Are you considering taking out your first loan? It can be both an exciting and daunting journey, filled with questions and uncertainties. Understanding the process and knowing what to expect can make all the difference, and that's exactly why we're here to help you navigate through your first-time borrowing experience. Keep reading to discover essential tips and insights that will empower you on your financial journey!

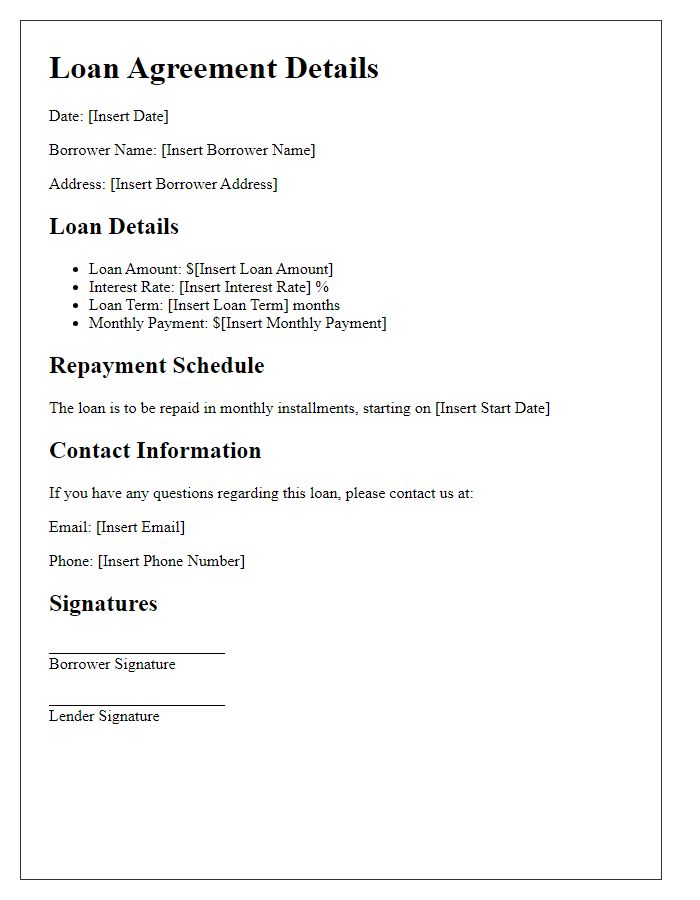

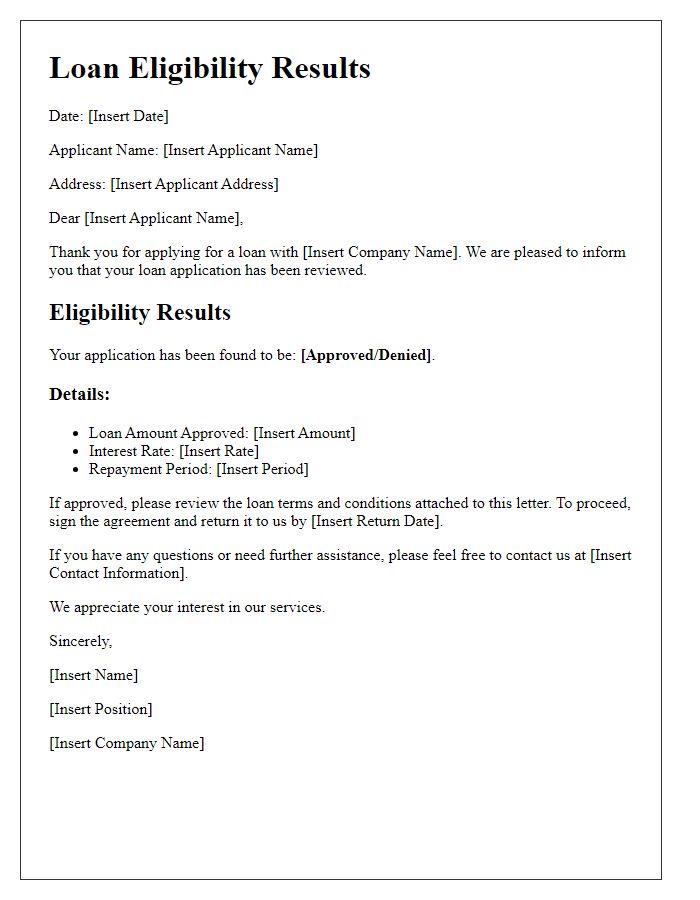

