The holiday season is just around the corner, and it's the perfect time to think about how to make your celebrations extra special this year. Whether you're planning to host a festive gathering, buy gifts for loved ones, or take that dream vacation, a holiday loan can help turn your visions into reality. Why not take advantage of our exclusive holiday season loan promotions designed to fit your needs? Read on to discover how you can make the most of this joyous time with financial freedom!

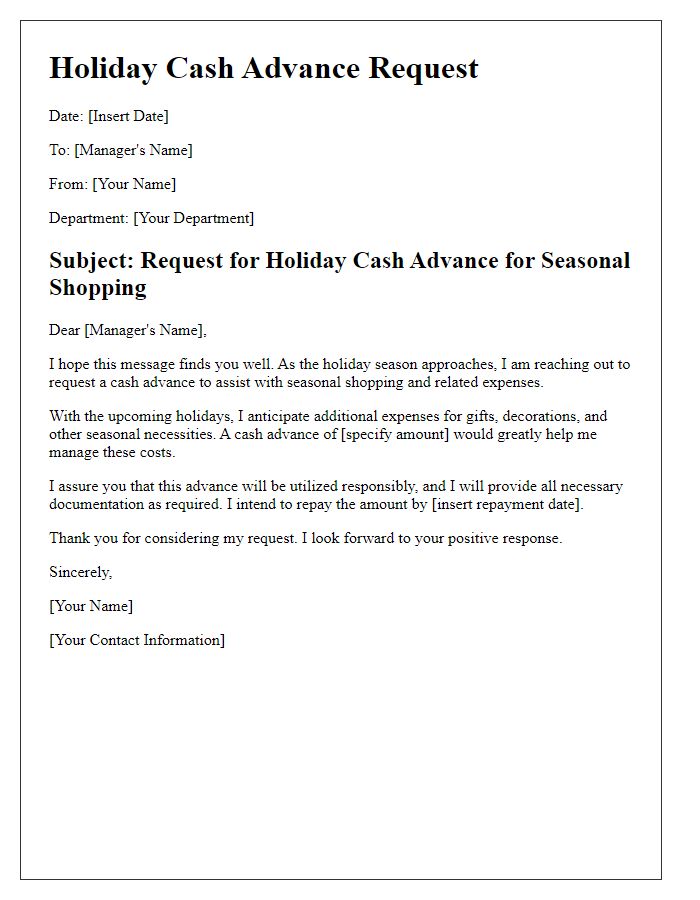

Personalization and Salutation

Holiday season loan promotions serve as a strategic opportunity for financial institutions to connect with clients and boost engagement. During this time, organizations often personalize messages to reflect individual customer needs, enhancing connection and relevance. The salutation typically addresses clients with their names, fostering a sense of familiarity and warmth typical of the festive period. Crafting messages that outline special loan rates or offers, such as reduced interest rates or extended repayment terms, attracts clients seeking financial support for holiday expenses. Implementing festive themes and visuals in promotional materials can elevate the appeal, resonating with customers looking to celebrate the season worry-free.

Holiday-themed Imagery and Language

The holiday season brings joy and cheer to families and individuals preparing for festive celebrations and gatherings. Many people enhance their experiences with decorations, gift shopping, and travel plans, creating unforgettable memories. Local retailers often see a significant uptick in sales during this period, contributing to the overall festive spirit. A holiday loan promotion can provide individuals the financial flexibility to secure these wonderful experiences without compromising their budgets. Recognizing the significance of financial ease during this season can empower individuals to enjoy their holidays to the fullest, making every moment bright with the support of manageable financial solutions.

