Are you considering extending a short-term loan but unsure of how to approach the lender? Crafting the perfect letter can not only express your intentions clearly but also strengthen your case for consideration. With the right structure and polite tone, you can effectively communicate your request while highlighting your reliability as a borrower. Ready to learn the ins and outs of writing a compelling letter for a loan extension? Let's dive in!

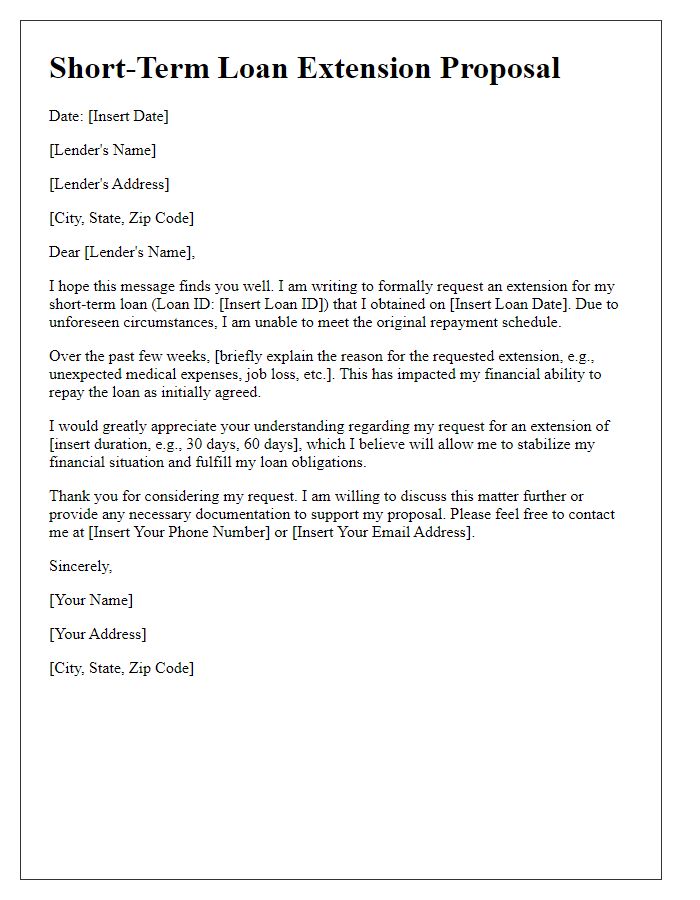

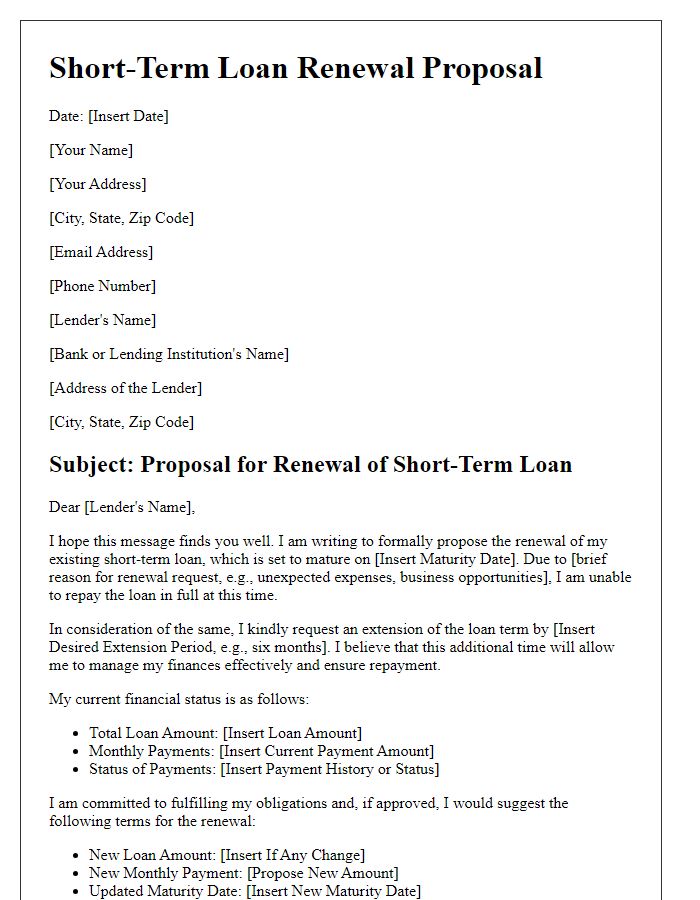

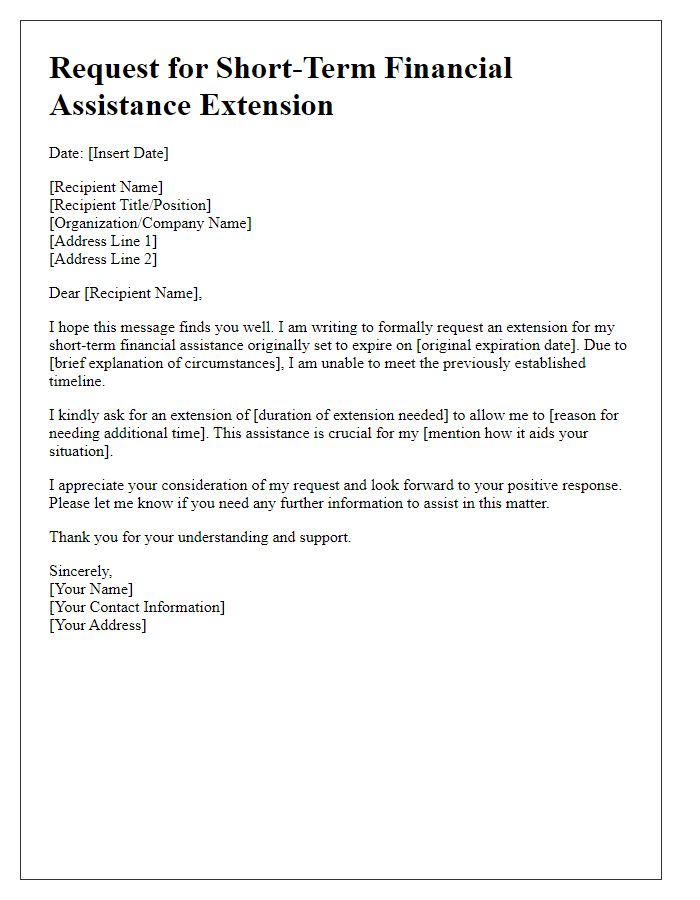

Borrower's Contact Information

Borrower's contact information is crucial in the process of short-term loan extension requests. The contact details should include the borrower's full name, current residential address, phone number, and email address to ensure seamless communication. Accurate information is essential for verifying the identity of the borrower, facilitating timely correspondence regarding the loan terms, and addressing any potential issues that arise during the extension process. Providing updated contact details can significantly enhance the efficiency of managing the loan extension negotiations, ensuring that all parties remain informed and engaged.