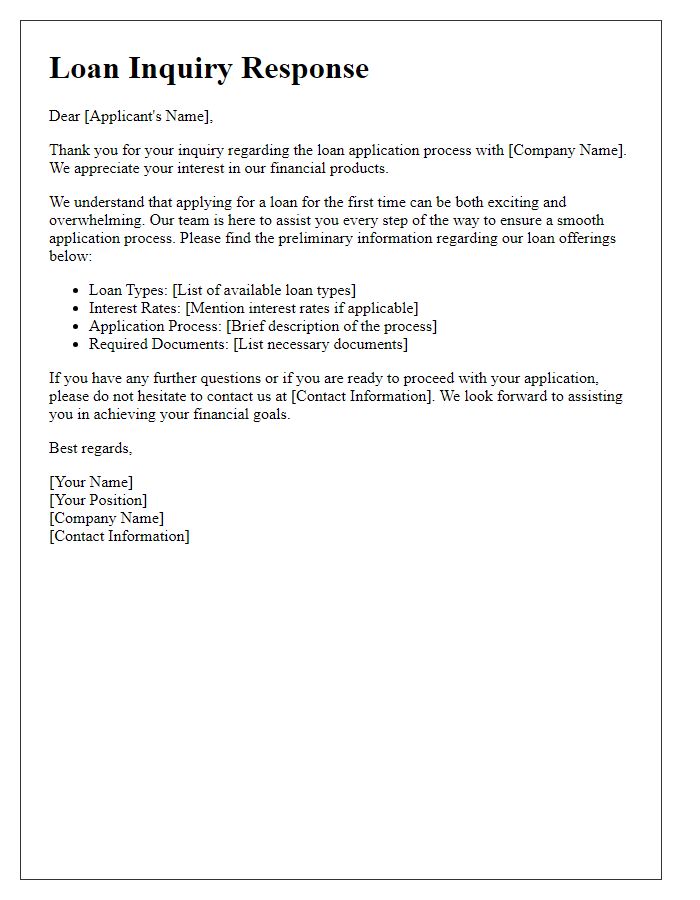

Personalization and Borrower Information

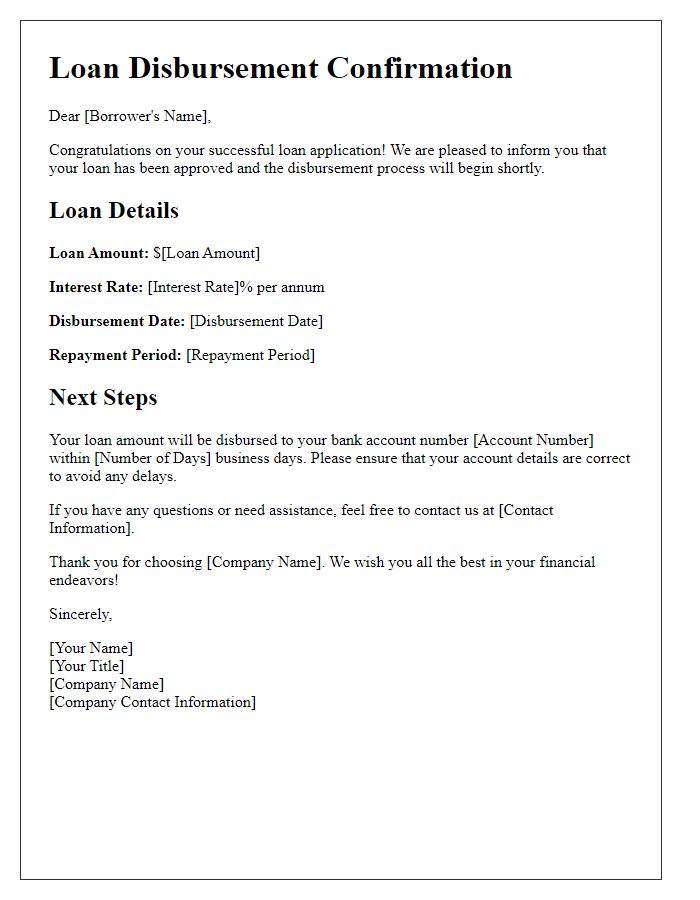

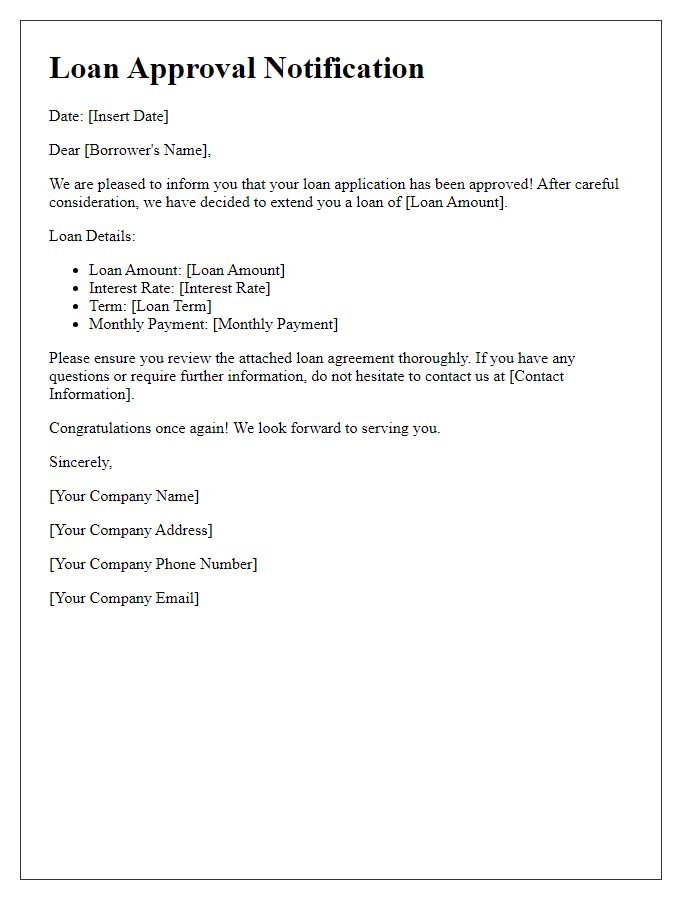

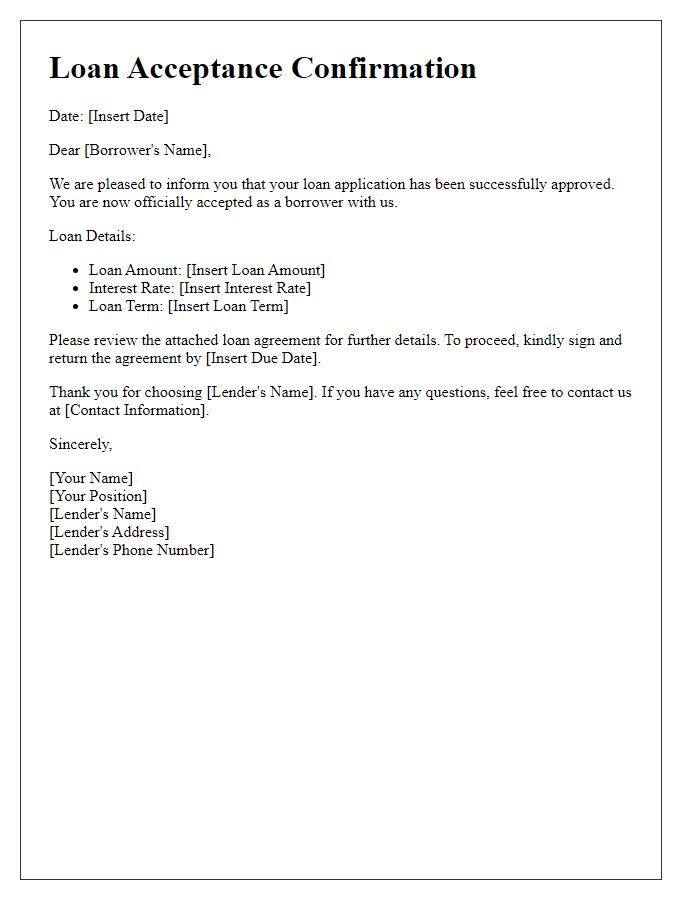

First-time loan borrowers receive crucial notifications about their loan details, such as principal amounts and interest rates. Notifications typically include personalized information like the borrower's name, contact details, and unique loan identification numbers, ensuring clear communication. Important dates such as loan disbursement dates and payment due dates are also highlighted for the borrower's awareness. Additionally, remarks about installment plans--including monthly payment amounts, term lengths, and total repayment amounts--help the borrower understand their financial commitment. Essential contact information for customer service representatives is provided, facilitating assistance in answering queries regarding loan specifics or payment arrangements.

