Are you considering investing in your future through a career development loan? Taking this step can open doors to new opportunities and skill enhancement, making you a more competitive candidate in today's job market. Whether you're looking to acquire new qualifications or further your education, funding options are essential for turning your aspirations into reality. Join me as we explore the ins and outs of crafting a compelling loan request letter that can set you on the path to success!

Clear purpose statement

A career development loan request aims to fund educational opportunities and skills training that enhance employability and promote career advancement. This loan can cover costs associated with courses, certifications, or programs that are essential for professional growth in various industries. By acquiring new skills or knowledge, individuals increase their marketability and potential income, positively impacting both personal and economic development. Specifically, a focus on obtaining qualifications in high-demand fields, such as technology or healthcare, highlights the significance of investing in one's future career prospects.

Detailed career advancement plan

A detailed career advancement plan outlines strategic steps for professional growth, emphasizing goals within specific industries or roles. It typically includes educational milestones, such as pursuing degrees or certifications relevant to fields like project management, information technology, or healthcare. Networking opportunities through industry conferences or local professional organizations, such as the American Management Association or local chambers of commerce, enhance connections with industry professionals. Specific targets, such as achieving promotions within a set timeframe or acquiring new skill sets during training programs, form essential components of the plan, motivating progression. Ultimately, this structured approach ensures a clear pathway to success and fulfillment in one's chosen career.

Specific financial request and amount

Career development loans serve as a vital resource for individuals seeking to enhance their skills or pursue educational qualifications necessary for career advancement. Applicants typically request specific amounts, such as PS1,000 to PS25,000. This financial assistance can facilitate enrollment in accredited programs, such as vocational training courses or university degrees, which can lead to better job prospects and higher income potential. Often, loan terms include manageable repayment schedules and favorable interest rates to support borrowers in achieving their professional goals without undue financial strain. Detailed plans outlining how the education or training will enhance career opportunities should accompany the request, emphasizing the potential return on investment.

Repayment strategy outline

A well-structured repayment strategy for a career development loan ensures timely payment while aligning with personal financial goals. Monthly repayments typically range between 5% to 10% of net income, depending on the loan amount and interest rates, often set around 4% to 7%. Borrowers may consider employing budgeting tools, like the 50/30/20 rule, to allocate funds efficiently: 50% for necessities, 30% for discretionary spending, and 20% for debt repayment. Establishing an emergency fund, ideally three to six months' worth of living expenses, can safeguard against unexpected situations. Additionally, securing stable employment after the training period, with an expected salary increase of 10% to 20%, can enhance repayment capability. Regularly reviewing financial commitments helps adjust the strategy as needed. Engaging with financial advisers or banks may provide insight and additional options such as income-driven repayment plans or refinancing for lower interest rates.

