Are you looking to adjust your revolving loan credit limit? Understanding the process can help streamline your financial management and empower you to make informed decisions. Whether you're aiming to increase your limit for future expenses or seeking a decrease to better align with your spending habits, it's essential to know what to include in your request. Join us as we delve into the specifics of writing an effective letter for a credit limit adjustment that can help you achieve your financial goalsâread on for more!

Borrower's Information

Revolving loan credit limits can significantly impact a borrower's financial flexibility and management of expenses. Borrower's information typically includes critical details such as the borrower's name, which identifies the individual or entity requesting the adjustment. Account number serves as a unique identifier linking the loan to the borrower, while the loan type may indicate whether it is a personal loan, business loan, or secured credit line. Current credit limit denotes the maximum amount the borrower can access immediately, while the requested limit change specifies the desired adjustment amount. Borrower's income statement and credit score (measured on a scale of 300 to 850) provide insight into the financial health and repayment ability of the borrower, playing a crucial role in the assessment process by the lending institution. Proper documentation will ensure smoother processing of the credit limit adjustment request.

Current Credit Limit Details

Current credit limits serve as crucial financial benchmarks for individuals and businesses. A standard revolving loan credit limit can range from $1,000 to $100,000 based on factors such as credit history, income, and existing debts. Accurate evaluation of current credit limits involves reviewing the borrower's financial profile, including debt-to-income ratios and credit utilization percentages. Additionally, institutions may impose specific criteria for adjustments, such as the length of account history with the lender (typically requiring at least six months). Timely payments may positively influence the credit limit modification process, while late payments could restrict potential increases. Understanding these dynamics aids in navigating the complexities of revolving loans effectively.

Requested Adjustment Amount

The revolving loan credit limit adjustment can significantly impact a borrower's financial flexibility. When considering an adjustment, lenders typically evaluate the requested adjustment amount, which may vary widely based on the customer's creditworthiness and repayment history. For instance, a borrower with a solid credit history and a consistent repayment record may request an increase in their limit from $5,000 to $10,000, enabling more strategic financial management, such as consolidating existing debt or financing unexpected expenses. Additionally, factors such as the current interest rate environment and the borrower's income stability can influence the lender's decision regarding the credit limit change.

