Are you looking to streamline your construction project finances? Managing a construction loan draw schedule can be a daunting task, but it doesn't have to be! With the right templates and guidelines, you can effectively track your funding, ensuring that each phase of your project is completed on time and within budget. So, let's dive deeper into how to create a successful draw schedule that keeps your project on trackâread on!

Project timeline milestones

A construction loan draw schedule is a critical financial plan outlining the timing and amounts of funds disbursed throughout a construction project. The schedule should align with project timeline milestones, indicating significant events such as groundbreaking, which typically occurs at the start of the construction phase; framing completion, usually around the 60% mark of project progress; and final inspection, marking project completion and readiness for occupancy. Each milestone triggers specific draw requests to ensure adequate cash flow, such as 30% draw after foundation completion and 40% draw upon roofing installation. Establishing clear and realistic milestones ensures effective budgeting and resource allocation at locations like commercial sites or residential developments. Proper documentation and adherence to the draw schedule can prevent delays and enhance project efficiency.

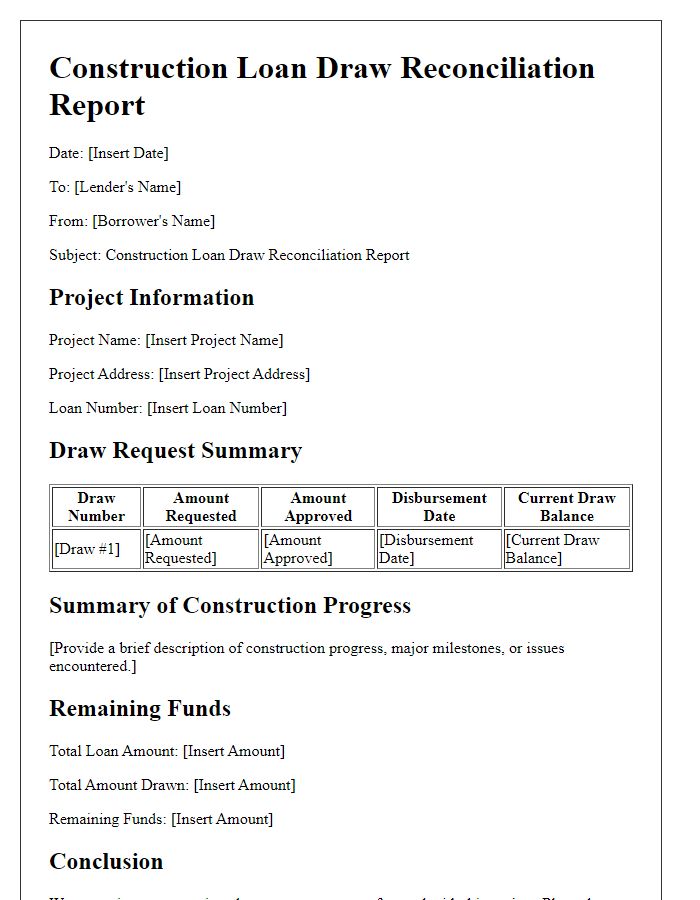

Detailed budget breakdown

A construction loan draw schedule typically includes a detailed budget breakdown outlining specific phases of construction, associated costs, and timelines for fund disbursement. The budget breakdown can categorize expenses into various sections: land acquisition, site preparation, foundation, framing, exterior work, interior finishes, and final landscaping. Each section may include itemized costs, such as permitting fees (varies by municipality), labor charges (hourly rates for skilled trades), and materials (e.g., lumber prices fluctuating based on market conditions). Proposed timelines for each phase often align with project milestones to ensure funds are drawn in coordination with construction progress, typically set to specific intervals, such as completion of foundation or roofing installation. This systematic approach supports project management efficiency and ensures adequate cash flow throughout the construction process, reducing financial risk for lenders and builders alike.

