Are you facing a sudden financial hurdle and in need of some quick cash? Writing an effective emergency loan request letter can significantly improve your chances of gaining approval. In this article, we'll guide you through the essential elements to include in your letter and offer tips to make your request stand out. Dive in to find out how to craft the perfect request that can help you get back on your feet!

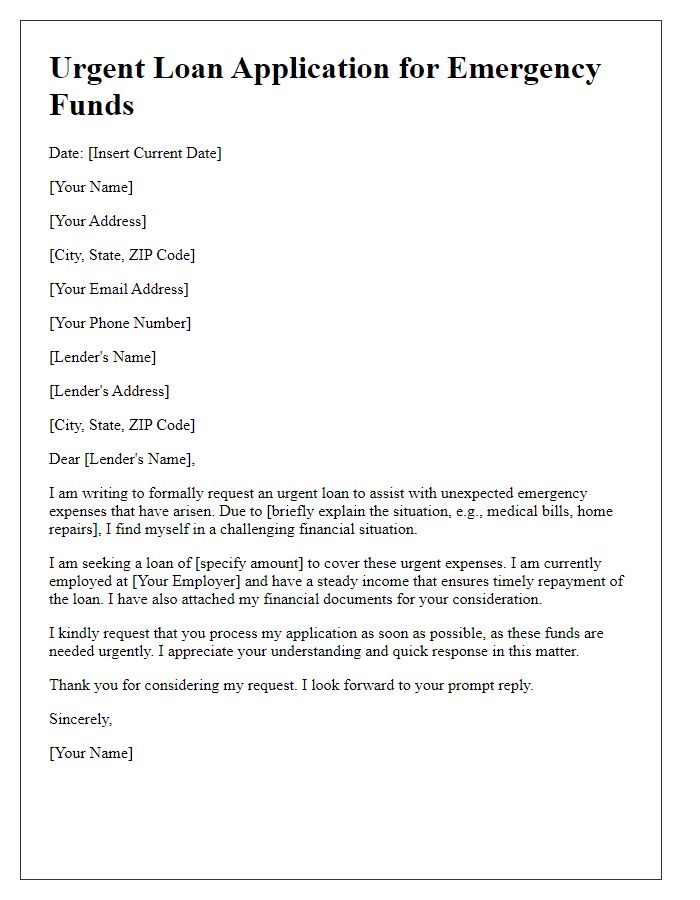

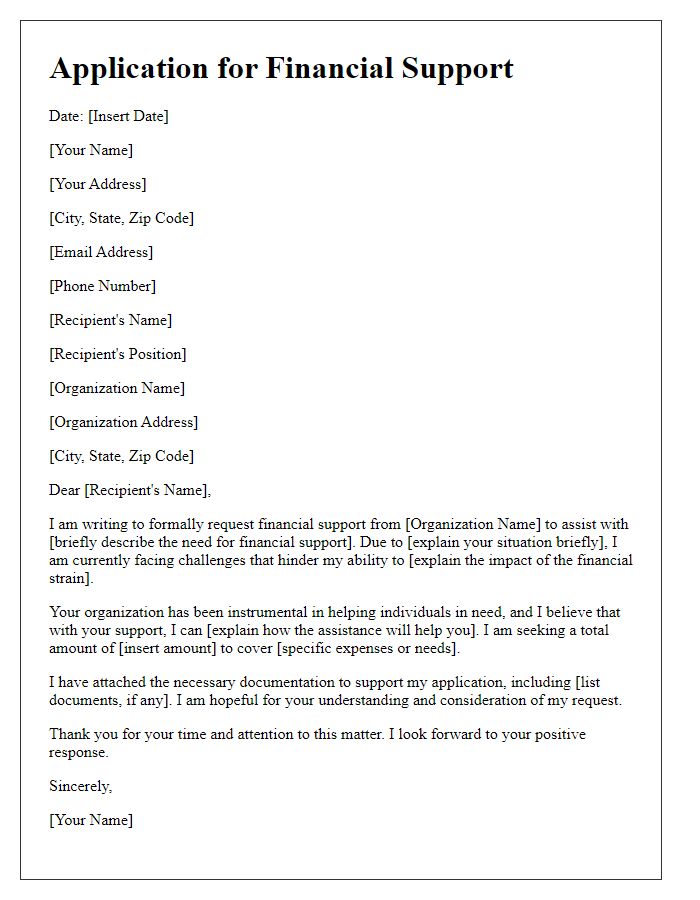

Applicant's personal and financial details

Emergency loans provide immediate financial relief for individuals facing unexpected hardships. Applicants must submit personal information, including full name, date of birth, and address, as well as financial details like annual income, outstanding debts, and monthly expenses. Essential documentation may include pay stubs, bank statements, and identification, ensuring lenders assess eligibility effectively. Loan amounts typically range from $500 to $5,000, with varying repayment terms depending on the lender's policies. Timely approval is crucial, often occurring within 24 to 48 hours, allowing applicants to address urgent issues such as medical expenses, car repairs, or essential bills.

