Are you considering renewing your short-term loan but unsure about the steps involved? Navigating the world of loans can be tricky, but with the right information, you can streamline the process and make informed decisions. In this article, we'll break down everything you need to know about short-term loan renewals, from understanding the terms to what documents you might need. So, grab a cup of coffee and let's dive into the details!

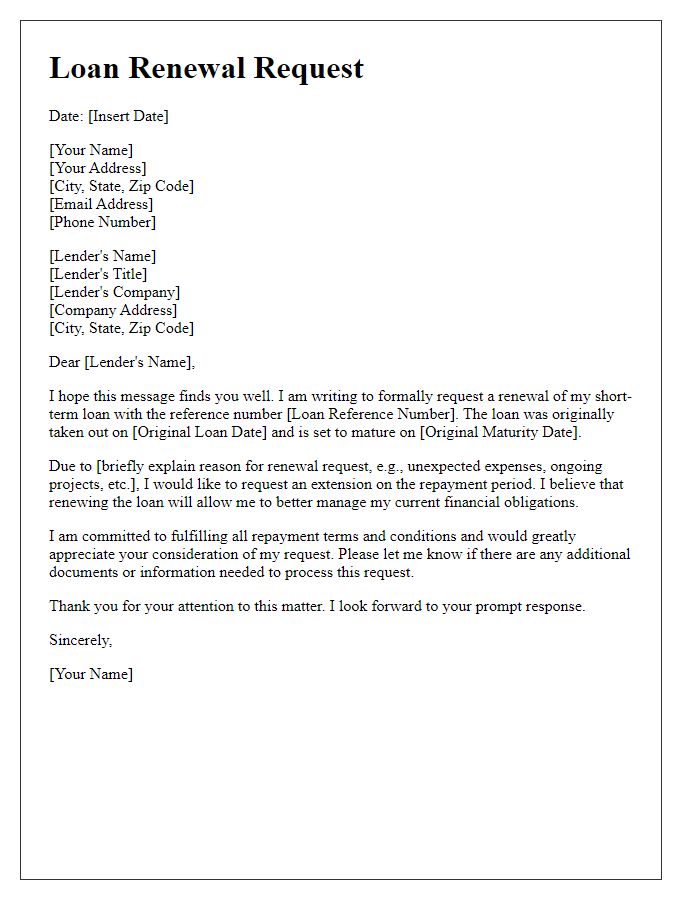

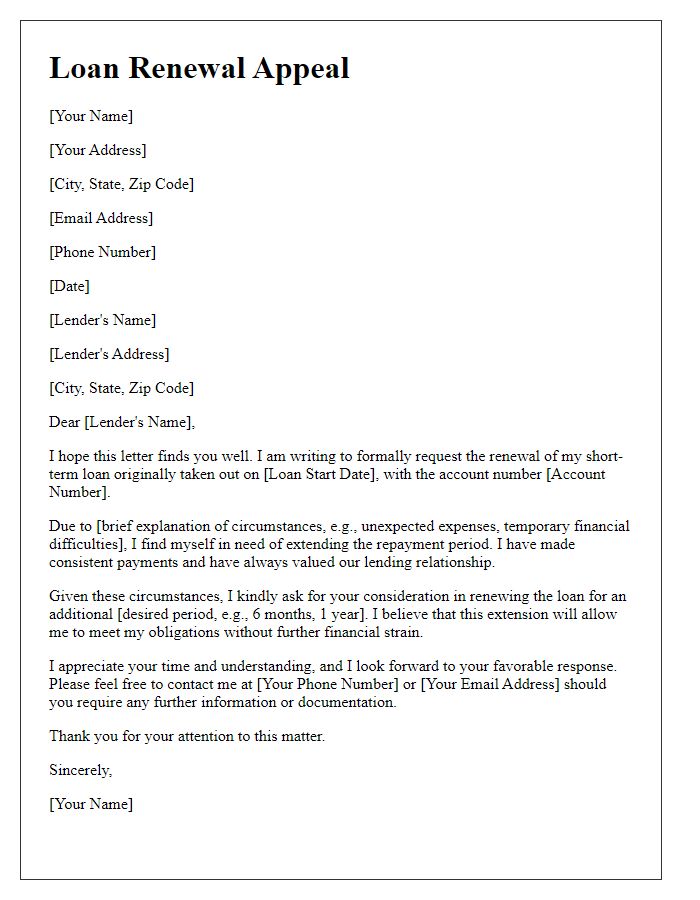

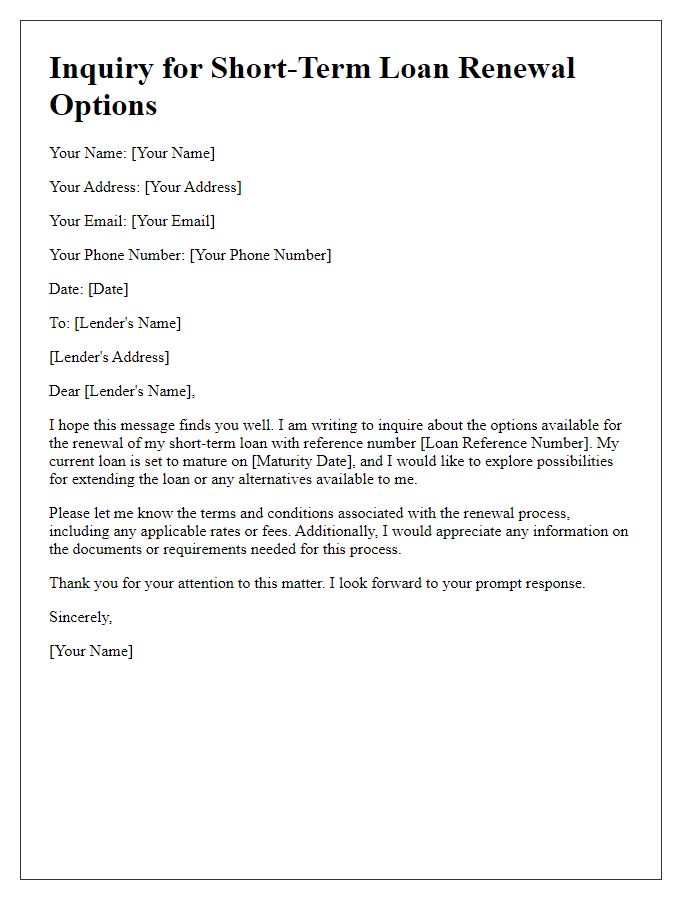

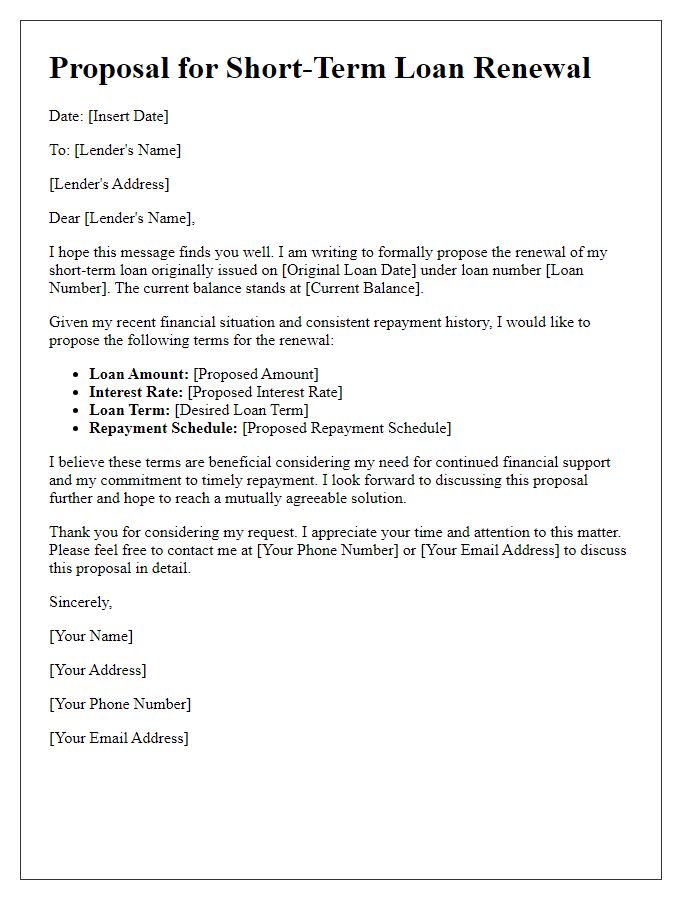

Personal and Contact Information

