Are you a tech startup seeking funding to fuel your innovative ideas? Navigating the world of loans can seem daunting, but it doesn't have to be. Understanding the right options for your unique needs can pave the way for growth and success. Let's dive in and explore how a well-crafted loan can help turn your startup dreams into realityâread on to discover more!

Business Summary

A tech startup focused on innovative solutions in artificial intelligence aims to revolutionize industries such as healthcare and finance. Founded in 2023 in Silicon Valley, this startup addresses challenges like data processing inefficiencies and predictive analytics. The core product is an AI-driven platform designed to enhance decision-making for businesses, leveraging machine learning algorithms capable of analyzing large datasets in real-time. The target market includes small to medium enterprises, with projected growth in demand for AI services expected to reach $126 billion by 2025 globally. Key partnerships with established firms, along with a skilled team of engineers and data scientists, position the startup for success in a highly competitive landscape. Funding will support product development, marketing strategies, and scaling efforts to meet increasing client needs.

Market Opportunity

Exploring market opportunities reveals significant growth potential for technology startups focusing on innovative solutions. The global technology sector is projected to reach a valuation of $5 trillion by 2023, driven by advancements in artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). Regions such as Silicon Valley, recognized as a tech hub, host over 2,800 startups and attract billions in venture capital investments annually. Emerging trends, including remote work and digital transformation, create demand for tools enhancing productivity and collaboration. Specific industries, like healthcare technology, anticipate a compound annual growth rate (CAGR) of 27% through 2026, indicating robust investment opportunities for startups creating disruptive technologies. Collaborations and partnerships with established tech giants further amplify market entry potential and scalability. Effective strategies addressing user needs can position startups favorably in this competitive landscape.

Product or Service Offering

Innovative tech startups often focus on unique value propositions in product or service offerings. For instance, a company might develop an AI-driven application (Artificial Intelligence application) for personalized healthcare solutions aimed at enhancing patient outcomes. This service combines machine learning algorithms (data analysis techniques allowing software to learn from data) with real-time health monitoring (tracking health metrics using wearable devices). The startup could also emphasize user-friendly interfaces (easy navigation and interaction guidelines) to improve user engagement. In an emerging market, such solutions may address existing gaps, like accessibility in rural regions or cost-effectiveness in the healthcare sector, offering scalable options tailored to diverse consumer needs.

Revenue Model

For a technology startup seeking a loan, the revenue model plays a crucial role in demonstrating financial viability and growth potential. Key components of this model include subscription services for software-as-a-service (SaaS) platforms, targeting a market of over 30 million small to medium-sized enterprises in the United States. Offering tiered pricing plans allows for diverse customer acquisition, with monthly subscription fees ranging from $29 to $299. Additionally, advertising partnerships can generate supplementary income, leveraging the platform's user engagement which averages 5 hours per user monthly. E-commerce integration can provide an additional revenue stream, with online sales accounting for approximately $4.9 trillion globally. Understanding customer acquisition cost (CAC) and lifetime value (LTV) ratios will also be essential, with the ideal LTV to CAC ratio being 3:1 to ensure sustainable growth.

Financial Plan

A robust financial plan serves as a blueprint for the fiscal health of a technology startup, detailing projections for revenue, expenses, and growth for the next three to five years. Revenue streams may include subscription services, licensing agreements, or product sales, generating income estimated at $500,000 in the first year, with a projected growth of 25% annually. Startup costs, including software development, marketing, and staffing, might total around $300,000, necessitating loans or investment funding. Detailed budgeting for operational expenses, such as salaries, rent, and utilities, will ensure sustainable cash flow management, allowing the startup to remain agile in response to market demands. A break-even analysis will highlight the critical point where total revenue equals total costs, anticipated in year two, enabling the tech startup to strategize for profitability. Regular financial reviews will assess performance against these benchmarks, facilitating informed adjustments necessary for growth in the competitive technology landscape.

Letter Template For Tech Startup Loan Exploration Samples

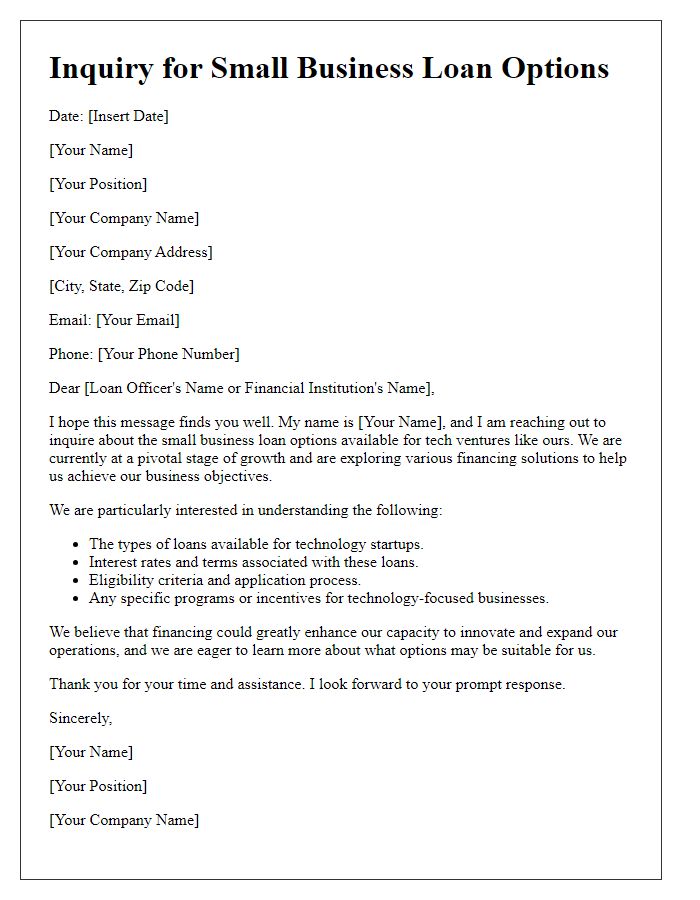

Letter template of inquiry for small business loan options for tech ventures.

