Are you considering taking out a personal loan but feeling overwhelmed by high interest rates? You're not alone! Many borrowers are on the lookout for solutions that not only provide financial support, but also don't break the bank with hefty interest fees. Discover how a low interest rate personal loan can be the key to achieving your financial goalsâread on to find out more!

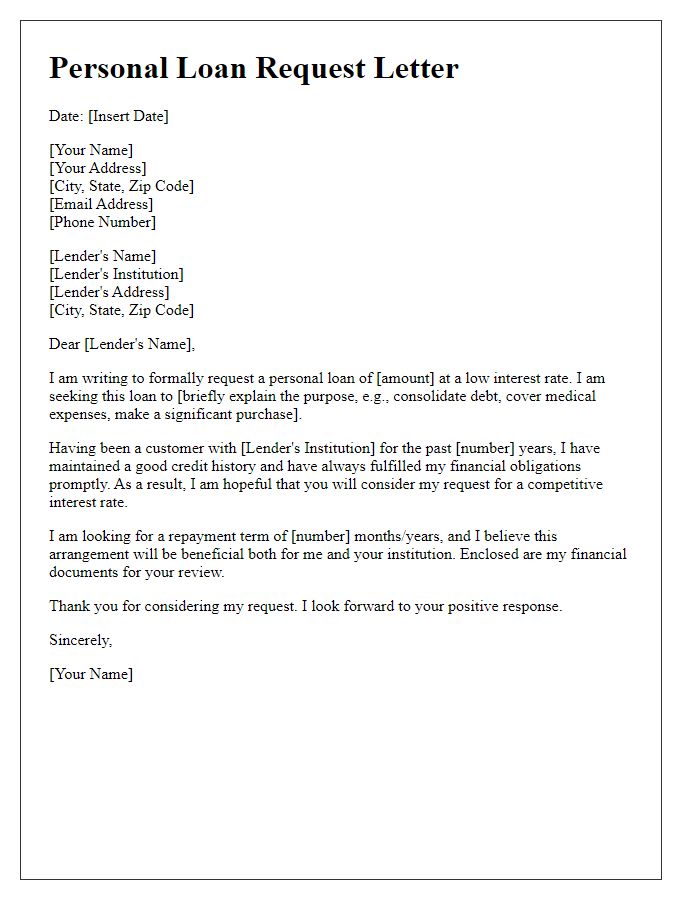

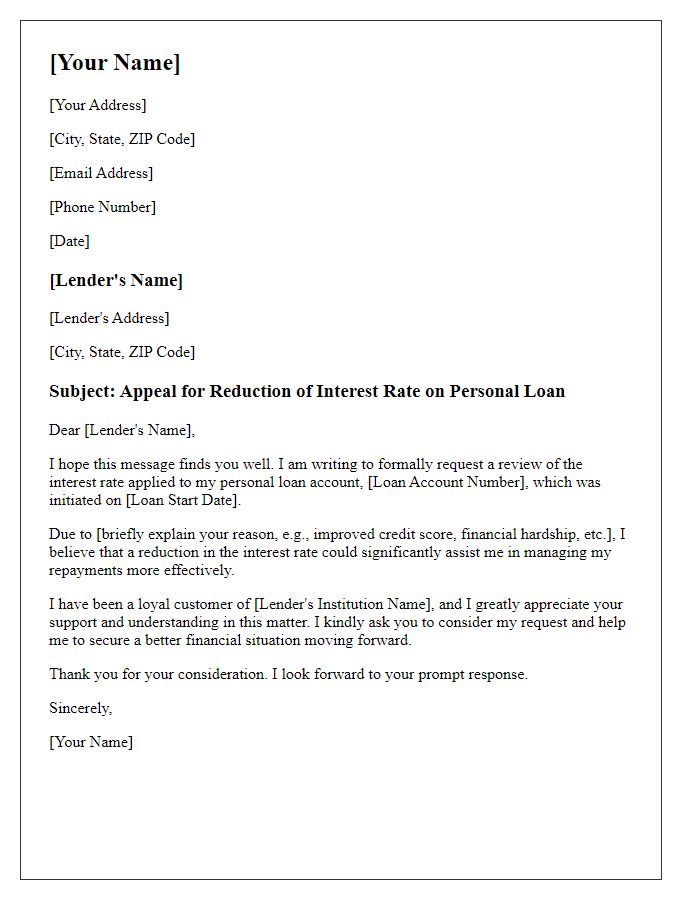

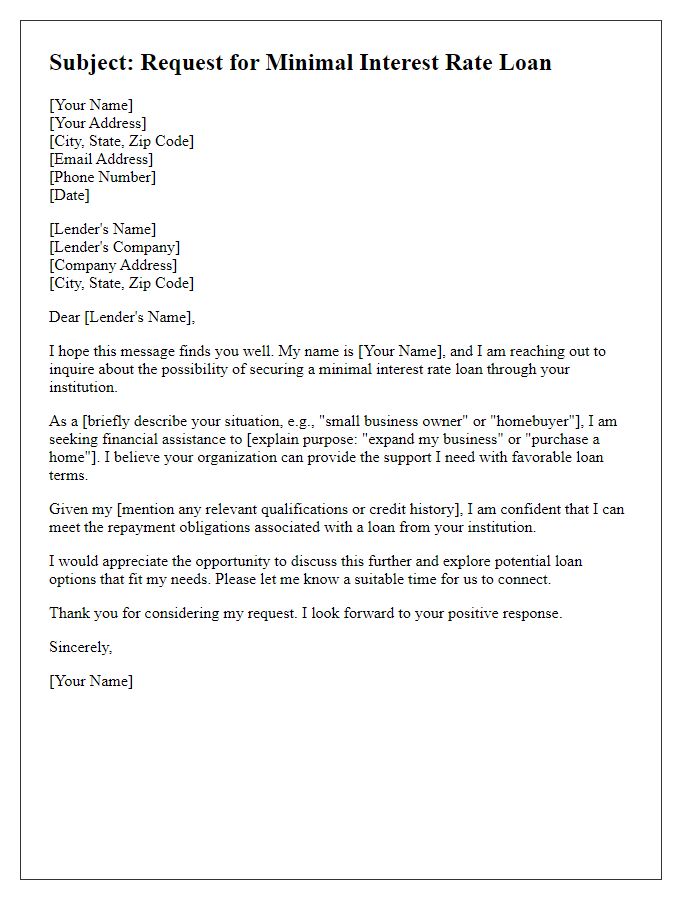

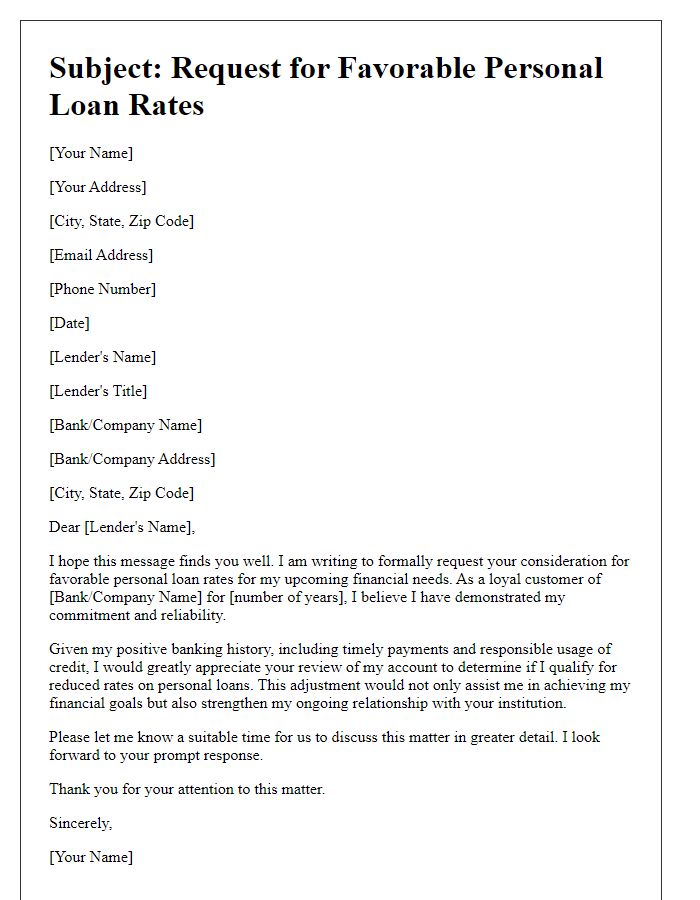

Personal Information

Personal information, including identification details such as full name (John Doe), residential address (123 Maple Street, Springfield), date of birth (January 1, 1985), and social security number (123-45-6789), plays a crucial role in loan applications. Financial background, encompassing income details (annual salary of $50,000), employment status (full-time at XYZ Corporation since 2010), and credit score (700, categorized as good), is essential for lenders to assess the borrower's creditworthiness. The individual's loan purpose, such as debt consolidation or home improvement, along with requested loan amount (e.g., $15,000) and desired term (36 months), further aids in the evaluation process, ensuring that lenders can offer a suitable low-interest rate.