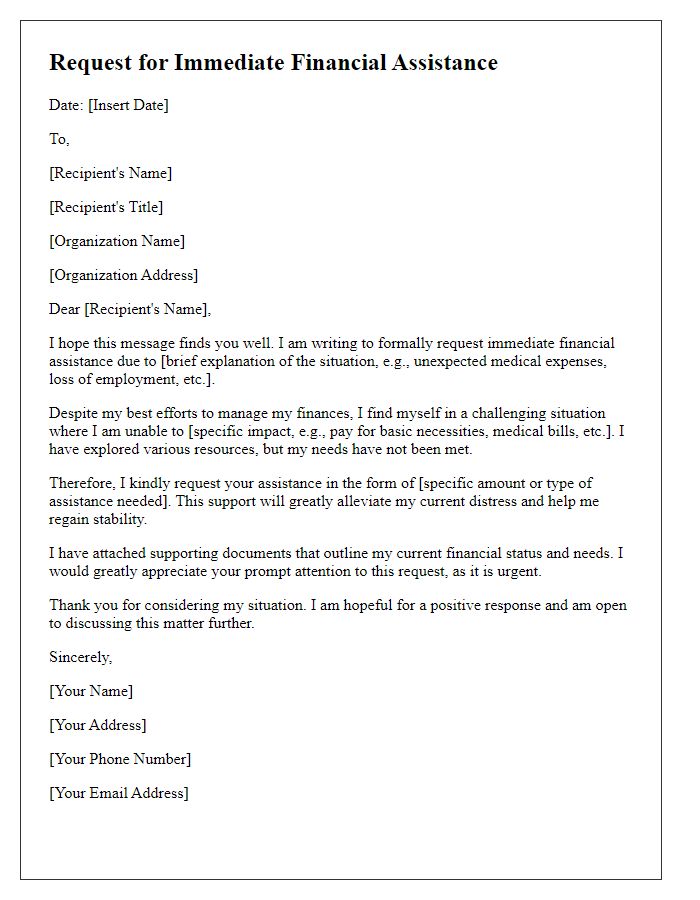

Explanation of emergency situation

A sudden medical emergency, such as an unexpected surgery, can create significant financial strain. Costs associated with medical procedures often exceed thousands of dollars, particularly in facilities like hospitals in major cities. In addition to medical bills, transportation expenses for specialists may also arise. Time-sensitive situations often require immediate action, leading to the necessity of emergency loans. The need for funds to cover these unforeseen circumstances can become critical, especially when dealing with deadlines for payment to service providers or looming bills that threaten to escalate. Quick access to financial support in such cases can alleviate stress during challenging times, allowing focus on recovery and management.

