Are you curious about how loan forgiveness programs can ease your financial burden? Many borrowers are finding relief through various initiatives designed to alleviate student loan debt, making it more manageable. From income-driven repayment plans to public service forgiveness, these options offer hope and support to those navigating the complexities of loans. Join us as we delve deeper into the specifics of these programs and discover if you qualify for assistance!

Borrower Information

The Loan Forgiveness Program provides relief for eligible borrowers who have made consistent payments on federal student loans, specifically under the Public Service Loan Forgiveness (PSLF) initiative. Applicants must have completed at least 120 qualifying monthly payments while employed full-time by a qualifying employer, such as government entities or non-profit organizations, and hold Direct Loans. Key details include the requirement to submit a completed Employment Certification Form annually to track qualifying payments and employment status. Additionally, borrowers must ensure their loans are in good standing (not in default) to qualify for forgiveness. The program aims to alleviate the burden of student debt, making a significant impact on financial wellness for those serving in public service roles.

Loan Account Details

Loan forgiveness programs, particularly those offered by the federal government, can provide significant relief for borrowers experiencing financial hardship. The Public Service Loan Forgiveness (PSLF) program, established in 2007, targets individuals employed in government or non-profit sectors after making 120 qualifying monthly payments under a repayment plan. Loan accounts like Federal Direct Consolidation Loans are eligible, while FFEL or Perkins Loans require consolidation before qualification. The program mandates an active employment status with an eligible employer to ensure forgiveness. The processing time for forgiveness applications can vary, generally taking from a few months to over a year, depending on the volume of applications and the complexity of the borrower's situation. Keeping accurate payment records and submitting the Employment Certification Form each year is critical in documenting eligibility for this program.

Eligibility Criteria

Eligibility criteria for a loan forgiveness program typically encompass a variety of factors, including employment status, type of loan, and duration of repayment. For individuals seeking forgiveness of student loans under programs like Public Service Loan Forgiveness (PSLF), it is essential that they work full-time for a qualifying employer, such as government entities or nonprofit organizations. Borrowers must also make 120 qualifying monthly payments under a qualifying repayment plan, including Income-Driven Repayment Plans, before eligibility is considered. Loan types, like Direct Loans, are often specified, while borrowers with Federal Family Education Loans (FFEL) or Perkins Loans may need to consolidate them into Direct Loans. Additional criteria may include demonstrating financial hardship, maintaining full-time employment status, or enrolling in specific programs aligned with the forgiveness guidelines. Familiarity with the specific rules, deadlines, and documentation requirements can significantly impact one's ability to successfully achieve loan forgiveness.

Forgiveness Terms

The Forgiveness Terms for the Loan Forgiveness Program outline specific criteria that borrowers must meet to qualify for debt relief. Eligible loans include federal student loans (subsidized, unsubsidized, and PLUS loans) issued under the William D. Ford Federal Direct Loan Program. Borrowers must demonstrate a commitment to eligible employment, typically in public service sectors, such as teaching, social work, or nonprofit organizations. A minimum of 120 qualifying monthly payments are required, which must be made while employed in an eligible position. Full-time employment status (generally 30 hours per week) is also a prerequisite for achieving forgiveness. All applications must be submitted to the U.S. Department of Education and approved through the Federal Student Aid office. Program participants should maintain records of employment certifications and payment history to facilitate the verification process.

Application Process

The loan forgiveness program, particularly under the Public Service Loan Forgiveness (PSLF) initiative, involves a structured application process designed for eligible borrowers who have made qualifying payments while working in public service roles. Applicants must first complete the Employment Certification Form to demonstrate that their employment qualifies under the program guidelines. Following approval, borrowers can accumulate months of qualifying payments; the total number required is 120 payments spread over a minimum of 10 years. Upon reaching this threshold, individuals need to submit the PSLF application along with any additional documentation required, such as proof of loan servicing details and employment history. Detailed reviews can take several months, and program updates from the U.S. Department of Education often shape the eligibility criteria, reflecting changes in federal regulations to aid more borrowers in achieving financial relief.