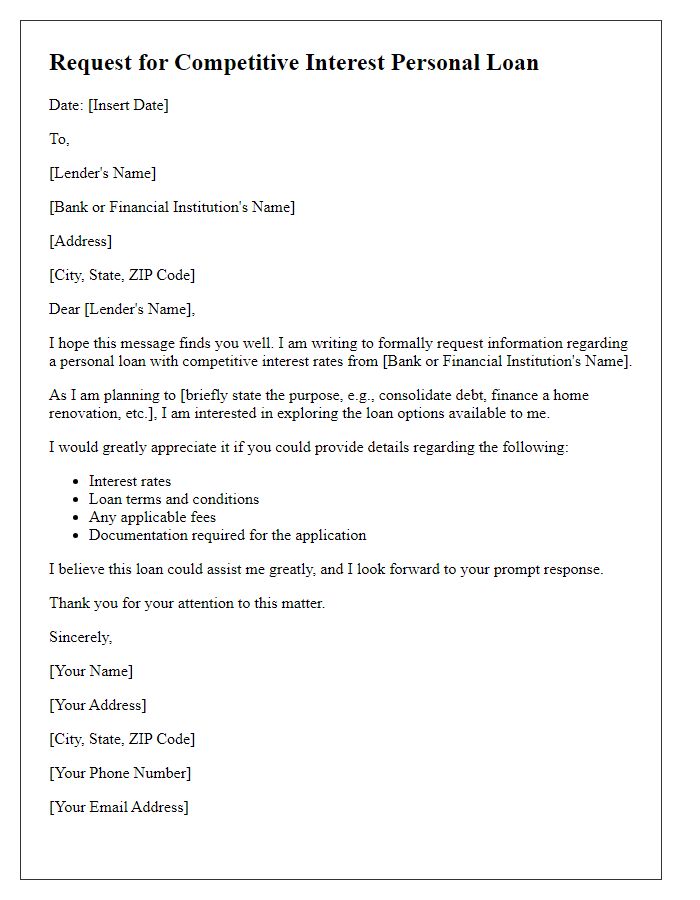

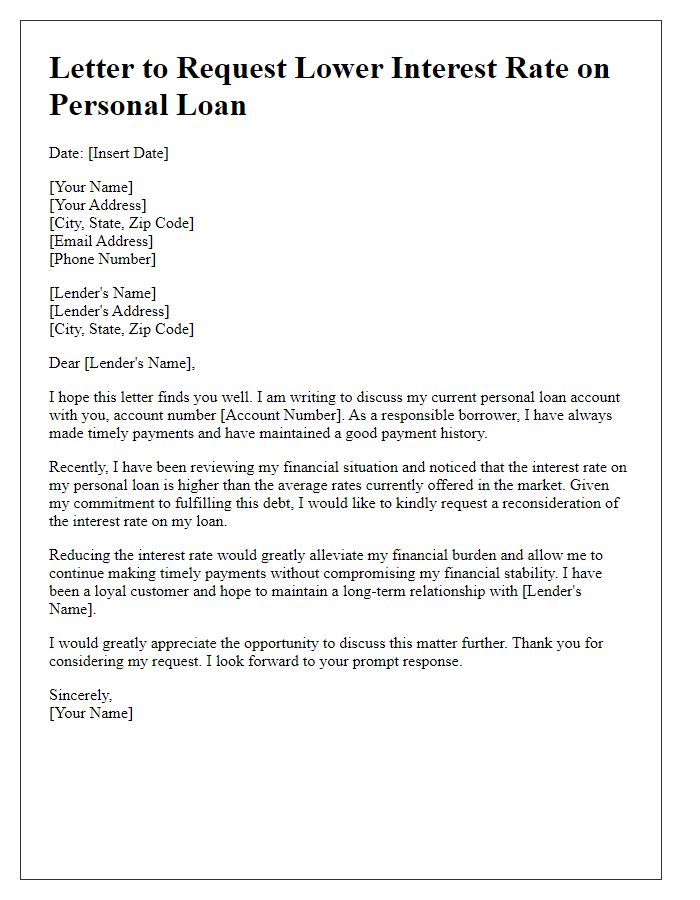

Loan Details

Low interest rate personal loans offer financial relief for individuals seeking to consolidate debt, make significant purchases, or cover unexpected expenses. Various lenders provide competitive rates, usually ranging from 5% to 15% annual percentage rates (APRs), depending on credit scores and loan amounts. Loan terms typically span from 1 to 7 years, influencing monthly payments and total interest paid. Borrowers can access funds ranging from $1,000 to $50,000, ensuring flexibility to meet diverse financial needs. It is vital to evaluate terms, including origination fees and repayment options, to select a suitable loan tailored to individual financial circumstances.

