Are you facing the challenge of canceling a loan and unsure how to approach it? Navigating the process can seem daunting, but knowing how to articulate your request effectively can make all the difference. In this article, we'll explore a handy letter template that simplifies your loan cancellation request, ensuring you convey your needs clearly and professionally. So, let's dive in and empower you to take the first step toward financial relief!

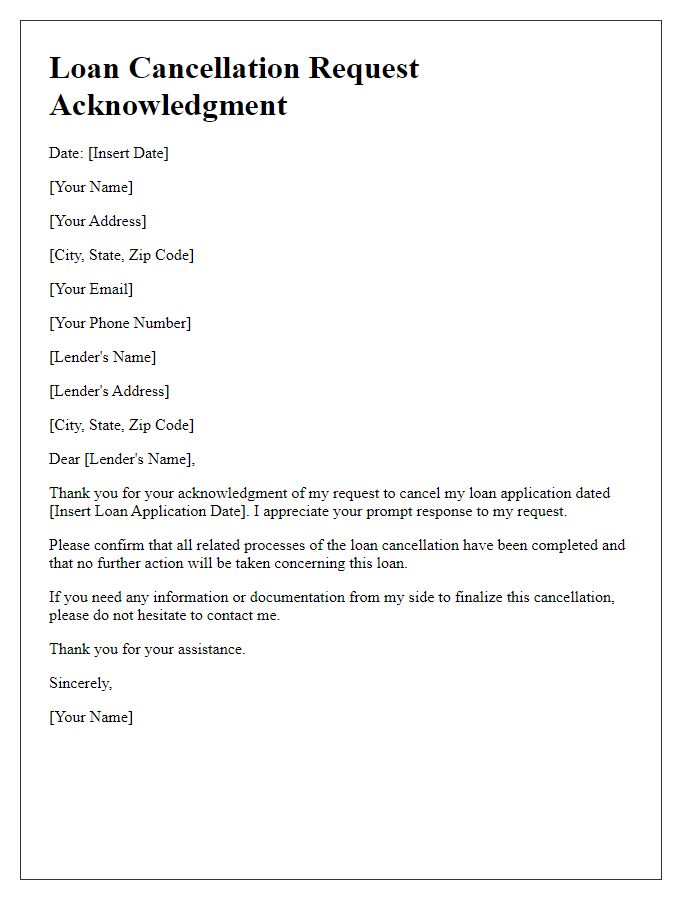

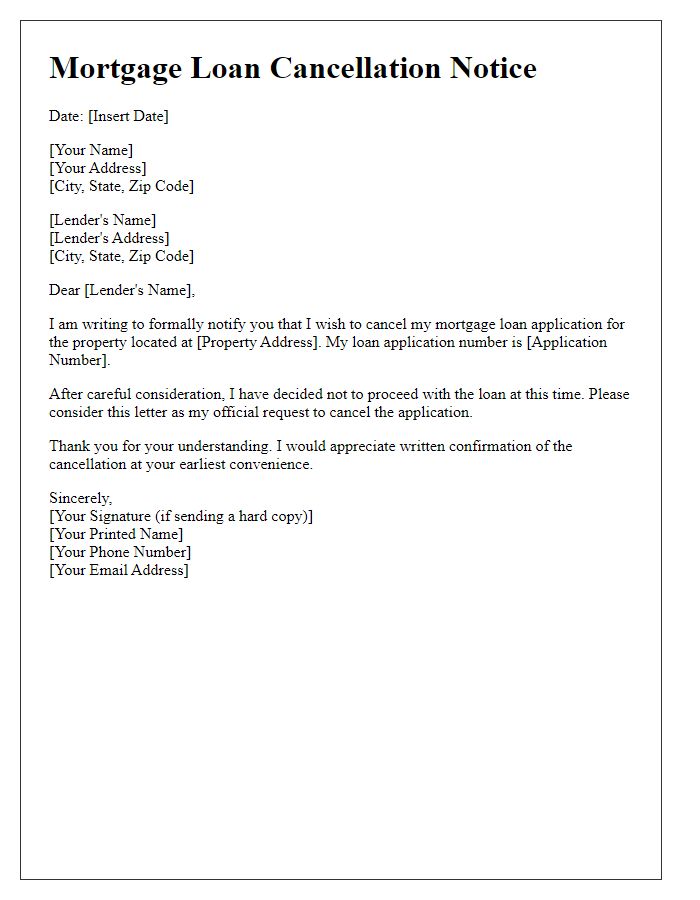

Acknowledgment of receipt

The loan cancellation request acknowledgment serves to confirm the receipt of the formal request, providing assurance to the borrower regarding the process. Upon receipt, the loan officer, in say, a banking institution such as Bank of America, will review the application details, including the loan number (e.g., 123456789) and the reason for cancellation (such as a change in financial circumstances). A timeline for the next steps, usually within 10 business days, will be communicated, ensuring the borrower understands the anticipated duration of the review process. This acknowledgment is critical for maintaining transparency and trust during the financial decision-making journey.