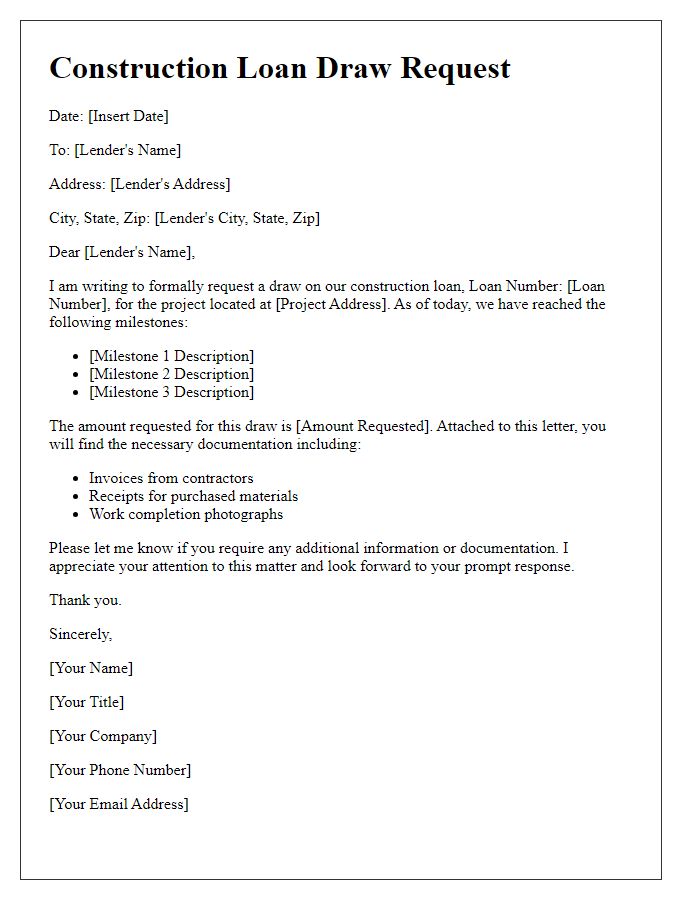

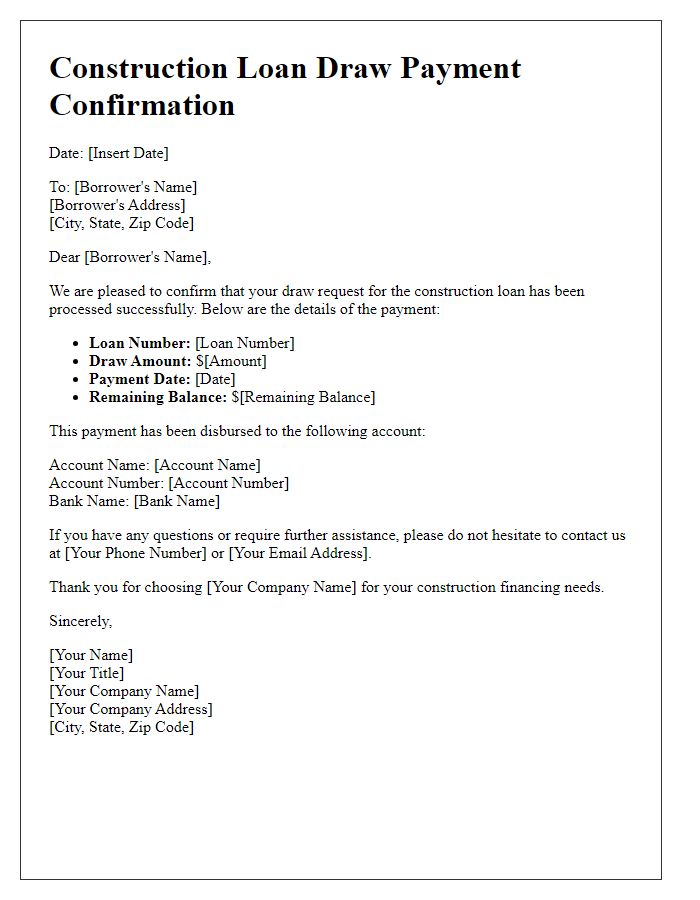

Payment disbursement terms

The construction loan draw schedule outlines the payment disbursement terms crucial for project financing. It specifies predetermined milestones, such as the completion of foundation work, framing, and roofing, which trigger disbursement stages at various percentages (typically 25%, 50%, and 75% through the project). Each draw request requires submission of documented progress, including invoices from contractors, materials receipts, and inspection reports, to lenders at financial institutions such as banks or credit unions. The final draw, often designated for project completion, necessitates final inspections and approval from both the borrower and lender prior to fund release, ensuring financial control throughout the construction process.