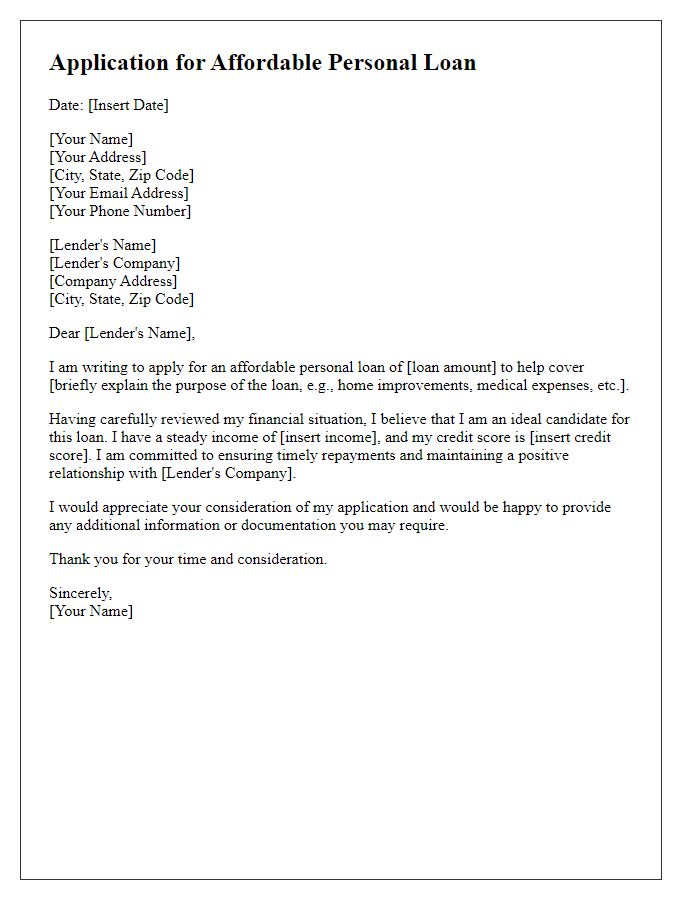

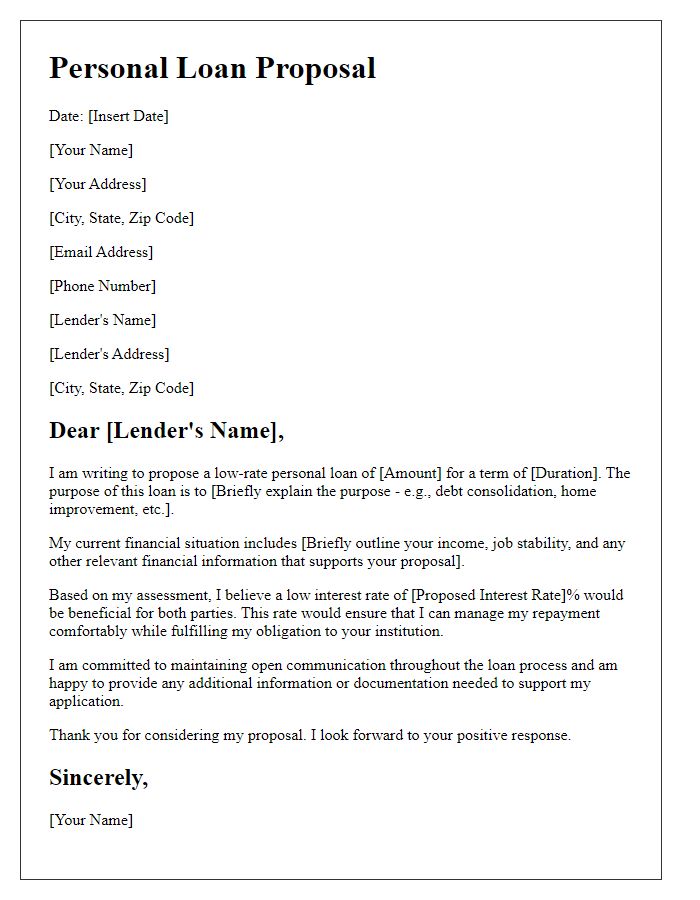

Financial Situation

Individuals seeking low-interest personal loans often scrutinize their financial situations for optimal outcomes. Factors include credit score metrics, loan amounts averaging $10,000, and terms spanning 3 to 5 years. A solid credit score, ideally above 700, can secure interest rates around 5% to 10%, significantly lower than those charged to higher-risk borrowers. Monthly payments are calculated based on the principal amount, interest rate, and loan duration, influencing overall repayment amounts. Additionally, applicants may consider their debt-to-income ratio, which should ideally remain below 36%, to enhance approval chances with lenders, such as banks or credit unions. A comprehensive evaluation of monthly expenses and income stability is essential for sustainable financial commitments.