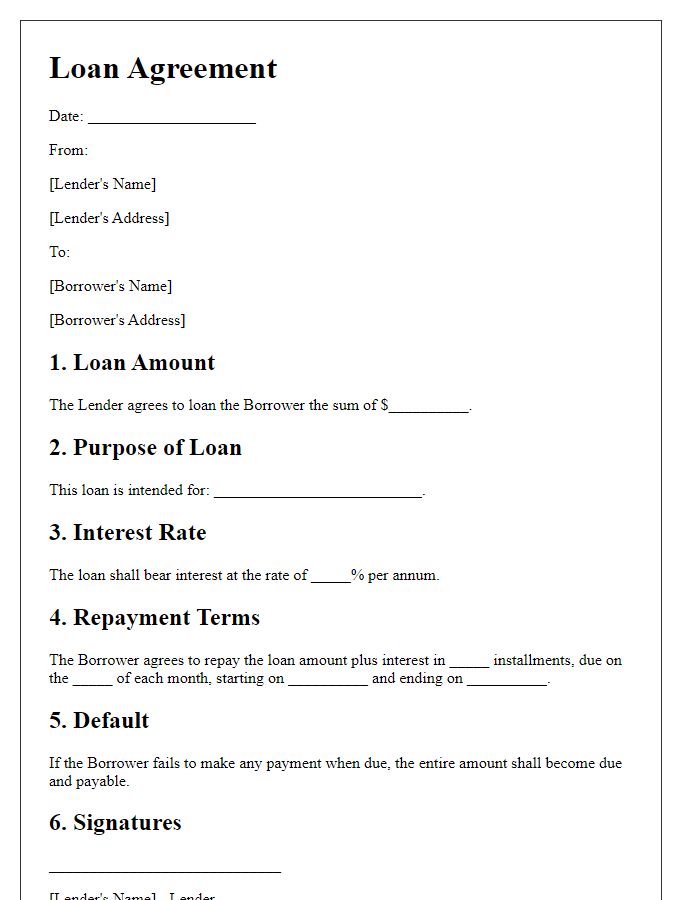

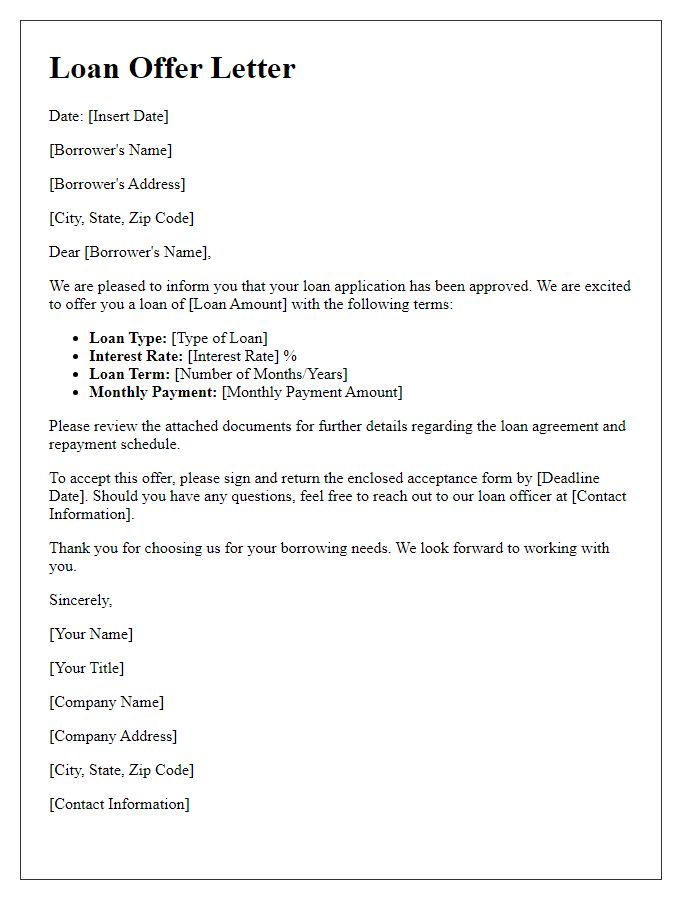

Loan Details and Terms

First-time loan borrowers receive crucial notifications detailing loan specifics. Notifications typically include principal amount (usually ranging from $1,000 to $50,000), interest rate (commonly between 5% to 15%), repayment period (generally 1 to 7 years), and monthly payment amount calculated using amortization formulas. Borrowers should also note any applicable fees such as origination fees (often 1% to 5% of the loan amount) or late payment penalties (frequently around $25 or more). Key dates include the loan disbursement date and the first payment due date, which is typically set within 30 days following disbursement. Finally, financial institutions often include insights on credit reporting practices, emphasizing that timely payments enhance credit scores while missed payments could negatively impact financial standing.