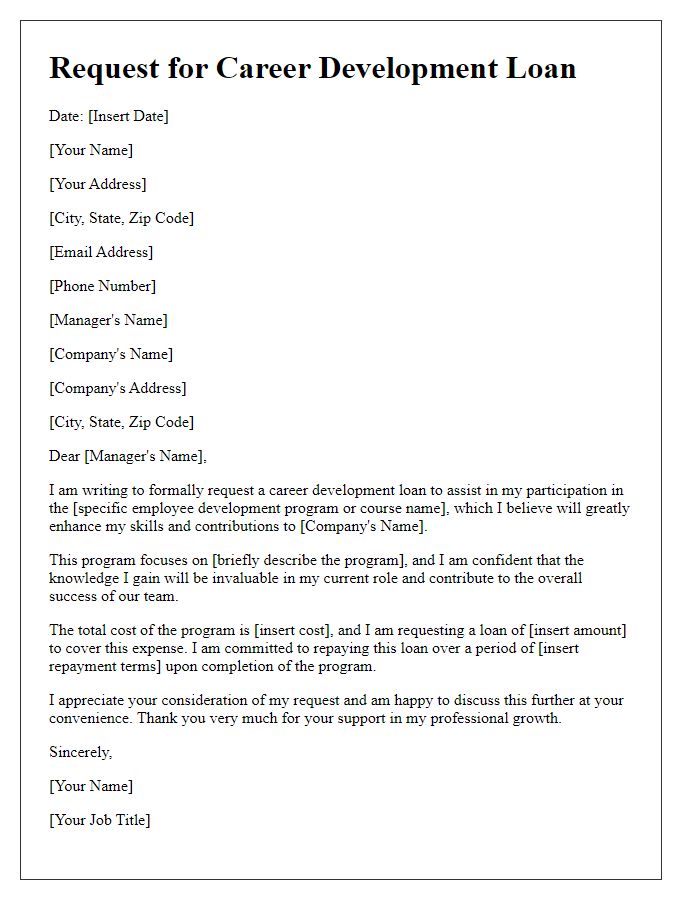

Professional tone and format

Career development loans can provide financial support for individuals seeking to enhance their skills and improve their career prospects. Such loans typically cover tuition fees and training costs for educational programs, which can range from technical courses to advanced degrees, often aiding professionals in fields like healthcare, technology, or business. By investing in career advancement, individuals can potentially increase their earning potentials significantly, contributing to overall economic growth. Many institutions and banks in the United Kingdom, such as the Co-operative Bank and the United Kingdom's Department for Business and Trade, offer specific career development loans with varying terms and conditions, including repayment schedules that align with the borrower's employment situation upon completion of their studies.

Letter Template For Career Development Loan Request Samples

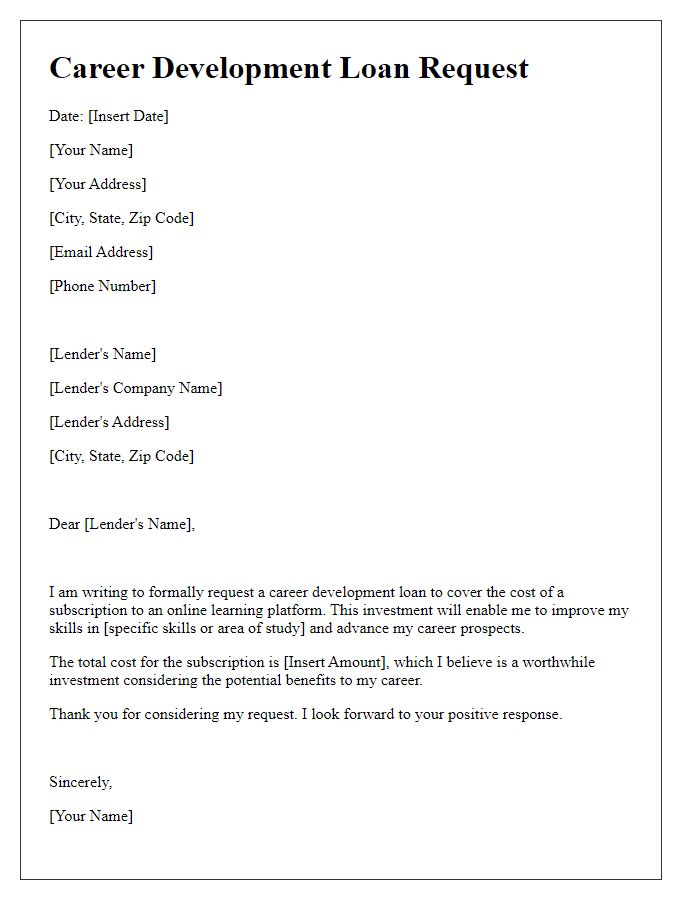

Letter template of career development loan request for professional certification.

Letter template of career development loan request for advanced degree funding.

Letter template of career development loan request for vocational training.

Letter template of career development loan request for skill enhancement workshop.

Letter template of career development loan request for industry conference attendance.

Letter template of career development loan request for business startup training.

Letter template of career development loan request for apprenticeship program.

Letter template of career development loan request for leadership development course.

Letter template of career development loan request for online learning platform subscription.

Comments