Are you an international student navigating the complex world of loans? Understanding your options can be overwhelming, but it's crucial for financing your education abroad. In this article, we'll break down the various types of loans available, tips for applying, and what you should consider before making a decision. Keep reading to empower yourself with the knowledge you need for your financial journey!

Loan eligibility criteria

International students seeking loans need to navigate specific eligibility criteria, often varying by lender. Typically, criteria include enrollment in accredited institutions such as the US Department of Education's list of recognized colleges. Age requirements often indicate the borrower must be at least 18 years old. Several lenders require a minimum GPA threshold, commonly around 2.5 on a 4.0 scale, assessed through academic performance. Furthermore, proof of income or a co-signer, particularly a permanent resident or US citizen, is frequently mandated. Documentation such as visa status confirmation, enrollment verification, and financial statements showcasing tuition costs (often ranging from $20,000 to $60,000 annually for international students) also play critical roles in the assessment of loan applications.

Interest rates and repayment terms

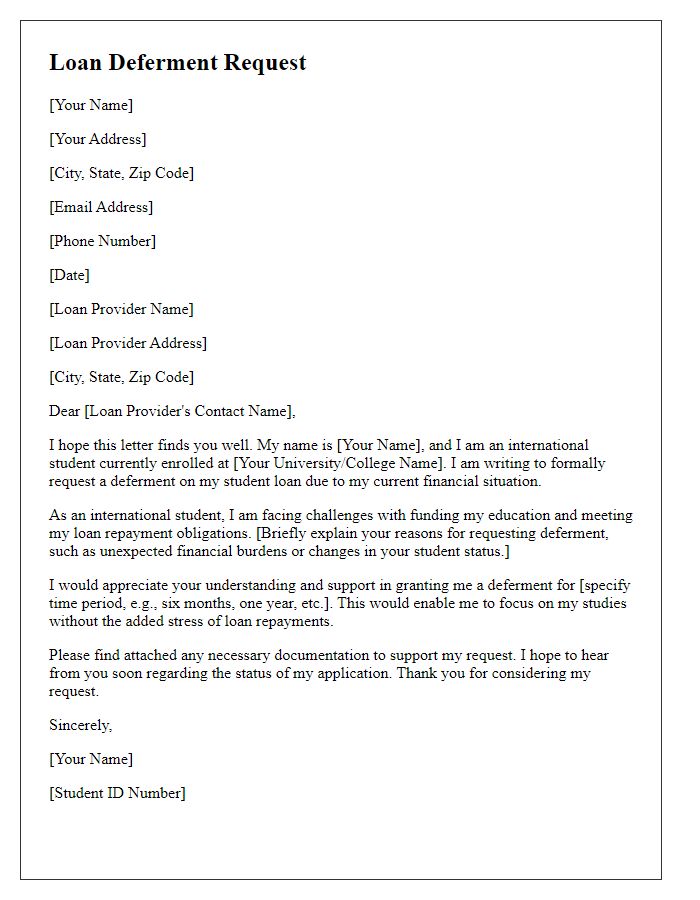

International student loans often feature varying interest rates, typically ranging from 4% to 12% depending on the lender and borrower's credit history. Repayment terms can span from 5 to 20 years, depending on the loan type and institution policies. Some lenders offer a grace period of 6 to 12 months post-graduation before repayments commence, providing students time to secure employment. Additionally, numerous loans may allow for deferment options, enabling borrowers to temporarily pause payments under certain conditions, such as economic hardship or further education pursuits. Understanding these factors can significantly impact financial planning for international students studying in countries like the United States or Canada.