Renewing a short-term loan requires clear communication regarding personal information and contact details. When drafting a renewal request, include full name, home address (including city, state, and ZIP code), phone number (preferably a mobile number for quick response), and email address (for written correspondence). Additionally, clearly state the loan account number associated with the current loan to ensure accurate processing. You may also want to mention the original loan amount, the date when the loan was initially issued, and any changes in financial status that may be relevant for the renewal process. Clear and concise details can facilitate a smoother renewal procedure.

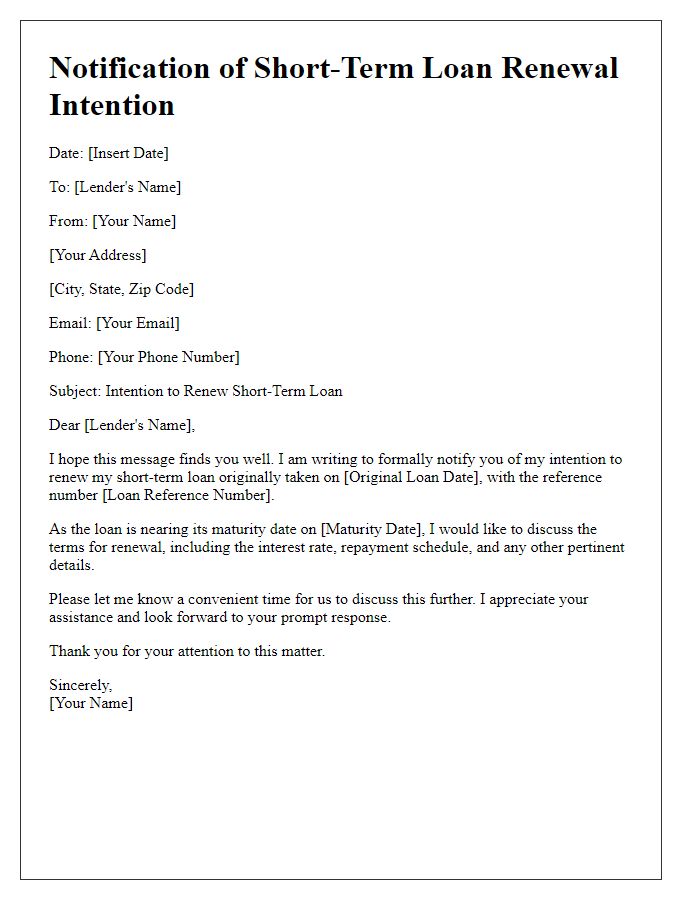

Current Loan Details

A short-term loan renewal requires the assessment of existing loan terms such as interest rates, repayment schedules, and outstanding balances. Specific loan details may include principal amount, original loan term (typically ranging from 30 to 90 days), and lender information, like Main Street Bank. Borrowers often seek renewal for various reasons, including cash flow issues or unexpected expenses. Full financial disclosures should accompany the renewal request, illustrating income statements, creditworthiness, and any changes in financial circumstances that might influence loan approval. An understanding of any applicable fees or penalties tied to renewing the loan is crucial to avoid unanticipated financial strain.