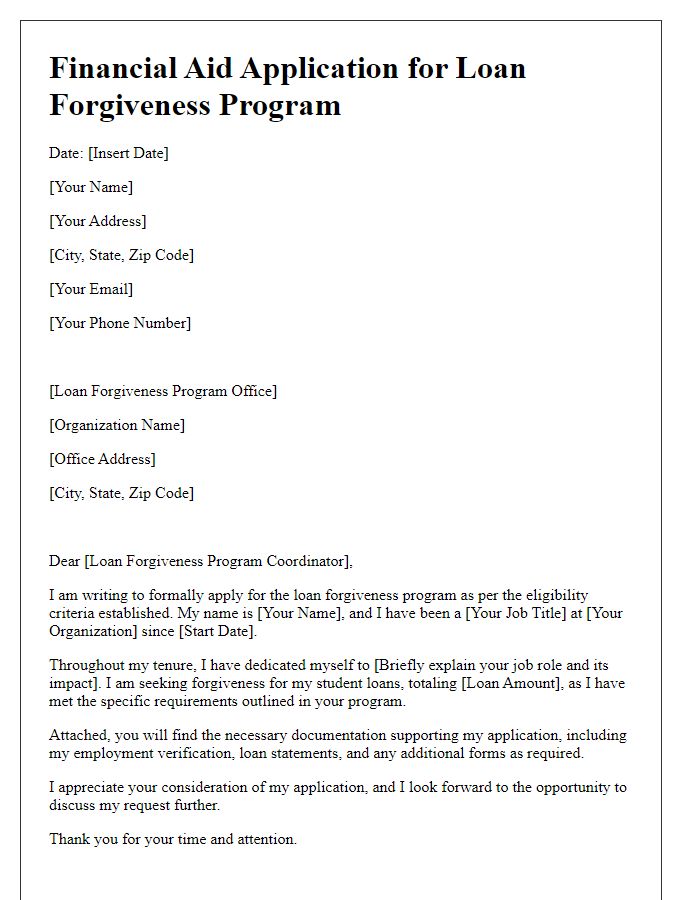

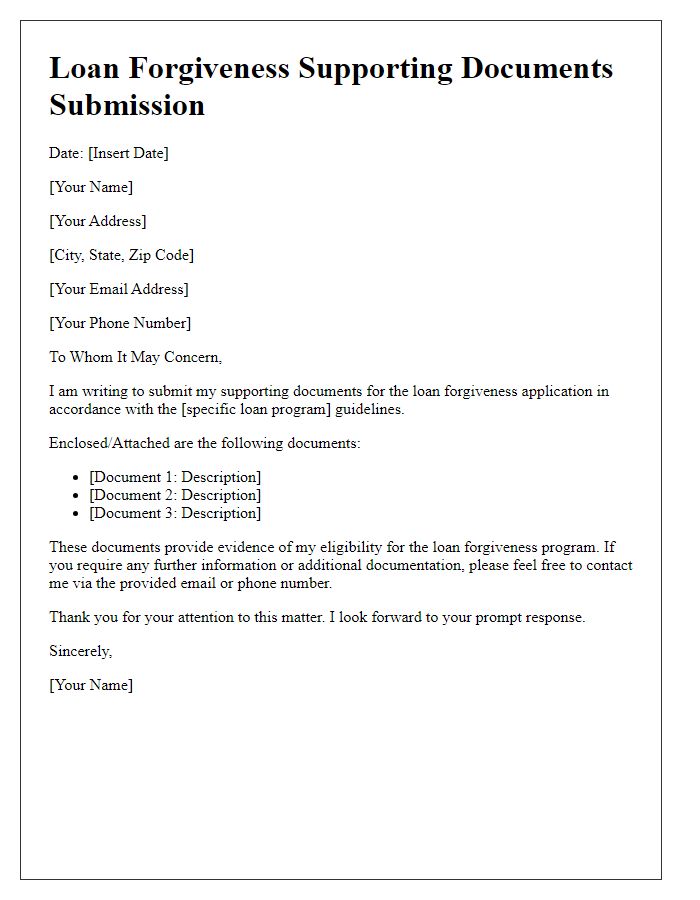

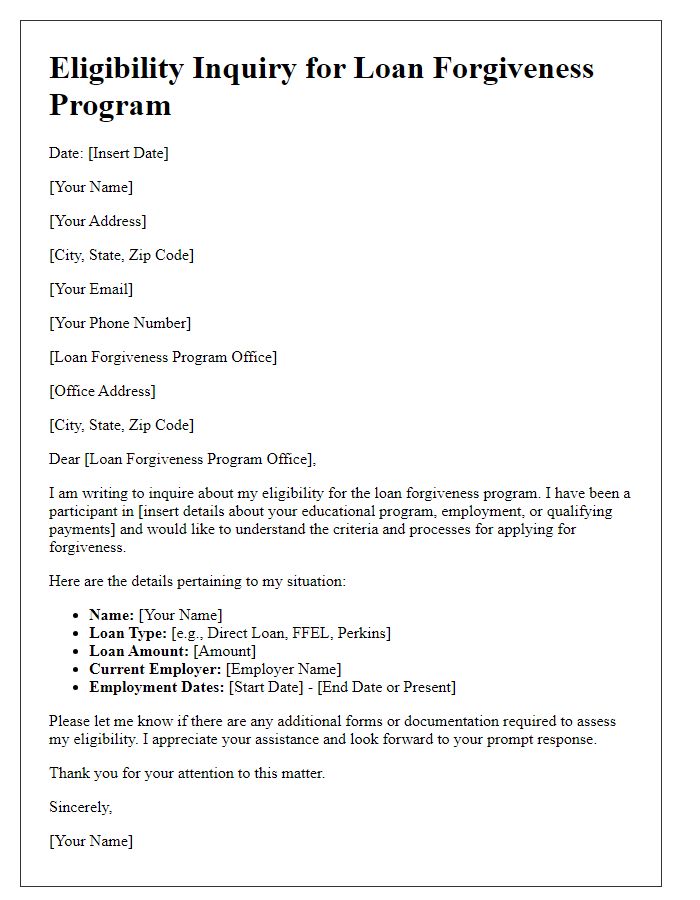

Letter Template For Loan Forgiveness Program Details Samples

Letter template of financial aid application for loan forgiveness program.

Letter template of supporting documents submission for loan forgiveness.

Comments