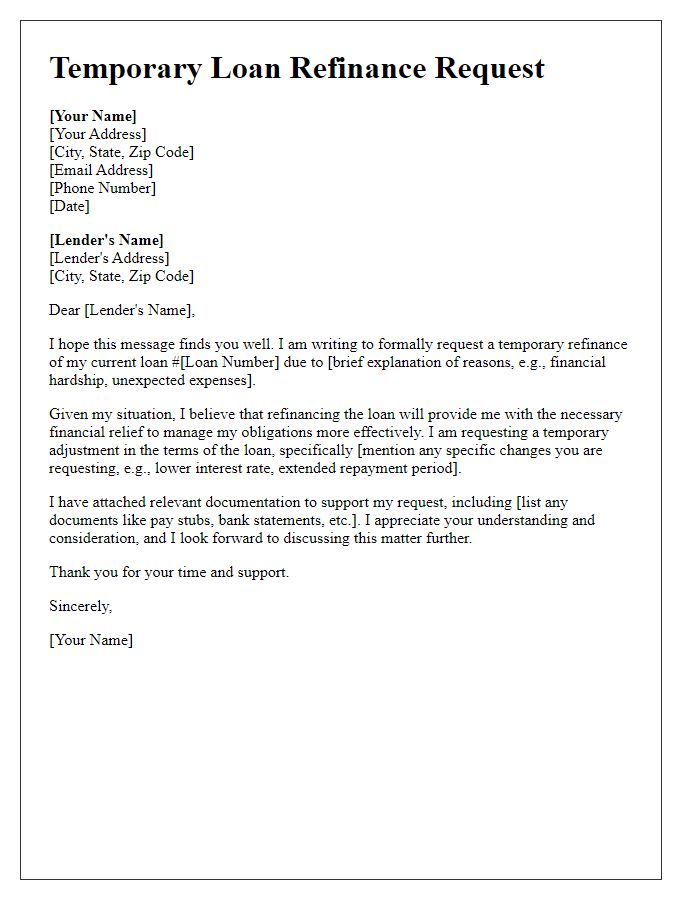

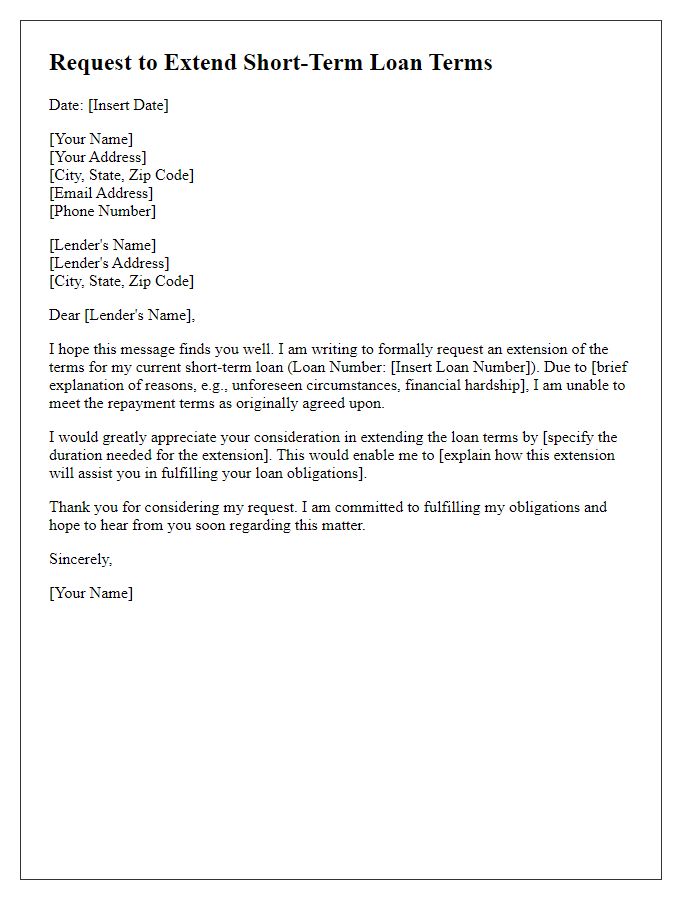

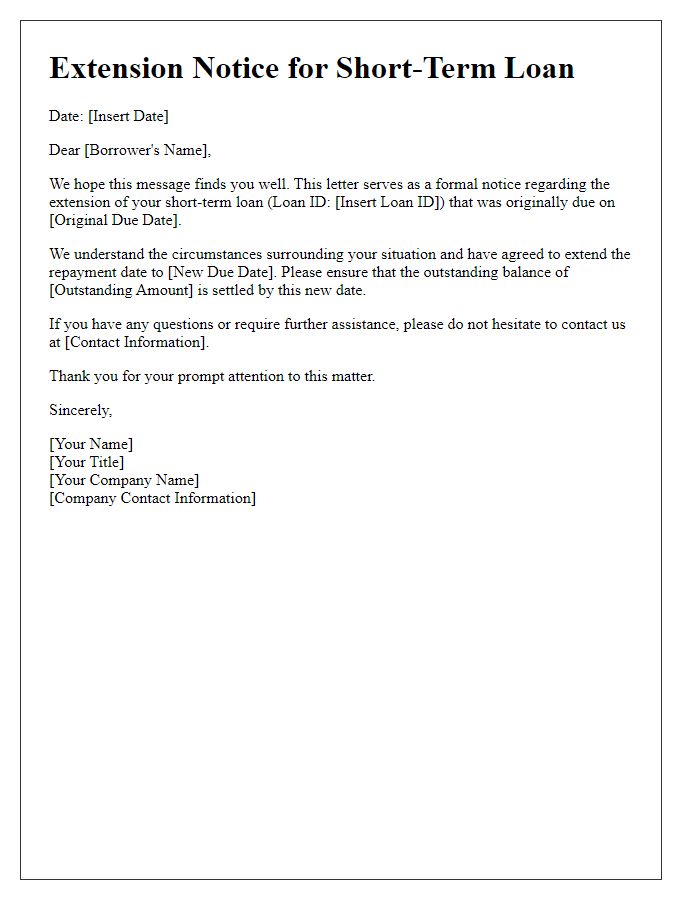

Loan Details and Current Terms

A short-term loan extension offer includes critical loan details such as the initial loan amount, for example, $5,000, along with the interest rate, typically around 8% per annum. The current repayment terms may specify a duration of six months, with monthly payments of approximately $850 due on the first day of each month. An extension offer might propose additional time, perhaps extending the repayment period by three months, allowing borrowers to maintain regular payments of $850 while providing the opportunity to clear the outstanding balance without incurring significant penalties. This offer aims to support borrowers facing temporary financial challenges, ensuring they avoid default and maintain a positive credit rating.