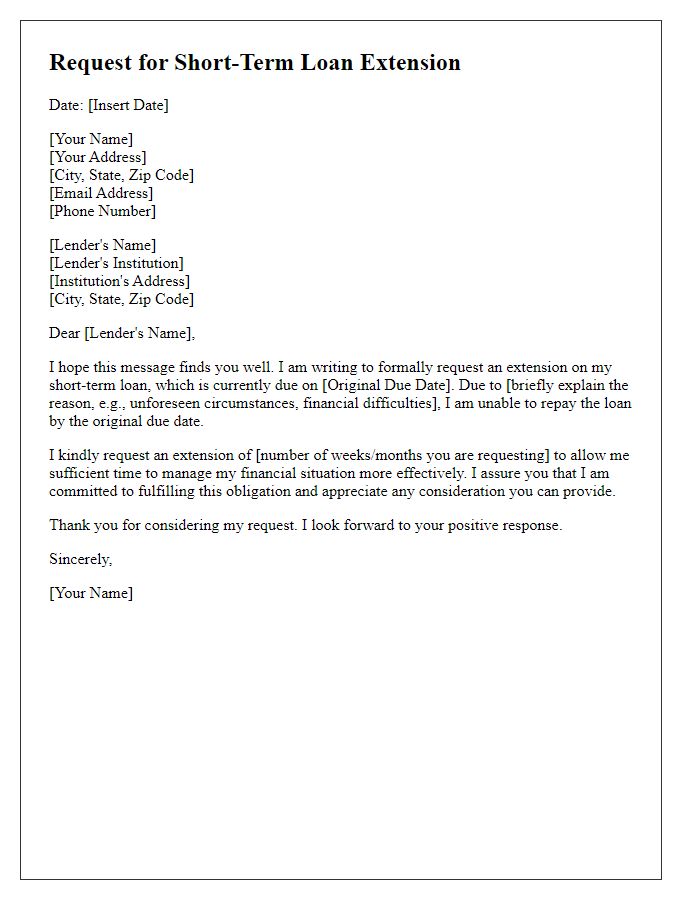

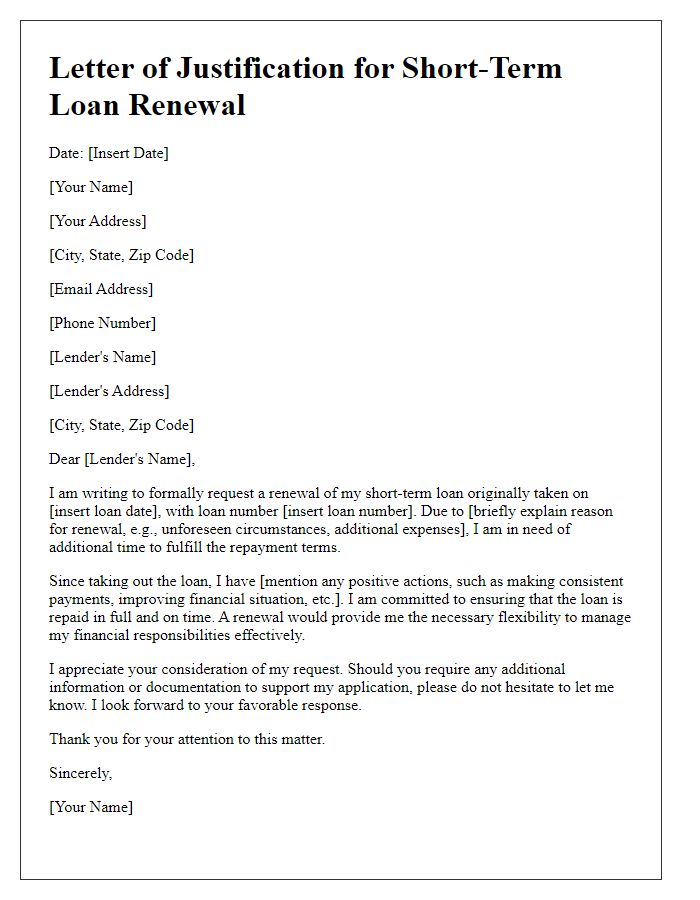

Reason for Renewal Request

Individuals often seek short-term loan renewals due to various financial circumstances. Factors such as unexpected medical expenses, temporary job loss, or urgent home repairs may necessitate extending existing loans. According to recent statistics, about 40% of borrowers opt for renewal as a means to manage cash flow effectively. Timely payments can improve credit scores, which makes borrowers more eligible for favorable terms. Loan agreements, typically ranging from $500 to $5,000, offer essential support during financial hardships. Renewing these loans allows individuals to alleviate immediate financial pressures while strategizing for long-term financial stability.