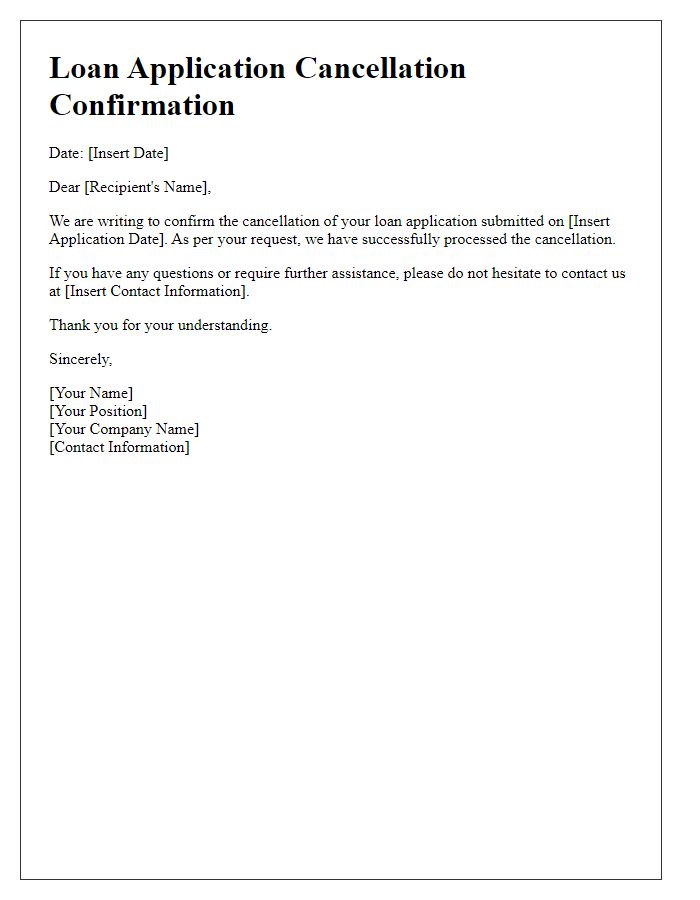

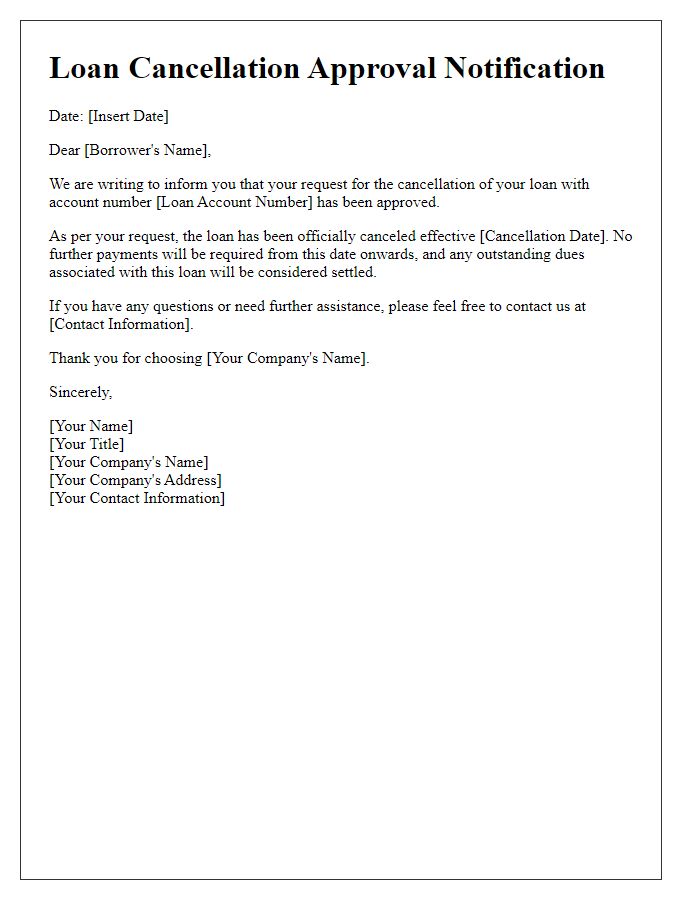

Clear decision statement

Loan cancellations are critical financial events that require clear communication. A well-defined decision statement regarding a loan cancellation request ensures all parties understand the outcome. A concise response may include specifics such as loan type, cancellation date, and any associated fees (e.g., processing fees that may apply), along with confirmation of the cancellation in the financial record. It is also essential to mention the impact on the borrower's credit score and future borrowing eligibility. Transparency on any remaining obligations can prevent misunderstandings and set the stage for a positive future financial relationship.