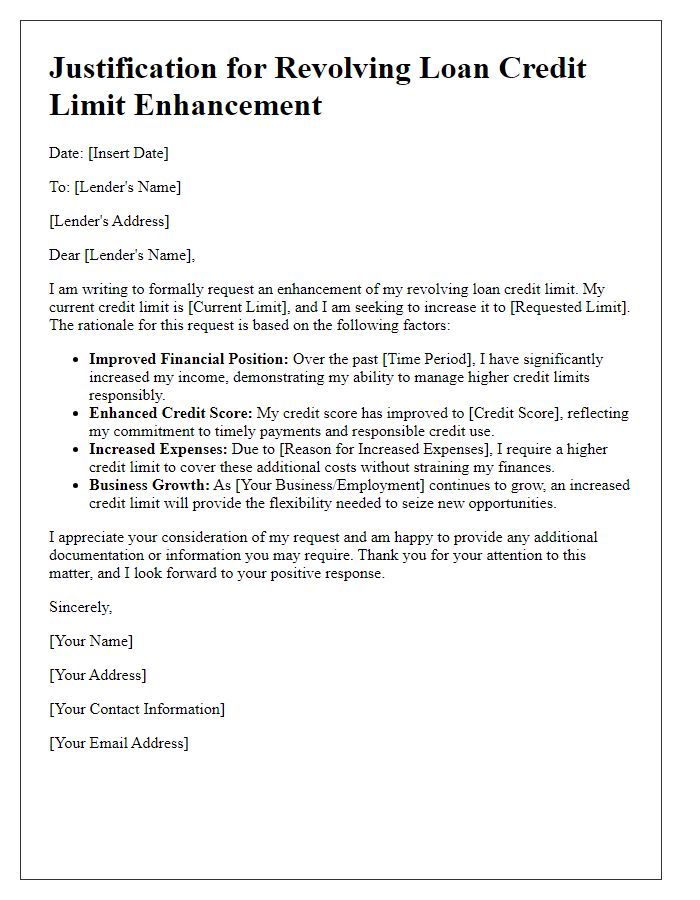

Justification for Adjustment

A revolving loan credit limit adjustment is crucial for maintaining financial agility and aligning borrowing capacity with current economic needs. Businesses, such as small and medium enterprises (SMEs) in sectors like retail or construction, often face fluctuations in cash flow. A revised credit limit can provide necessary liquidity for managing operational expenses, investing in inventory, or addressing unforeseen expenses. For instance, a construction firm might require an increased credit limit during peak project seasons to acquire materials promptly. Furthermore, organizations maintaining strong credit scores, typically 700 or above, demonstrate their reliability to lenders, making a justification for adjustment more compelling. A well-articulated rationale highlighting factors such as enhanced revenue, improved cash flow management, and the ability to seize growth opportunities can significantly bolster the request for an increased credit limit.

Terms and Conditions for New Limit

A revolving loan credit limit adjustment can significantly influence financial flexibility for individuals managing their credit, such as personal loans or credit cards. Financial institutions establish specific terms and conditions for the new limit, which may require a review of repayment history (often focusing on the past 12 months), current income status, and credit score metrics. Adjustments can vary, with potential increases often exceeding 20% of the existing limit or reductions based on risk assessments. Borrowers must understand the implications of interest rates that could range from 9% to 36%, late fee structures, and recalibration of minimum monthly payments. Consideration of eligibility for promotional offers, such as zero-interest periods on purchases, can also be a pivotal factor in the adjustment process. Review of contractual obligations and compliance with the lender's guidelines is essential for maintaining a positive credit profile.

