Are you a legal professional seeking clarity on loan terms tailored to your needs? Navigating the world of financing can be daunting, especially when it comes to understanding your options. In this article, we'll break down the essential elements of legal professional loan terms, making it easier for you to make informed decisions. So, grab a cup of coffee and join us as we delve into the details!

Loan Amount and Disbursement

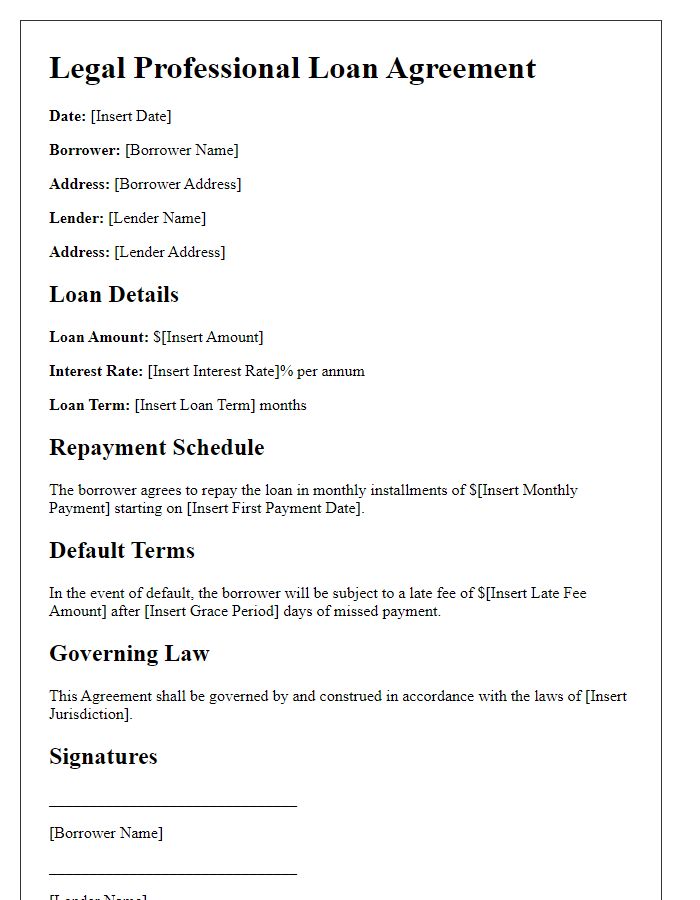

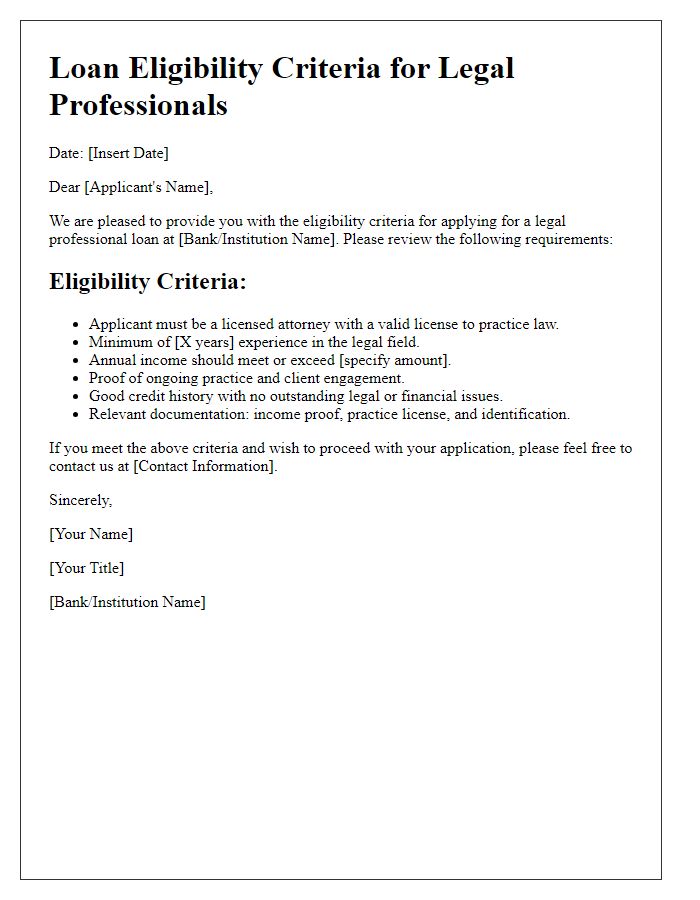

Loan amounts in legal professional loans typically range from $5,000 to $500,000, catering specifically to attorneys and law firms. Disbursement usually occurs within 30 days after approval, often through electronic transfer to ensure quick access. The interest rates vary significantly, generally between 6% and 12%, depending on the borrower's creditworthiness and financial history. Repayment terms may span from 5 to 15 years, entailing monthly or quarterly payments. Importantly, the loans are usually unsecured, meaning no collateral is required, but this can also result in higher interest rates. Legal professionals should also be aware of potential origination fees, which might add to the total loan cost.

