Have you recently applied for a consumer loan and are feeling a bit anxious about the status of your application? It's completely normal to want clarity during this process, and a follow-up letter can help you get the answers you need. In this article, we'll explore how to craft a professional yet friendly letter that can facilitate communication with your lender. So, let's dive into the details and ensure you feel confident in your follow-up efforts!

Professional tone and clear subject

Insurance premiums can significantly impact household budgets, with the average American spending approximately $1,500 annually on several types of coverage. Homeowners insurance protects properties, while auto insurance safeguards vehicles, with rates influenced by factors such as location and driving history. Health insurance premiums can vary widely based on plan types (HMO, PPO) and deductible levels, further complicating financial planning for families. Additionally, life insurance policies provide financial security for beneficiaries, with term and whole life options catering to diverse needs. An increasing number of consumers are utilizing online comparison tools to assess and select suitable policies, enhancing their understanding of premium costs and coverage options available in their region.

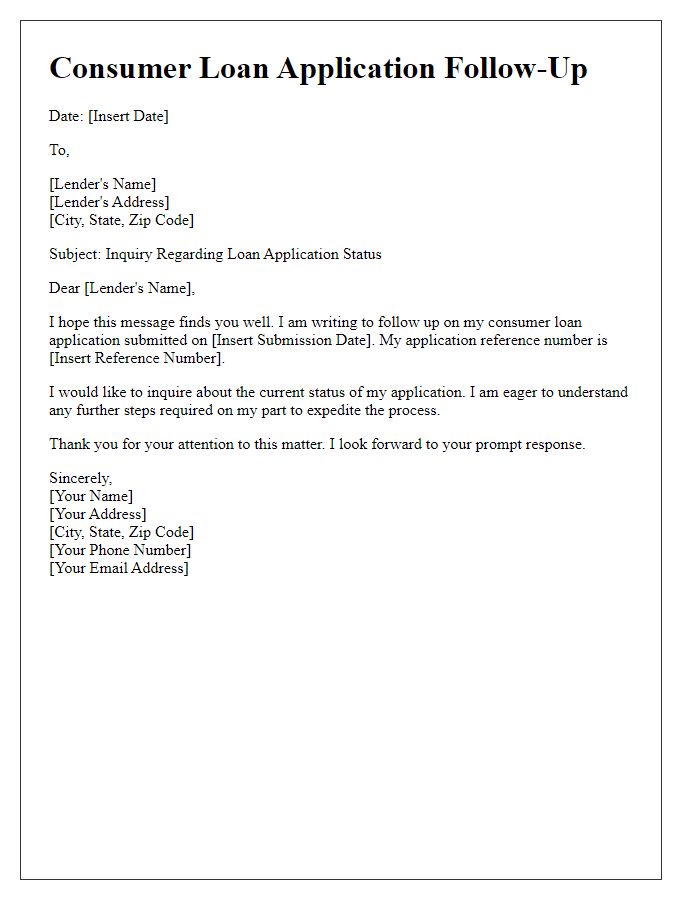

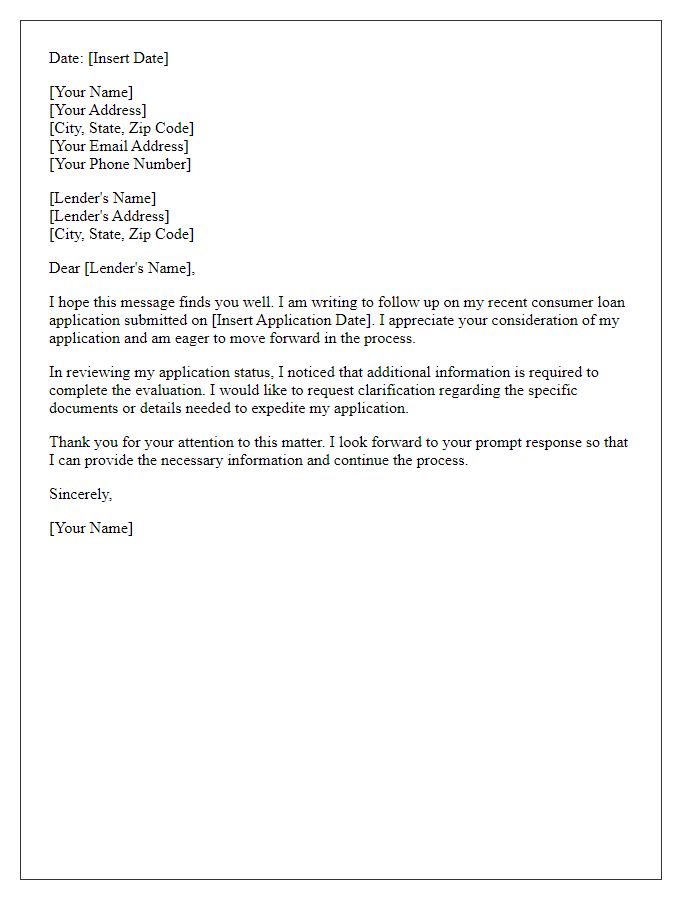

Accurate personal and loan details

Consumer loan applications often require thorough follow-up communications for clarity and progression. Providing accurate information is crucial for both parties. Personal details include full name, address including ZIP code, date of birth, and Social Security Number for identity verification. Loan details require loan amount requested, purpose of the loan (such as home improvement or debt consolidation), desired loan term (typically ranging from 12 to 60 months), and preferred interest rate. Including application reference number helps expedite the follow-up process. Timely updates on application status are essential for resolving any potential issues and ensuring a smooth transaction.

