Are you feeling overwhelmed by the maze of credit improvement loans? You're not aloneâmany people find themselves confused about how to boost their credit scores while managing their finances. Fortunately, navigating this path can be easier with the right guidance and resources at your disposal. So, let's dive into the essential tips and strategies for securing a credit improvement loan that works for youâready to learn more?

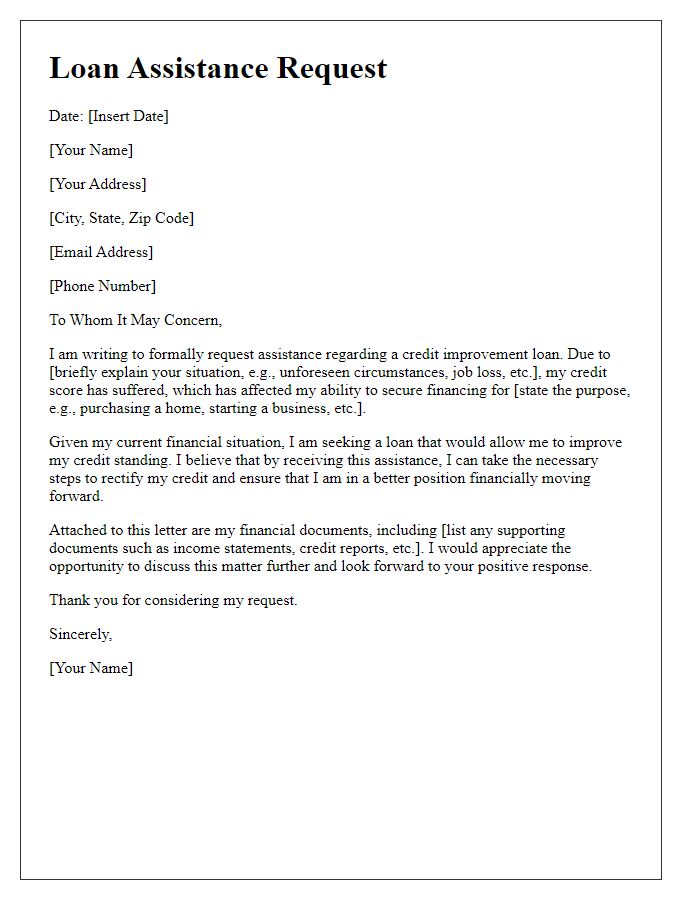

Personalized borrower details

Navigating credit improvement loans can significantly enhance financial health, especially for individuals with credit scores below the average threshold of 700. Personalized guidance tailored to each borrower's unique financial situation involves assessing key factors such as income stability, existing debt levels, and overall credit history. Various loan options, including secured and unsecured loans, can play a vital role in building credit. Using tools like secured credit cards or credit-builder loans can facilitate timely payments; such actions contribute positively to credit utilization ratios and payment history metrics. Understanding local lending organizations, interest rates averaging around 5-10% for low-risk borrowers, and terms of the loans can empower individuals in their quest for credit improvement. This meticulous approach not only aids in securing more favorable loan conditions but also fosters a sustainable path towards a robust credit profile.

Financial status disclosure

Understanding financial statuses can significantly impact the effectiveness of credit improvement loans. Loan applicants should comprehensively disclose personal financial details, including outstanding debts (such as credit card balances averaging $6,500) and monthly income (median household income around $68,700 in 2021). Essential aspects include debt-to-income ratio (a key metric ideally below 36%), credit scores (FICO scores ranging from 300 to 850), and any recent financial hardships experienced. Providing accurate information about assets (like savings accounts typically holding around $8,000) and liabilities creates a clearer picture for lenders. Moreover, maintaining transparency regarding late payments (which can severely affect credit history) allows for tailored guidance in improving credit profiles and securing favorable loan terms.