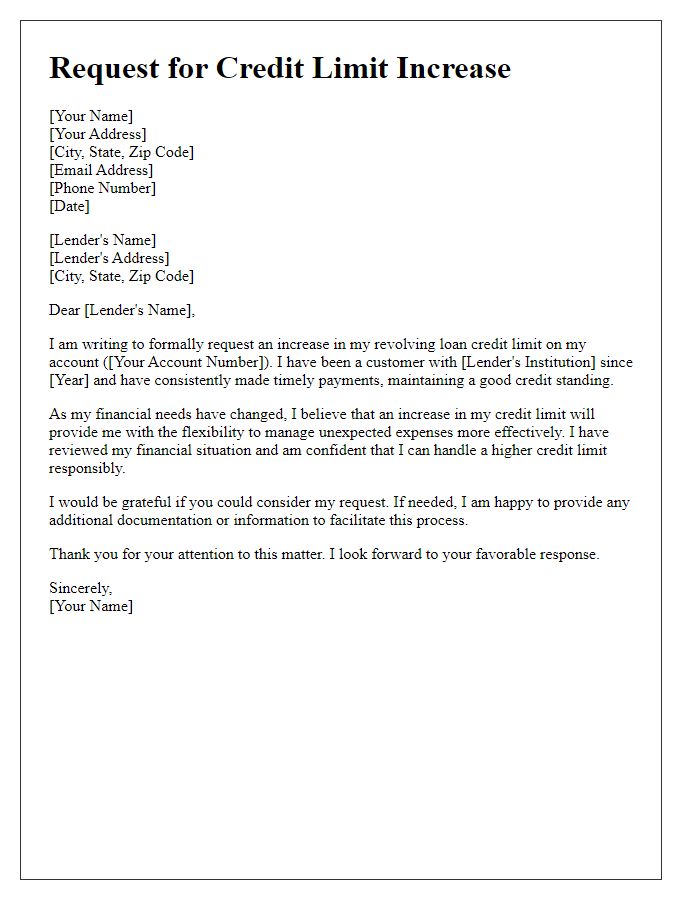

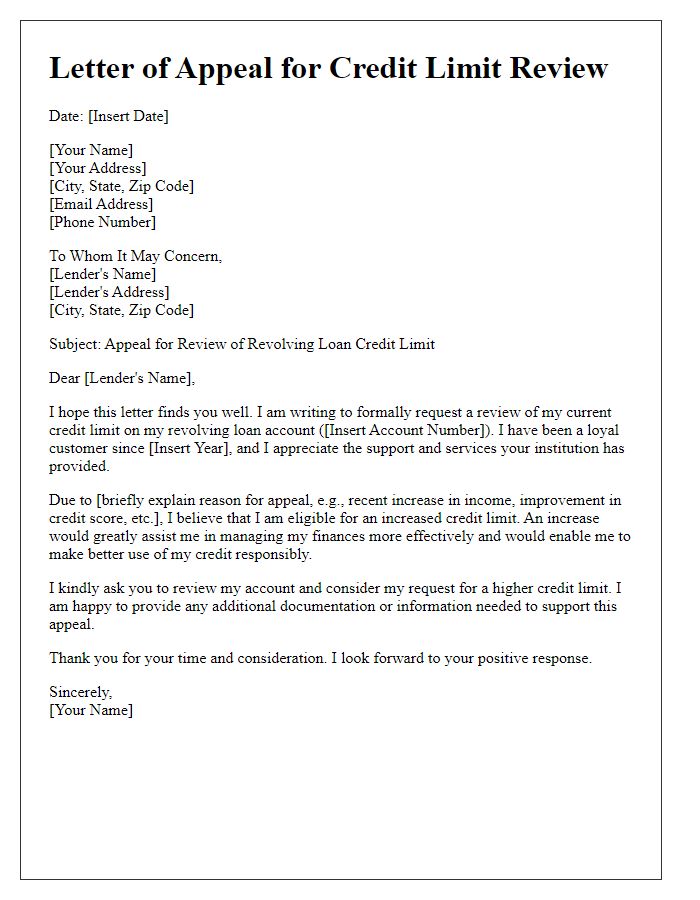

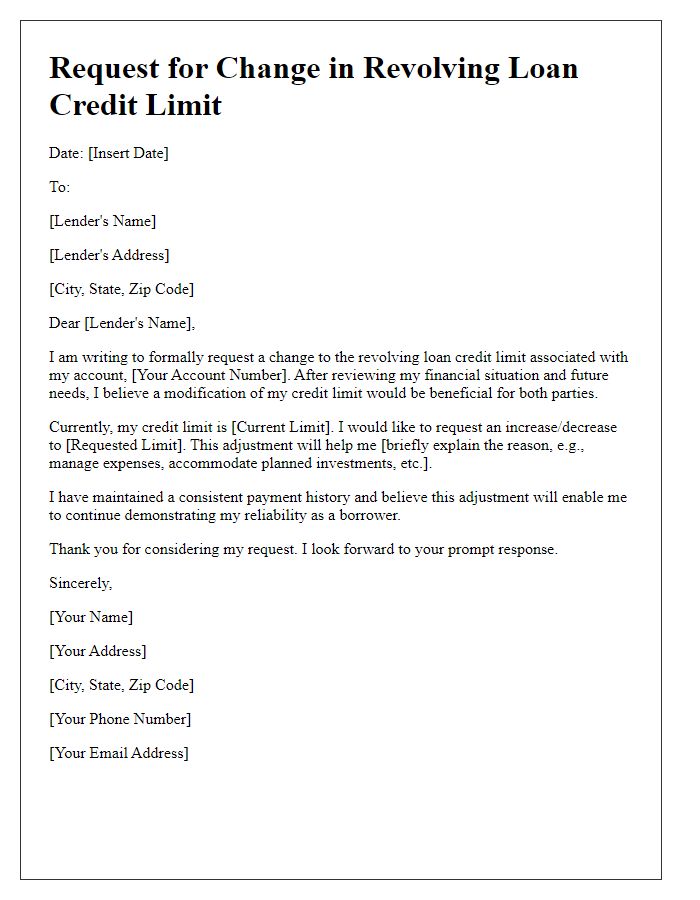

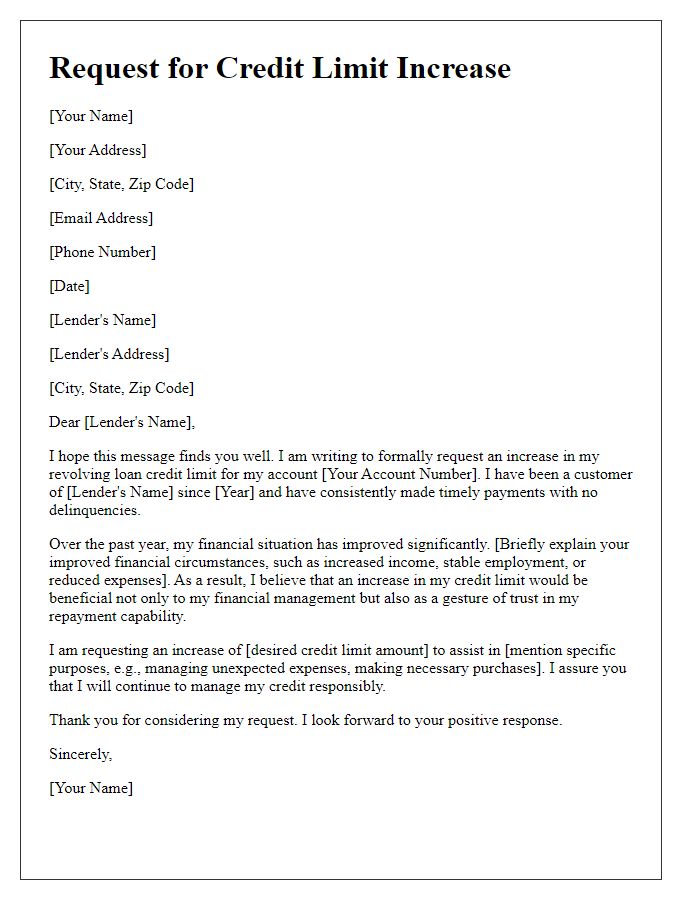

