Hey there! We know that waiting for updates on your loan underwriting process can feel a bit nerve-wracking, and we're here to keep you in the loop. In this article, we'll break down what you can expect during this important phase, including key milestones and tips to ensure a smooth experience. So, grab a cup of coffee and dive in to discover all the details you need to stay informed!

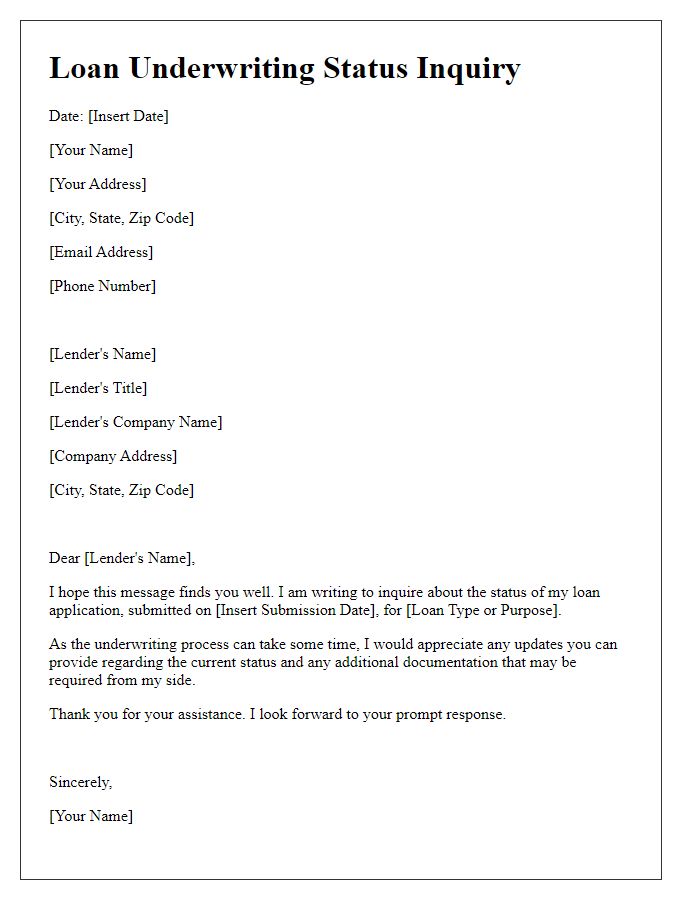

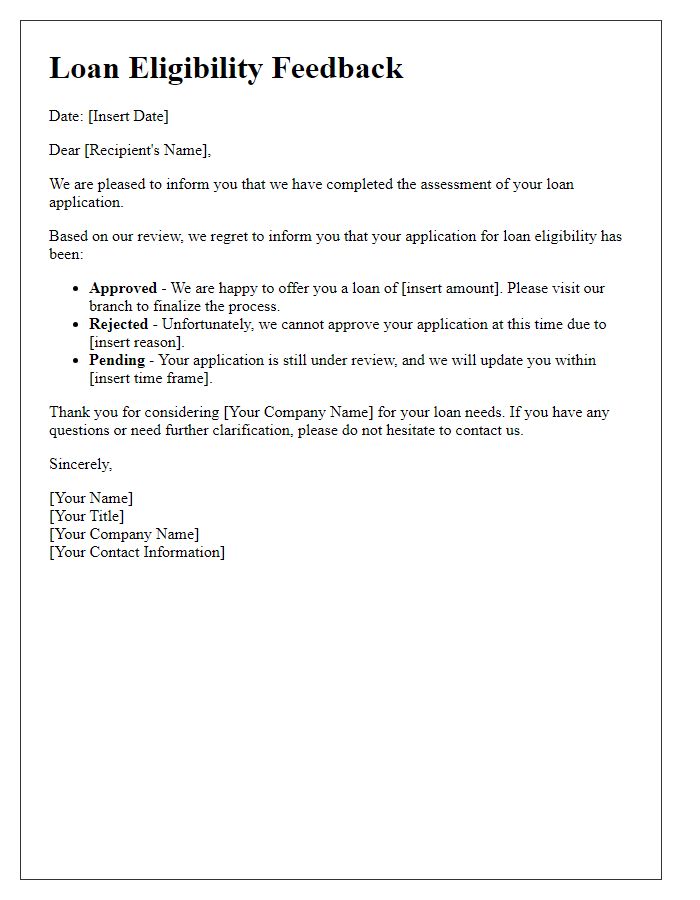

Application Status

Loan underwriting processes are critical steps in determining the eligibility and risk assessment of borrowers seeking financial assistance. The underwriting team conducts a comprehensive review of applicant data, including credit scores, income verification, debt-to-income ratios, and previous financial history to ensure their capacity for repayment. The process is often influenced by external factors such as current interest rates (which may fluctuate based on Federal Reserve policy changes) and housing market trends in specific regions like California or New York. Timely communication regarding the application's status is essential, as it keeps borrowers informed about any required additional documentation or potential delays, ensuring transparency and trust throughout the lending cycle.

