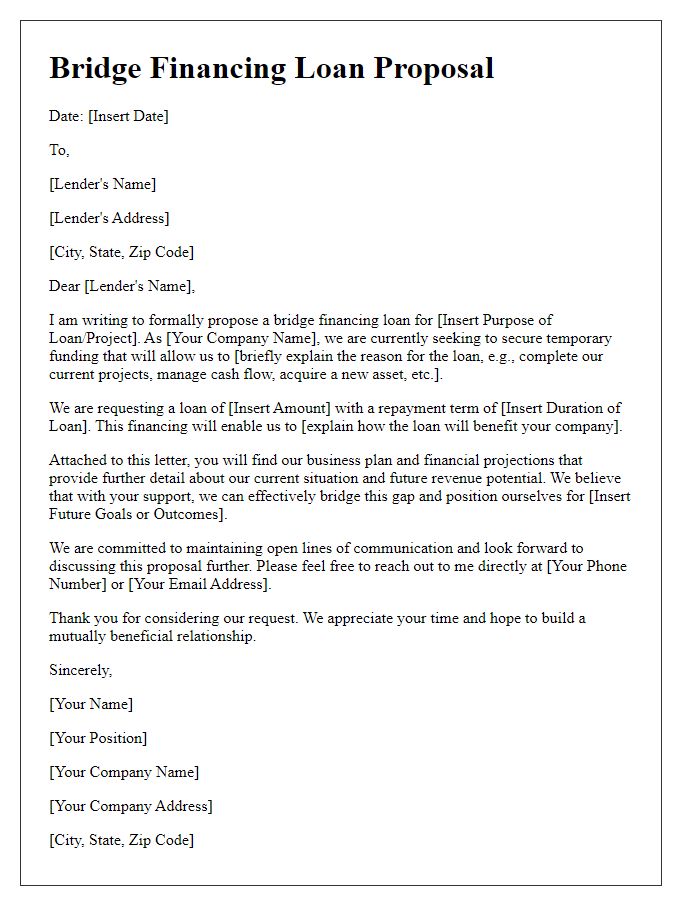

Are you looking for a way to secure the necessary funds for your next project? Bridge financing can be an excellent solution when you need quick capital to cover immediate expenses until you secure more permanent financing. In this article, we'll explore the essential terms and conditions you should consider when crafting a letter template for bridge financing. Dive in to learn more about how to make your financing process smoother and more efficient!

