Are you looking for a quick and hassle-free way to secure an instant loan? Many individuals find themselves in urgent need of financial assistance, and an effective response letter can make all the difference in the approval process. In this article, we'll guide you through creating a compelling letter template that will impress lenders and increase your chances of getting that much-needed financial support. So, stick around and discover how to craft the perfect response for your instant loan approval!

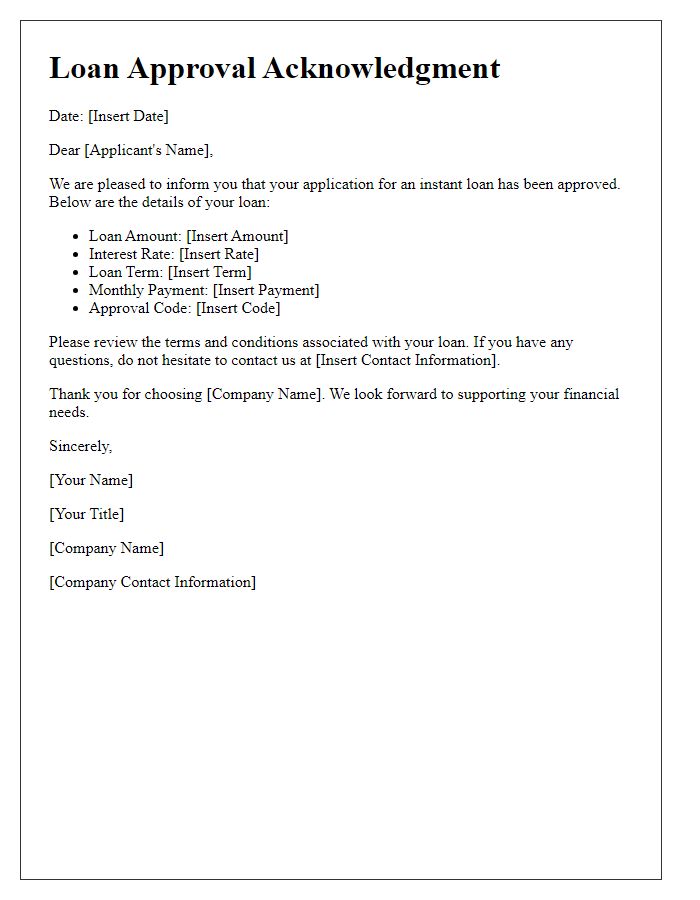

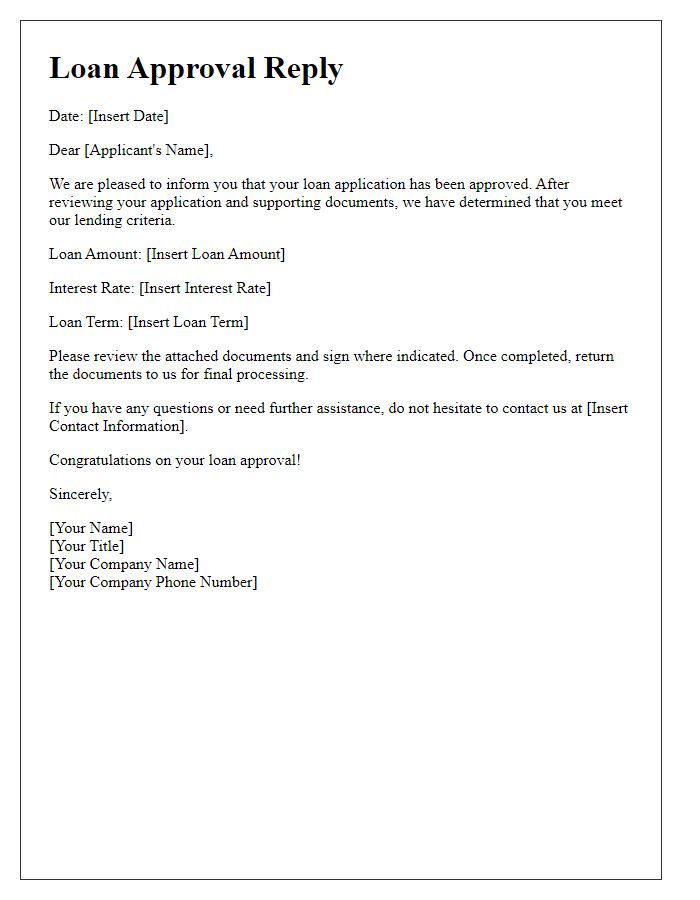

Applicant's Full Name and Contact Information

Instant loan approval processes provide applicants with quick financial solutions. Efficient systems allow individuals to submit personal information, including full names and contact details, facilitating rapid verification. Automated underwriting algorithms assess creditworthiness, ensuring timely decisions. Approved loans can be deposited into bank accounts within hours, offering relief for urgent financial needs. Effective communication throughout the process keeps applicants informed, enhancing customer satisfaction with services from financial institutions. Such advancements illustrate the growing demand for streamlined access to credit in today's fast-paced economy.

