Are you feeling a bit overwhelmed trying to keep track of your loan account balance? We've all been there, trying to manage finances while juggling unexpected expenses. Crafting a concise and polite inquiry letter can make all the difference when it comes to getting the information you need. Stay tuned as we explore an effective letter template that will help streamline your balance inquiry process!

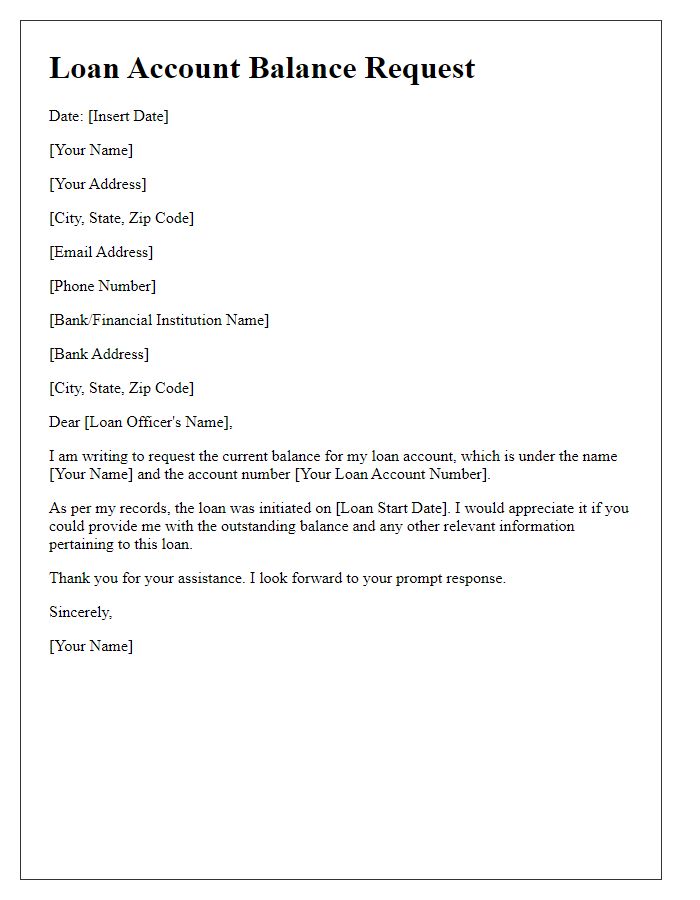

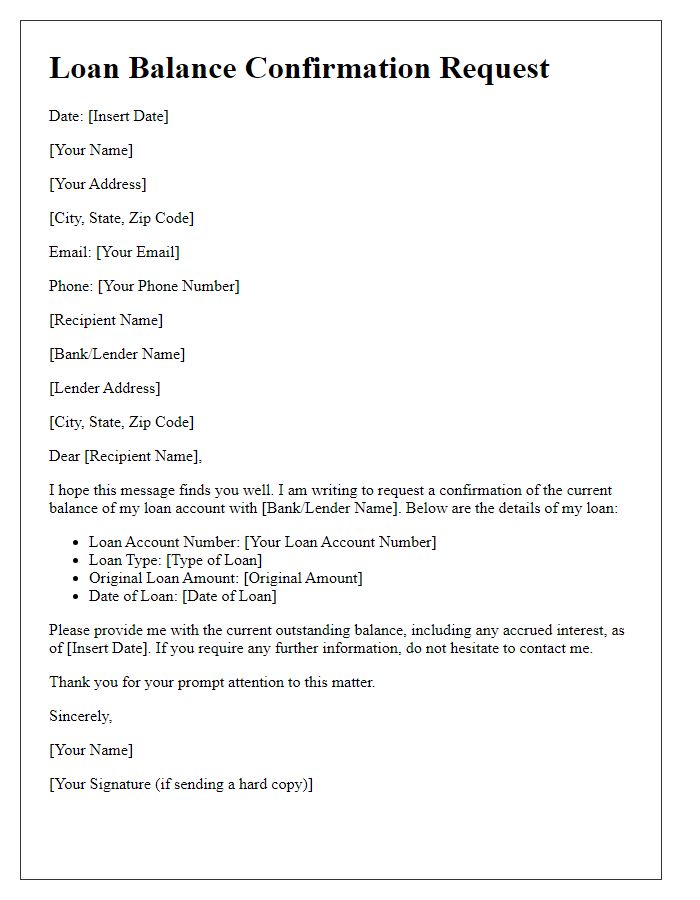

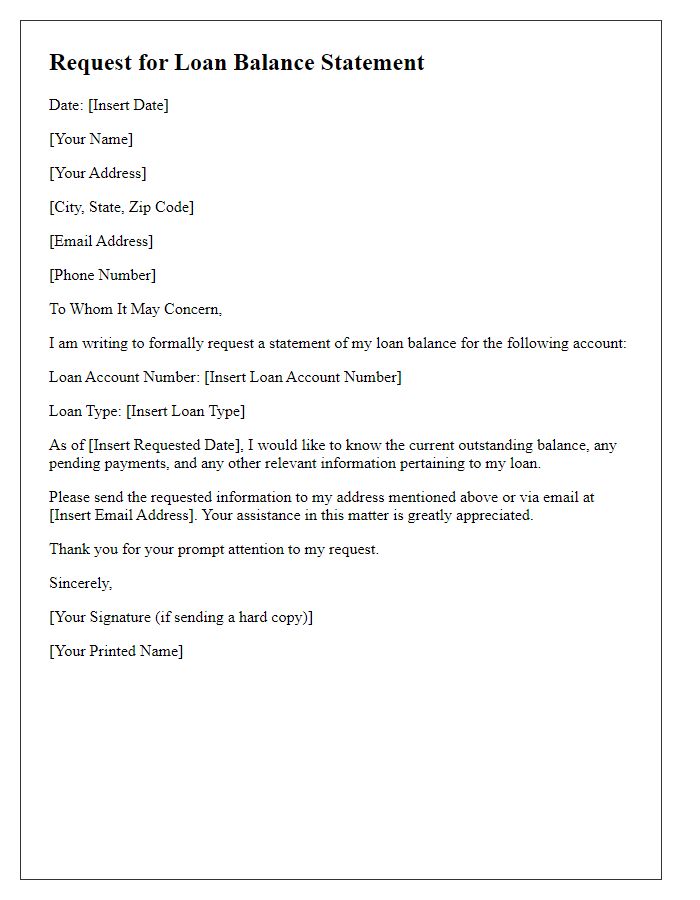

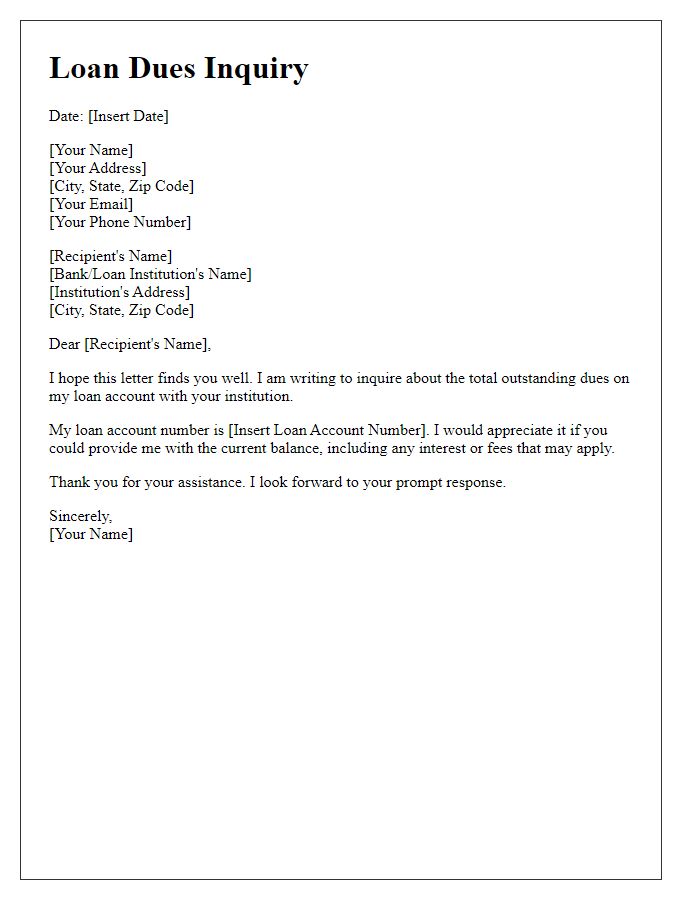

Personal Identification Information

Individuals seeking information regarding their loan account balance must include personal identification details for verification. Key elements include full name, account number, and Social Security Number (SSN). Providing the loan identification number associated with the specific loan, such as a mortgage or an auto loan, enhances the clarity of the inquiry. It is essential to specify the type of loan, as institutions may manage various loan products. Including contact information such as a phone number or email address facilitates a prompt response from the lending institution regarding the account balance. Additionally, mentioning the date of the inquiry helps track the request in case follow-up is necessary.