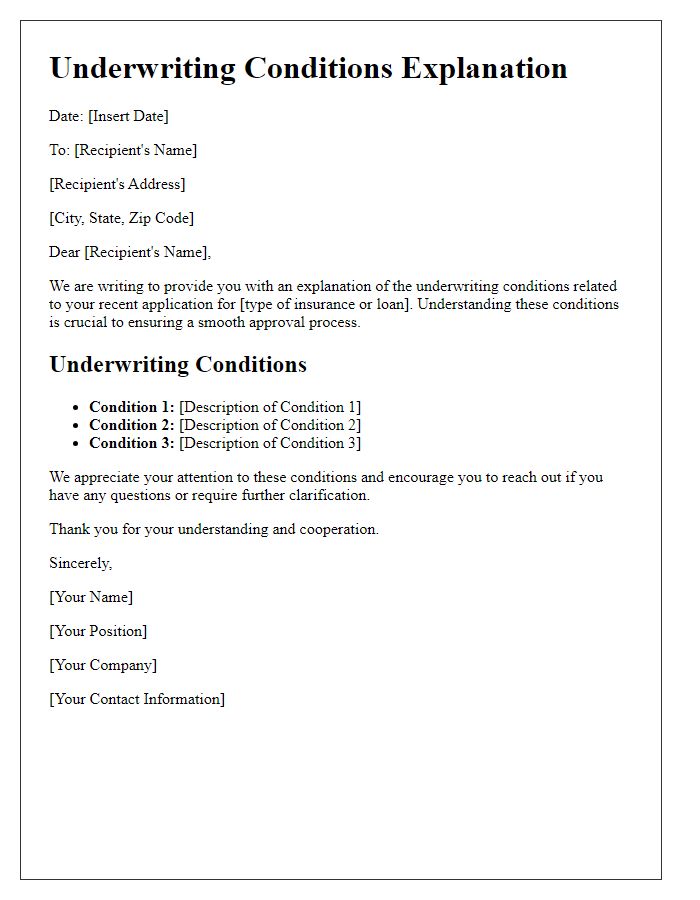

Required Documentation

Loan underwriting processes require meticulous attention to detail, as various documents must be submitted for thorough evaluation. Essential documents include the borrower's income verification, such as pay stubs from employment or tax returns for self-employed individuals, illustrating financial stability. Credit reports, crucial for assessing creditworthiness, must reflect recent activity within the last 90 days. Additionally, property appraisals provide insight into the market value of the real estate involved, ensuring it meets lender standards, while bank statements (usually spanning the last two months) showcase cash reserves. Identification documents, such as a government-issued photo ID and Social Security Number verification, confirm borrower identity and eligibility. Each document plays a pivotal role in determining loan approval and safeguarding against financial risks.