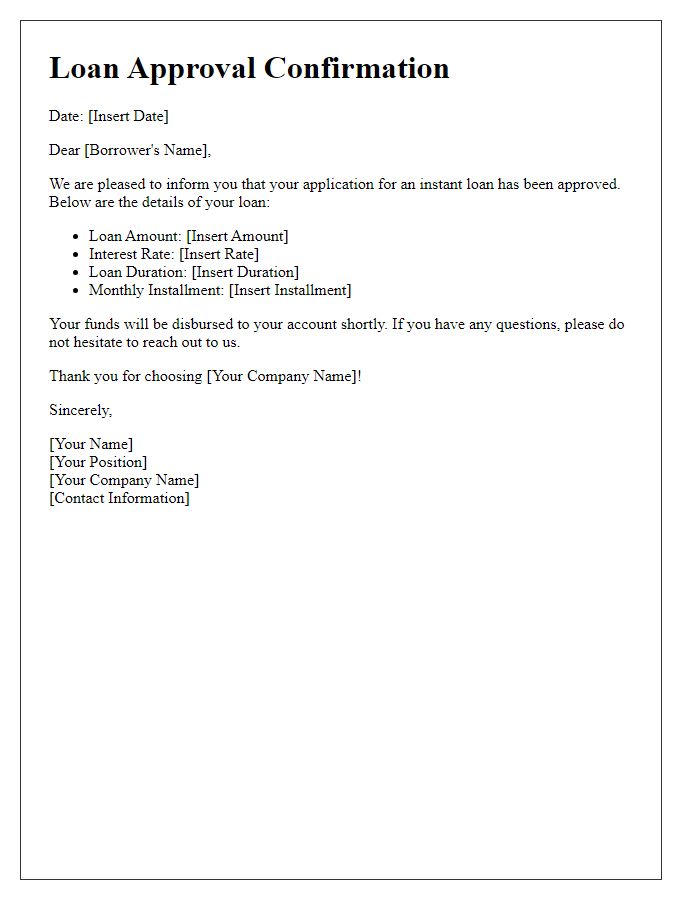

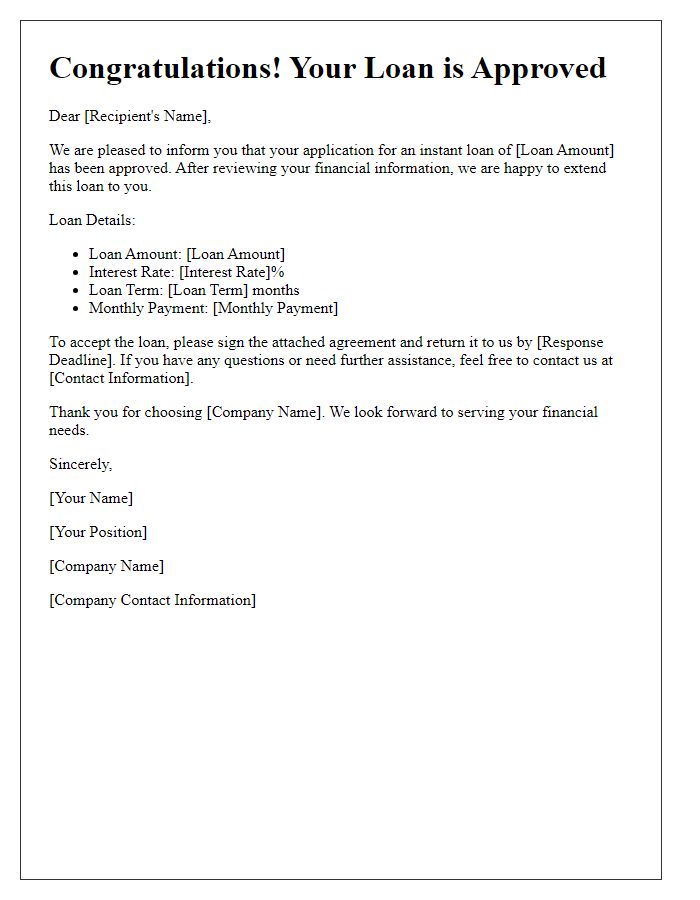

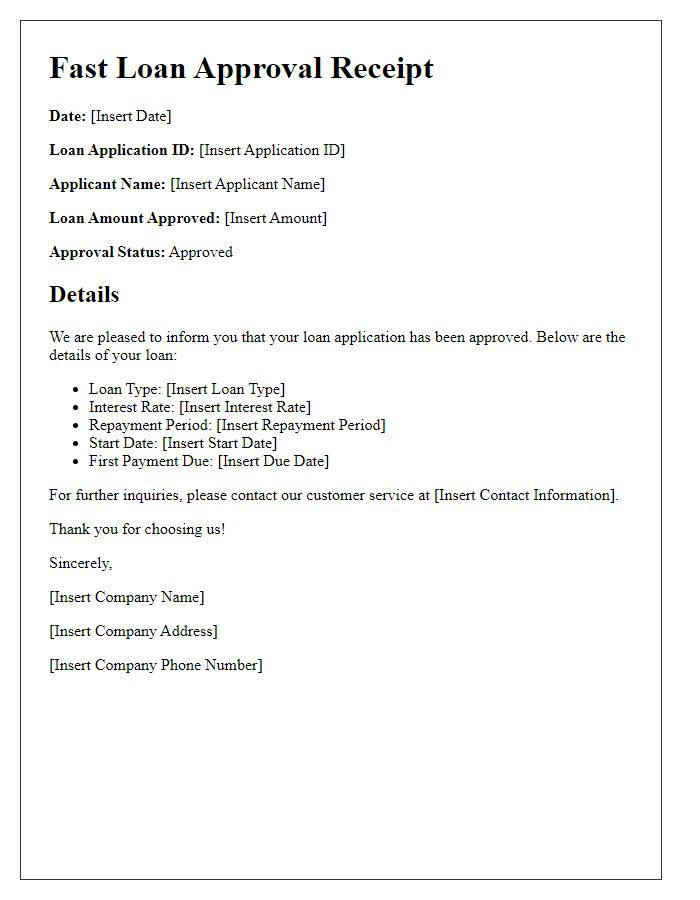

Loan Amount and Terms

Instant loan approval often involves a predetermined loan amount tailored to the borrower's financial profile and repayment capacity. For example, a borrower might be approved for an instant loan of $5,000 with a term of 24 months at an interest rate of 8% APR. This quick processing reduces paperwork and expedites funds availability, encouraging financial responsibility and allowing individuals to meet urgent monetary needs such as medical expenses or home repairs. The clarity of terms helps borrowers understand their repayment obligations, ensuring informed decision-making.

