Are you feeling overwhelmed by your current loan payments? You're not aloneâmany people find themselves in situations where adjusting their loan terms can provide much-needed relief. In this article, we'll explore how to effectively craft a letter requesting a loan rescheduling, ensuring that your needs are clearly communicated to your lender. So, if you're ready to take the first step towards financial flexibility, keep reading for some invaluable tips!

Applicant's Personal and Financial Details

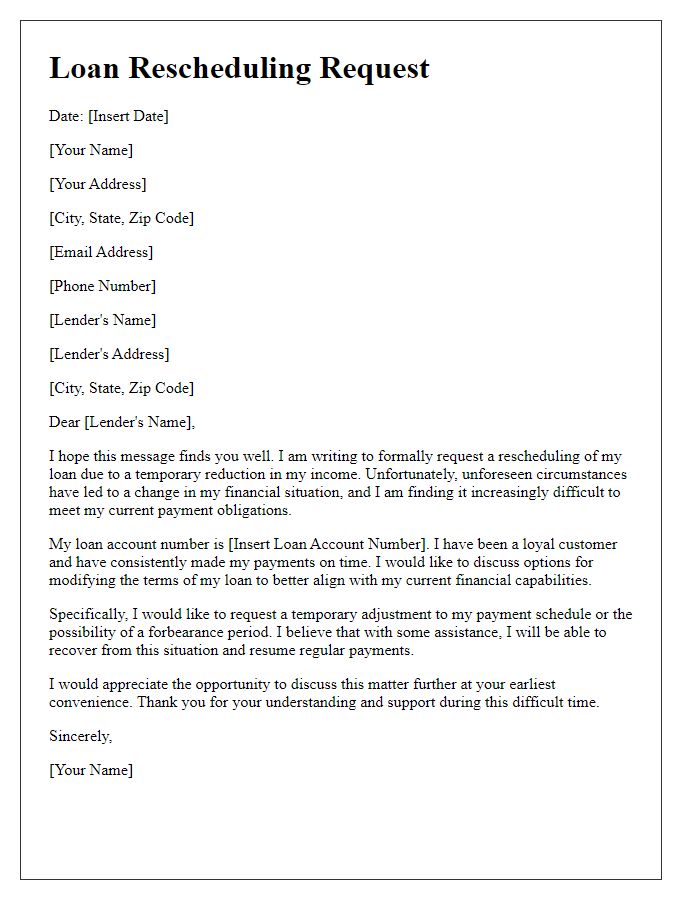

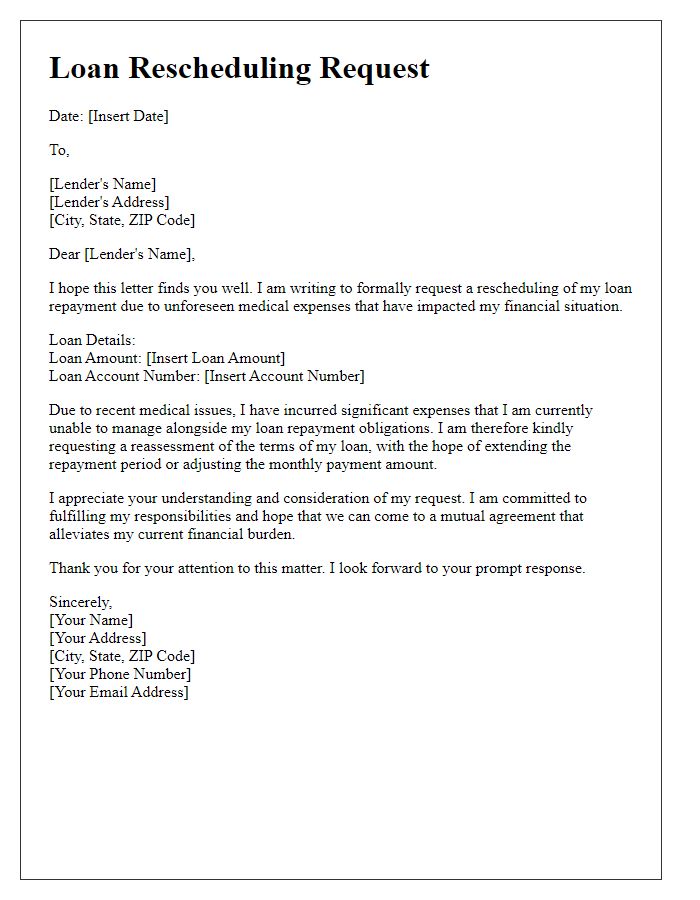

In cases of financial strain, loan rescheduling becomes an essential option for many borrowers. Personal details such as the applicant's name, address, and contact information provide identity verification, crucial for addressing sensitive financial matters. Financial details include outstanding loan amounts, monthly payment obligations, and income sources, helping lenders assess the probability of repayment. Additional context such as recent job loss statistics or economic downturn events significantly impacts the lending environment, making rescheduling requests more relevant. Documentation such as payslips or bank statements often accompanies these requests to substantiate the applicant's current financial status, ensuring a thorough evaluation of the situation by the lender.

