Are you an aspiring entrepreneur looking to secure a loan for your business dreams? Navigating the world of financing can be daunting, but with the right guidance, you can unlock the capital you need to thrive. This article offers valuable insights and practical tips to help you craft a compelling loan proposal that stands out to lenders. So, let's dive in and discover how to transform your business vision into reality!

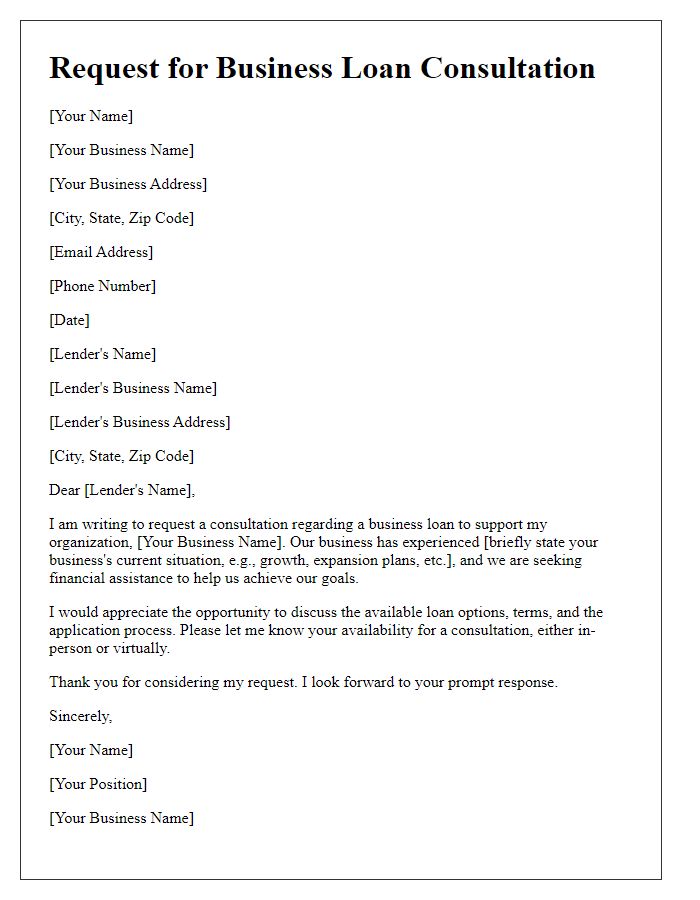

Purpose and Objective

Entrepreneurial loans serve as a crucial financial resource for startups and small businesses, providing the necessary capital to launch or expand operations. The primary objective of these loans includes facilitating the acquisition of equipment, funding inventory, covering operational costs, and empowering innovative projects. Financial institutions often have specific criteria for eligibility, including credit scores, business plans, and cash flow projections. Additionally, understanding terms such as interest rates, repayment schedules, and potential collateral requirements is essential for entrepreneurs, ensuring informed decision-making when seeking funding. With the right advisory support, entrepreneurs can successfully navigate the loan process, maximizing their opportunities for growth and sustainability in the competitive market landscape.