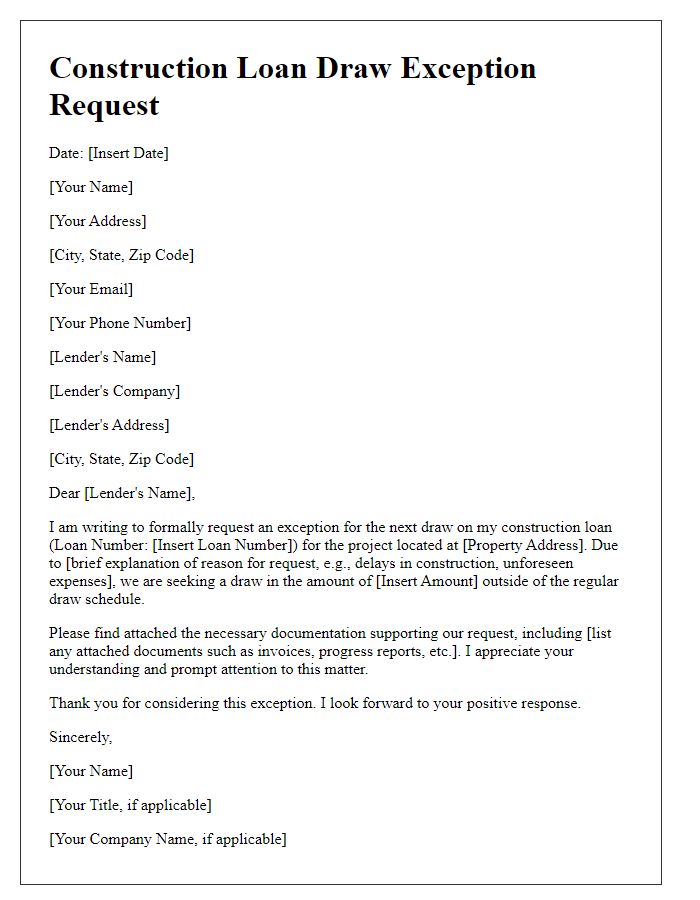

Documentation requirements

Construction loan draw schedules require detailed documentation to facilitate timely disbursement of funds for various stages of construction. Essential documents include a completed draw request form, which outlines specific amounts requested at each phase, along with proof of completed work such as invoices or lien waivers from contractors (necessary to ensure no unpaid debts exist on the project). Additionally, a narrative explaining the progress should accompany each request, detailing labor and materials utilized, and photographs of the site may be required to visually confirm work status (often mandated by lenders). Other essential entities may include updated project budgets and cost breakdowns, which help ensure that the funds are being used appropriately according to the agreed construction plan. This meticulous documentation process supports adherence to lender guidelines and compliance with construction contracts.

