Are you considering a luxury item purchase but unsure how to finance it? A well-crafted letter template for a luxury item purchase loan can simplify the process and help you present your case effectively to lenders. This guide will provide you with the essential elements to include, ensuring that your request stands out. Read on to discover tips and templates that will make your luxury item dreams a reality!

Tone of Exclusivity

Luxury item purchases, such as high-end watches, designer handbags, or bespoke jewelry, often require financing options that cater to affluent clientele. High-value items, often exceeding thousands of dollars, necessitate premium loan products that offer flexible terms and competitive interest rates tailored for exclusive purchases. Financial institutions specializing in luxury financing prioritize personalized services, ensuring responsible lending while considering the unique financial situations of their clients. Many buyers in high-income brackets appreciate the ability to leverage their assets while enjoying the prestigious experience associated with acquiring luxury goods. This financing often includes personalized service, such as dedicated account managers and tailored repayment plans that enhance the exclusivity of the buying experience.

Detailed Item Description

When applying for a loan for a luxury item purchase, the detailed item description is crucial for assessing the item's value and authenticity. For instance, a Rolex Submariner, specifically the 116610LN model, features a robust stainless steel case measuring 40mm in diameter, renowned for its water resistance up to 300 meters, perfect for diving enthusiasts. This watch showcases a striking black ceramic bezel with a 60-minute scale and luminous hour markers, ensuring visibility in low-light conditions. The heart of the watch is the high-precision Caliber 3130 movement, known for its reliability and chronometer certification, guaranteeing accurate timekeeping. The iconic Oyster case design not only enhances durability but also adds to its timeless elegance. Accompanying documents, such as the original warranty from 2021 and the elegant blue Rolex box, provide proof of authenticity and elevate the item's desirability among collectors, further justifying the loan request amount.

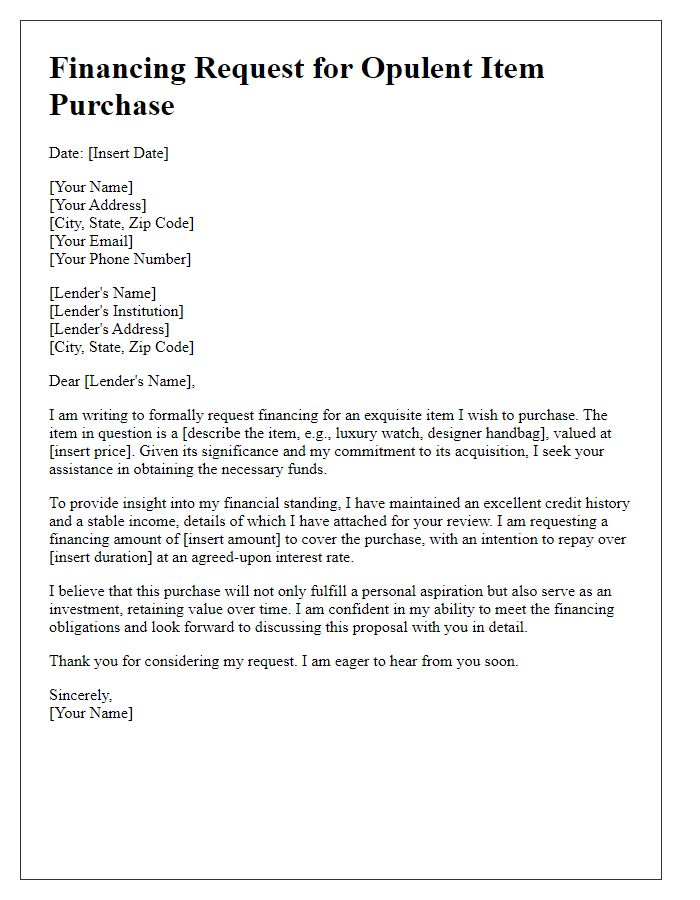

Financial Justification

Luxury item purchases, such as high-end watches or designer handbags, necessitate careful financial justification to ensure responsible borrowing. The average cost of a luxury watch may range from $5,000 to $50,000, while iconic handbags can exceed $10,000, depending on brand and rarity. Securing a loan for such purchases typically involves demonstrating stable income sources, often necessitating a minimum annual salary of $75,000. The total debt-to-income ratio should remain under 30% to maintain financial health. Furthermore, assessing resale value is critical; luxury items can often retain or appreciate in value, with designer brands like Rolex or Chanel showing significant resale potential, sometimes fetching 70% to 90% of their retail price. Understanding the implications of interest rates, payment terms, and potential fees associated with luxury purchases is vital in making informed financial decisions.

