When life throws unexpected challenges our way, the weight of financial obligations can feel particularly heavy, especially when it comes to loan repayments. Understanding the consequences of loan default is crucial; not only can it impact your credit score, but it may also lead to additional fees and a potential legal burden. However, it's never too late to regain control and explore your options for resolution. So, if you're curious about how to navigate this difficult situation and what steps to take next, keep reading!

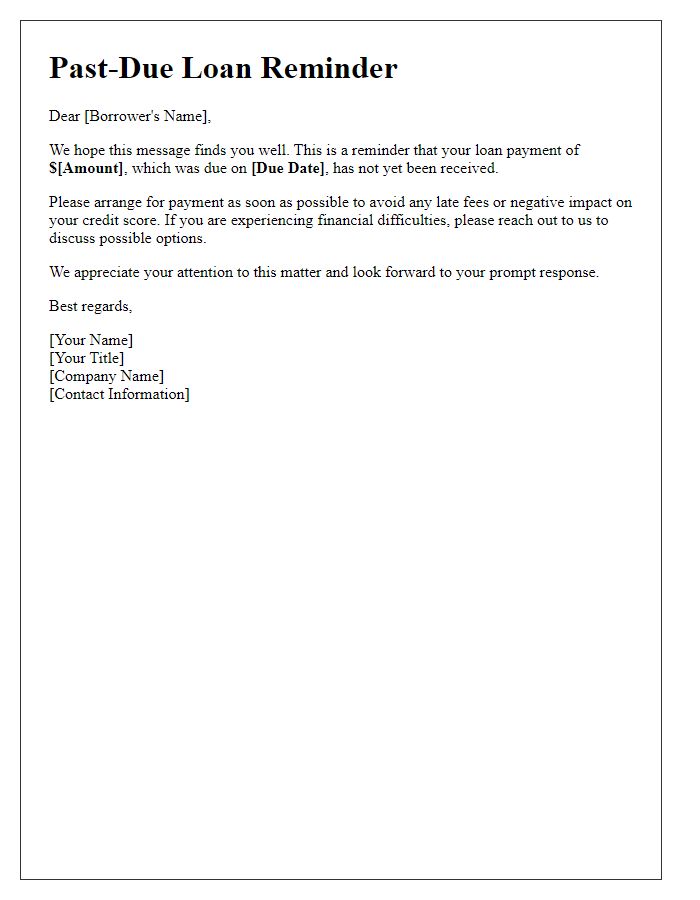

Clear subject line

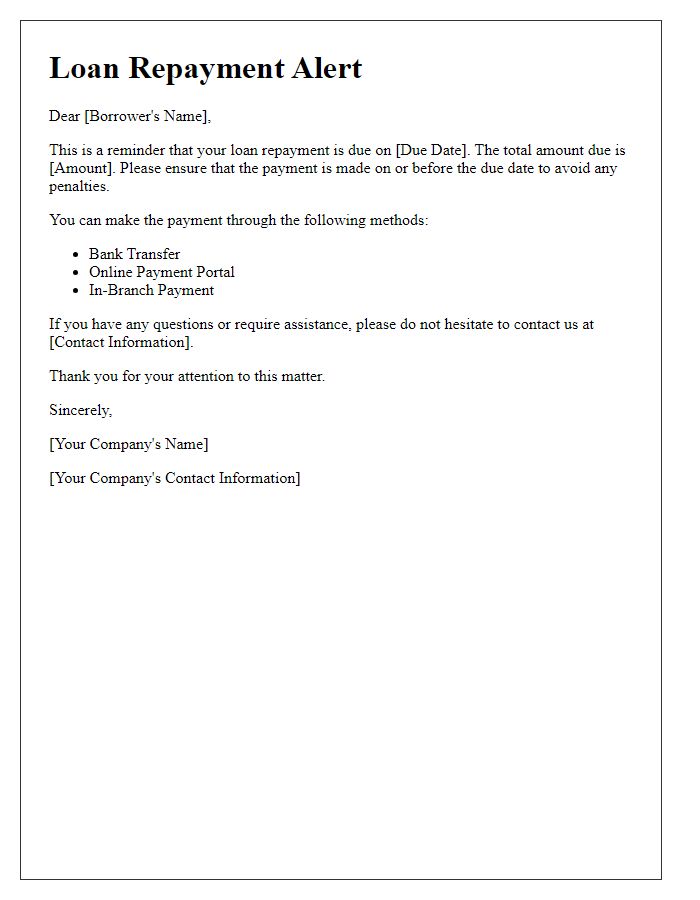

Loan Default Warning Notice: Immediate Action Required This notice serves as an urgent reminder regarding an overdue loan payment, specifically referencing the loan agreement initiated on January 15, 2023, with a principal amount of $10,000 from XYZ Financial Institution in New York. The outstanding balance of $1,200, which was due on March 15, 2023, remains unpaid. Failure to address this delinquency within the next 15 days may result in serious repercussions, including penalties, increased interest rates, or further legal actions. Immediate repayment or arrangements for settling this amount are crucial to avoid further complications and maintain a positive borrowing history.