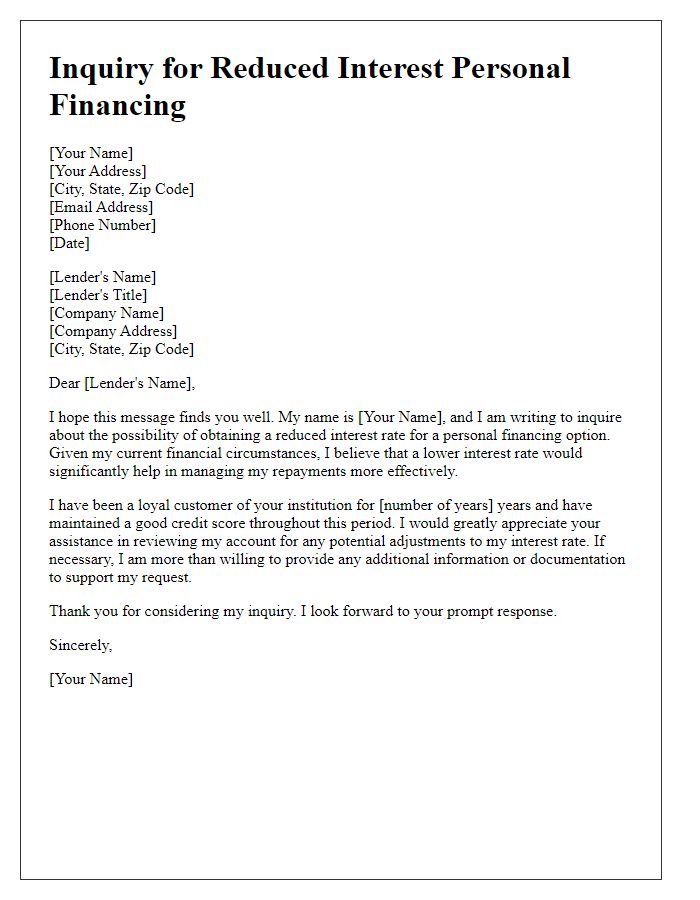

Employment Status

Individuals seeking personal loans often present their employment status to lenders, which can influence loan approval and interest rates significantly. Full-time employment (defined as working at least 35 hours per week) offers increased stability, enhancing creditworthiness. In contrast, part-time jobs may provide fluctuating income, potentially raising concerns for lenders on repayment ability. Self-employment (operating a business or freelance gigs) requires additional documentation, such as tax returns and profit-loss statements, to demonstrate consistent revenue streams. Additionally, employment in high-demand sectors, like technology or healthcare, can positively impact negotiation power for lower interest rates due to perceived job security and income stability. Understanding these nuances in employment status is crucial when applying for favorable loan terms.