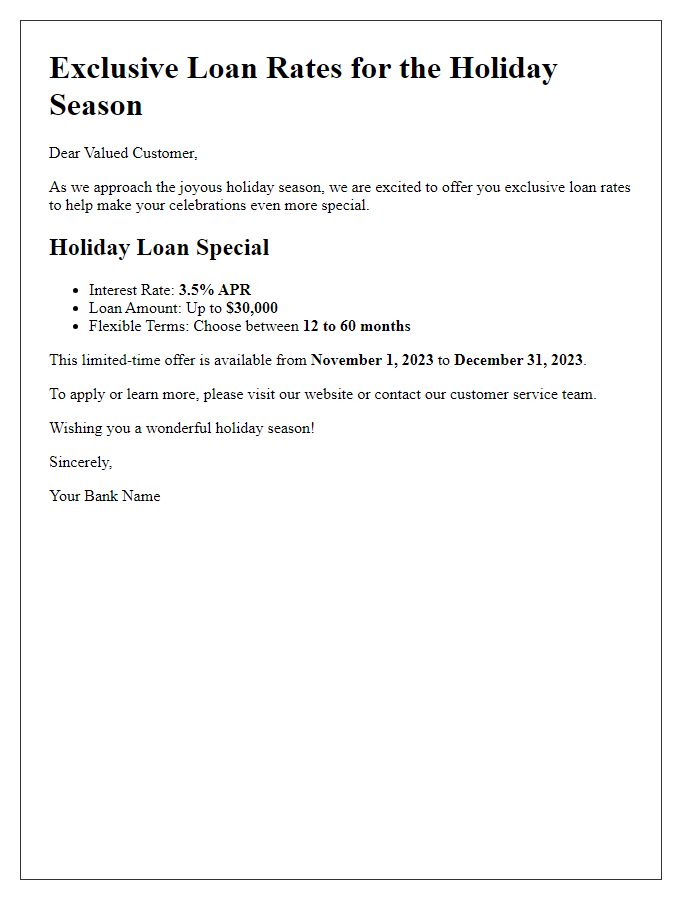

Clear and Attractive Loan Offer Details

During the holiday season, financial institutions often present enticing loan promotions to their customers, designed to alleviate seasonal expenses. Attractive loan offers typically include competitive interest rates, sometimes as low as 3.5% APR, and flexible repayment terms ranging from 12 to 60 months. Borrowers may enjoy additional perks such as deferred payment options for the first three months, enabling families to manage holiday expenditures without immediate financial pressure. Furthermore, institutions may provide personalized loan amounts, catering to individual needs, whether for holiday shopping, travel expenses, or home improvements. Lastly, streamlined application processes, often completed online within 10 minutes, make it easier for customers to secure funding quickly, ensuring they can fully embrace the festive spirit.

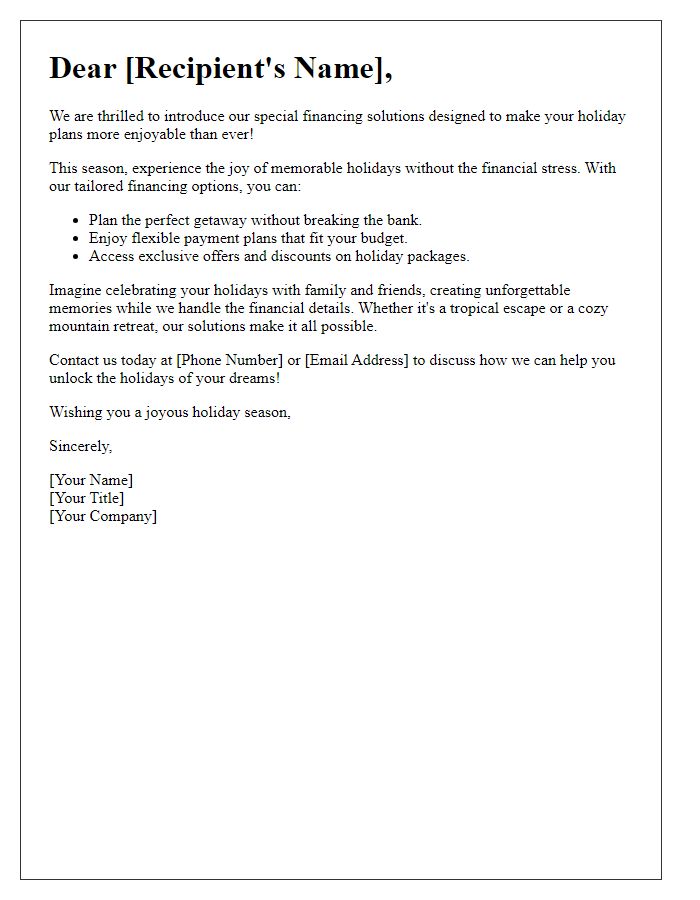

Call-to-Action and Contact Information

Enhancing holiday season loan promotions can attract potential customers effectively. Utilize catchy phrases such as "Unlock Your Dream Holiday" or "Celebrate with Our Special Loan Rates," showcasing enticing interest rates (as low as 3.5% APR) tailored for festive expenses. Include a clear call-to-action, urging potential borrowers to "Apply Now for Your Loan" with the promise of quick approvals within 24 hours. Ensure to provide contact information, like a dedicated hotline (1-800-555-LOAN), an email address (support@yourbank.com), and social media handles (Facebook, Twitter, Instagram). Highlight limited-time offer deadlines, such as "Apply by December 31st," to create urgency among applicants.

Festive Closing and Well Wishes

During the holiday season, financial institutions often launch festive loan promotions tailored to support families and individuals in managing their seasonal expenses. These loans, often featuring reduced interest rates or flexible repayment terms, aim to assist customers in purchasing gifts, traveling, or preparing festive meals. Noteworthy statistics indicate that consumer spending during the holiday season in the United States reached over $800 billion in 2022, reflecting a significant increase from previous years. This financial boost can encourage credit utilization amongst consumers. Institutions may highlight their commitment to community well-being through holiday-themed messaging, emphasizing generosity and support. Well wishes for a prosperous New Year can enhance customer relationships, reinforcing brand loyalty as clients look forward to fulfilling their financial goals in the upcoming year.

Letter Template For Holiday Season Loan Promotion Samples

Letter template of holiday borrowing options to enhance your festivities

Comments