Loan Amount and Purpose

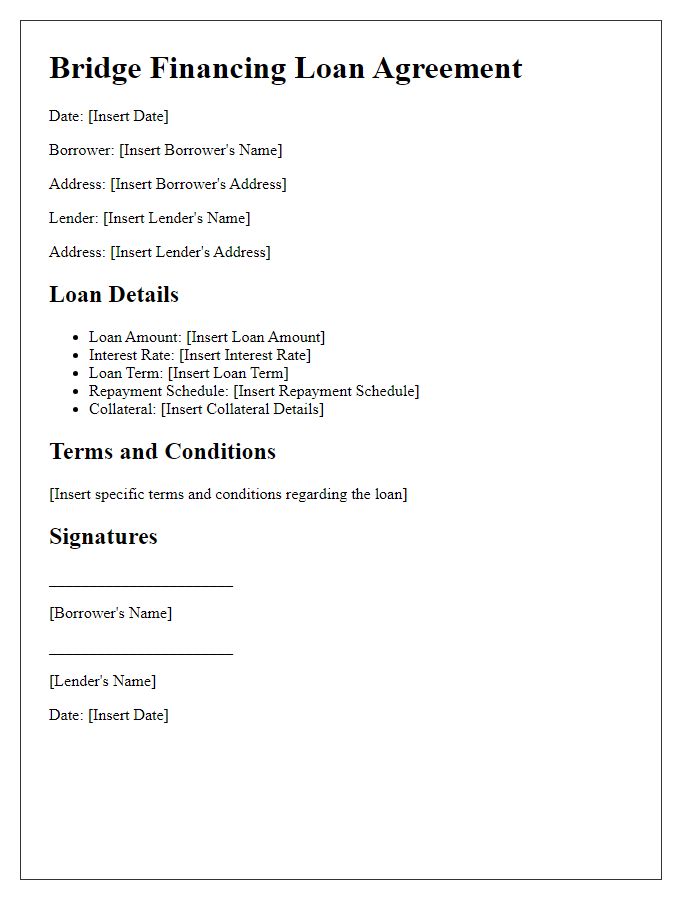

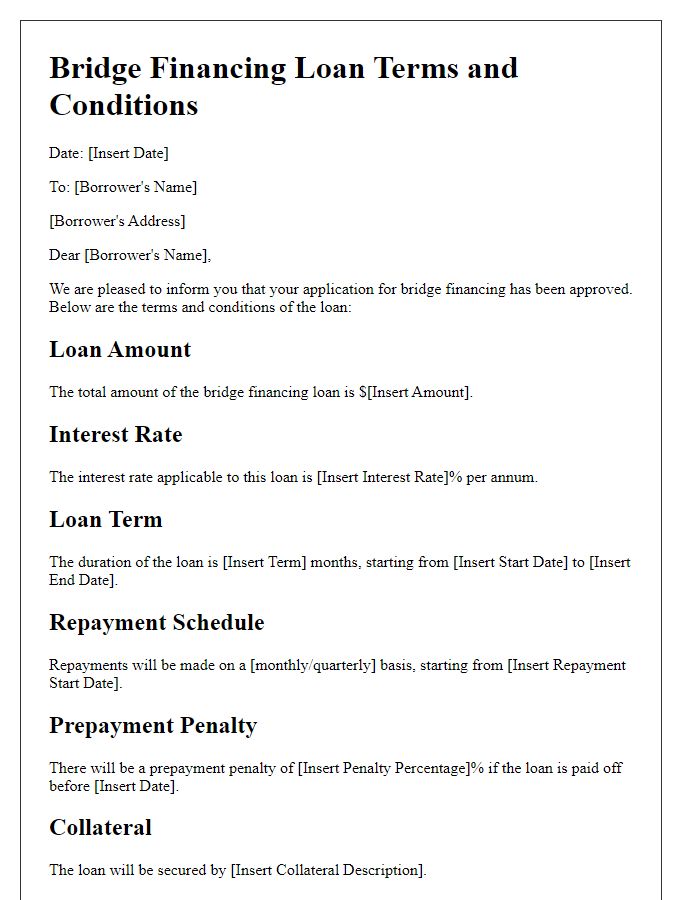

Bridge financing loans typically offer a temporary financial solution, often between $50,000 and $5 million, designed to cover funding gaps in real estate transactions or business operations. This type of financing assists borrowers during transitional periods, such as awaiting the sale of an existing property or closing on a new venture, particularly common in urban markets like New York City or San Francisco. The funds are frequently allocated for urgent needs, such as renovation costs, inventory purchases, or operational expenses to maintain business continuity. Key terms generally include a repayment period ranging from a few months to two years, interest rates typically between 6% and 12%, and flexible qualification requirements, allowing for quick access to capital, often within days.

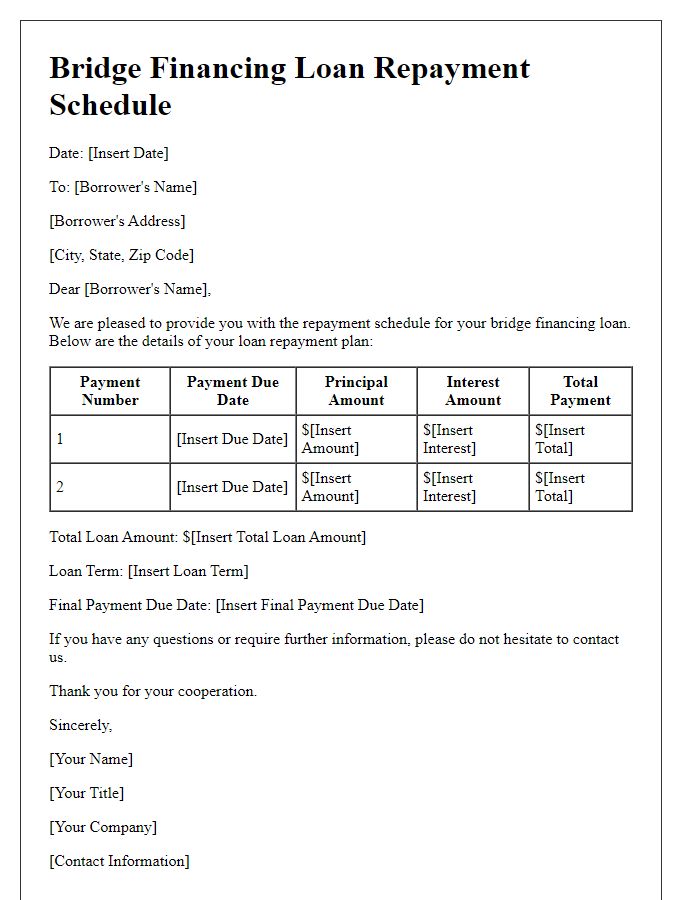

Interest Rate and Payment Schedule

Bridge financing loans often come with specific interest rates and payment schedules tailored to the borrower's needs. Typically, interest rates can vary between 7% to 12%, depending on the lender's risk assessment and the borrower's creditworthiness. Payment schedules are generally structured for short-term durations, commonly ranging from three to 18 months. Borrowers may encounter options such as interest-only payments during the loan term, allowing them to preserve cash flow while seeking long-term financing solutions. It is essential for borrowers to understand the terms regarding prepayment penalties, which can impact the overall cost of the financing. Flexibility in repayment terms can provide significant advantages when navigating transitional financial periods.

