Are you considering refinancing your loan and feeling overwhelmed by the process? You're not alone; many homeowners are looking for ways to lower their interest rates or improve their financial situations. This article will guide you through the key elements of a refinance loan approval letter, ensuring you understand what to expect and how to prepare. So, grab a cup of coffee and let's dive in to discover the essential steps for securing that refinancing approval!

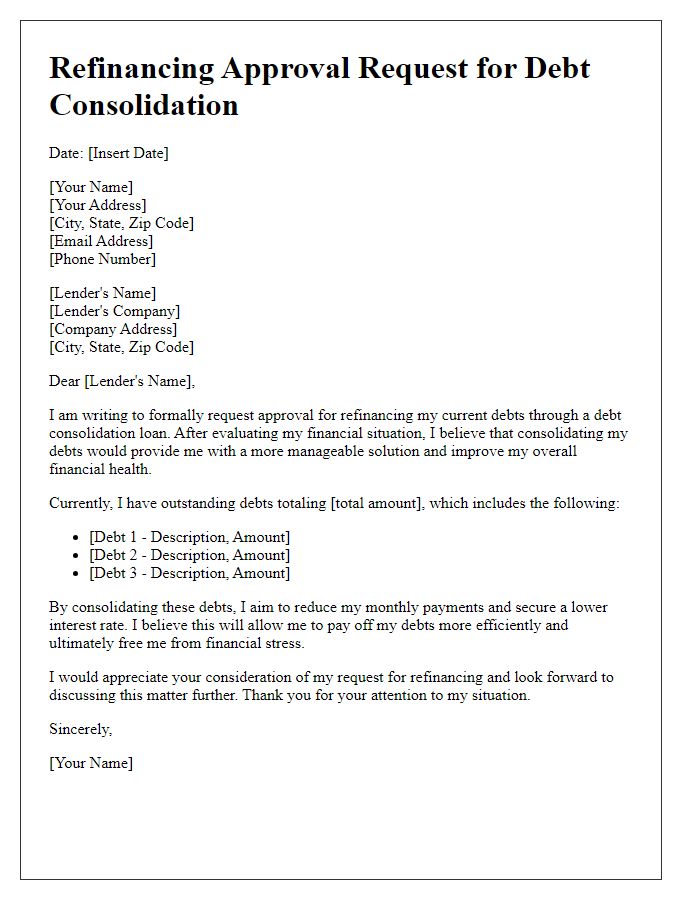

Loan approval conditions and terms

Refinancing a loan involves obtaining approval based on specific conditions and terms set by financial institutions. Essential factors include credit score, which generally needs to be above 620 for favorable rates; debt-to-income ratio (DTI) must typically be below 43%, demonstrating manageable debt; and the loan-to-value ratio (LTV) ideally at or below 80% to mitigate risk. Additionally, employment history, showing stability in the current job for at least two years, influences approval decisions. Interest rates can vary significantly, often between 3% to 5% based on market conditions, while closing costs may range from 2% to 5% of the loan amount, impacting overall affordability. Understanding these parameters is crucial for successfully navigating the refinancing process.