Reason for Rescheduling Request

Financial circumstances can change unexpectedly, necessitating a loan rescheduling request. Borrowers may face challenges such as job loss (unemployment rates reaching 8% in some areas), medical emergencies (average hospital costs exceeding $15,000 for non-insured individuals), or other unforeseen expenses (like major car repairs costing over $1,000). Rescheduling loans provides borrowers with the opportunity to restructure payment plans, often leading to reduced monthly obligations and extended repayment terms. Entities such as banks or credit unions (with assets totaling over $20 trillion in the U.S.) typically consider these requests to assist clients in maintaining their financial commitments while minimizing defaults. A well-structured request can lead to more manageable payments and help preserve the borrower's credit score (which can drop significantly due to missed payments).

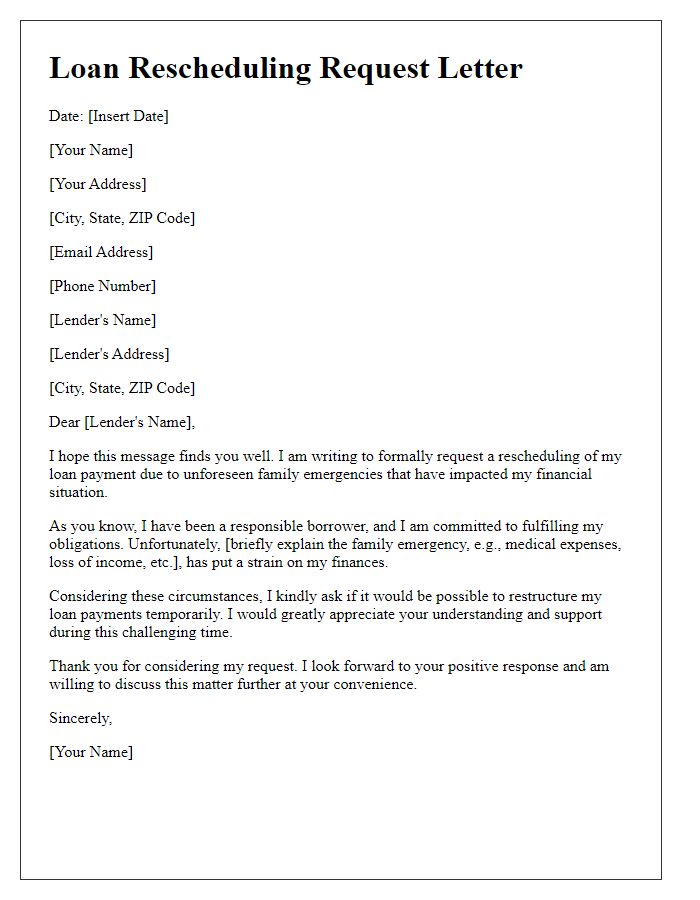

Proposed New Repayment Plan

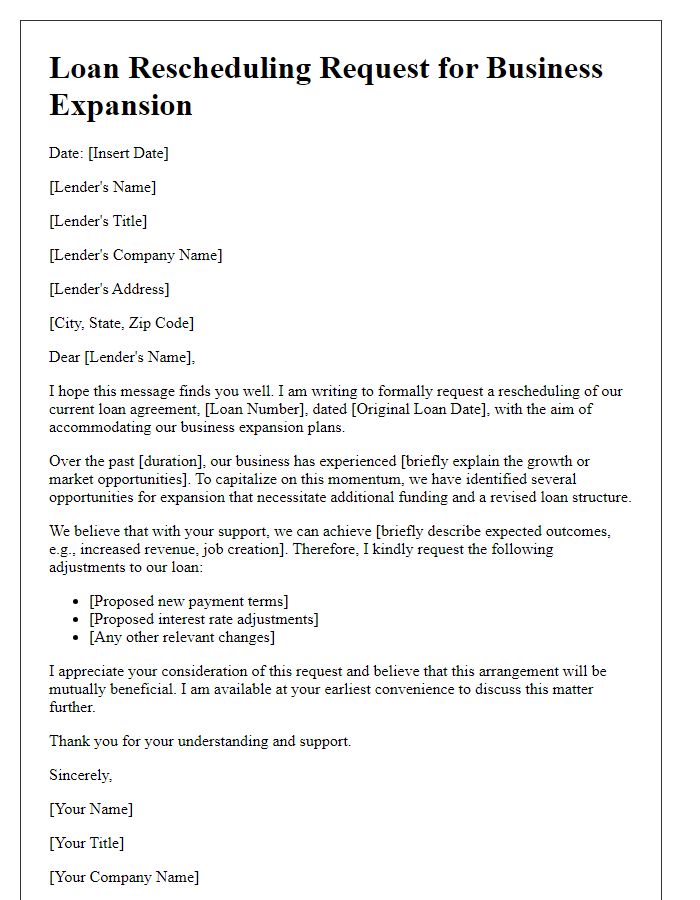

A loan rescheduling request can be initiated when borrowers face financial difficulties and seek to alter their repayment terms. This process often involves detail-oriented communication with financial institutions. Borrowers must outline their current financial situation, specifying challenges such as job loss or increased expenses. A proposed new repayment plan should include specifics like reduced monthly payments, adjusted interest rates, or extended loan terms. Essential metrics such as proposed payment amounts, new loan duration, and total estimated interest over the life of the loan should be clearly outlined to facilitate understanding. Providing clear documentation of current income and expenses adds credibility. This will assist in negotiations with lenders for more favorable terms.

Demonstration of Financial Stability

