Are you considering applying for a trust fund loan but feeling overwhelmed by the details? You're not aloneâmany individuals find themselves navigating the complexities of trust fund loans for the first time. Understanding the terms, conditions, and implications of such financial arrangements is crucial to making informed decisions. Dive into our article for a comprehensive guide that breaks down everything you need to know and helps you navigate your options effectively!

Clear Identification of Parties

A trust fund loan disclosure must clearly identify all involved parties to ensure transparency and accountability. The primary party, the borrower, might be an individual or an entity seeking financial assistance, while the lender is typically the trustee responsible for managing the trust fund, which can be established under state laws like the Uniform Trust Code in a jurisdiction such as California. Also, key contacts within the trust management team, along with their respective roles and contact information, should be listed to facilitate communication. Accurate identification of all parties, including any co-borrowers or guarantors, is crucial for legal and financial documentation purposes, as it establishes the rights, responsibilities, and obligations associated with the loan agreement.

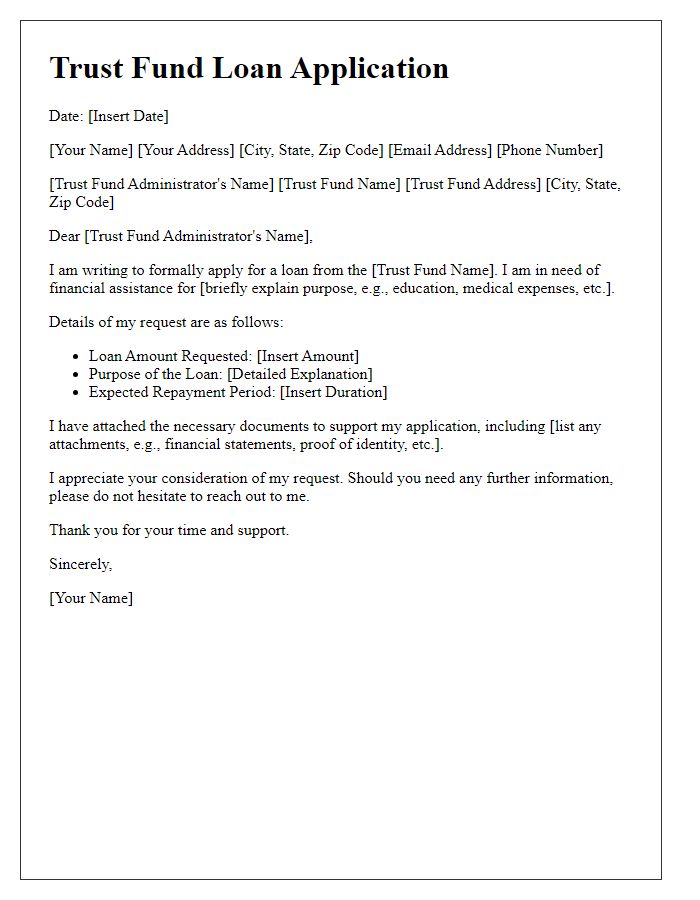

Detailed Loan Terms and Conditions

A trust fund loan disclosure outlines essential details about financial arrangements. Borrowers should carefully review terms such as the loan amount (e.g., $50,000), interest rate (fixed at 5%), repayment period (typically 10 years), and any applicable fees (such as origination fees of 1%). Key conditions also include stipulations for collateral, specifying whether personal assets or trust assets are required. Additionally, borrowers should note the amortization schedule detailing monthly payments (e.g., $530.33), along with consequences of late payments which may include penalties ranging from $50 to $500. It's critical for borrowers to understand the implications of default, such as potential loss of collateral and legal actions. Understanding these terms ensures informed decisions and helps maintain financial stability within the trust fund framework.

