Are you a senior citizen looking for financial support tailored just for you? Understanding the unique needs of older adults, various organizations now offer specialized loan benefits to make your golden years more comfortable. These loans can help cover medical expenses, home improvements, or even leisure activities, ensuring you enjoy your retirement without financial stress. Curious about how you can take advantage of these opportunities? Read on to discover more!

Eligibility Criteria

Senior citizen loan benefits provide financial assistance tailored for individuals aged 60 and above, often addressing specific needs such as healthcare, home repairs, or lifestyle improvements. Eligibility criteria for these loans typically include age verification through government-issued identification, proof of income that demonstrates a stable financial background, and a satisfactory credit score (usually a minimum of 600). Additionally, some lenders may require proof of assets, such as property deeds or investment statements, to assess the overall financial health of the applicant. Residence verification often necessitates utility bills or lease agreements within recognized areas, ensuring that the applicant is a legal resident. Understanding these criteria is crucial for seniors seeking to leverage financial products that enhance their quality of life.

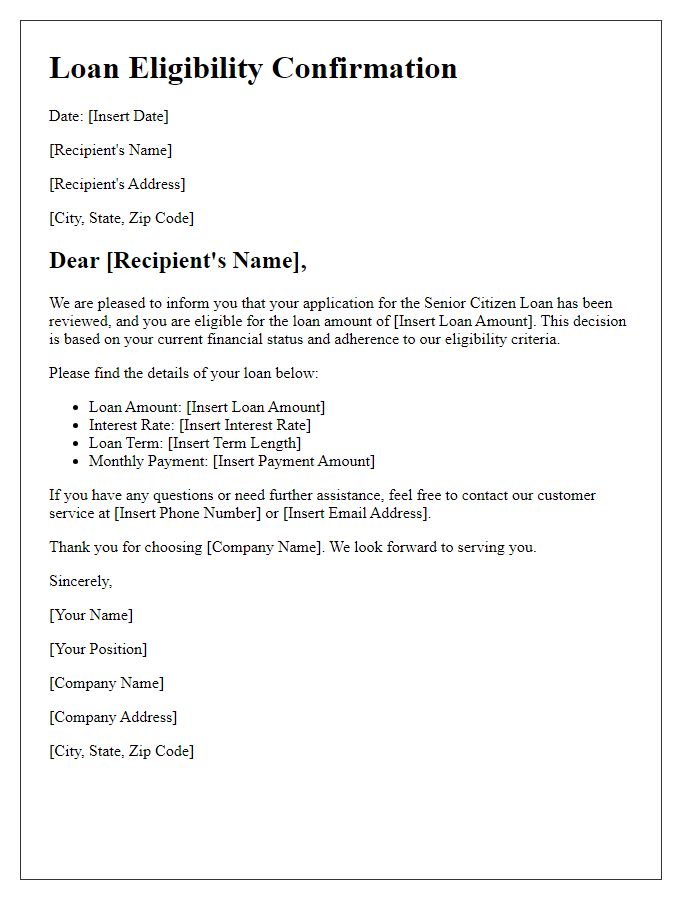

Loan Amount and Interest Rate

Senior citizen loans offer financial support tailored for individuals aged 60 and above. The loan amounts typically range from $5,000 to $100,000, depending on factors such as income stability and credit history. Interest rates often vary from 5% to 12%, influenced by the lending institution and prevailing market conditions. Many financial institutions, like credit unions and banks, provide specialized loans for senior citizens, with favorable repayment options that can extend up to 15 years. Some loans may also accommodate fixed interest rates, providing predictability in monthly payments, while others might offer variable rates linked to national benchmarks such as the Prime Rate.