Letter Template For Revolving Loan Credit Limit Adjustment Samples

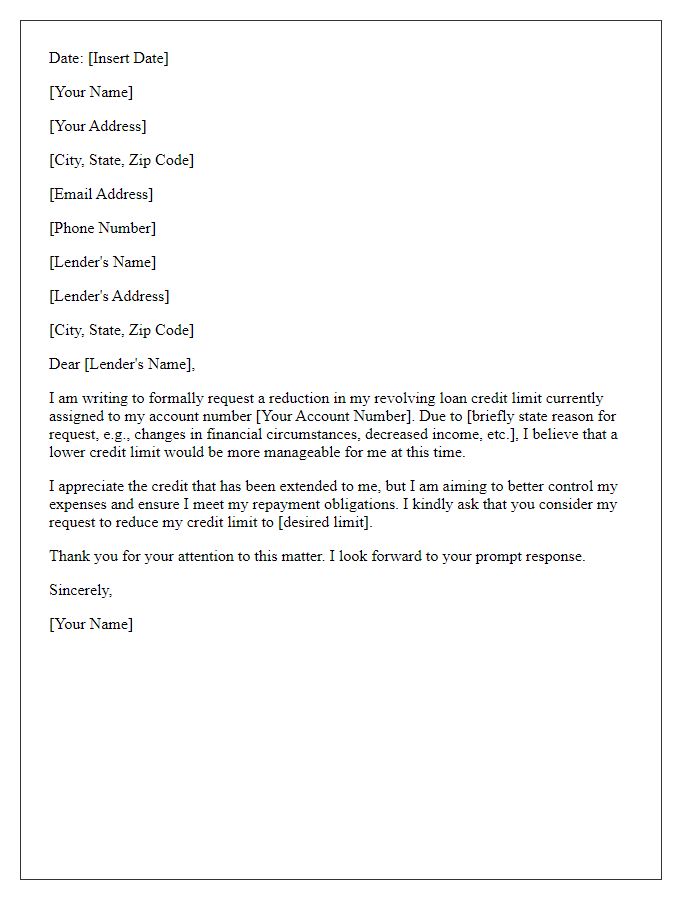

Letter template of application for revolving loan credit limit reduction.