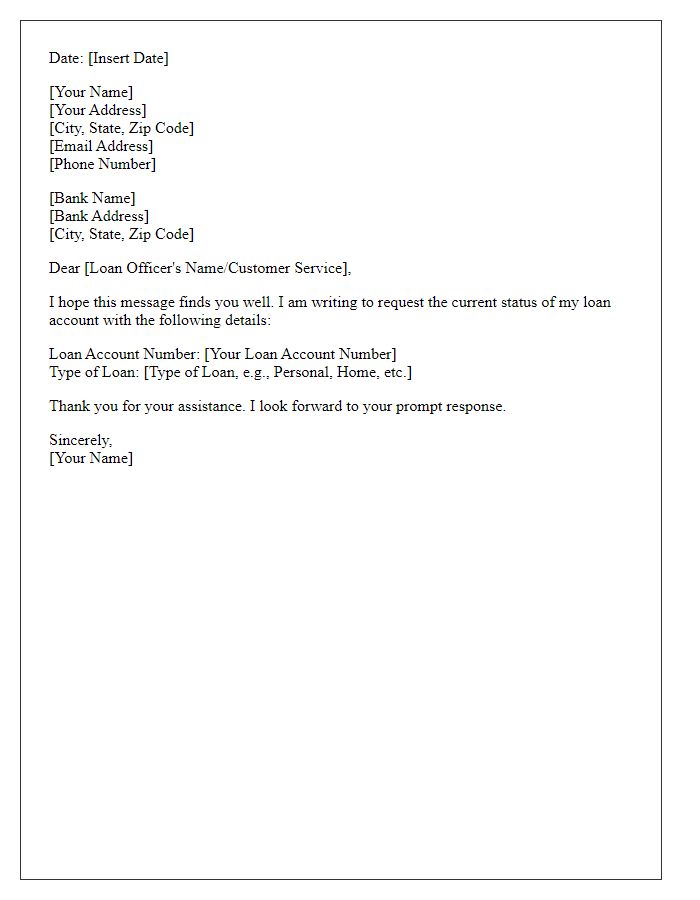

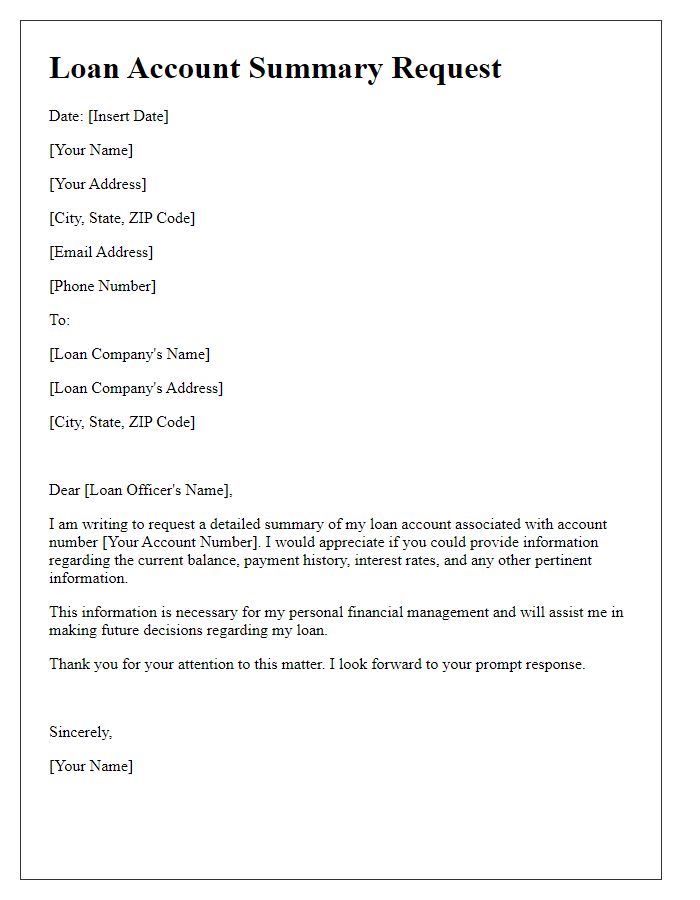

Loan Account Details

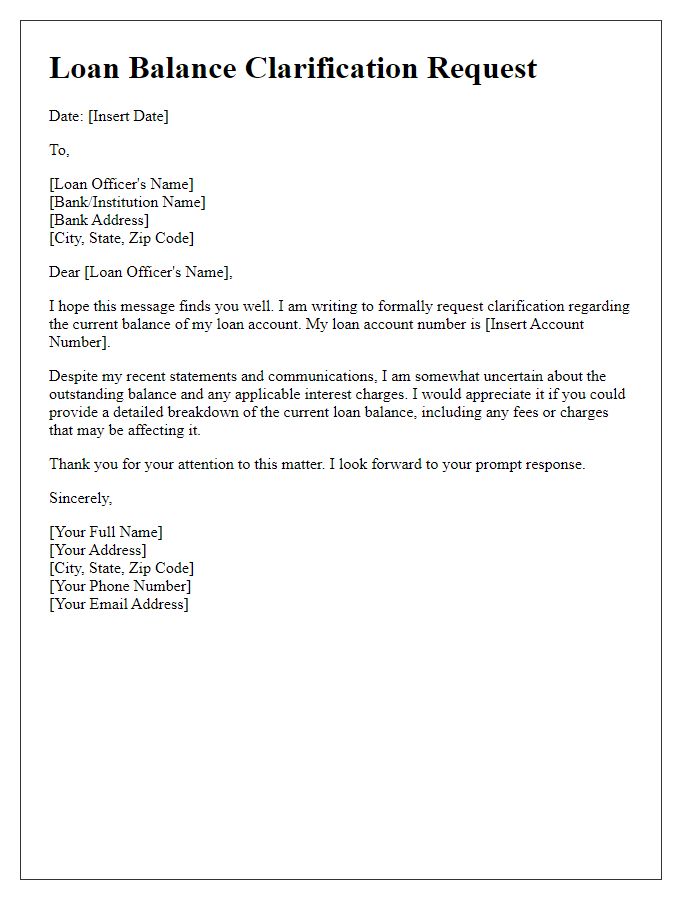

Inquiries regarding loan account balances are essential for financial management. For instance, a loan account balance request typically includes details such as the loan account number, which uniquely identifies a borrower's loan among many at financial institutions like banks or credit unions. The outstanding balance indicates the remaining amount owed on the principal, often influenced by interest rates--fixed or variable--which can fluctuate over time based on monetary policy changes. Additionally, repayment terms, such as monthly payment amounts and duration, play a crucial role in determining the total cost of borrowing. Providing specifics regarding any recent transactions or payment history can also enhance the clarity of the inquiry, ensuring accurate and timely information is received.