A loan rescheduling request can significantly assist individuals in navigating financial challenges, particularly during difficult times. Financial stability is assessed through factors such as consistent income (documented via pay stubs from the last three months), a solid credit score (typically above 650 for favorable terms), and a stable employment history (minimum of two years at the current employer), which collectively provide lenders with confidence in the borrower's repayment capability. Further confirmation may be derived from monthly expenses (outlined in a budget sheet), illustrating a prudent approach to managing finances. Additionally, understanding the terms and conditions of the original loan agreement (including interest rates and repayment schedules) is crucial for proposing realistic adjustments. By highlighting these elements, borrowers can effectively demonstrate their commitment to fulfilling financial obligations while seeking relief through loan rescheduling.

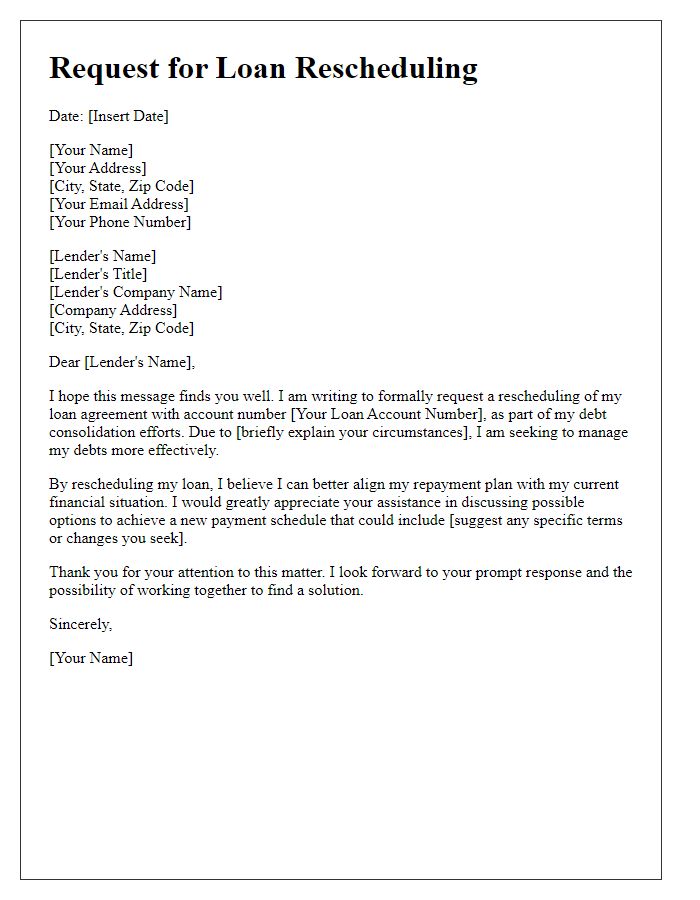

Request for Written Confirmation

Loan rescheduling requests often arise from financial difficulties impacting borrowers' repayment capabilities. When crafting such requests, specific details are pivotal. Lenders usually require account numbers, loan types (like personal or mortgage loans), and the original loan agreement date for accurate processing. Relevant financial status indicators, such as monthly income, existing debts, and changes in employment status, should be highlighted to clarify the necessity for adjusting repayment terms. Additionally, including proposed new repayment schedules, indicating desired loan amounts and revised timelines, demonstrates proactive engagement and responsibility. Such clear communication fosters understanding and enhances the likelihood of receiving a favorable response from the lending institution.