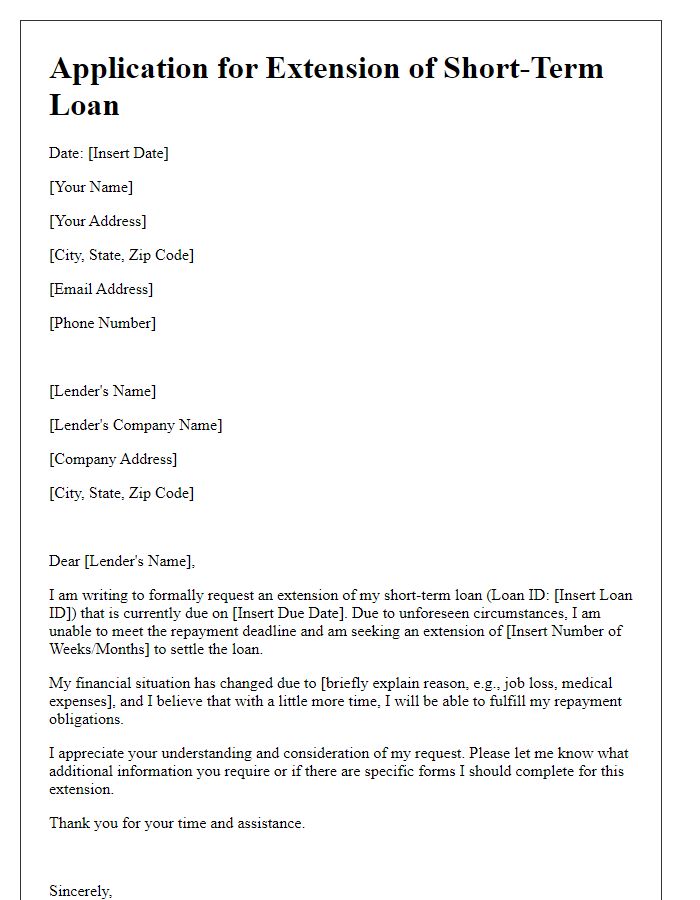

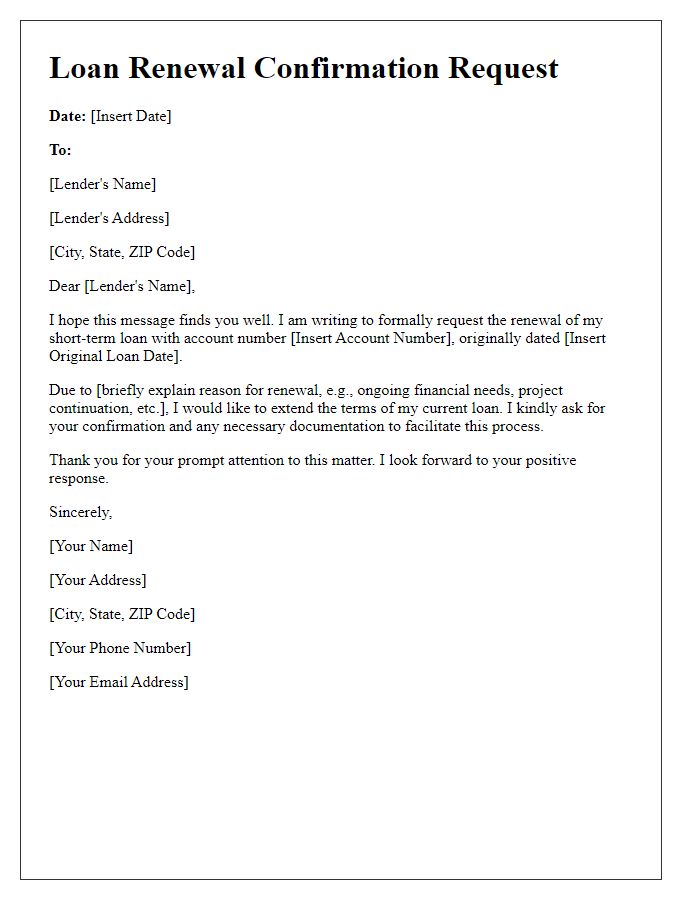

Proposed Repayment Plan

The proposed repayment plan for a short-term loan renewal highlights the structured approach to managing outstanding debt effectively. The loan amount, estimated at $5,000, will be repaid over a period of six months. Monthly payments are calculated to be approximately $850, ensuring timely resolution of principal and interest. Interest rates, typically around 10% APR for personal loans, will be applied monthly. The plan emphasizes consistent income verification, with evidence from recent bank statements or pay stubs, ensuring lender confidence. A prompt payment schedule, starting on the 1st of each month, will enhance creditworthiness and facilitate future financing opportunities.

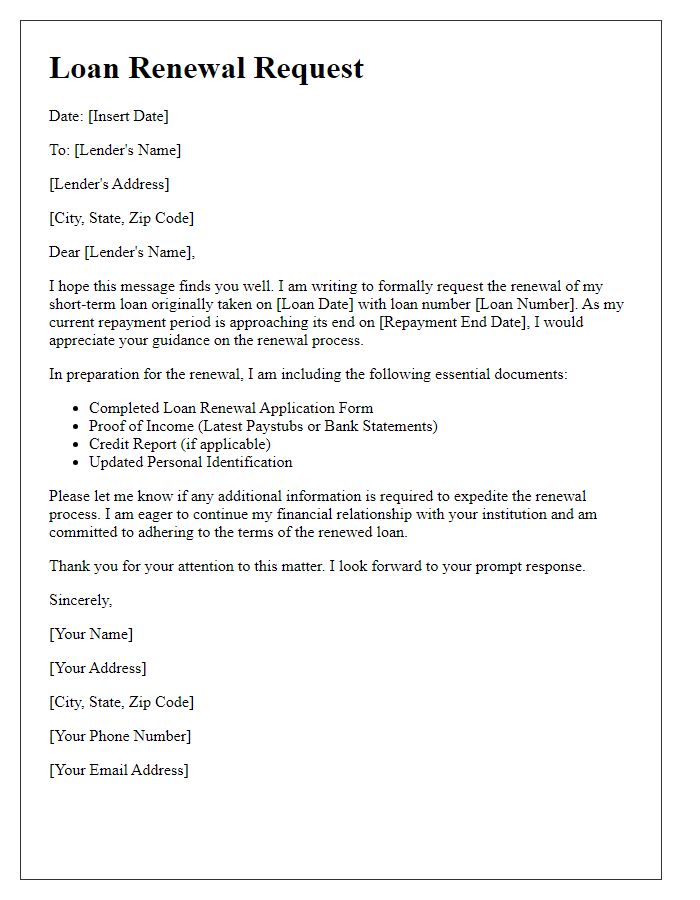

Supporting Financial Documentation

Short-term loan renewals require comprehensive financial documentation to support a successful application process. Key documents include the current bank statements, typically covering the last three months, which provide insight into monthly cash flow and spending habits. Tax returns (for the past two years) serve as proof of income stability, especially for self-employed borrowers. A credit report, detailing credit history and scores, can also highlight repayment patterns and overall creditworthiness. Moreover, personal identification, such as a government-issued ID or social security number, is essential for verification purposes. Finally, the loan application form must be accurately completed, reflecting the borrower's current financial situation and requested loan renewal amount, typically ranging from $500 to $5,000 for short-term loans.

Comments