Application process guidelines

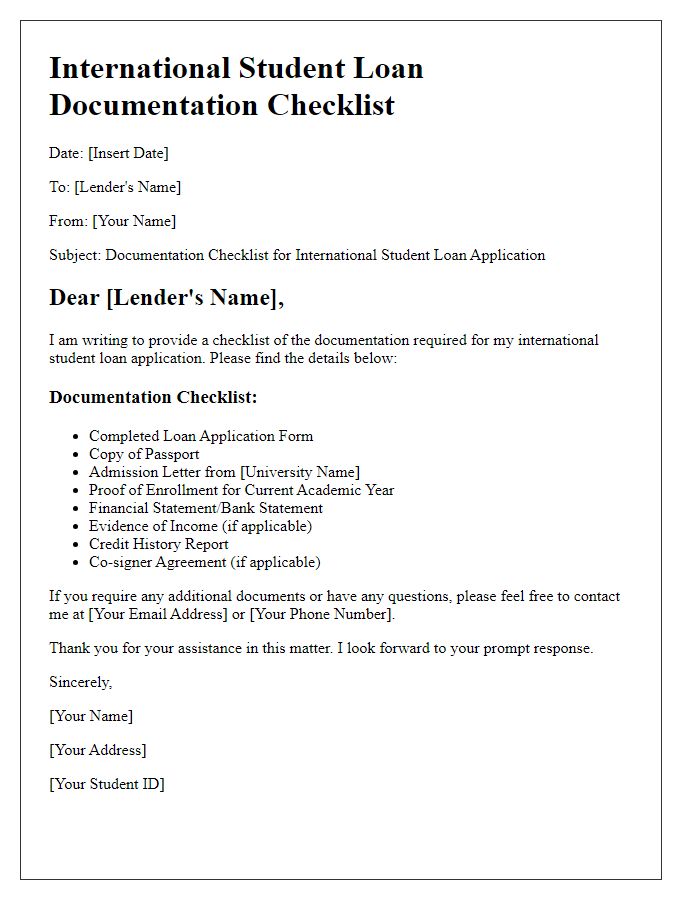

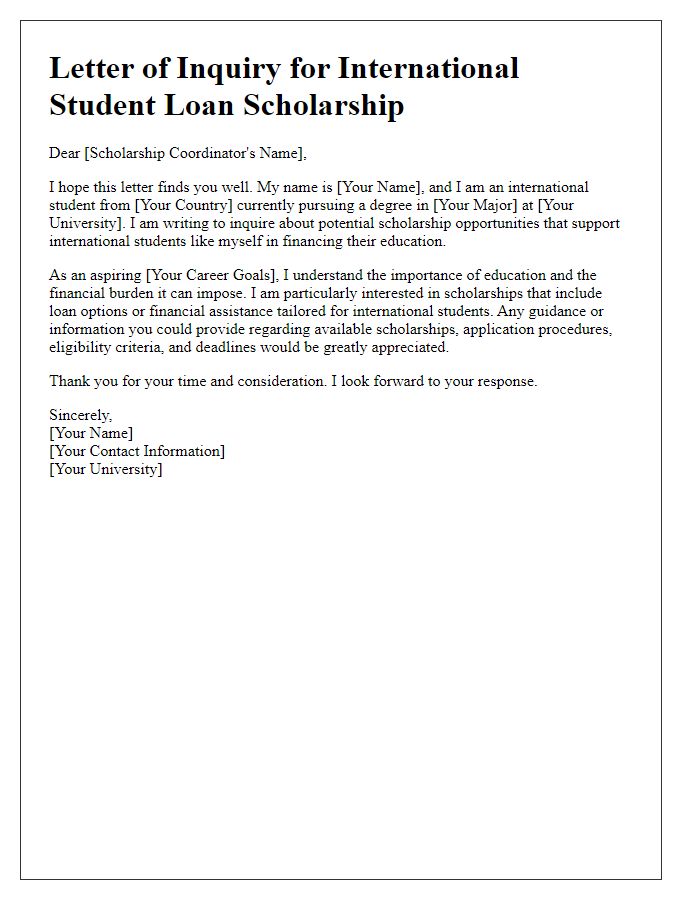

International students seeking educational loans must navigate a complex application process. Eligibility criteria typically require applicants to possess a valid student visa, enroll in an accredited institution, and demonstrate financial need through documents like bank statements or income verification. Key documents often include proof of identity (such as a passport), admission letters from universities, and school enrollment verifications. Lenders may also request a co-signer, often a U.S. citizen or permanent resident, who guarantees the loan. Interest rates can vary significantly based on the lender's terms, often ranging from 5% to 15%, depending on the applicant's creditworthiness. Furthermore, students should be aware of repayment terms, which usually commence six months after graduation or dropping below half-time enrollment. Understanding these guidelines will help streamline the application process for international student loans.