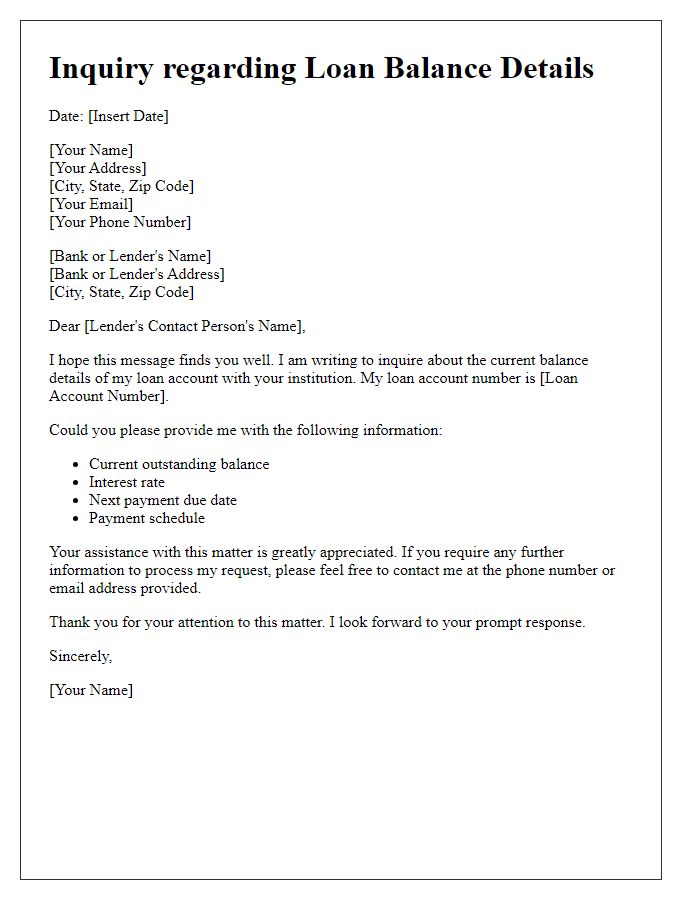

Inquiry Purpose and Request Statement

Loan account balance inquiries are essential for managing personal finances effectively. Understanding the current balance on loans, such as student loans or mortgage loans, helps individuals budget and plan payments accurately. For example, the remaining amount on a home mortgage can impact decisions on refinancing or selling property. Individuals can typically request this information from financial institutions via formal communication, specifying the loan account number, the requesting party's details, and the desired information. Regular inquiries can provide insights into interest accumulation over time and highlight any potential discrepancies in the account, ensuring transparency and accuracy in financial dealings.