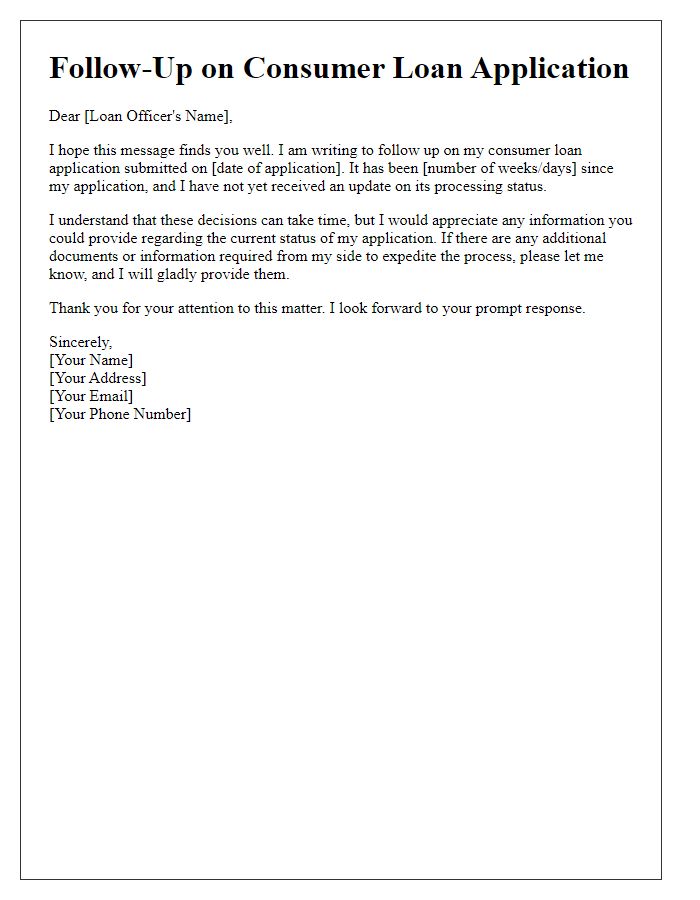

Request for status update

An applicant may seek a status update on their consumer loan application to understand the progress and timeline for a decision. The applicant should mention their application number, typically assigned by the lending institution, which is crucial for tracking the request. It's important to specify the date of application submission, providing context for the request. Additionally, applicants might inquire about any additional documentation needed for processing. Communication should be directed to a specific department, such as customer service or loan processing, highlighting the urgency of the request. Including personal information like the applicant's full name, contact details, and loan type ensures clarity.

Expression of appreciation

A consumer loan application follow-up demonstrates gratitude to lenders for reviewing an application. Proper acknowledgment of their time emphasizes professionalism. Confirmation of submitted documents, including identification and proof of income, reassures the lender about your commitment. Mention of the loan amount requested, interest rates discussed, and intended use for the funds, such as home improvements or debt consolidation, provides clarity. Timely responses to queries reflect effective communication skills, fostering a positive relationship. Concluding with anticipation of their feedback highlights eagerness to proceed further in the loan approval process.

Contact information for further communication

A consumer loan application follow-up requires specific contact information to facilitate communication between the applicant and the lending institution. Essential details include a primary phone number, ideally a mobile number for immediate accessibility, and an email address for formal correspondence. Inclusion of the applicant's full name ensures proper identification of the loan application within the lender's system. Additionally, providing a physical mailing address offers an alternative communication channel, which may be necessary for sending official documents or correspondence. Social media handles can serve as an informal means of communication, especially if the lender has an active presence on platforms like Twitter or Facebook.

Letter Template For Consumer Loan Application Follow-Up Samples

Letter template of consumer loan application follow-up for approval status inquiry.

Letter template of consumer loan application follow-up requesting additional information.

Letter template of consumer loan application follow-up on processing delays.

Letter template of consumer loan application follow-up for pre-approval confirmation.

Letter template of consumer loan application follow-up to update personal details.

Letter template of consumer loan application follow-up for interest rate clarification.

Letter template of consumer loan application follow-up on required documentation.

Letter template of consumer loan application follow-up to express urgency.

Letter template of consumer loan application follow-up for loan terms negotiation.

Comments