Are you ready to take the next step toward financial freedom? In this article, we'll guide you through the essential components of a comprehensive loan package offer, breaking down the key elements you need to consider and understand. Whether you're a first-time borrower or looking to refinance, having the right information can make all the difference in securing the best deal. So, grab a cup of coffee, sit back, and let's dive into the details!

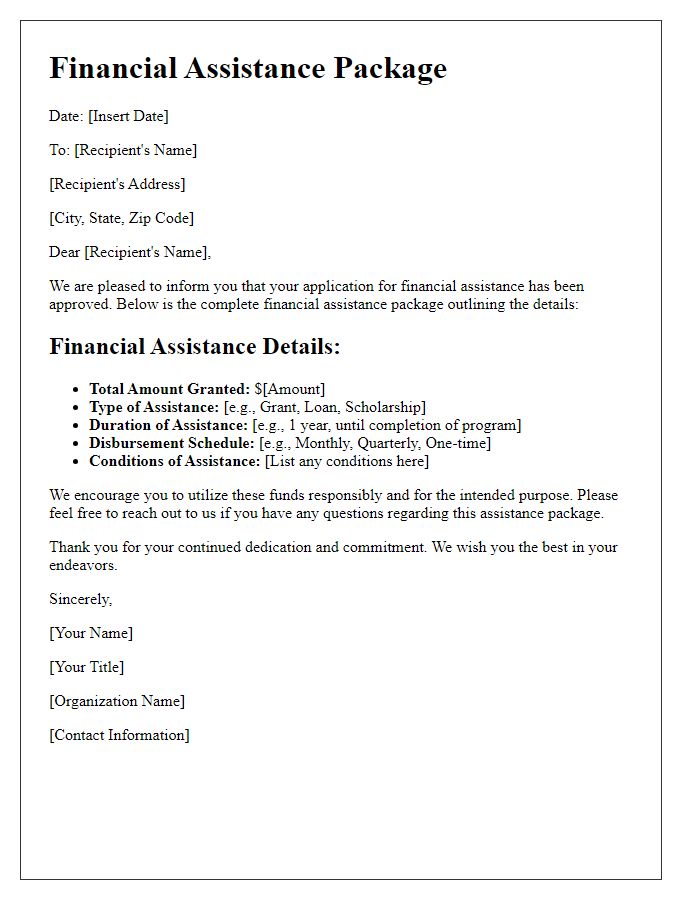

Borrower's Personal Information and Financial Overview

Borrowers seeking personal loans must provide comprehensive financial information to facilitate an accurate assessment. This includes details such as credit scores (typically ranging from 300 to 850), annual income figures (with median household income in the United States around $70,000), and outstanding debt levels (totaling approximately $15 trillion in the U.S.). Key documents necessary for verification include tax returns (covering the last two to three years), bank statements (for the past three to six months), and proof of employment (often requiring recent pay stubs). Additionally, the borrower's residential history, including the duration of residence at current address, can influence loan eligibility. Clear presentation of this information is crucial for determining loan amounts, interest rates, and repayment terms tailored to individual financial situations.