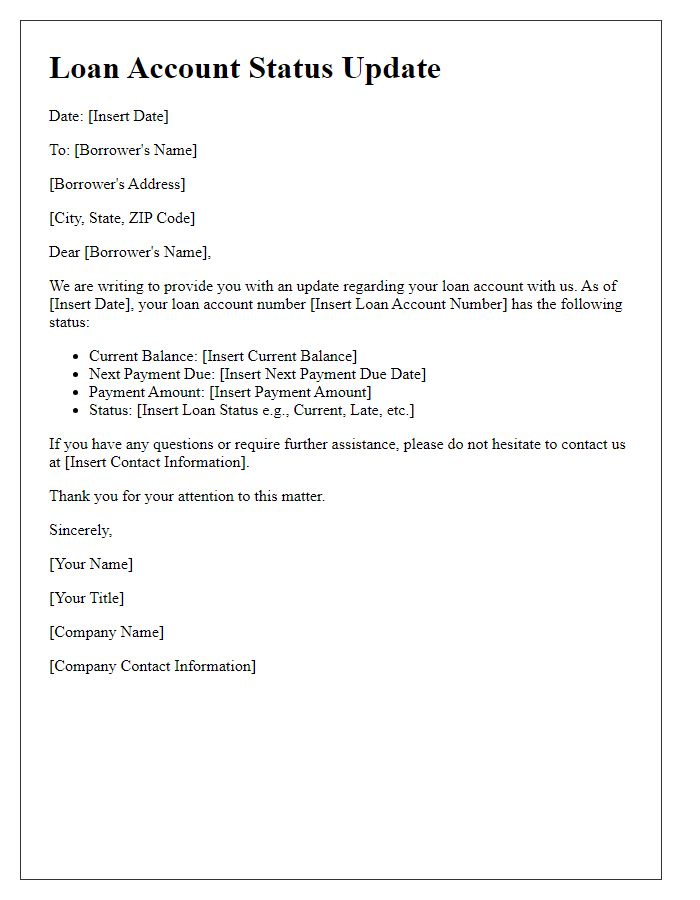

Borrower's personal information

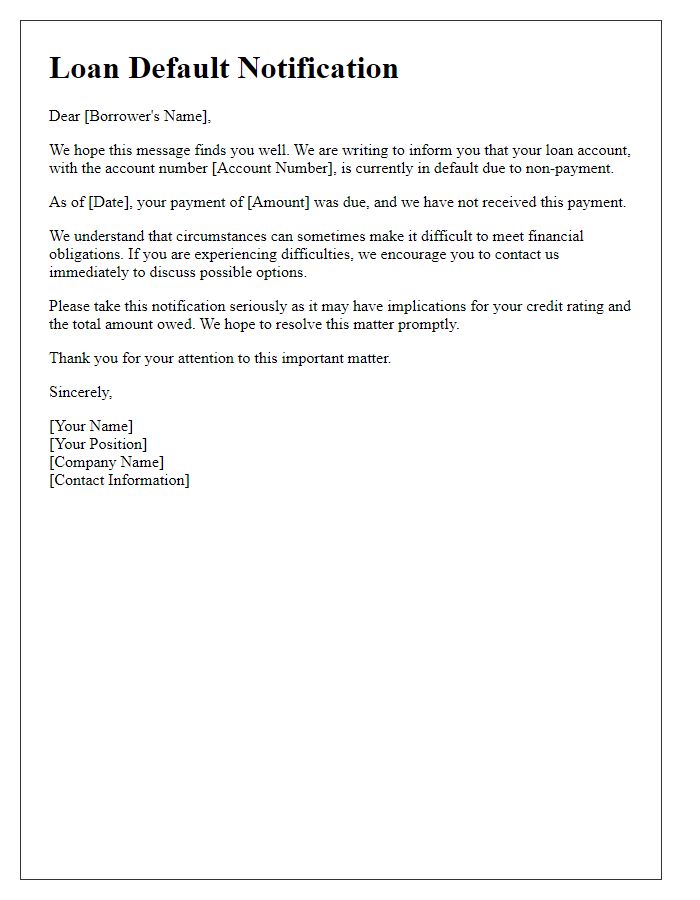

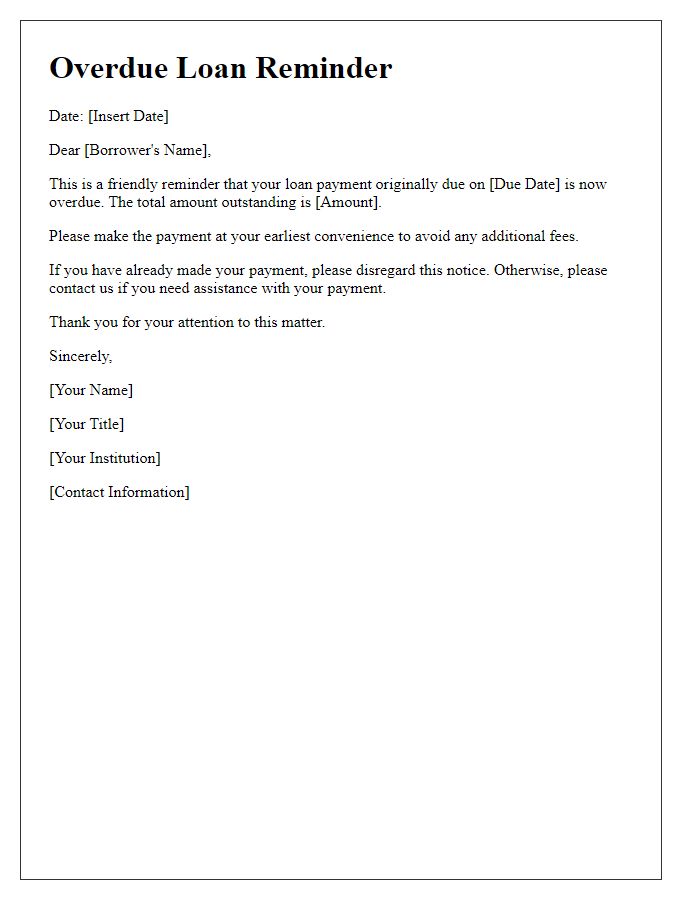

Loan default warning notices serve as crucial documents for informing borrowers about their outstanding obligations. A borrower (with personal information including full name, address, date of birth, and contact number) may receive communication regarding default on a loan that was originally issued from a financial institution such as Bank of America. The notice typically states the original loan amount (for instance, $10,000), outstanding balance (e.g., $8,500), and any accrued interest or fees resulting from non-payment. Dates regarding missed payment deadlines, such as 30 days past due as of September 1, 2023, are highlighted to convey urgency. Terms outlined in the loan agreement give context to the consequences of continued default, which may include legal action or damage to one's credit score, resulting in difficulties securing future credit. Specific actions to remedy the situation--like payment options or negotiation with the lender--are often mentioned to provide a pathway toward resolution for the borrower.