Trust Fund Management and Access Rights

A trust fund serves as a financial vehicle for managing assets designated for specific beneficiaries, often governed by legal documentation. Trust fund management involves fiduciary duties, ensuring adherence to the terms set by the grantor (the person who established the trust) regarding distribution and investment of funds. Access rights refer to the ability of beneficiaries to withdraw funds or use trust assets, subject to certain conditions and timelines delineated in trust agreements. For instance, in a revocable living trust, grantors can maintain control over assets while alive, whereas irrevocable trusts restrict access to assets, providing tax benefits but limiting withdrawal rights. Proper communication of these terms is crucial for beneficiaries who may rely on trust funds for education, housing, or healthcare needs, especially during periods of financial uncertainty. Understanding these aspects helps beneficiaries navigate their rights and responsibilities associated with trust fund access and potential loans facilitated through established agreements.

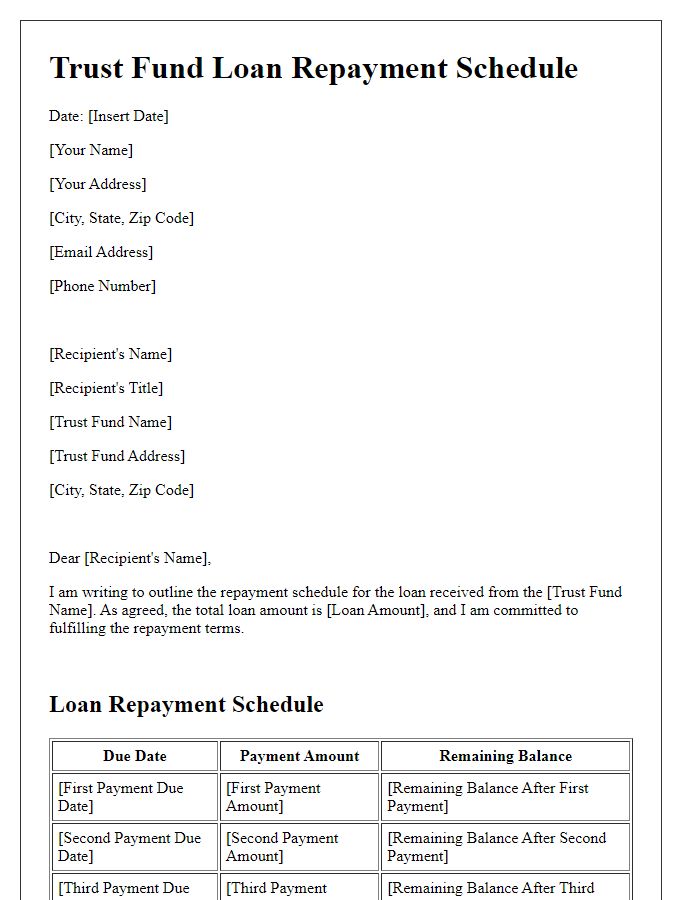

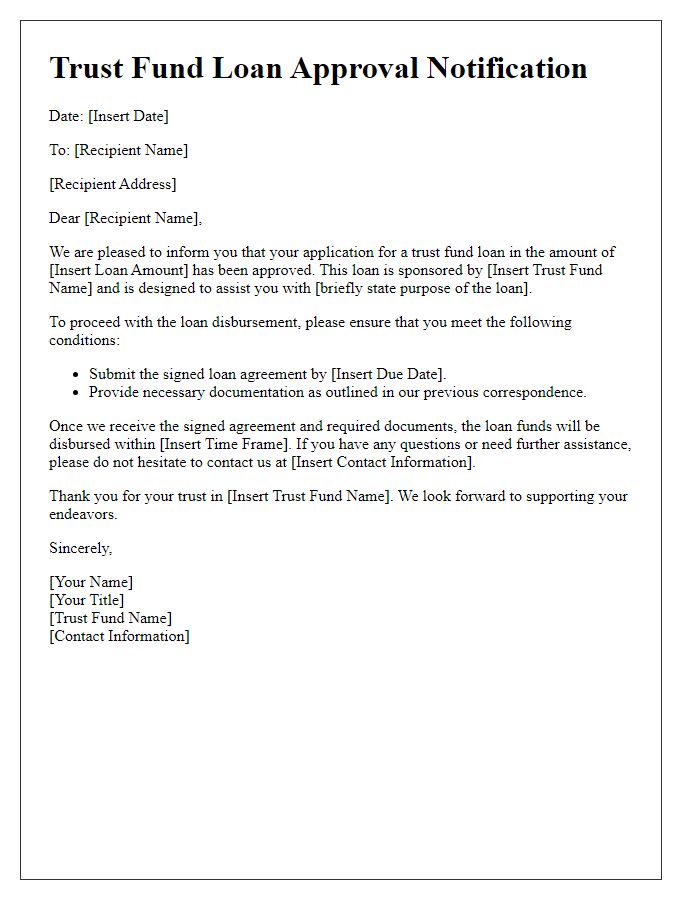

Repayment Schedule and Interest Rates

Trust fund loans, commonly issued by financial institutions or family trusts, have specific repayment schedules and interest rates that vary by lender. Typically, a trust fund loan requires a fixed interest rate ranging from 4% to 10%, depending on the loan amount and creditworthiness of the