Credit Evaluation Results

A comprehensive credit evaluation plays a crucial role in the loan underwriting process, particularly for financial institutions assessing borrower reliability. Credit scores, typically ranging from 300 to 850, are analyzed to determine the individual's creditworthiness. A score below 620 may indicate a higher risk, while scores above 740 are generally seen as favorable. The evaluation includes reviewing credit reports from major bureaus such as Experian, TransUnion, and Equifax, documenting credit history, outstanding debts, and payment history. Additionally, the underwriter considers key factors like debt-to-income ratio (DTI), which should ideally be below 36% to enhance approval chances. Overall, the credit evaluation results guide lenders in making informed decisions regarding loan approvals and interest rates.

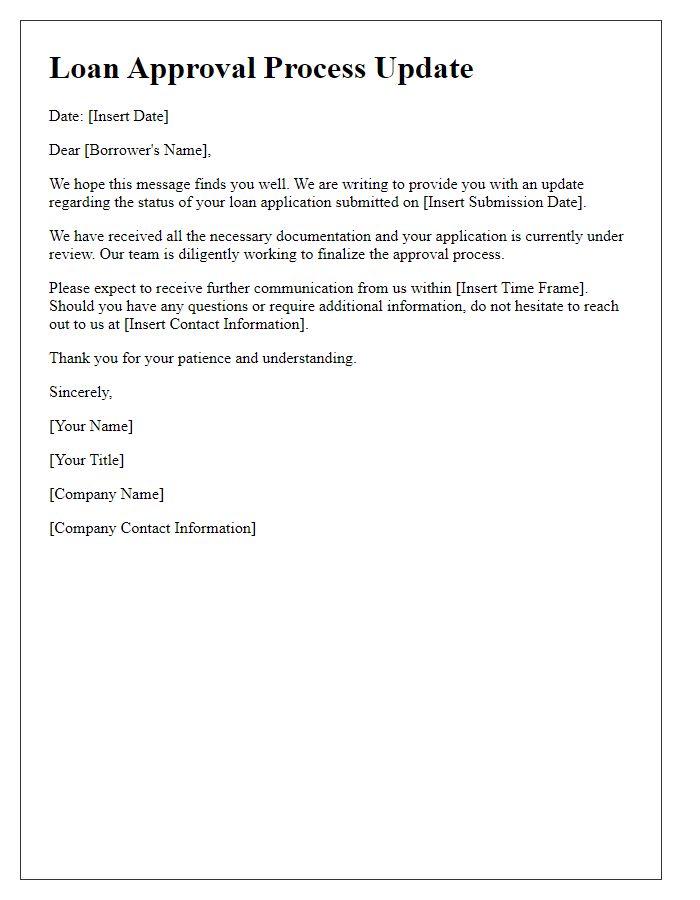

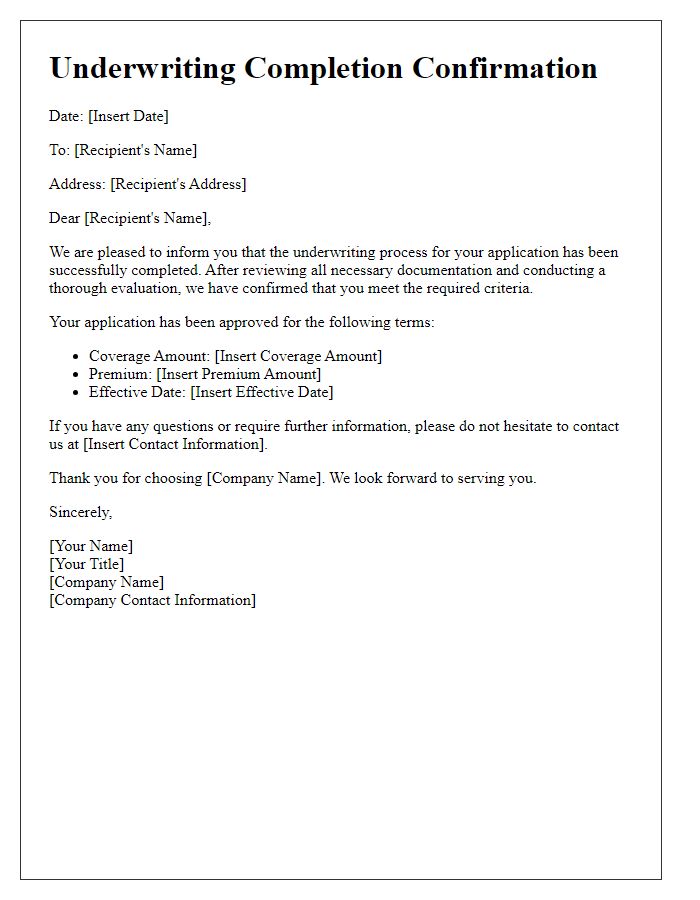

Underwriting Decision

Underwriting decision-making in loan processes heavily relies on various key factors, including applicant credit scores (usually ranging from 300 to 850), income verification through employment documents (like pay stubs and W-2 forms), and debt-to-income ratio calculations. Financial institutions conduct thorough assessments of collateral, often involving property appraisals conducted by certified appraisers, which