Loan details and outstanding balance

Loan default warnings indicate serious financial ramifications for defaulting borrowers. For example, a personal loan of $15,000 with an interest rate of 7% over five years can lead to a total outstanding balance of approximately $18,000 if payments are missed. Borrowers typically receive a warning notice after missing three consecutive payments, marking their account as delinquent. Financial institutions often mention specific deadlines within these notices, such as a 30-day grace period before legal actions begin. States like California enforce varying regulations on loan collections, emphasizing the need for clear communication from lenders to avoid disputes and additional fees.

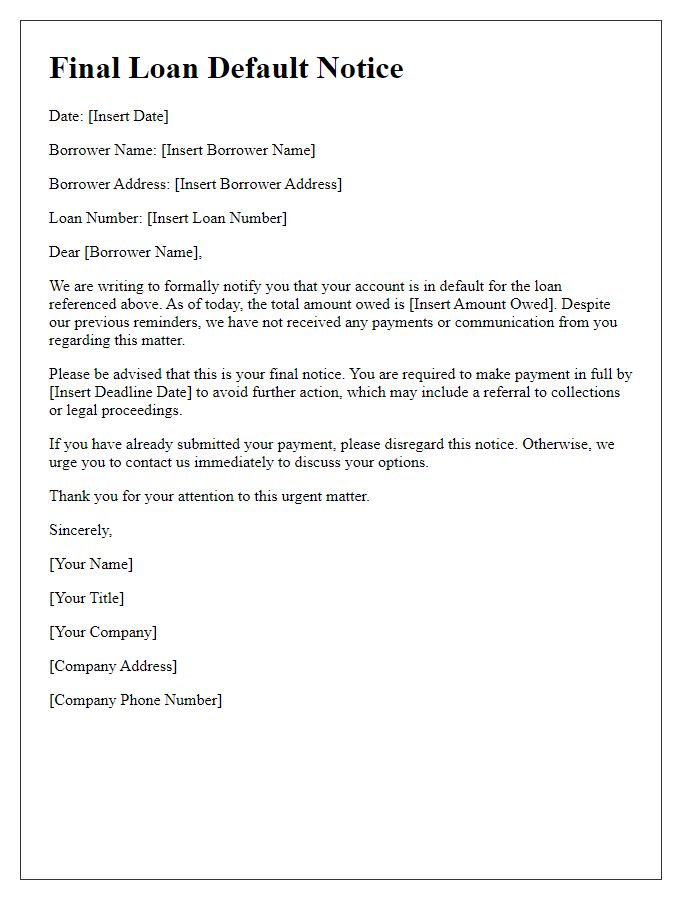

Consequences of default

Loan default consequences can lead to serious financial repercussions for borrowers, including damaged credit scores. A credit score drop of 100 points can significantly hinder future borrowing potential. Additionally, lending institutions may initiate collection actions, increasing stress levels for borrowers. This might involve third-party collections, adding legal fees to the outstanding debt. Property seizure can occur if secured loans are involved, leading to loss of homes or vehicles. Furthermore, borrowers may face court judgments, which could result in wage garnishments and long-term financial difficulties. Continuous default can lead to bankruptcy, a legal status that can take years to recover from.

Contact information for resolution

A loan default warning notice alerts borrowers about overdue payments on financial obligations, typically issued by lenders. This document emphasizes the importance of timely payments to maintain a healthy credit score, which is essential for future borrowing opportunities, such as mortgages or personal loans. It requests immediate action to avoid negative consequences, including potential foreclosure on real estate or vehicle repossession. Contact information for resolution should include the lender's customer service phone number, email address, and office location to facilitate discussions concerning repayment plans or financial assistance programs. Prompt communication is crucial in these situations to explore available options that can prevent further escalation of the default status.

Comments