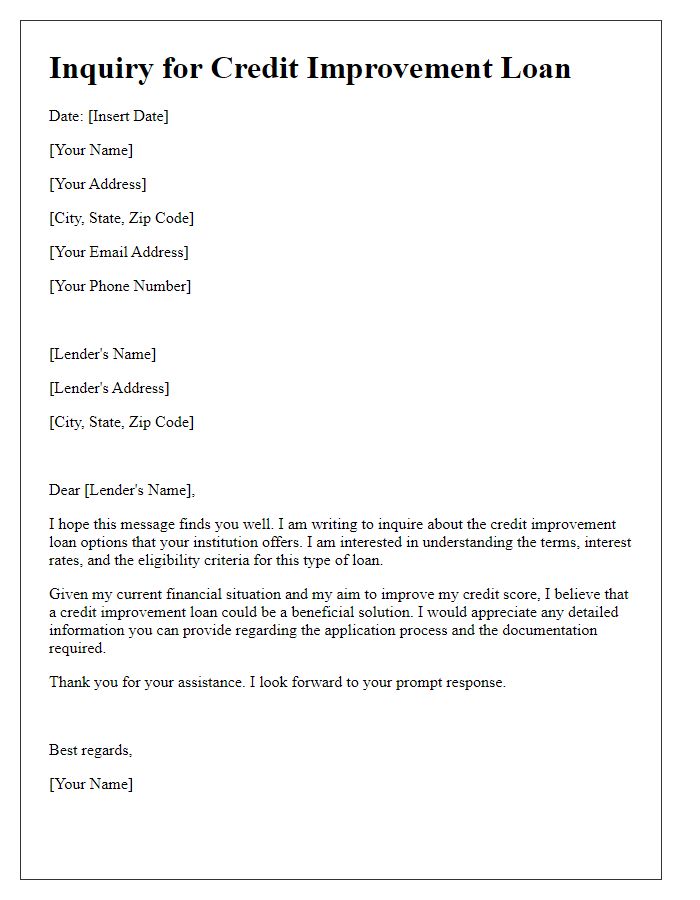

Loan purpose specification

Credit improvement loans serve as financial tools designed to enhance an individual's credit score through strategic borrowing. These loans, often ranging from $1,000 to $20,000, are intended for consolidating existing high-interest debt or funding necessary expenses that can build positive credit history. Borrowers typically utilize these funds to pay off credit card balances, reducing overall credit utilization ratios and demonstrating responsible repayment behavior. Participating in such a loan might also involve monthly payments, which contribute to establishing a consistent payment record, crucial for improving credit standing. Creditworthiness assessment of borrowers often involves FICO scores, where enhancements can lead to more favorable loan terms in the future.

Repayment plan outline

A credit improvement loan can significantly enhance financial health, particularly for individuals seeking to rebuild their creditworthiness after financial setbacks. Establishing a clear repayment plan is crucial for success in this endeavor. Monthly payment structures, typically ranging from $100 to $500, depend on the loan amount and borrower ability. Loan terms may vary between 12 to 60 months, providing flexibility for monthly budgeting. Timely payments contribute positively to credit scores, with each payment reported to major credit bureaus like Experian and TransUnion. To avoid potential penalties, borrowers should maintain an overall debt-to-income ratio below 30%. Regular monitoring of credit reports through platforms like Credit Karma can offer insights into score changes and help track repayment progress.

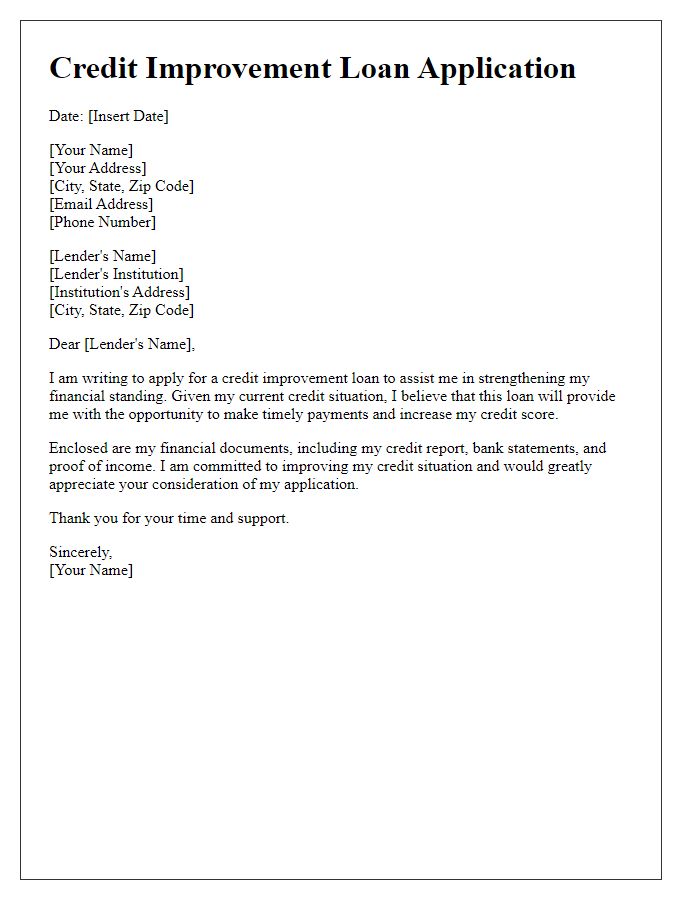

Interest rate breakdown

Understanding the interest rate breakdown for credit improvement loans is crucial for making informed financial decisions. Credit improvement loans typically feature interest rates that vary based on several factors including credit score, loan type, and lender policies. A borrower with a credit score below 600 might face interest rates exceeding 20 percent annually, while individuals with scores above 700 may secure rates starting around 5 percent. Loan types such as secured loans (backed by collateral) often offer lower interest rates compared to unsecured loans (not backed by collateral). Terms ranging from 12 to 60 months also influence the total cost of borrowing, with longer terms generally translating to higher overall interest paid. Moreover, additional factors such as origination fees or points may further affect the effective interest rate, impacting the total financial obligation over the loan's duration.

Comments