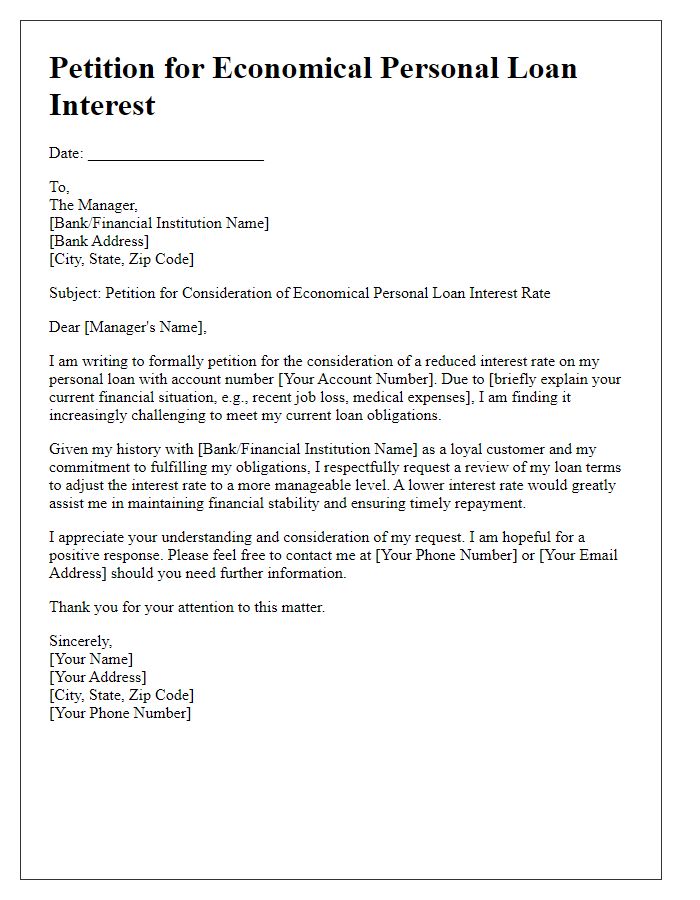

Contact Information

Personal loans, particularly those with low interest rates, can significantly aid in managing financial needs. Numerous financial institutions, such as banks or credit unions, offer competitive interest rates, often ranging between 3% to 10% annually, depending on credit score and loan amounts. For example, a loan of $10,000 at a 5% interest rate over five years results in manageable monthly payments and less financial strain. Prospective borrowers should consider their credit history, loan purpose, and current financial situation when applying. Accessible online resources and calculators can aid in evaluating options for lenders, while carefully reviewing terms and conditions ensures informed decisions and feasible repayment plans.

Comments