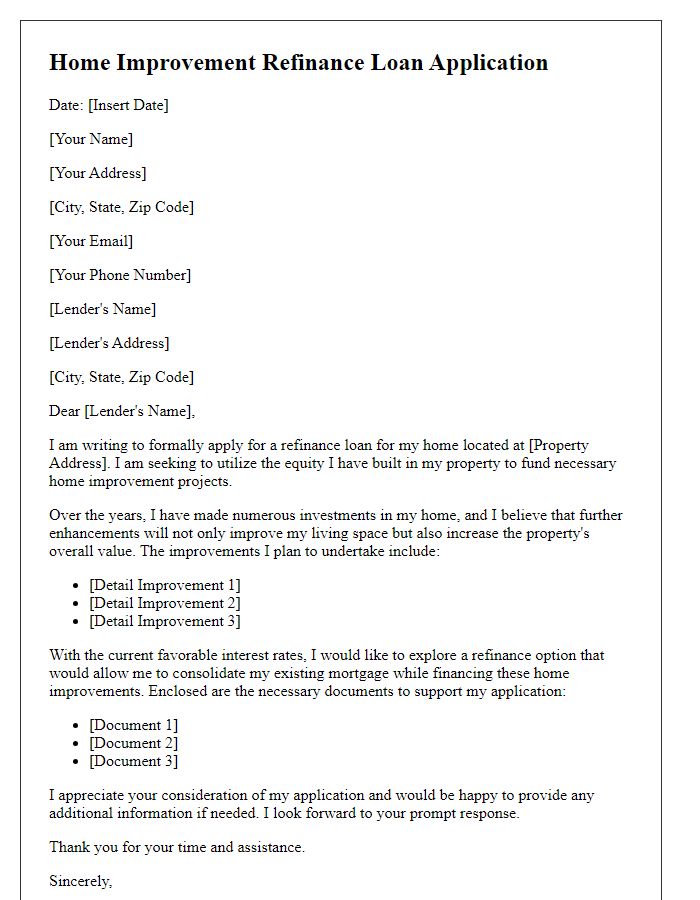

Interest rate and repayment schedule

Refinancing a loan can significantly affect your financial landscape, particularly regarding interest rate and repayment schedule. A lower interest rate, such as 3.5% compared to a previous rate of 5%, can lead to substantial monthly savings, impacting overall affordability. Understanding the repayment schedule, often structured to 15 or 30 years, is crucial for effective long-term financial planning. For instance, a 30-year plan allows for smaller monthly payments but results in higher total interest paid over the life of the loan, sometimes doubling initial borrowing amounts. Tracking these details ensures smarter budget management and better financial health.