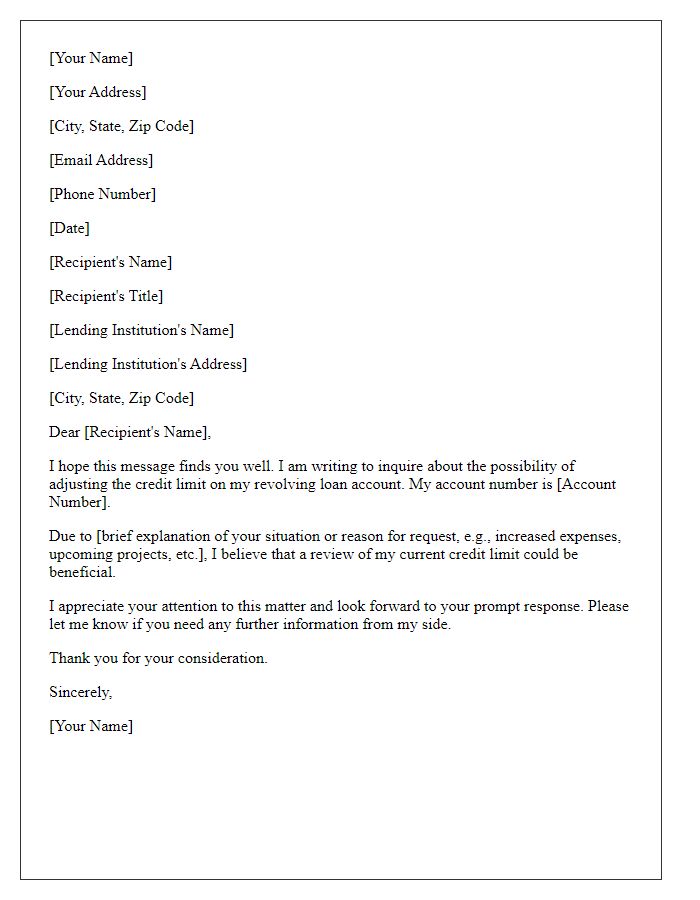

Letter template of inquiry regarding revolving loan credit limit adjustments.

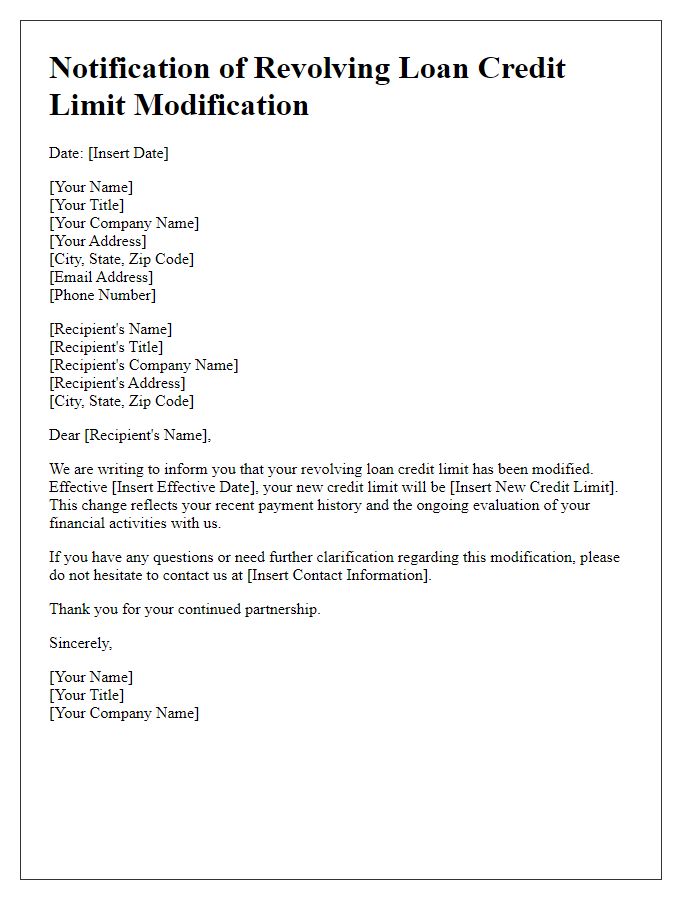

Letter template of notification for revolving loan credit limit modification.

