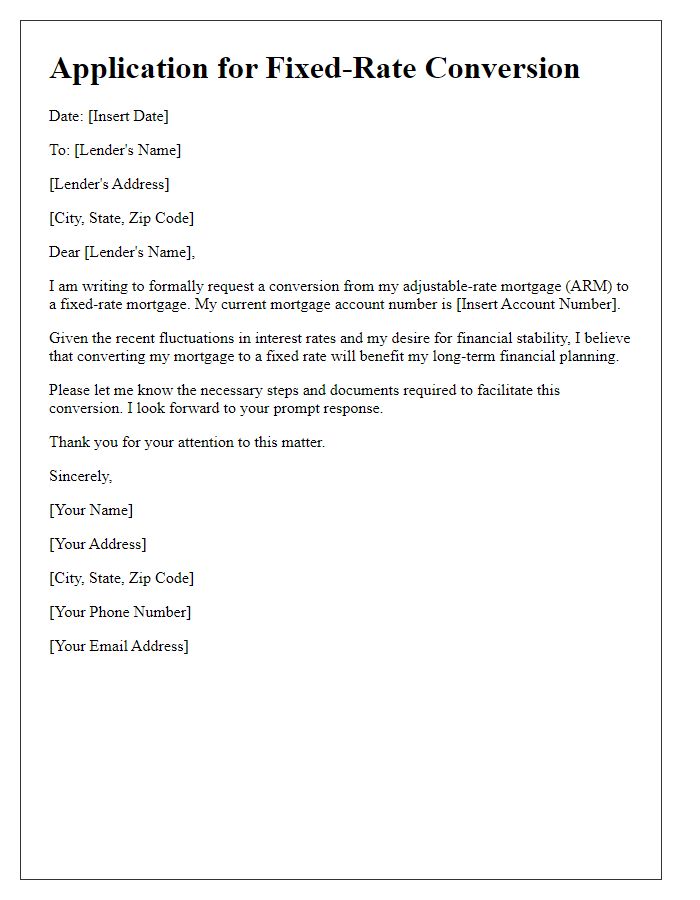

Letter template of application for fixed-rate conversion from adjustable mortgage

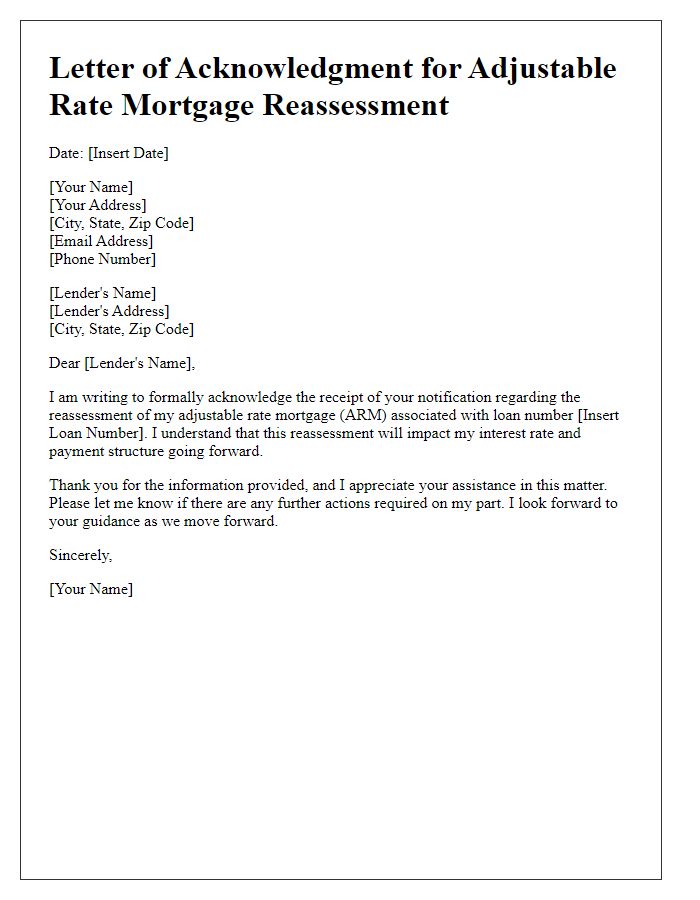

Letter template of acknowledgment for adjustable rate mortgage reassessment

Comments