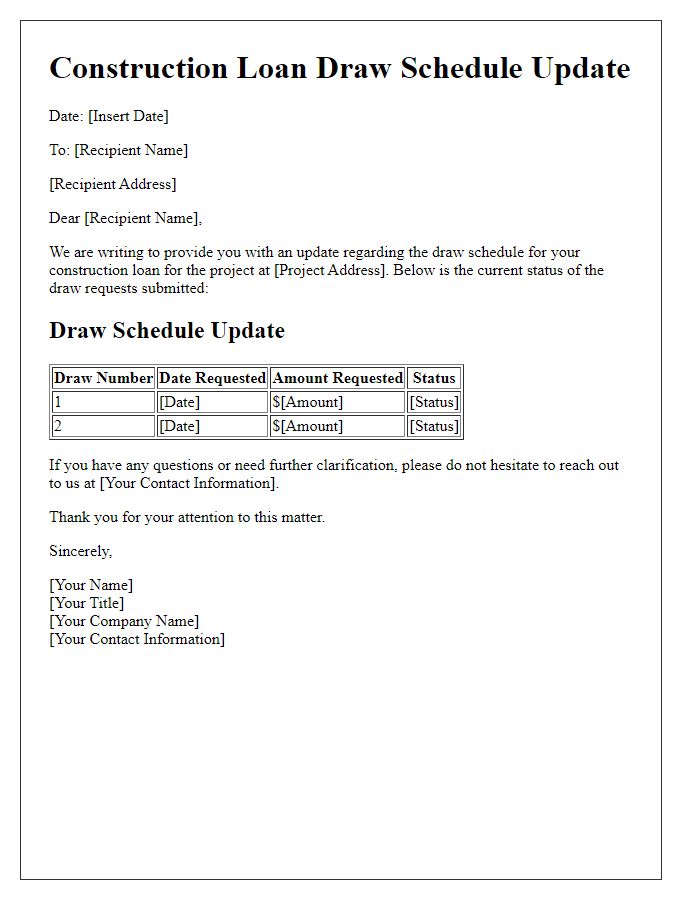

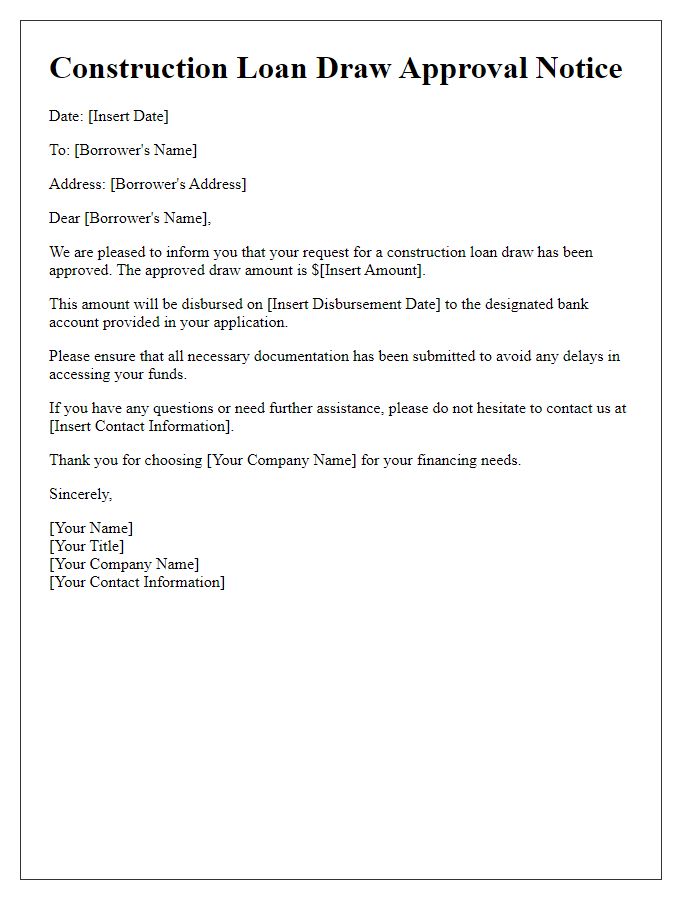

Lender approval process

The construction loan draw schedule outlines the systematic release of funds, critical for project progress, aligning with the construction phases of a project. Typically, lenders evaluate draw requests based on completed work milestones, such as foundation completion, framing, and roofing. Documentation, including invoices, inspection reports, and lien waivers, is essential for lender review, ensuring compliance with financial and regulatory standards. During the lender approval process, timelines are established, with specific intervals discussed, often aligned with project schedules. Proper communication is key, with both contractor and borrower involved in the draw request submission, streamlining the funding flow needed for labor and materials. Each draw should ideally correlate with a detailed budget that reflects actual expenditures to prevent financial discrepancies throughout the construction process.

Comments