borrower. Repayment schedules generally span 5 to 20 years, with monthly payments structured to include both principal and interest. Important details include the possibility of balloon payments, where larger sums are due at the end of the term, which can significantly impact borrower planning. Additionally, defaulting on these loans can result in asset liquidation, jeopardizing the trust fund's purpose and the financial security of the beneficiaries. It is crucial for borrowers to thoroughly understand these terms to make informed financial decisions.

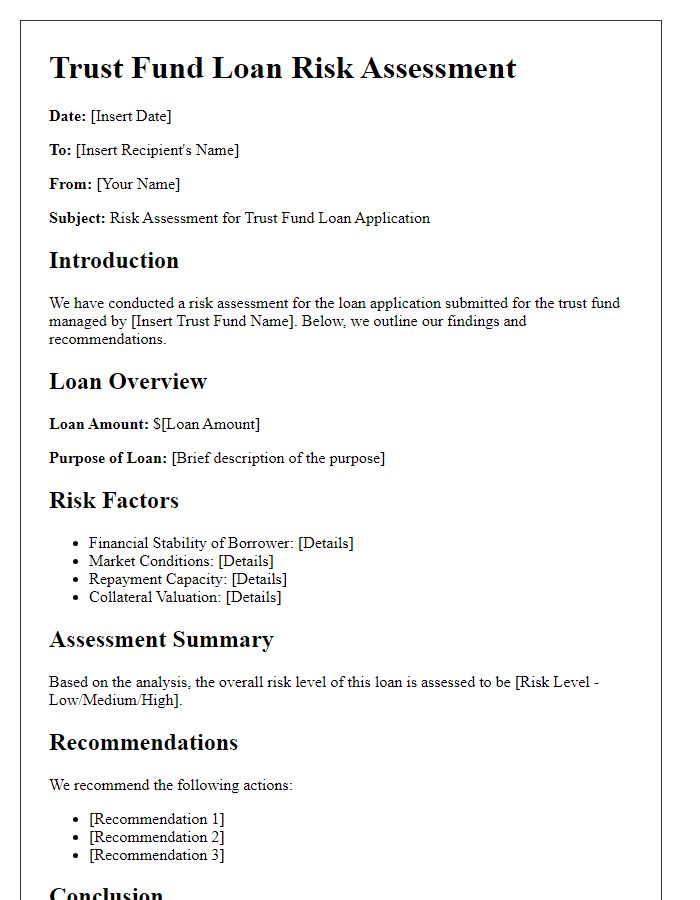

Disclosure of Risks and Obligations

Trust fund loans, such as those provided to beneficiaries of estate trusts, involve specific risks and obligations that require careful consideration. Borrowers must understand interest rates, which can vary significantly based on market conditions, and may lead to higher repayments over time. It's essential to recognize the potential impact on the trust's principal, which may diminish if loans are not repaid promptly. Additionally, legal implications exist if the terms of the trust document restrict borrowing against trust assets. Borrowers should also be aware of the necessity for transparent communication with trustees (individuals or institutions managing the trust), who must ensure compliance with fiduciary duties. Lastly, understanding the tax implications associated with trust fund loans, including potential income tax liabilities, is critical for effective financial planning.

Comments