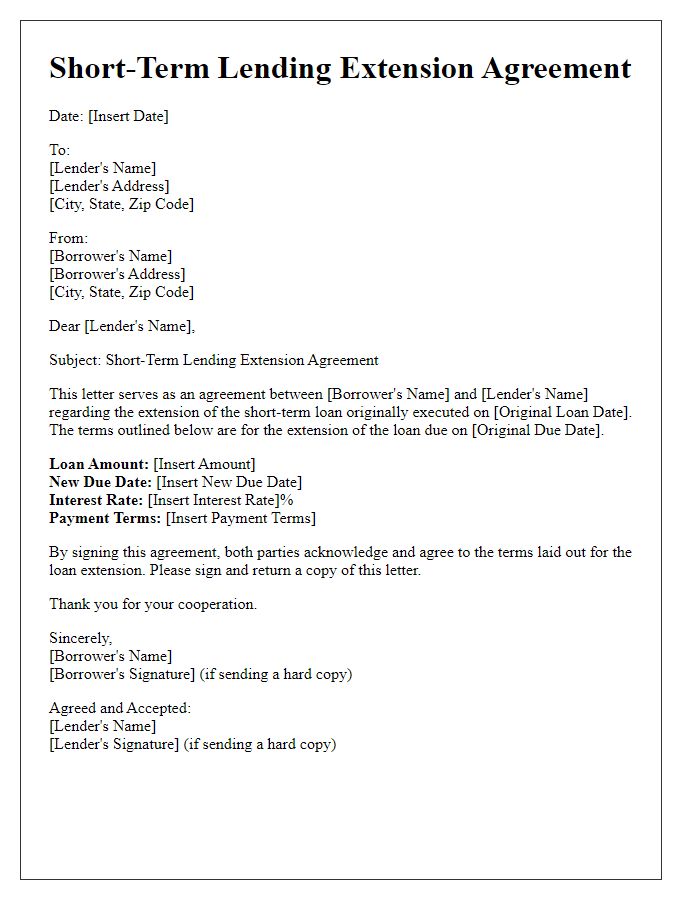

Extension Offer Terms

A short-term loan extension offer can provide financial relief for borrowers facing unexpected circumstances. The revised terms typically include an updated due date, allowing borrowers extra time to repay the outstanding balance without penalties. Interest rates may remain unchanged or adjust slightly, depending on the lender's policies, while any applicable fees related to the extension must be clearly outlined. Affected borrowers should consider their repayment capabilities and any potential impact on their credit score before accepting the offer. Understanding the lender's guidelines is crucial to ensure compliance and avoid further complications in the borrowing process.