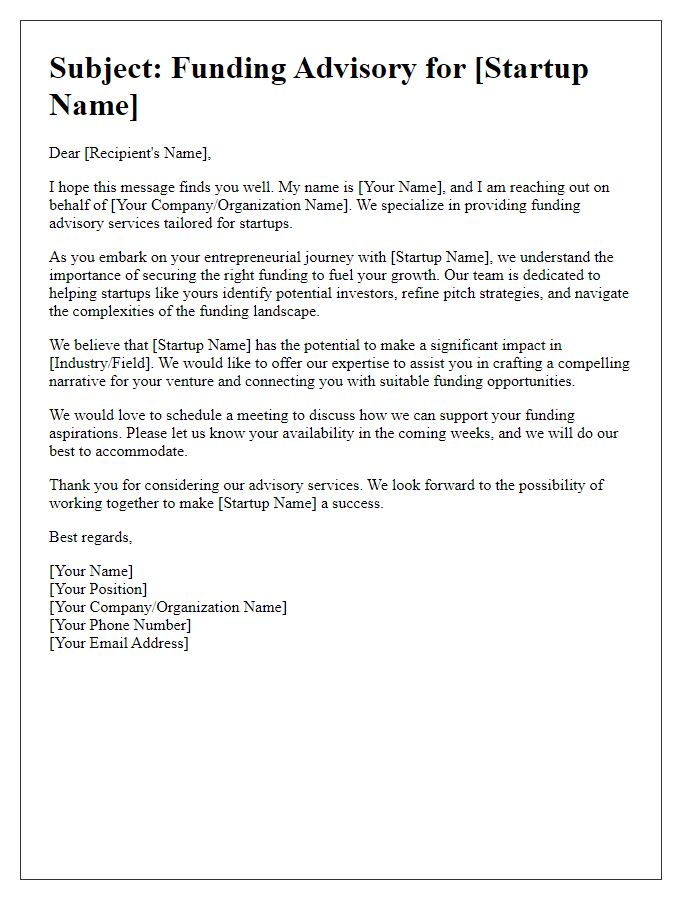

Business Plan Summary

A comprehensive business plan summary outlines critical elements for securing entrepreneurial loans. Market analysis (current trends, target demographics) provides insight into potential profitability. Financial projections (revenue forecasts, break-even analysis) demonstrate viability to lenders while identifying startup costs (equipment, lease agreements). Marketing strategies (branding, digital outreach) reveal approaches to reach customers effectively. Management structure (key personnel, responsibilities) highlights leadership and operational efficiency. Products or services (unique offerings, competitive advantages) detail what differentiates the business in the marketplace. This strategic document serves as a roadmap, guiding both the business owner and potential investors or lenders through the proposed venture's landscape.

Financial Projections

Financial projections serve as a critical roadmap for businesses seeking entrepreneurial loans, outlining anticipated revenues and expenses over specific periods. Sound projections typically cover a three to five-year timeframe, emphasizing key financial statements such as income statements, cash flow statements, and balance sheets. Entrepreneurs often employ market research data to support assumptions, projecting variables like sales growth percentages, cost of goods sold, and fixed expenses. Accurate forecasting helps lenders assess the viability of a business model, evaluate risk levels, and understand potential returns on investment. Providing detailed assumptions alongside projections reinforces credibility and demonstrates preparedness for potential financial challenges.

Loan Amount and Terms

Entrepreneurial loans can significantly impact business growth and expansion opportunities. Loan amounts often vary, typically ranging from $5,000 to $500,000, depending on the lender's assessment of the business's creditworthiness, revenue history, and potential for future profitability. Loan terms, usually spanning 1 to 5 years, dictate repayment schedules and interest rates, which may fluctuate between 5% and 20% based on the risk profile of the borrower. Additional financial considerations include origination fees, which can range from 1% to 5% of the loan amount, affecting the total cost of financing. Entrepreneurs must also evaluate the chosen lender's provisions related to prepayment penalties and collateral requirements, ensuring a thorough understanding of the financial obligations involved in securing the funds necessary for their business endeavors.

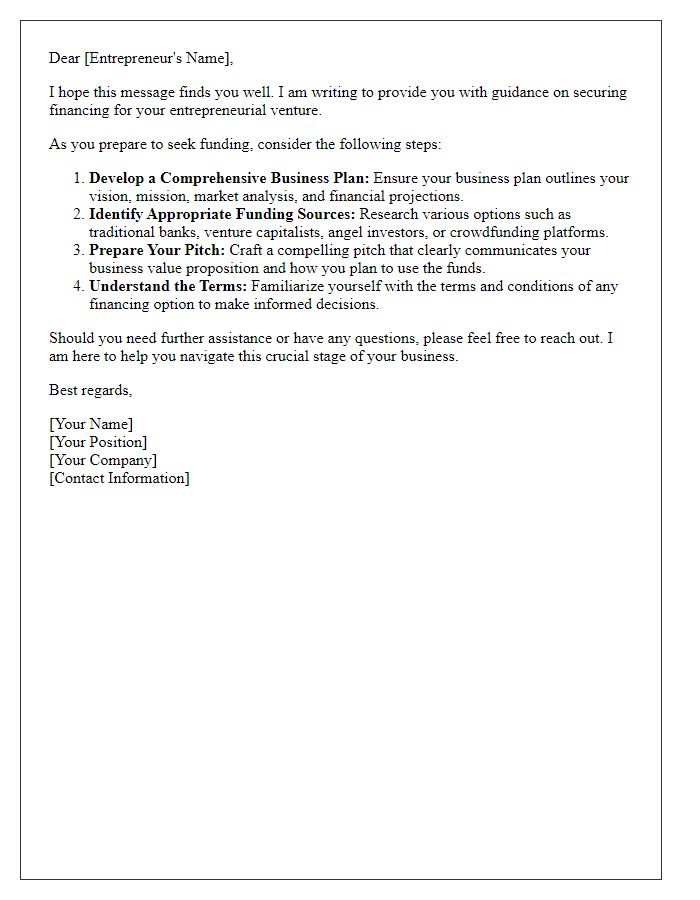

Risk Assessment and Mitigation Strategies

Entrepreneurial ventures often face financial challenges that require careful consideration and planning, especially when seeking loans for business expansion. A comprehensive risk assessment identifies potential threats to profitability, such as market volatility (fluctuations in demand affecting revenue) or operational inefficiencies (issues within production processes leading to increased costs). This assessment also emphasizes the significance of developing mitigation strategies, such as diversifying product offerings (introducing new goods or services to attract various customer segments) and optimizing supply chain management (enhancing logistics to reduce delays and costs). Furthermore, understanding regulatory changes (new laws impacting business operations) and establishing a solid credit history (demonstrating reliability and ability to repay loans) can significantly bolster an entrepreneur's credibility in the eyes of lenders, leading to better loan terms and increased financial support for sustainable growth.

Comments