Financial documentation requirements

International students seeking loans for studies in the United States often encounter specific financial documentation requirements that are essential for loan approval. Financial statements, such as bank statements from the past three months, must demonstrate sufficient funds to cover tuition and living expenses, typically estimated at $30,000 to $60,000 annually, depending on the institution. Additionally, proof of income or employment verification from a sponsor or family member may be necessary to establish ongoing financial support. International students should also consider obtaining an affidavit of support, which outlines the financial commitment from sponsors. Educational expenses, such as tuition fees from universities like Harvard or Stanford, often range between $50,000 and $70,000 per year, heightening the importance of comprehensive financial documentation.

Impact on credit score and credit history

International students seeking education loans must understand the significant impact on their credit score and credit history. Credit scores, numerical representations ranging from 300 to 850, assess the creditworthiness of borrowers based on various factors like payment history, credit utilization, and length of credit history. In the United States, major credit bureaus such as Experian, Equifax, and TransUnion collect and maintain records of individuals' credit activities. An international student without an established credit history may initially face challenges in obtaining loans, but timely payments on education loans can help build a positive credit history, leading to improved credit scores over time. It is crucial for international students to maintain awareness of their financial obligations, avoid late payments, and utilize credit responsibly to avoid lowering their credit score, which could affect future borrowing potential for items like car loans or mortgages.