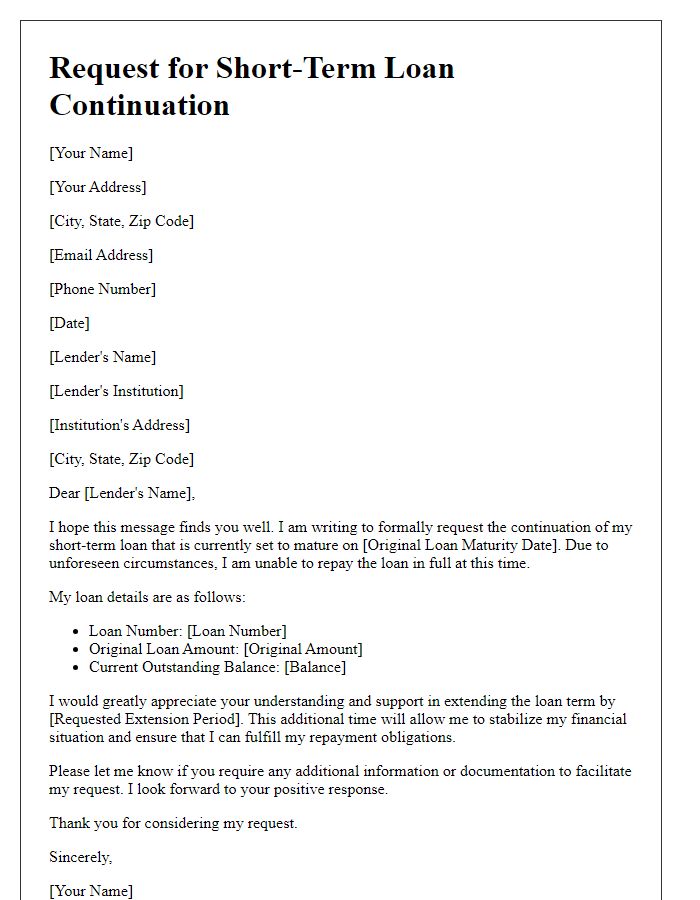

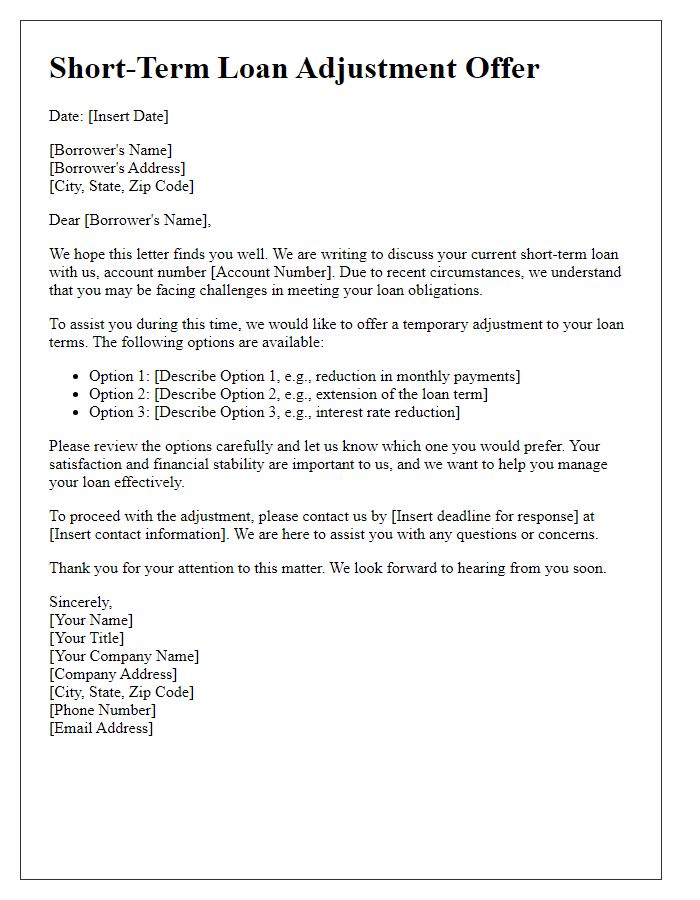

Repayment Schedule and Options

A short-term loan extension offer provides borrowers with flexibility regarding their repayment schedule and options tailored to their financial situation. Typically, these loan extensions are available for amounts ranging from $500 to $10,000, depending on the lender's criteria. Options for extending repayment periods can vary from an additional week to several months, accommodating borrowers facing temporary financial difficulties. For instance, some lenders may offer a revised repayment schedule that includes lower monthly installment amounts, allowing borrowers to manage their cash flow more effectively. It's essential to consider interest rates associated with the extension, which may range from 5% to 30% depending on the lender's policies. Borrowers