Are you considering a travel loan but not sure where to start? You're not alone! Many people are looking to finance their dream vacations, and understanding your options can be overwhelming. Dive into our article to explore everything you need to know about travel loans and how to make them work for you!

Subject Line & Greeting

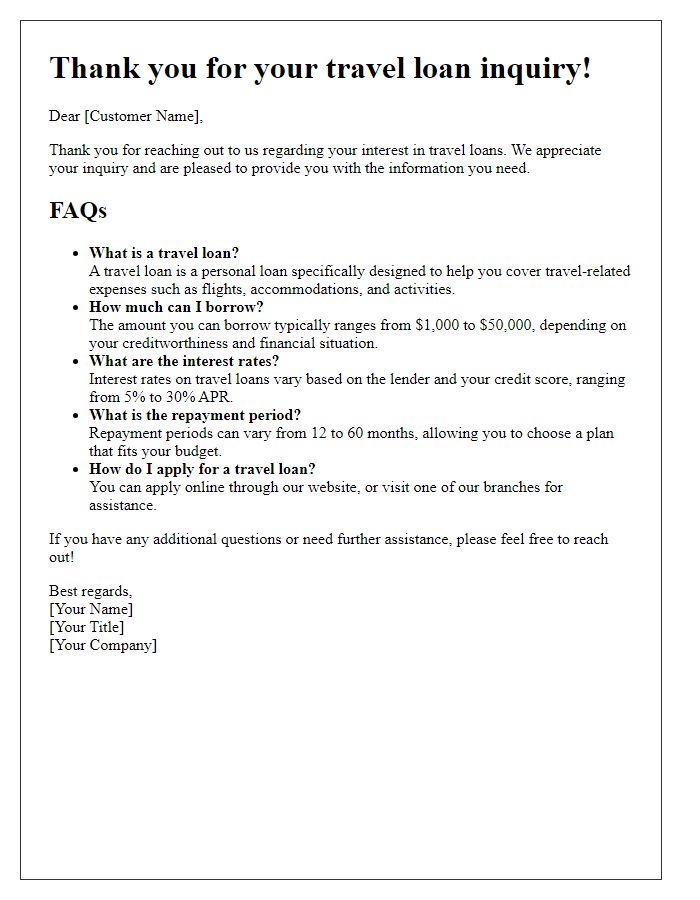

Travel loan inquiries can evoke a variety of important details pertaining to financial options available for various destinations. A standard response might begin with a clear subject line, such as "Travel Loan Inquiry Response" or "Your Travel Loan Request at [Bank Name]." The greeting typically acknowledges the recipient warmly, using phrases like "Dear [Recipient's Name]," or "Hello [Recipient's Name]," aiming to create an approachable yet professional tone. Furthermore, customization based on inquiries regarding specific loan amounts or travel locations can enhance the engagement, ensuring that the response feels personalized and relevant to the recipient's travel aspirations.

Applicant Information Recap

Inquiries regarding travel loans often require a thorough assessment of applicant information, including total income, credit score, and employment status, which directly influence loan approvals. Applicants typically submit personal details such as names, addresses, and Social Security numbers for verification purposes. Key financial documents, including bank statements from the past three months and recent pay stubs, may also be requested to evaluate financial stability. Loan amounts generally range from $1,000 to $50,000, with interest rates varying based on applicant profiles and market conditions. The evaluation process includes a review of any existing debts, which can impact loan eligibility based on the debt-to-income ratio. Timelines for response usually remain between 3 to 5 business days, ensuring applicants receive timely updates on their loan status.

Loan Details & Terms

Travel loans often provide flexible financing options for individuals seeking to fund their adventures. Typically, these loans range from $1,000 to $50,000, allowing borrowers to cover expenses related to airfare, accommodations, and activities. Terms often vary, with repayment periods stretching from 12 to 60 months, depending on the lender's guidelines. Interest rates can fluctuate based on credit scores, averaging between 5% and 24%. Many lenders offer unsecured options, meaning no collateral is required, which can simplify the application process. Additional fees such as origination fees or prepayment penalties may apply, influencing the total cost of the loan. Understanding these elements ensures borrowers can make informed financial decisions for their travel plans.