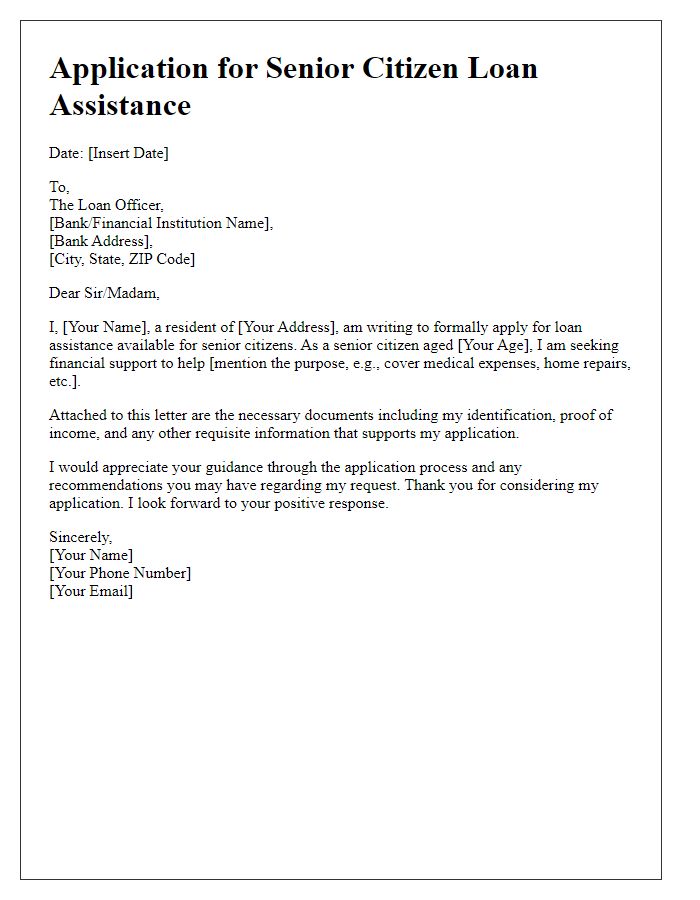

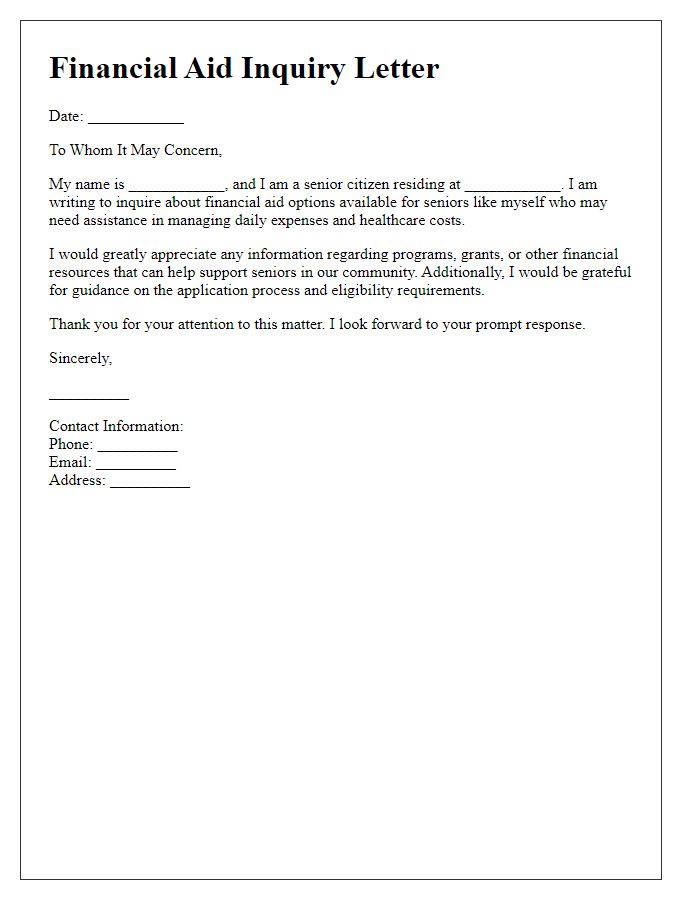

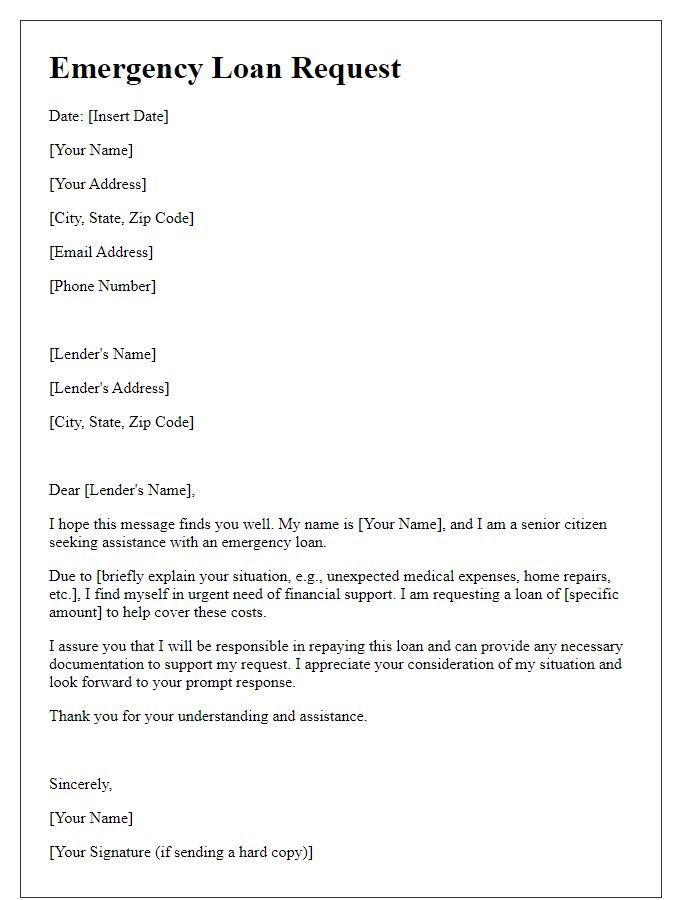

Application Process

The application process for senior citizen loan benefits typically involves several key steps that cater specifically to individuals aged 60 and above. Firstly, eligibility criteria must be established, which often includes age verification and income assessment to ensure financial stability. Required documents such as identification proof (like a government-issued ID), income statements (pension or social security benefits), and credit history reports are necessary for assessment. Next, prospective applicants should contact financial institutions or government-sponsored programs, such as the Senior Home Equity Conversion Mortgage (HECM) program, to gather detailed information regarding loan products tailored for seniors. Completing the application forms accurately is critical to avoid delays. Once submitted, the institution will evaluate the application, often involving an appraisal of any property (like a primary residence) used as collateral, before granting approval. Throughout this process, accessible assistance should be available to ensure that seniors fully understand their options and responsibilities associated with loan repayment.