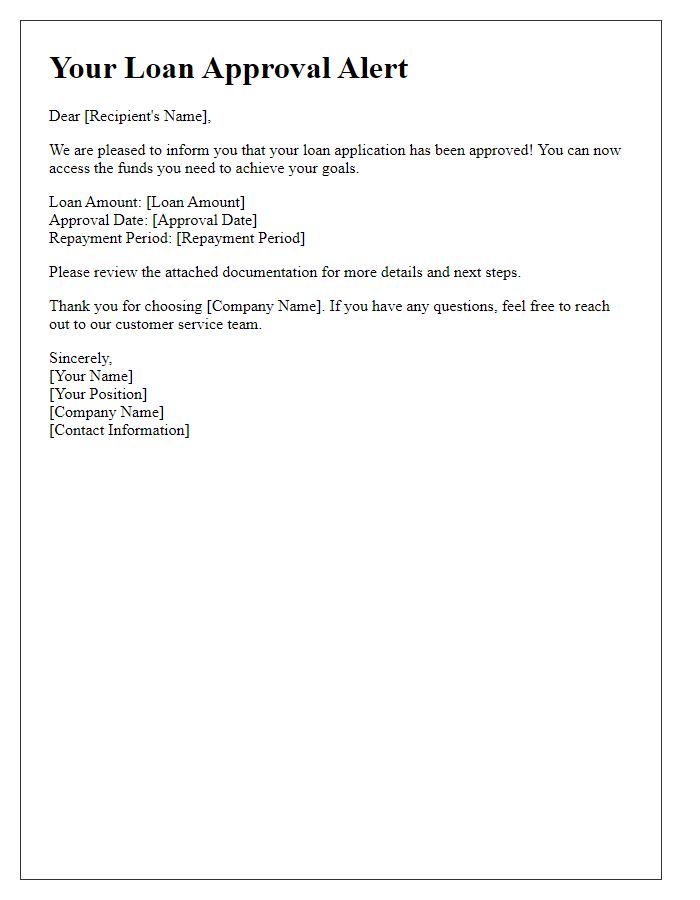

Approval Confirmation Statement

Instant loan approval improves financial accessibility for individuals needing urgent funds. This process typically takes less than 24 hours (often within minutes), allowing borrowers to receive confirmation from lending institutions like banks or fintech companies. Approval statements serve as formal notifications, detailing the loan amount (ranging from $1,000 to $50,000), interest rates, and repayment terms. Key information includes the loan purpose, such as medical expenses or home repairs, and the borrower's credit score (which can significantly impact approval chances). Clear communication of these terms is crucial, ensuring the borrower understands their financial commitments.

Repayment Schedule and Instructions

Instant loan approval facilitates immediate financial relief for borrowers across various circumstances, including unexpected medical expenses or urgent home repairs. The repayment schedule typically outlines a structured timeline for returning borrowed funds, often spanning several months to years, depending on the loan amount and terms set by lenders like banks or credit unions. Clear instructions regarding repayment methods, such as automatic bank withdrawals or online payments, are essential to ensure timely payments and avoid late fees. Additionally, understanding potential interest rates and penalties, which can vary significantly between lenders, helps borrowers manage their finances effectively and maintain a positive credit score.

Contact Details for Further Inquiries

Instant loan approval can expedite financial needs for individuals seeking quick access to funds. Applicants can receive confirmation of approval within minutes, often via email or smartphone notifications. The loan amounts typically range from $500 to $50,000, with varying interest rates depending on credit history and loan terms. Applicants are encouraged to reach out to customer support for further inquiries, with contact options including dedicated phone lines (available from 8 AM to 8 PM EST) and live chat on the official website. Providing thorough details such as full name, loan amount requested, and application reference number can expedite responses to inquiries.

Comments