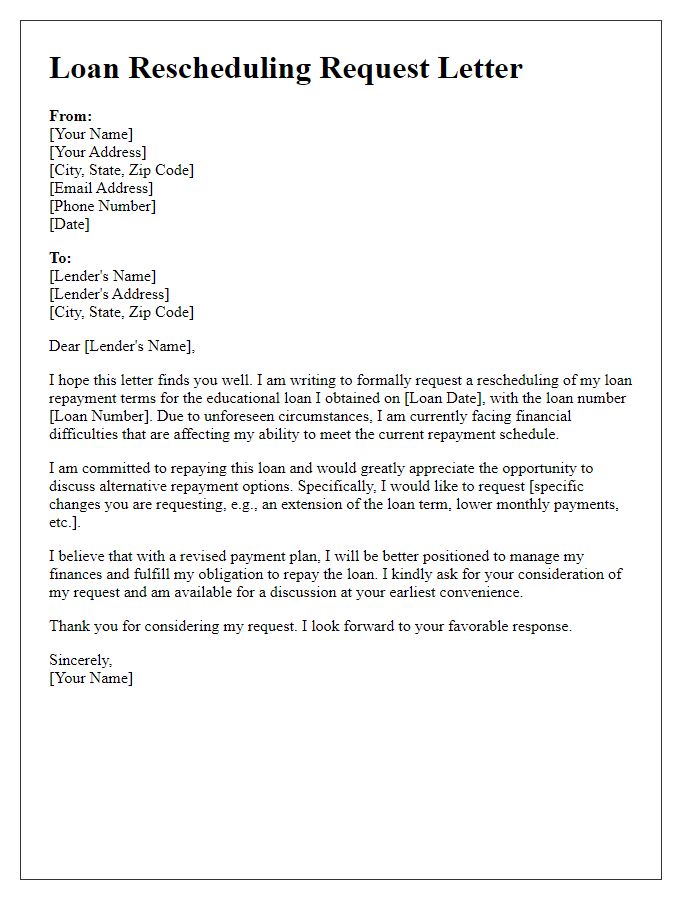

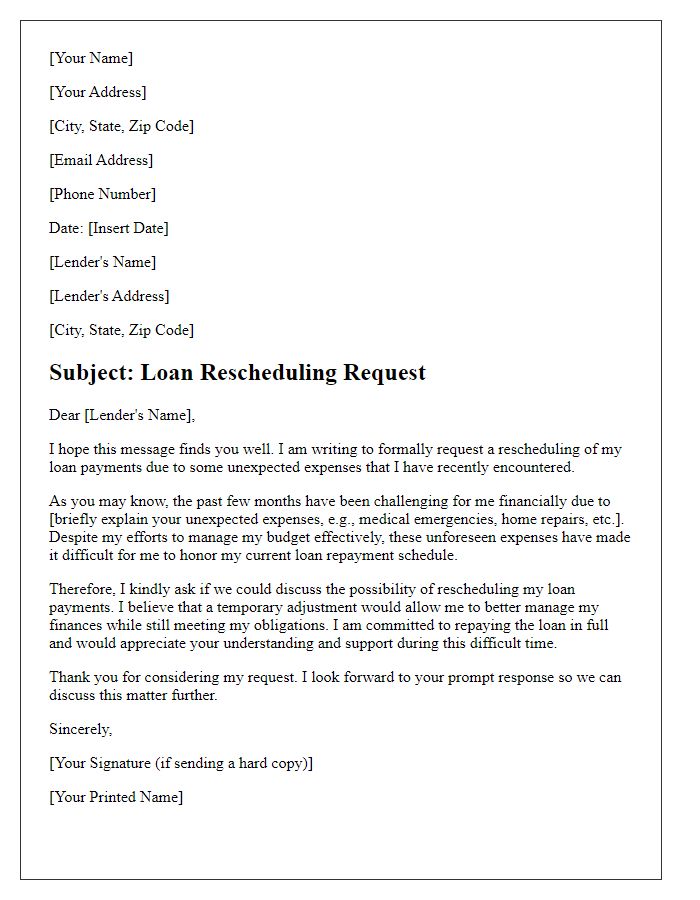

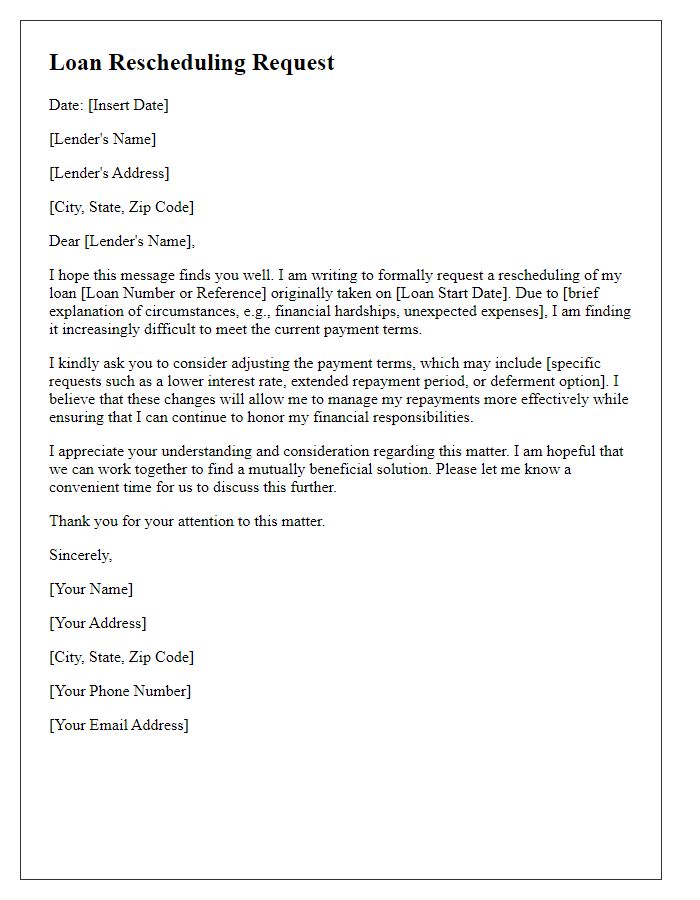

Letter Template For Loan