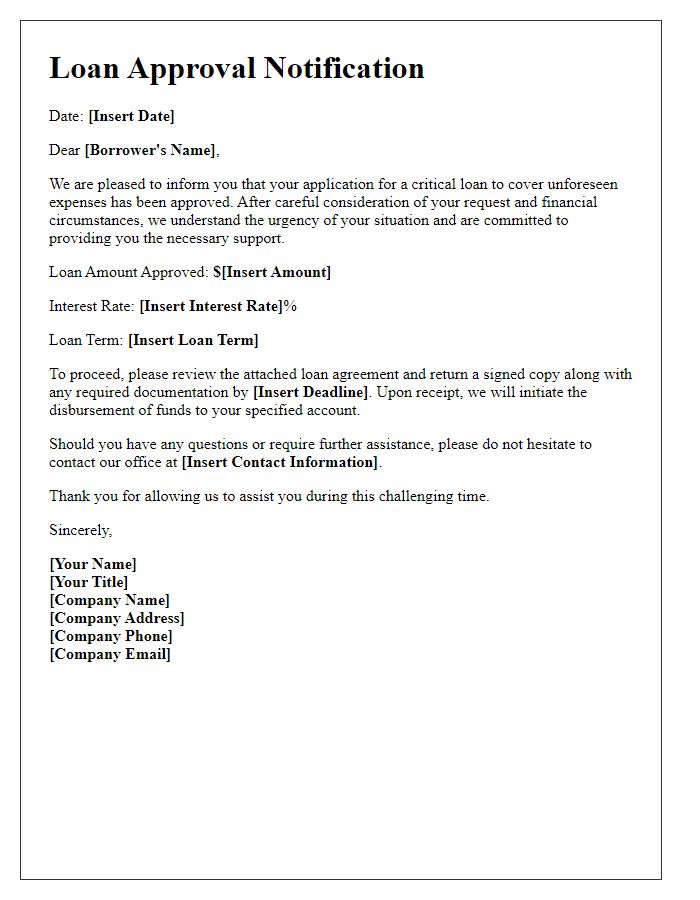

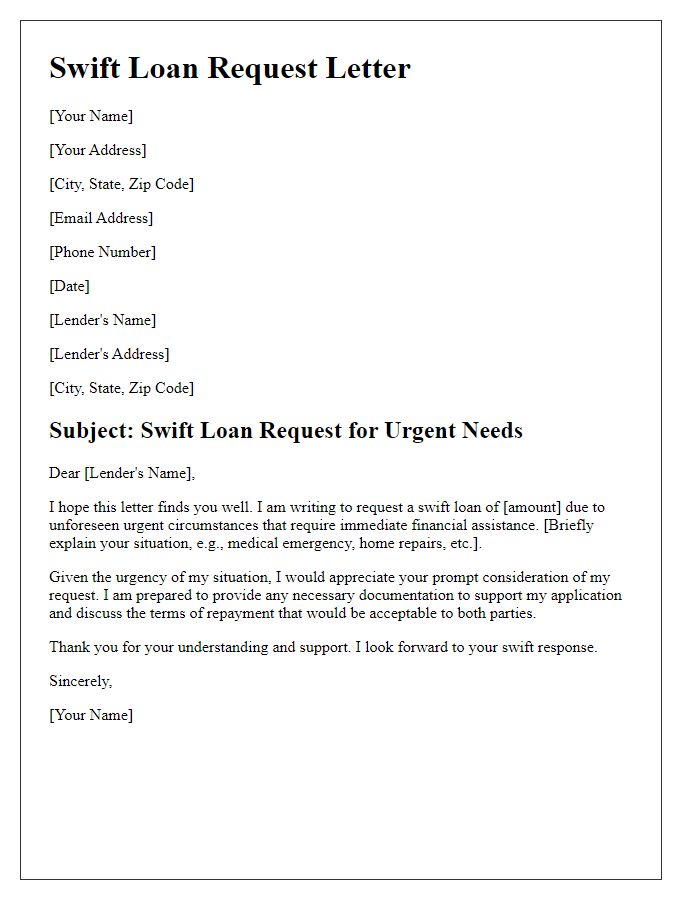

Proposed loan amount and repayment plan

Emergency loans, often sought in times of financial distress, require careful consideration regarding the proposed loan amount and adequate repayment plans. Typical amounts in emergency scenarios can range from $1,000 to $10,000, depending on the urgency of needs such as medical expenses, home repairs, or unforeseen bills. Repayment plans generally span six months to five years, with interest rates varying from 5% to 30%, based on the lender's policies and the borrower's creditworthiness. It is crucial to evaluate monthly payment abilities before committing, ensuring that financial stability remains while fulfilling loan obligations. Detailed documentation of income, expenses, and repayment strategies provides a clear picture to lenders, facilitating a smoother approval process.