should evaluate their options carefully, as the total payoff amount could significantly increase compared to the original loan terms.

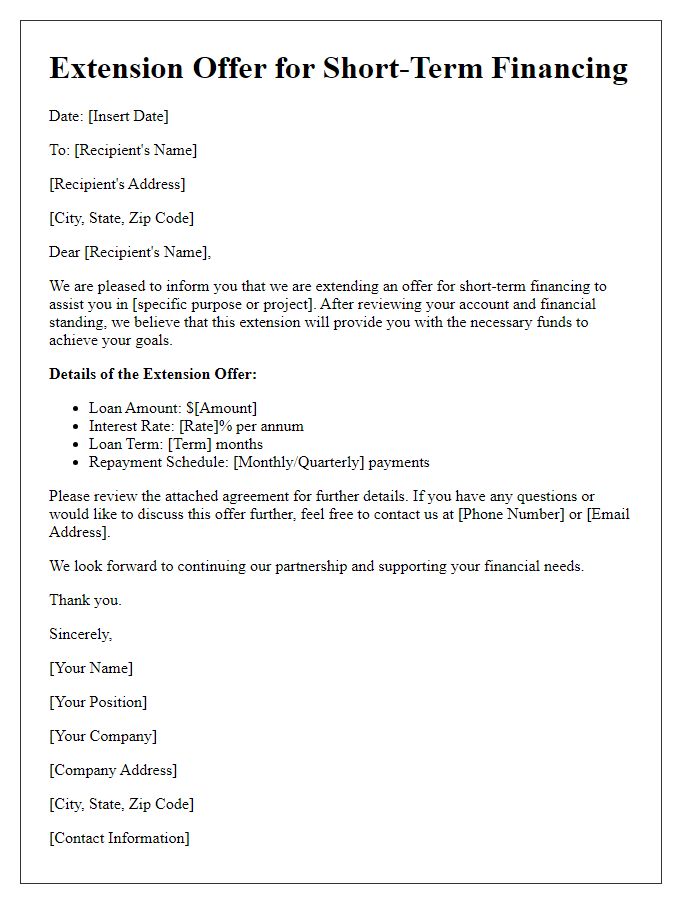

Contact for Further Assistance

Short-term loan extensions often require careful assessment of borrower financial situations, including income stability and existing debt ratios. Financial institutions typically evaluate these criteria to determine eligibility for an extension. Borrowers may also consider discussing their current circumstances directly with loan officers for tailored advice and options. Offering transparency about reasons for requesting an extension can enhance the likelihood of a positive response. When reaching out, providing specific details about the loan, such as the original amount, payment terms, and any interim payments made, can facilitate thorough assistance.

Comments