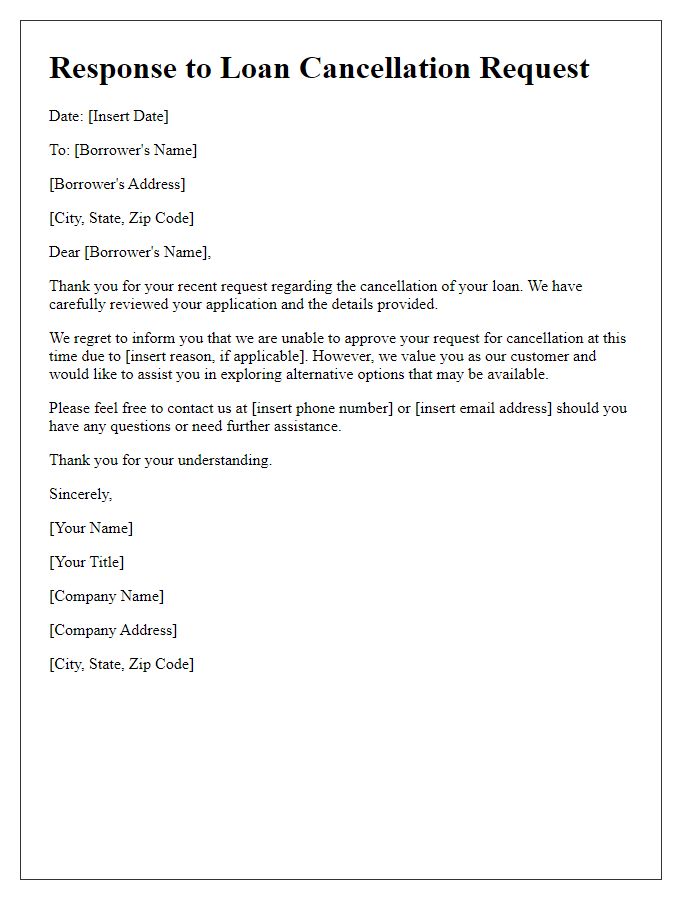

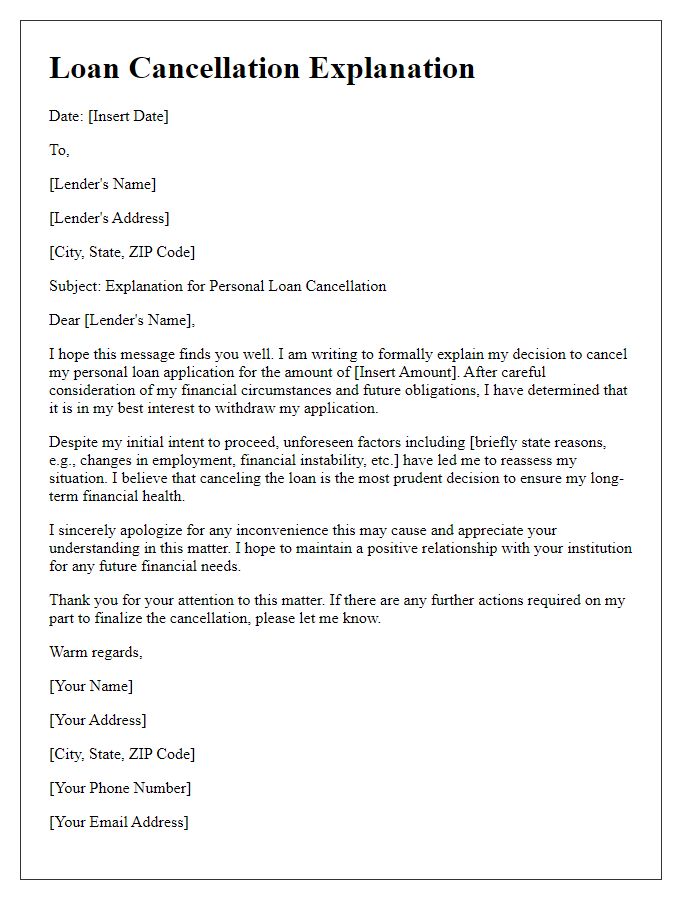

Explanation of decision

Loan cancellation requests often arise in various financial institutions, each with its specific policies and criteria. For example, an applicant may request to cancel a loan agreement of $10,000 obtained for personal expenses at Bank of America, citing unforeseen circumstances such as loss of employment. The bank's decision typically relies on internal guidelines, including the applicant's payment history, current financial status, and adherence to the terms stipulated in the contract signed on May 15, 2023. If the cancellation request is approved, the customer would receive a formal notification outlining the terms of cancellation, potential fees, and implications for their credit score. Conversely, if declined, the applicant would receive an explanation highlighting the reasons based on the financial institution's criteria, ensuring transparency in the decision-making process. All responses adhere to compliance regulations defined by federal laws, such as the Truth in Lending Act.

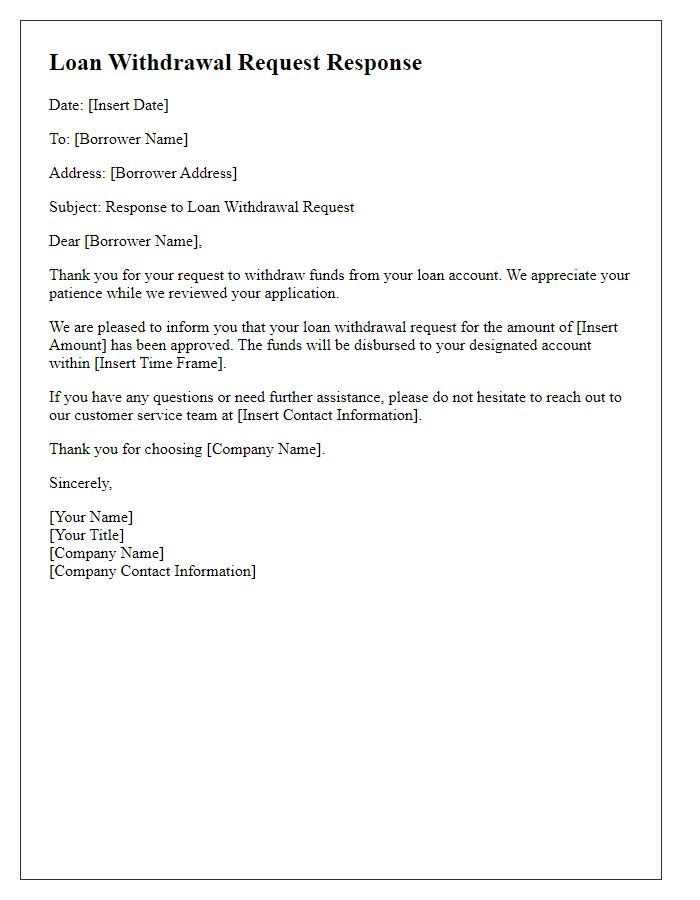

Next steps and instructions

Following a loan cancellation request, customers should carefully review the terms and conditions outlined in their loan agreement, including any penalties or fees related to the cancellation process. It is essential to prepare required documentation, such as a formal written request to the lender with the account number and specific details about the loan. Additionally, customers should verify the cancellation timeline, often specified in the lender's policy, which may range from a few days to several weeks. Contact with customer service may provide clarification on the status of the request and next steps for potential refunds or further actions. Finally, maintaining a record of all communications and correspondence with the lender ensures a smooth process and serves as proof of the cancellation request.

Contact information for further queries

Loan cancellation requests can be complex, requiring clear communication and understanding. Borrowers, such as homeowners or business owners, may seek to cancel loans due to various reasons, including financial difficulties or better financing options. It is essential for lenders to provide clear contact information for further queries, such as direct phone numbers or email addresses of customer service representatives. This ensures that borrowers can quickly access assistance and resolve any outstanding concerns regarding their loans, including repayment terms or potential penalties associated with cancellation. Timely follow-ups and professional guidance can help maintain positive relationships between lenders and borrowers throughout the loan management process.

Comments