Collateral and Security Details

Bridge financing loans provide temporary funding solutions during transitions, often secured by valuable assets. Common collateral may include real estate holdings, commercial property in metropolitan areas such as New York City or San Francisco, or other tangible assets like inventory, equipment, or accounts receivable. Lenders typically assess the loan-to-value (LTV) ratio, usually ranging from 60% to 80%, to determine the amount of financing available. Security details involve legal documentation, including deeds of trust or liens placing the lender's claim on the asset until the loan is repaid. Interest rates for bridge loans can vary, generally between 6% and 12%, depending on the borrower's creditworthiness and market conditions. These loans are designed to be short-term, with repayment periods typically between three months to three years, making them suitable for real estate investors or businesses seeking quick capital access.

Loan Term and Maturity Date

Bridge financing loans are typically short-term loans designed to provide immediate cash flow solutions for businesses or real estate transactions. Loan terms for this type of financing often range from six months to one year, depending on the lender's policies and the borrower's needs. Maturity dates are crucial, as they indicate the deadline for loan repayment, allowing businesses to prepare for refinancing or securing long-term financing thereafter. Lenders may have specific requirements for maturity dates, with some offering flexible terms based on project timelines or market conditions. These loans typically carry higher interest rates due to their short-term nature and perceived risk, emphasizing the importance of clear loan agreements to outline expectations and repayment structures.

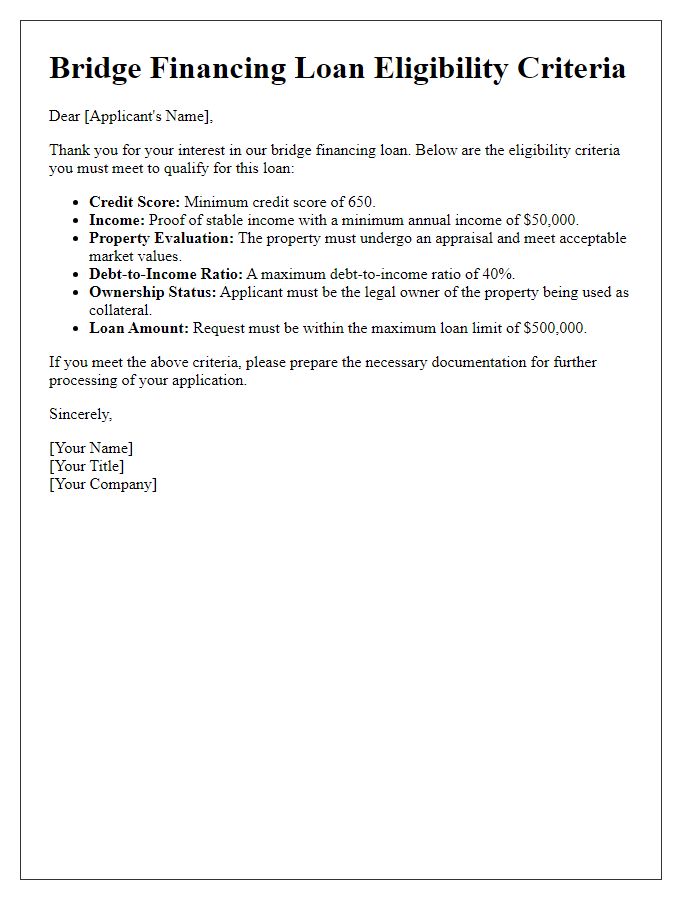

Conditions and Covenants

Bridge financing loans typically involve specific terms and conditions that borrowers must adhere to throughout the loan period. These loans, often utilized by businesses or real estate developers seeking short-term capital, usually have a defined term (6 to 24 months) and a higher interest rate (typically between 8% to 12%). Key conditions may include maintaining a certain debt-to-equity ratio (often not exceeding 2:1) and providing monthly financial statements for the lender's review. Covenants may restrict certain actions such as incurring additional debt or selling significant assets without lender approval. Additionally, the loan documentation may require collateral, which can include property or equipment, assessed through an appraisal process conducted by a licensed professional. Compliance with these terms is vital for borrower flexibility and maintaining a positive relationship with the lender.

Comments