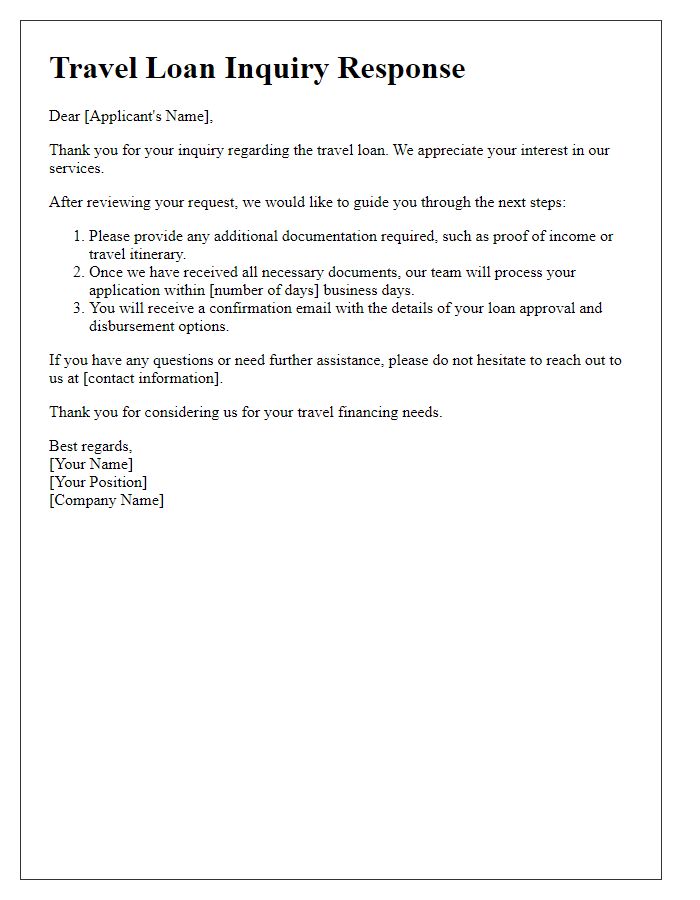

Required Documentation & Next Steps

When applying for a travel loan, essential documentation includes proof of income, such as recent pay stubs (typically last two months), tax returns (last year), and employment verification letter from your employer. Additionally, a government-issued identification document, like a passport or driver's license, is necessary. Financial documents should include bank statements (last three months) to demonstrate existing savings or financial stability. For travel-related expenses, a detailed itinerary, including flight bookings and accommodation confirmations, can strengthen your application. Next steps involve gathering all required documents, completing the loan application form, and submitting the materials to the financial institution for review. Approval timelines may vary, typically ranging from a few days to weeks, depending on the lender's processing policies.

Contact Information & Support Options

Travel loan inquiries often involve understanding various financing options available for personal or business trips, especially regarding interest rates and repayment terms. Contact information typically includes a dedicated customer support line, often with a specific extension for loan inquiries, available weekdays from 9 AM to 6 PM. Email support may also be provided, allowing for detailed questions regarding eligibility criteria or documentation required for loan approval. Some financial institutions may offer online chat options for immediate assistance. Additionally, a comprehensive FAQ section on the institution's website can address common concerns about travel loans, including application processing time and potential fees involved.

Letter Template For Travel Loan Inquiry Response Samples

Letter template of travel loan inquiry response – customer service focus

Letter template of travel loan inquiry response – financial advisor format

Letter template of travel loan inquiry response – quick approval highlights

Letter template of travel loan inquiry response – detailed terms explanation

Letter template of travel loan inquiry response – alternative financing options

Letter template of travel loan inquiry response – promotional rates emphasis

Letter template of travel loan inquiry response – trust-building reassurance

Comments