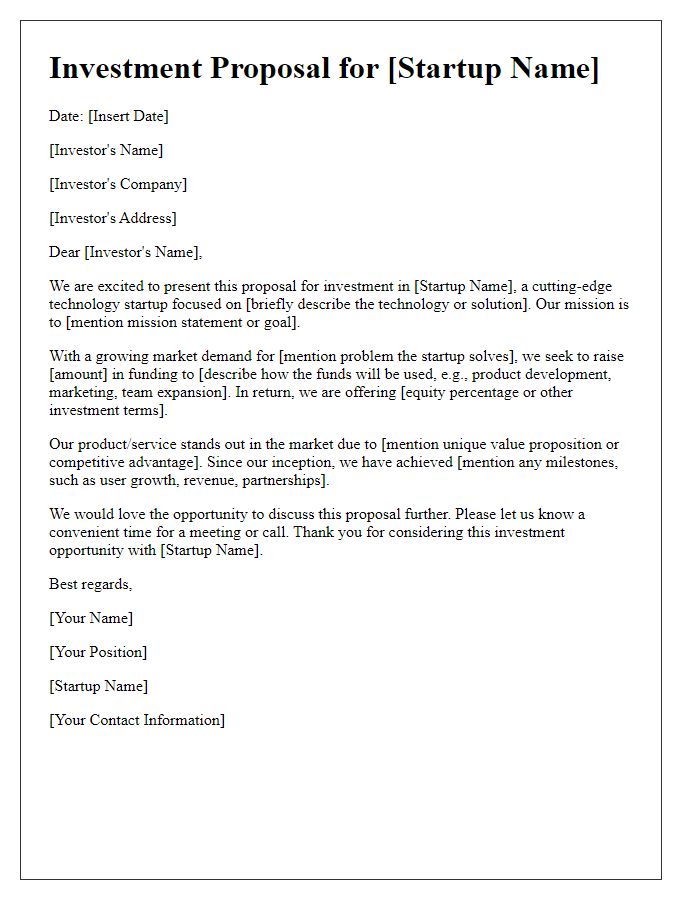

Letter template of proposal for investment funding in a technology startup.

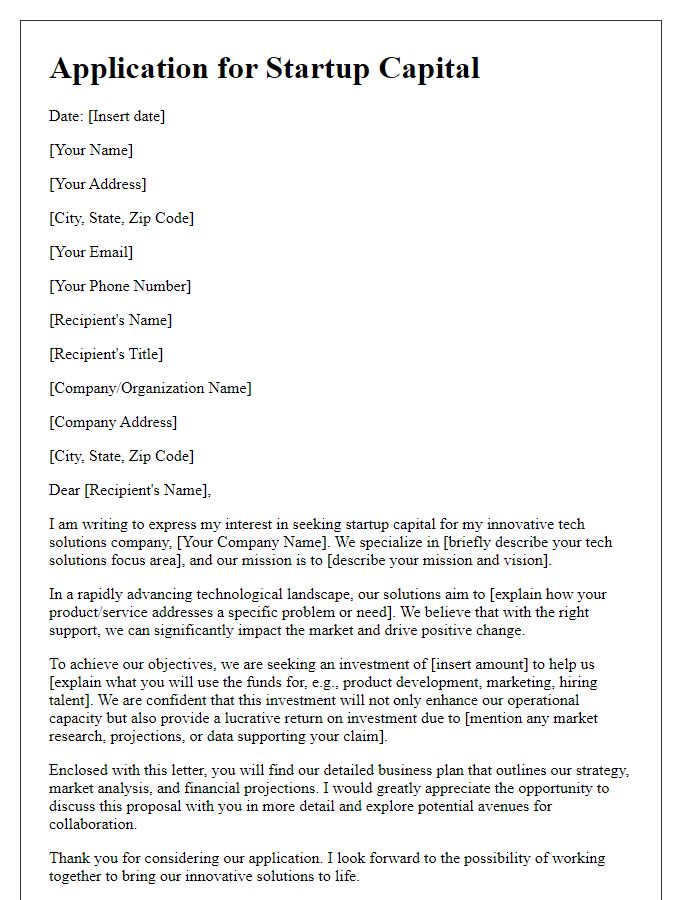

Letter template of application for startup capital to innovate tech solutions.

Letter template of interest in financing opportunities for tech entrepreneurs.

Letter template of intent to secure a loan for technology project development.

Letter template of business plan submission for tech startup loan consideration.

Letter template of request for loan terms clarification for tech startups.

Comments