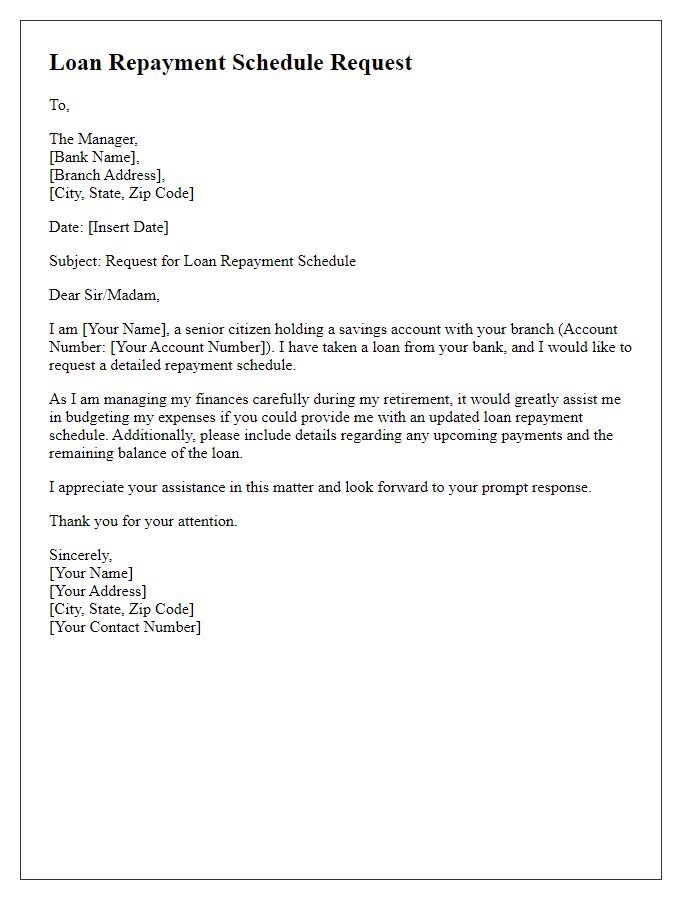

Repayment Terms

Senior citizen loan benefits often include flexible repayment terms tailored to the unique financial situations of retirees. Many lenders provide extended repayment periods, sometimes up to 30 years, allowing seniors to manage monthly payments effectively. Interest rates may be lower, typically ranging from 4% to 8%, depending on creditworthiness and loan type. Additionally, some financial institutions offer options such as interest-only payments for the initial years, easing the financial burden. Prepayment penalties are often waived, allowing seniors to pay off loans early without additional costs. Moreover, specialized programs may offer deferment options based on income levels, ensuring accessibility for seniors on fixed incomes.

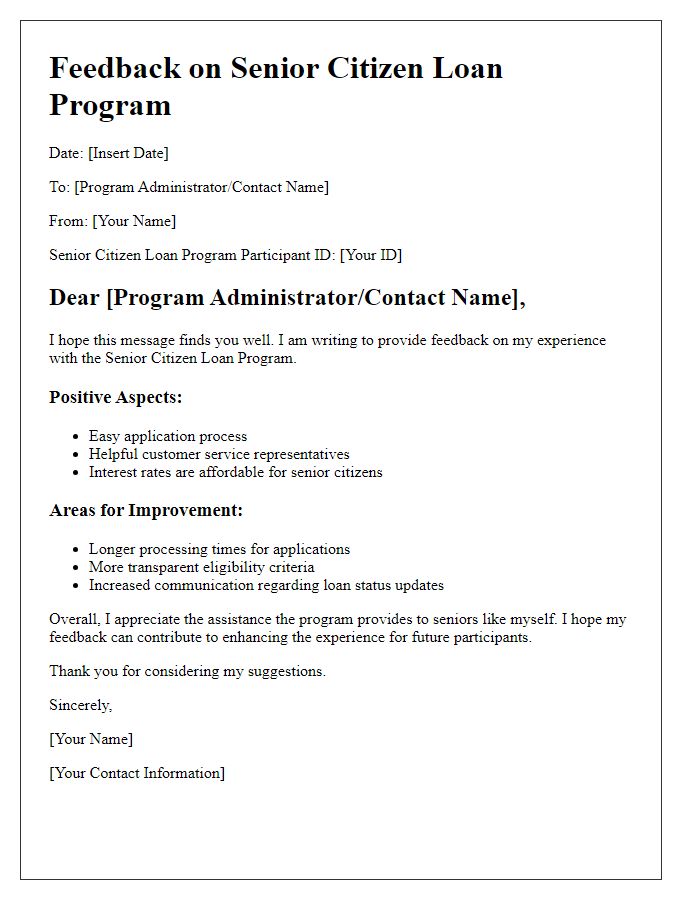

Discounts and Special Offers

Senior citizens can access a variety of loan benefits tailored to their financial needs. Numerous banks and financial institutions provide discounts on interest rates, which can be as much as 0.5% lower than standard rates for individuals aged 60 and above. Special offers may include processing fee waivers, allowing seniors to save significantly on upfront costs. Moreover, extended repayment periods (up to 10 years in some cases) provide flexibility, catering to the income patterns of retirees. Additionally, certain government-backed schemes, such as the Senior Citizens' Savings Scheme (SCSS), enhance savings potential while offering loan options against the accumulated deposits. These diverse benefits aim to promote financial stability and support the changing economic landscape for elderly citizens.

Comments