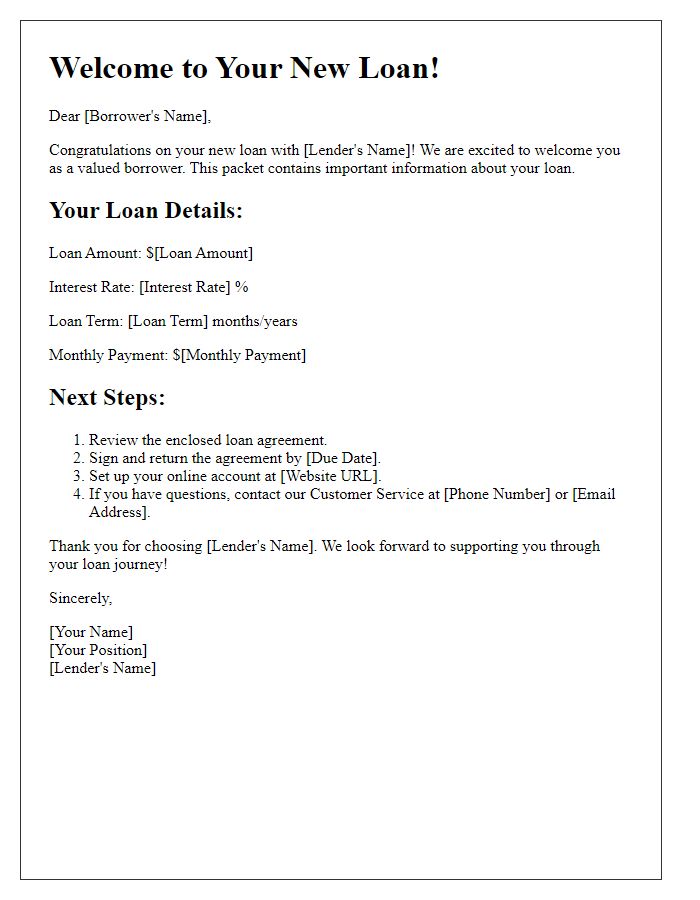

Repayment Schedule and Options

New loan borrowers receive a repayment schedule outlining their financial obligations, typically involving principal and interest payments. This schedule details the specific due dates for monthly payments, generally starting 30 days post-funding. Standard loan terms range from 12 to 60 months, with varying interest rates based on credit risk. Borrowers can choose from multiple repayment options, including fixed rates, which maintain consistent monthly payments, or variable rates, which can fluctuate based on market conditions. Additionally, some lenders offer deferment options for borrowers facing financial hardship, allowing temporary suspension of payments. Understanding these options ensures borrowers make informed decisions regarding their financial commitments, promoting responsible borrowing behavior.

Contact Information and Support

In the process of securing a personal loan through financial institutions, first-time borrowers must carefully review their contact information for the lender, typically including names, addresses, and phone numbers. Establishing clear lines of communication is crucial; therefore, borrowers should note customer support hours, often spanning weekdays from 9 AM to 5 PM. Ensuring access to dedicated support teams can provide guidance through the intricacies of loan terms, interest rates (averaging between 5% and 36% for unsecured loans), and repayment schedules. Additionally, organizations may offer online resources, such as FAQs or chat services, to assist in the process. First-time borrowers should also consider documenting their application steps, enhancing their understanding of the lending process.

Legal Disclosures and Privacy Policies

First-time loan borrowers must carefully review legal disclosures and privacy policies to understand their rights and responsibilities. Important documentation includes the Truth in Lending Act (TILA) disclosures, outlining loan terms such as the Annual Percentage Rate (APR) and repayment schedule, which are regulated to ensure transparency. Borrowers should also pay attention to privacy policies that explain how personal information is collected, used, and protected, in compliance with the Gramm-Leach-Bliley Act (GLBA). Timely access to these documents is crucial for informed decision-making, particularly when securing loans through financial institutions or credit unions. Understanding these disclosures helps borrowers avoid potential pitfalls associated with hidden fees or miscommunications regarding loan terms.

Letter Template For First-Time Loan Borrower Notification Samples

Letter template of loan disbursement information for first-time borrowers

Comments