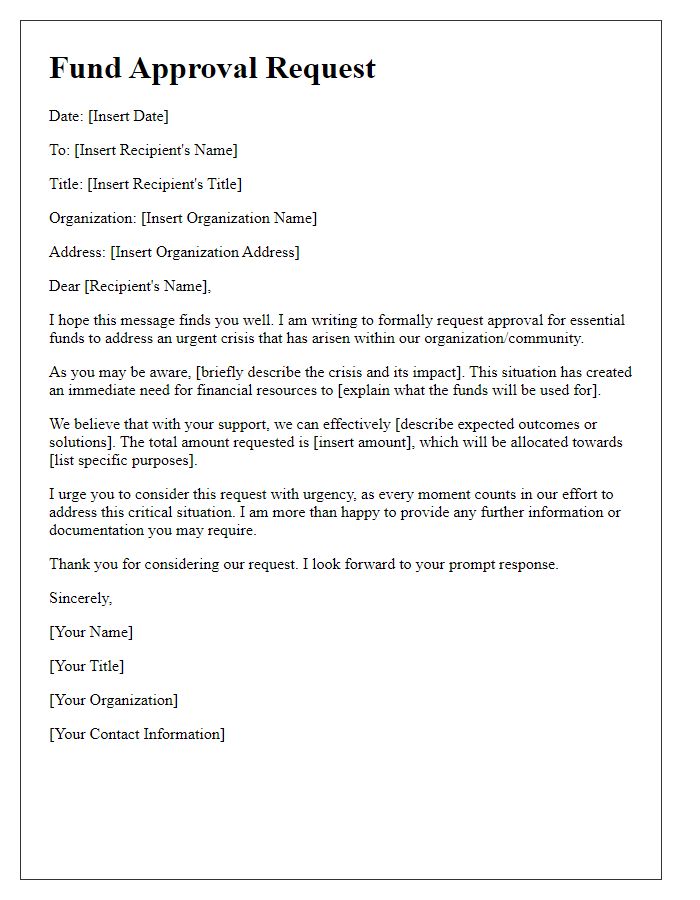

Justification for loan necessity

Emergency loans serve as critical financial assistance during unforeseen circumstances, such as natural disasters or medical emergencies. In 2023, millions of families in the United States experienced the impact of significant weather events, like hurricanes and wildfires, resulting in urgent financial needs to cover essential expenses. For instance, immediate access to funds allows individuals to manage unexpected repairs for homes damaged by flooding in states like Florida or California. Furthermore, medical emergencies can arise suddenly, necessitating funds for treatment and related costs; hospital bills can easily surpass thousands of dollars. Timely approval of such loans directly addresses these urgent financial pressures, granting borrowers the necessary resources to stabilize their situations and restore normalcy in their lives.

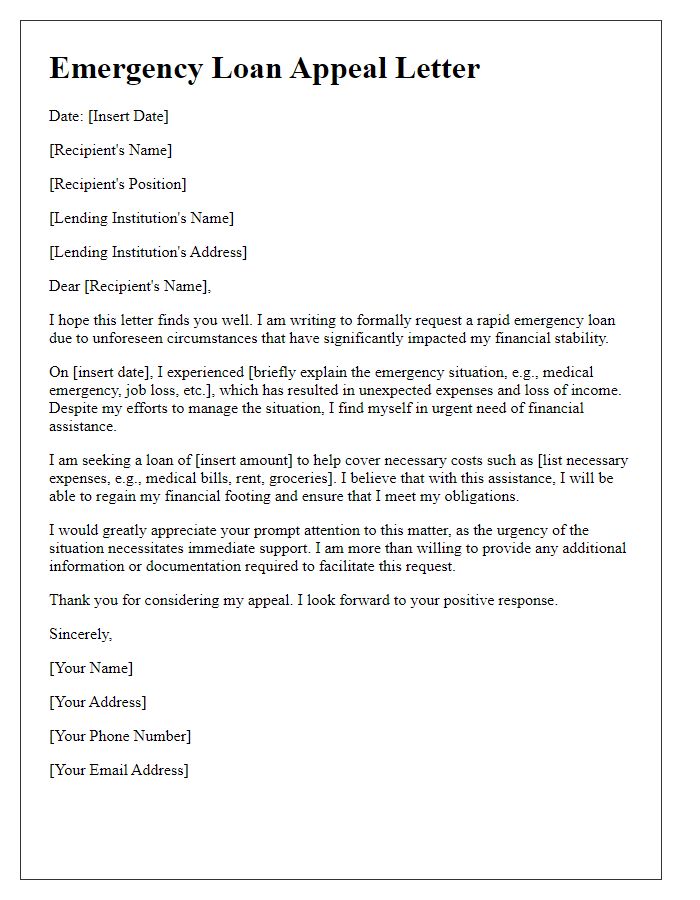

Supporting documents and evidence

In response to financial hardship, an emergency loan request may be submitted to financial institutions, such as banks or credit unions. This request requires supporting documentation to substantiate the applicant's claims. Key documents can include proof of income (such as recent pay stubs or tax returns for the year 2022), bank statements reflecting current financial status, and any notices of unpaid bills or debts that signify urgent financial distress. Additional evidence, such as medical bills or an eviction notice from a landlord, can further validate the need for emergency funds. Collectively, these documents help establish credibility and enhance the likelihood of loan approval.

Comments