Rescheduling Request Samples

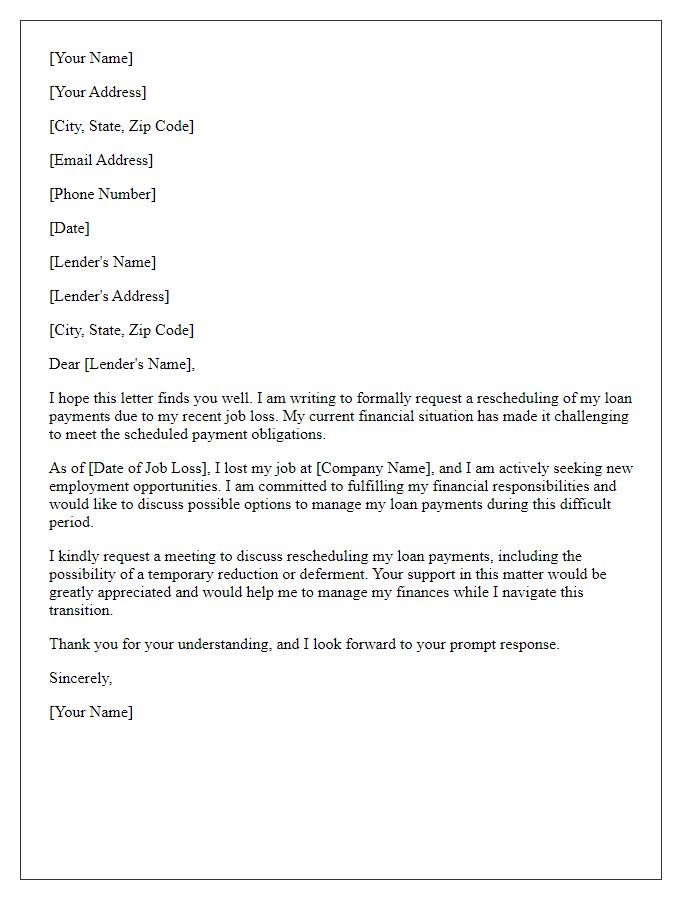

Letter template of loan rescheduling request for temporary income reduction

Comments