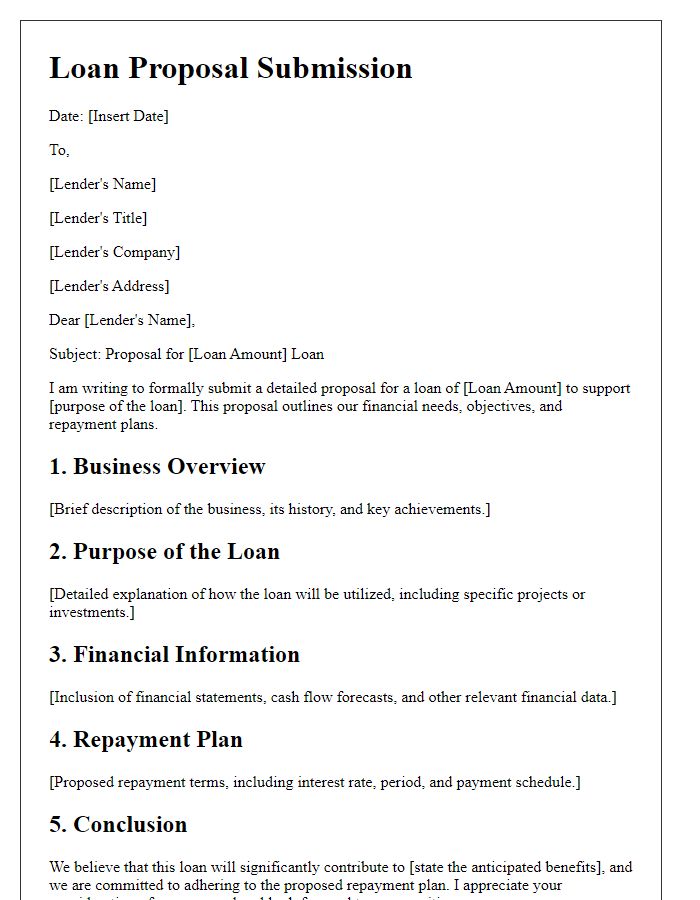

Detailed Loan Terms and Conditions

A comprehensive loan package offer includes essential terms and conditions that outline the specifics of the loan agreement. The principal amount, which is the total sum borrowed (for example, $250,000 for a mortgage), sets the foundation of the agreement. Interest rates, which may be fixed at 4.5% annually or variable depending on market conditions, determine the cost of borrowing. The repayment term spans a specified duration, commonly between 15 to 30 years, impacting monthly payment amounts. Origination fees, typically around 1% of the loan amount, are upfront charges associated with processing the loan application. Monthly payments are calculated based on amortization schedules detailing the breakdown of principal and interest payments over time. Prepayment penalties may apply if the borrower pays off the loan early, ensuring lenders recoup expected interest earnings. Other stipulations may involve collateral requirements, such as the property or asset securing the loan, and eligibility criteria, including credit score thresholds of 620 or higher for conventional loans. A thorough understanding of these terms is critical for borrowers considering their financial commitments and long-term obligations.

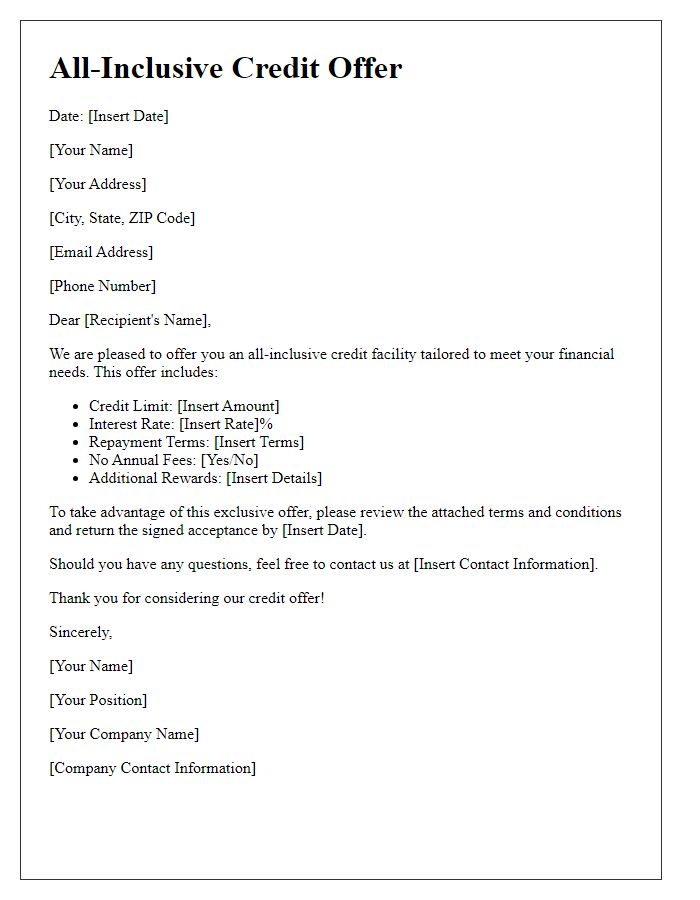

Repayment Schedule and Interest Rates

A comprehensive loan package offer outlines essential financial details, such as the repayment schedule and interest rates, critical for potential borrowers. Typically, repayment schedules delineate the duration of the loan, which may range from 12 to 60 months, specifying monthly payment amounts based on borrowed principal. For instance, a $10,000 loan with a 5% annual interest rate might require monthly payments of around $188. Interest rates fluctuate based on market trends, credit scores, and loan types; for example, current fixed rates for personal loans might vary from 6% to 36%. Understanding these terms helps borrowers assess overall costs, ensuring financial stability throughout the repayment period and fostering informed decisions about their financial commitments.

Right to Cancel and Prepayment Options

A comprehensive loan package offer details important aspects such as the Right to Cancel and Prepayment Options, providing borrowers with critical information about their financial commitments. The Right to Cancel, mandated by the Truth in Lending Act, gives borrowers a three-day period (72 hours) to rescind a mortgage loan agreement, ensuring they can reconsider their decision without penalty. Prepayment Options allow borrowers to pay off their loan early, which is beneficial for those wishing to reduce interest costs; however, some loans may include prepayment penalties, typically ranging from 1% to 6% of the remaining balance, thus requiring careful consideration. Detailed disclosures are crucial for transparency and informed decision-making.

Contact Information for Assistance and Inquiries

A comprehensive loan package offer requires clear contact information for assistance and inquiries. Potential borrowers often seek clarity on terms, interest rates (which can vary significantly, ranging from 2.5% to 6.5% depending on creditworthiness), and repayment options tailored to their financial situations. Including a dedicated customer service number, such as a 1-800 toll-free line, ensures immediate support. Email addresses should be professional and easily recognizable, ideally reflecting the institution's name, like support@bankname.com. Physical locations, including branch addresses, enhance trust, particularly in major metropolitan areas like New York City (ZIP Code 10001) or Los Angeles (ZIP Code 90001), where face-to-face interactions may be preferred by some clients. Clear hours of operation provide reassurance, typically spanning weekdays from 9 AM to 5 PM.

Comments