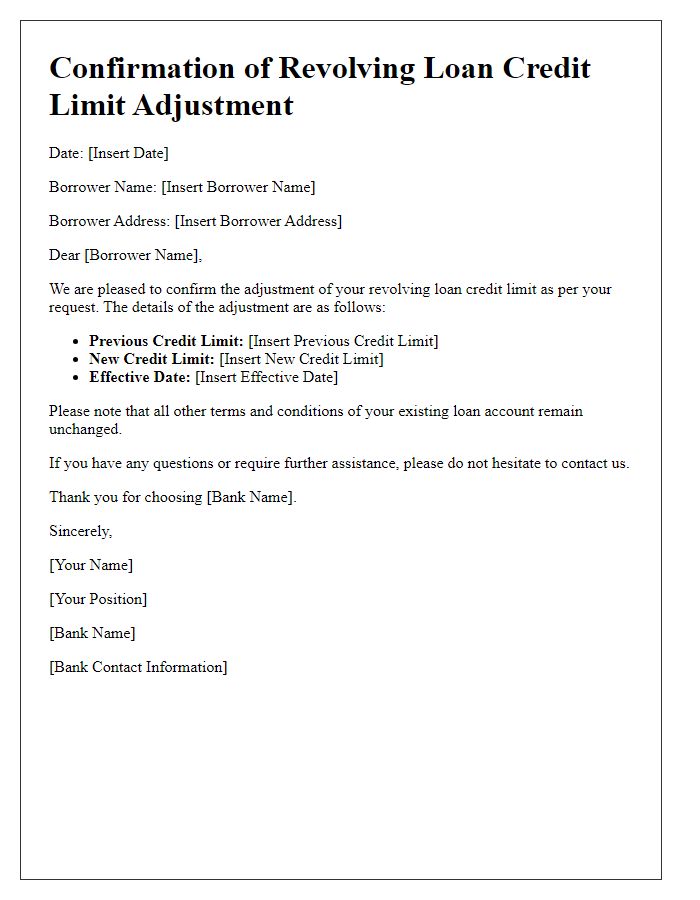

Letter template of confirmation of revolving loan credit limit adjustment.

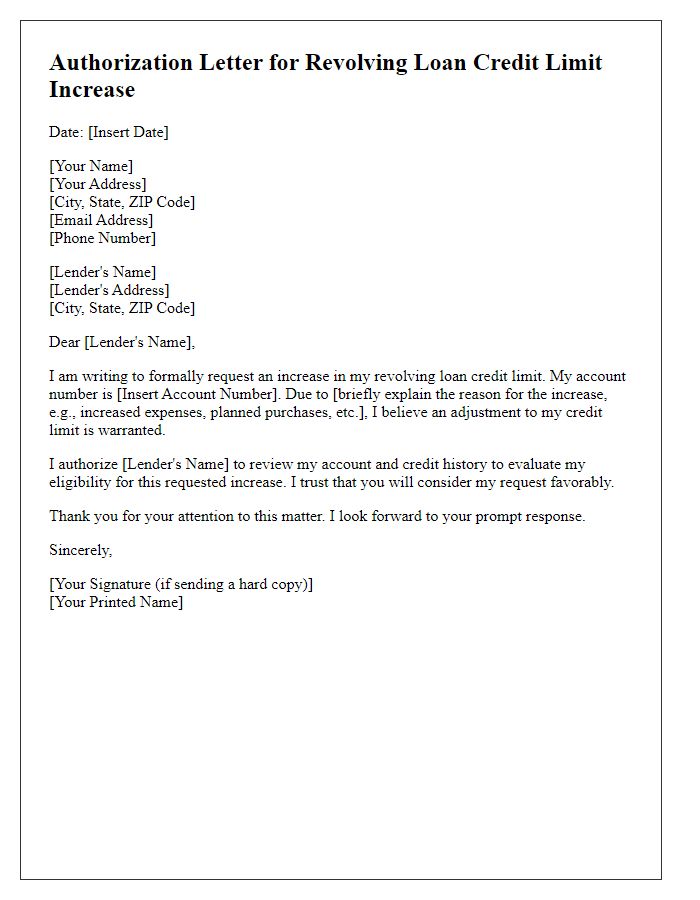

Letter template of authorization for revolving loan credit limit increase.

Comments