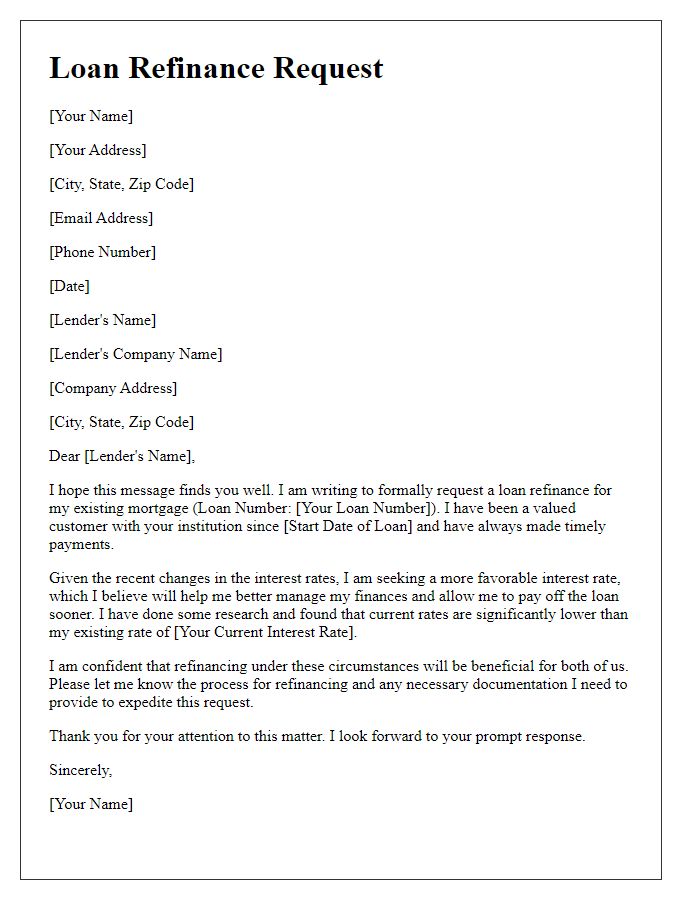

Documentation and verification requirements

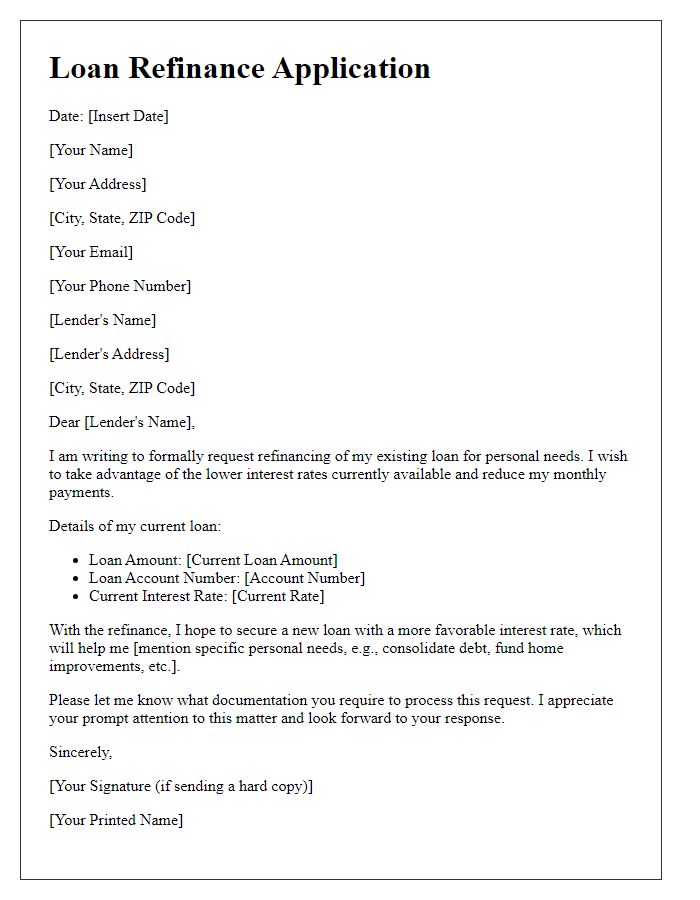

When applying for refinancing of a loan, specific documentation and verification requirements are essential for approval. Key documents include recent pay stubs, often covering the last 30 days, tax returns for the past two years to demonstrate income stability, and a credit report reflecting the applicant's creditworthiness (with scores ideally above 620 for favorable rates). Bank statements--usually from the last two months--are required to verify assets and ensure sufficient funds for closing costs. Property appraisal reports are also necessary, ensuring the home's current market value aligns with the loan amount being sought. Additionally, lenders often require a signed loan application and proof of homeowners insurance to protect the property during the loan term, along with any other relevant financial documentation. Timely and thorough submission of these documents expedites the refinancing process.

Contact information for further inquiries

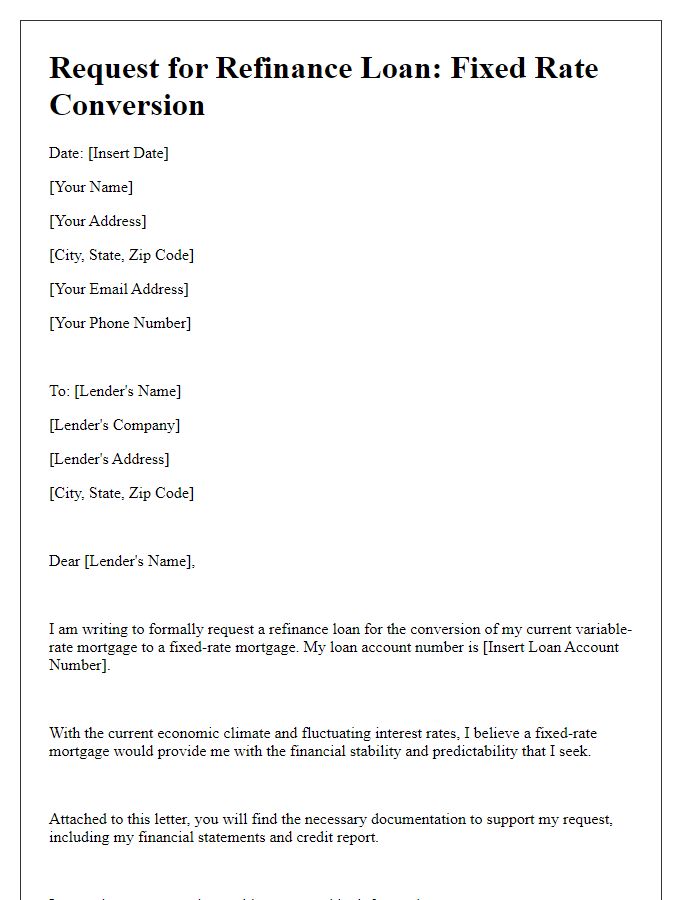

Refinancing a loan can significantly impact financial entities, such as mortgage lenders and borrowers, with potential changes in interest rates, loan terms, and monthly payments. The process often involves gathering specific financial documents like pay stubs, tax returns, and bank statements, which lenders require to assess eligibility. Loan approval typically involves several stages, including credit checks, property appraisals, and underwriting processes that evaluate the risk associated with issuing new loans. Contact information for further inquiries usually includes direct phone numbers, email addresses, or customer service web portals, allowing borrowers to seek clarifications or additional support regarding their refinancing options.

Acceptance deadline and next steps

Refinancing a loan often requires timely decisions and careful planning. The acceptance deadline for loan approval generally falls within 30 days post-application submission, which can vary by lender and loan type. Factors such as credit score, income verification, and existing debt influence approval timelines. After the acceptance deadline, next steps typically involve finalizing documentation, including income statements, asset verification, and any required disclosures. Once documentation is submitted, lenders conduct a thorough underwriting process, which can take an additional 2-4 weeks. Borrowers may expect a closing date to be scheduled, where final paperwork is signed, and the loan funds are disbursed. Understanding each phase assists borrowers in preparing for refinancing effectively.

Comments