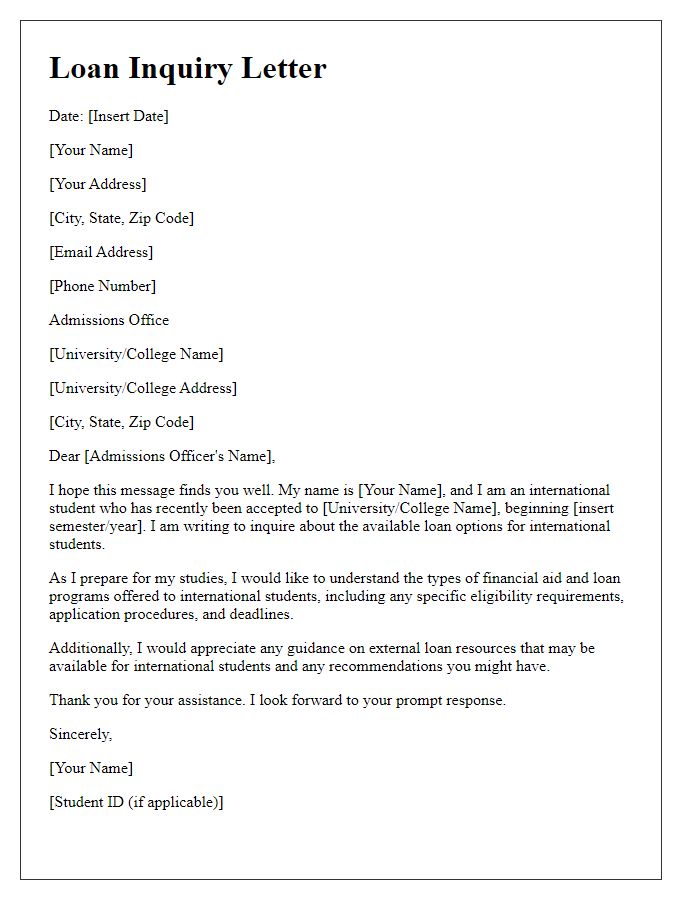

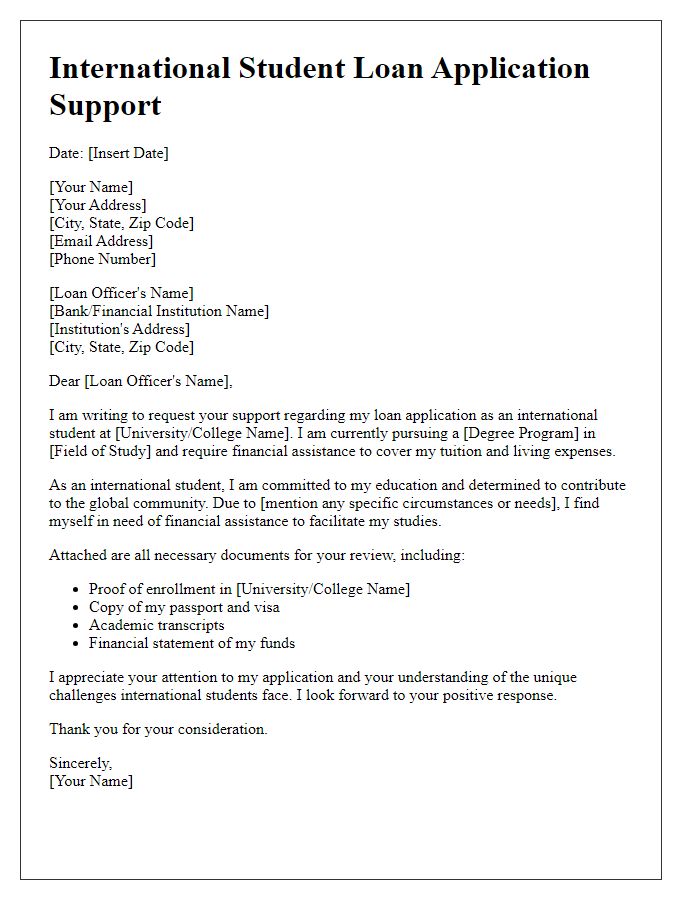

Letter Template For International Student Loan Advice Samples

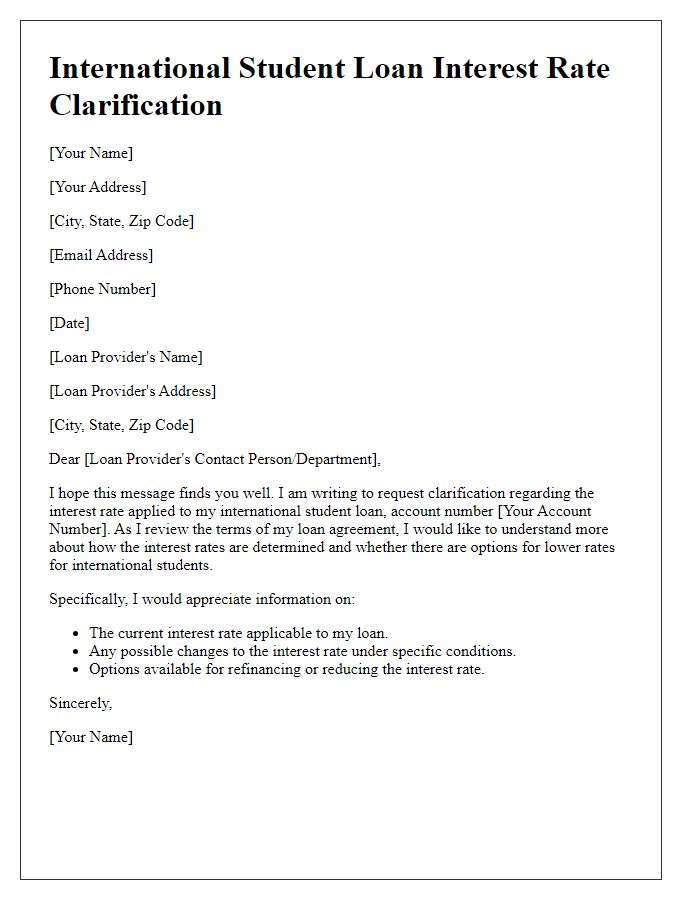

Letter template of international student loan interest rate clarification.

Comments