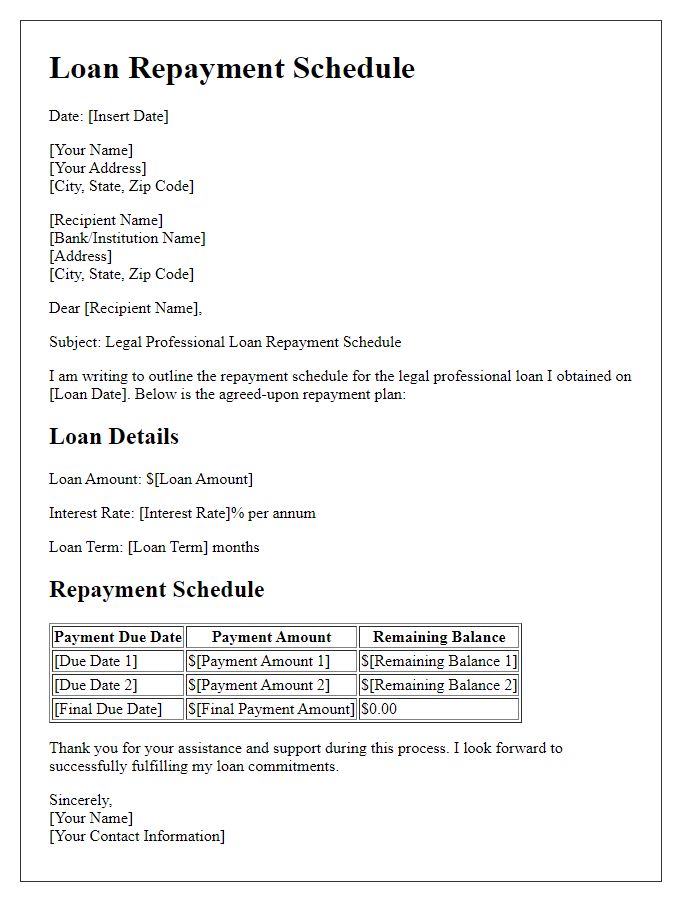

Interest Rate and Repayment Schedule

Legal professionals seeking a loan can expect competitive interest rates, typically ranging between 4% to 7% annually, depending on creditworthiness and financial history. Loan repayment schedules generally span from 5 to 15 years, with monthly payments structured to ensure financial stability. Most agreements require an initial down payment of 10% to 20%, influencing the overall loan amount. Additionally, borrowers may consider options for deferment or forbearance, especially during periods of practice establishment, often seen in new legal practitioners in cities like New York or Los Angeles. Proper documentation, including proof of income, employment verification, and a detailed business plan, is essential to secure favorable loan terms and ensure adherence to agreed-upon repayment conditions.

Collateral and Security Agreement

A Collateral and Security Agreement outlines the terms governing the security interest in assets provided as collateral for a legal professional loan. Key components usually include a detailed description of the collateral, such as real property, vehicles, or equipment, along with their estimated values. The Agreement specifies the borrower's obligations regarding the maintenance and insurance of the collateral, ensuring its preservation until the loan is fully repaid, including interest and fees. The document also outlines the lender's rights, which may involve repossession in the event of default, describing the procedures legally required in the jurisdiction, such as applicable notice periods under local laws. Additional provisions often address the loan amount, repayment schedule, and any penalties for late payments, ensuring clear expectations for both parties.

Default and Penalties

Defaulting on a legal professional loan, such as those offered for attorneys or law firms, entails serious repercussions. A default is typically defined as missing a payment after a grace period of 30 days post due date. Penalties for default may include late fees (often 5% of the missed payment), increasing the overall loan balance. In some instances, the lender may initiate collection actions, impacting credit scores significantly--potentially reducing a score by 100 points. Furthermore, legal repercussions can lead to additional costs associated with litigation, as well as the possibility of losing professional licenses if financial obligations remain unresolved. It is advisable to consult the loan agreement for specific terms, including state laws affecting collections, like those in California, which can provide borrower protections not typically found in other jurisdictions.

Legal Notices and Jurisdiction

Legal notices serve as essential communication tools in formal agreements, particularly in professional loan terms. These notices typically outline the obligation of both parties concerning legal responsibilities, ensuring clarity in the event of disputes. Jurisdiction refers to the legal authority of a particular court to hear cases and make judgments. It often specifies the geographical location (such as a county or state, for example, New York) and the specific court system (like the Superior Court) that will handle any legal proceedings related to the loan agreement. This provision delineates where legal actions must be brought, which is crucial in protecting the interests of both borrowers and lenders. By establishing clear legal notices and jurisdictional stipulations, parties can avoid confusion and ensure proper legal recourse, maintaining transparency throughout the borrowing process.

Comments