provide accurate market value estimates. Loan types, such as FHA (Federal Housing Administration) loans or conventional mortgages, have distinct eligibility criteria that affect underwriting outcomes. Processing times for underwriting decisions can vary widely, typically taking anywhere from three to ten business days, depending on the complexity and completeness of the application submitted.

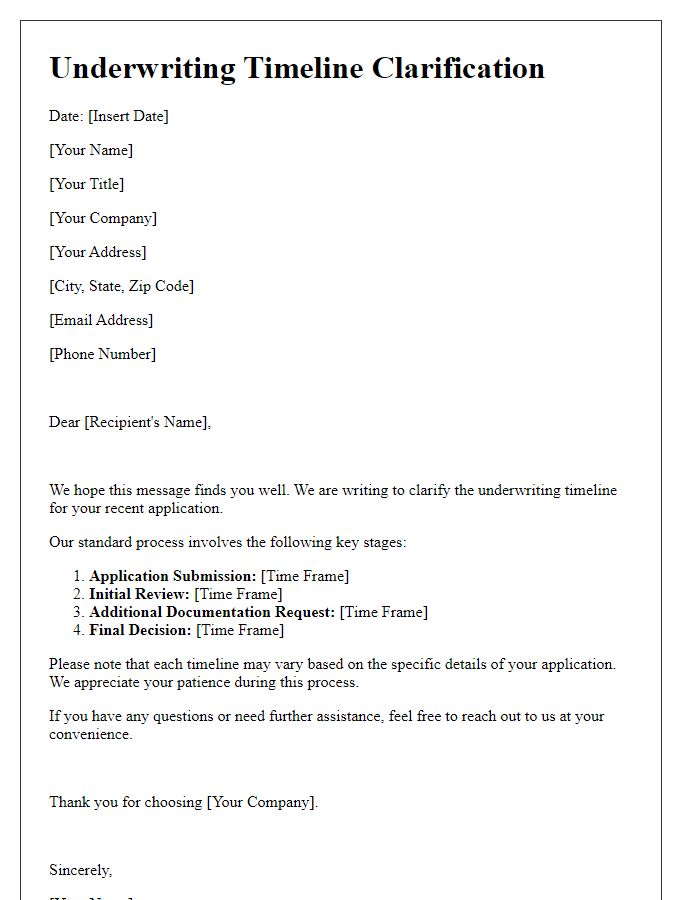

Next Steps and Timeline

The loan underwriting process progresses through several critical stages, impacting approval timelines for applicants seeking financing. The initial review of submitted documents, including income verification and credit reports, typically takes 3 to 5 business days. Once the underwriter completes this assessment, they may identify conditions or additional documentation requirements, extending the process by up to 7 days depending on applicant responsiveness. Upon satisfying these conditions, the loan proceeds to the final approval stage, which can take another 2 to 4 business days. Overall, applicants might expect a total timeline of approximately 2 to 3 weeks from application submission to loan finalization at financial institutions, such as credit unions or commercial banks. Understanding these steps aids borrowers in preparing adequately and streamlining their financing goals.

Comments