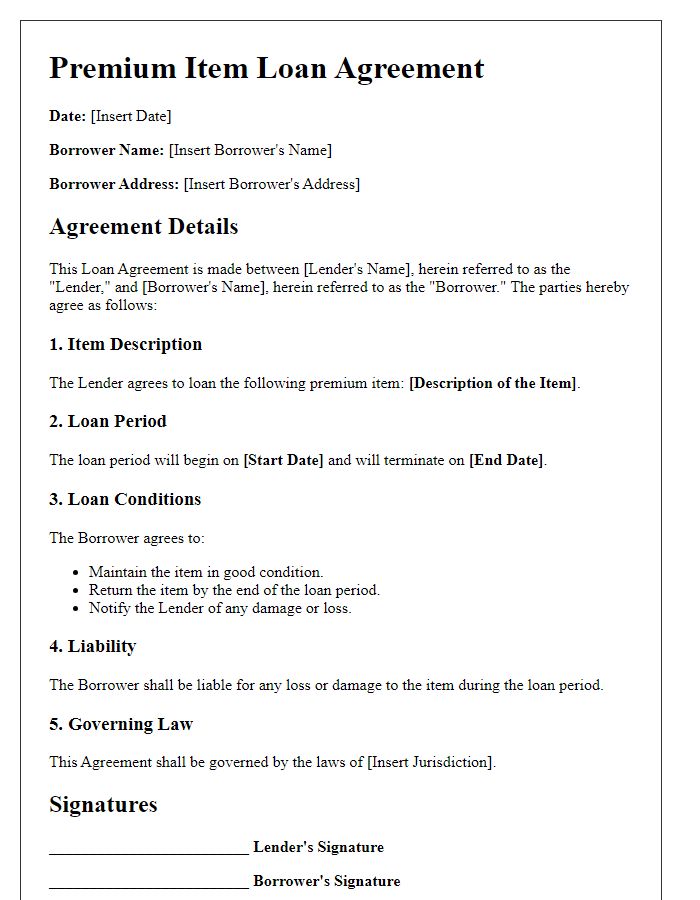

Repayment Terms

Luxury item purchase loans often involve specific repayment terms designed to accommodate high-value acquisitions. Financing for items such as designer handbags, high-end electronics, or luxury watches typically ranges from $1,000 to $50,000, depending on the item's value. These loans usually feature fixed or variable interest rates, which might be between 6% to 24% annually, influenced by factors like credit score and loan amount. Repayment schedules often span from 6 months to 5 years, with monthly installments structured to ease financial burden. Lenders might impose early repayment penalties if borrowers decide to settle the loan ahead of schedule, potentially costing between 1% to 3% of the remaining balance. Additionally, luxury item loans may require a down payment of 10% to 30% of the total amount, significantly impacting the overall financing cost.

Confidence in Approval

Purchasing luxury items often requires financial planning and confidence in obtaining loans. Personal loans for luxury purchases, like high-end watches or designer handbags, typically have criteria including credit score benchmarks (usually above 700), income verification through recent pay stubs, and debt-to-income ratios favoring a maximum of 30%. Financial institutions, such as banks or specialized lenders, assess the applicant's financial history before providing approval for loans, often offering interest rates ranging from 5% to 20% based on creditworthiness. Successfully navigating this loan application process can offer buyers the opportunity to possess luxury goods while maintaining financial stability, ensuring that the investment aligns with long-term financial goals.

Comments