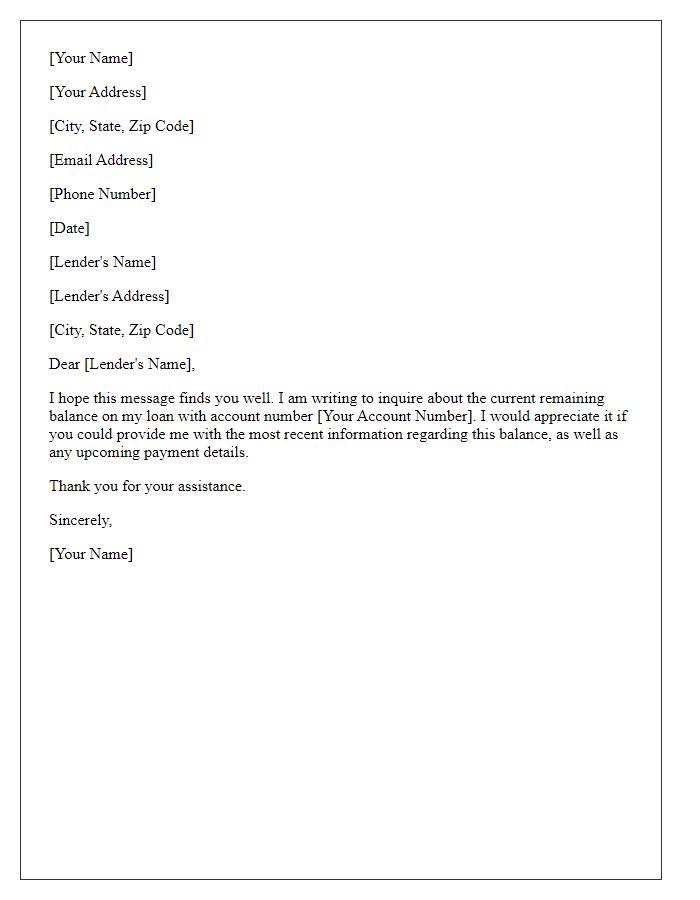

Contact Information

Loan account balance inquiries help borrowers understand their financial obligations regarding specific loans. The loan account, often managed by institutions such as banks or credit unions, contains crucial information including the outstanding balance, interest rates, and payment due dates. Inquiries can be conducted through various contact methods provided by the lender, including phone numbers and email addresses that facilitate direct communication. Recognizing events such as payment deadlines or interest recalculations, borrowers often seek timely updates to manage their budgets effectively. Accurate and current contact information ensures prompt resolution and clarity in financial dealings.

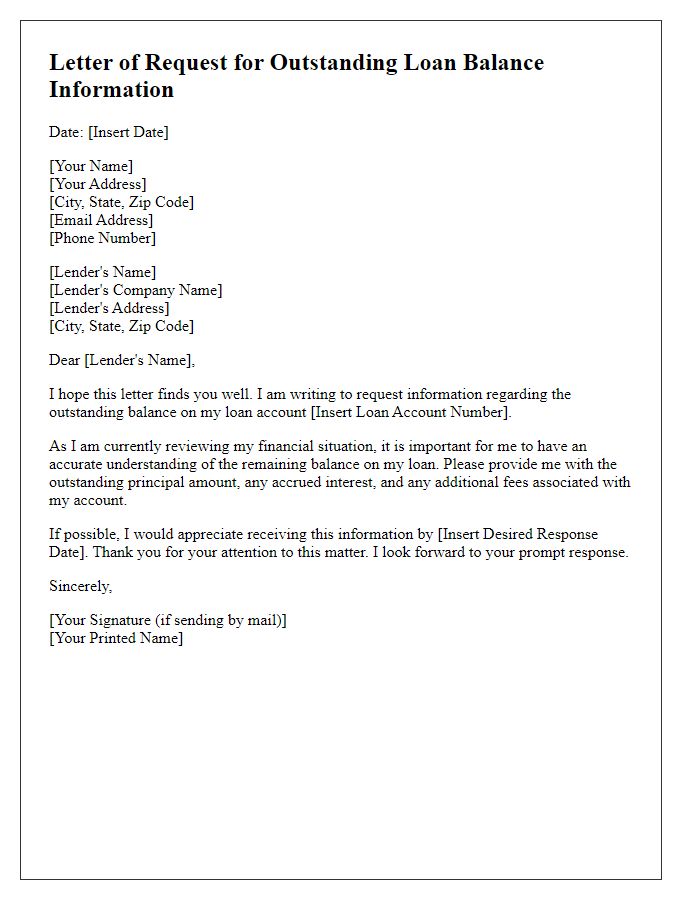

Expression of Appreciation and Professional Tone

A loan account balance inquiry can provide crucial information regarding outstanding amounts and payment schedules. Understanding the exact loan balance, including principal, interest, and any applicable fees, is essential for effective financial planning. Timely inquiries can prevent unnecessary late fees and help in budgeting future payments. Keeping updated records from financial institutions, such as banks or credit unions, aids in maintaining personal financial health. Utilizing online banking platforms allows for immediate access to loan balances, while official requests can ensure detailed statements are received efficiently.

Comments