Are you ready to take the leap into homeownership but feeling overwhelmed by the mortgage process? It's completely normal to seek clarity when it comes to loan approval requests, and knowing how to draft an effective letter can make all the difference. In this article, we'll guide you through the important elements to include, ensuring your request stands out in the eyes of lenders. So, grab a cup of coffee and let's dive into the details together!

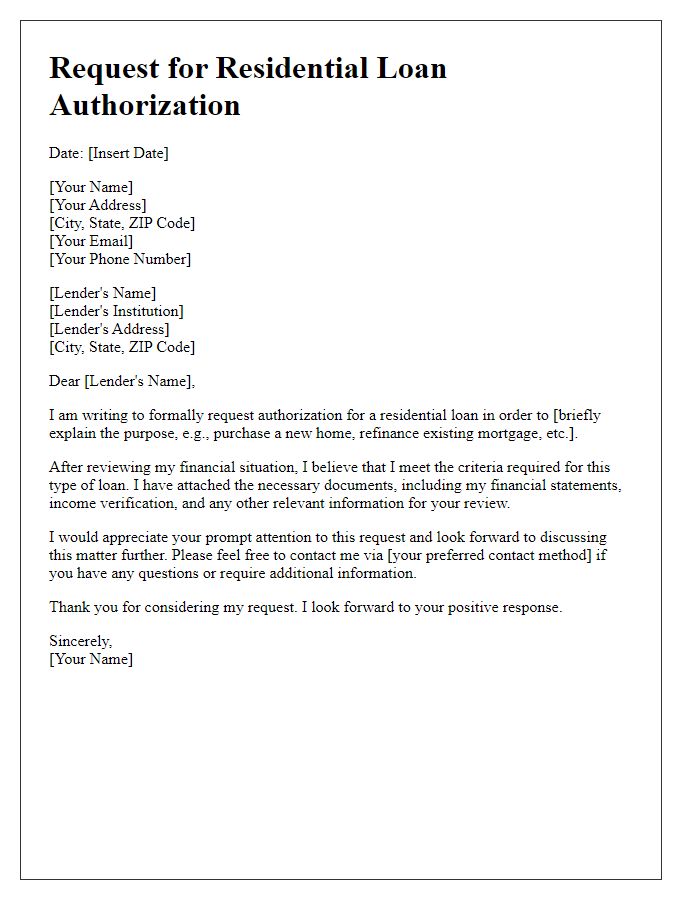

Clear Subject Line

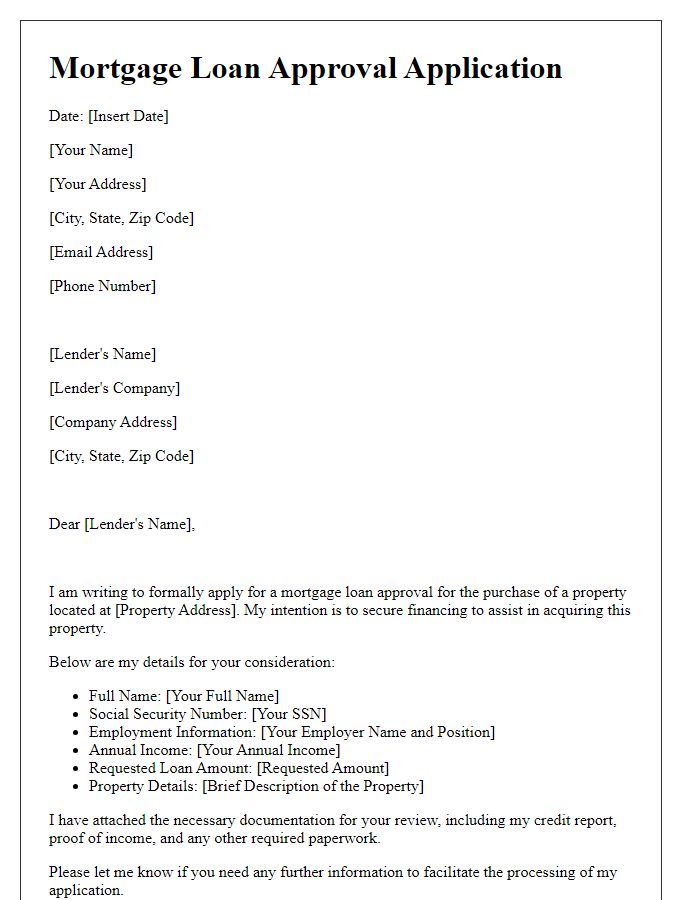

A concise subject line for a mortgage loan approval request could be "Request for Mortgage Loan Approval - [Your Name]". This clear designation immediately communicates the purpose of the email, efficiently signaling to the recipient the nature of the request. In this context, "Mortgage Loan Approval" refers to the process wherein lenders evaluate and decide on providing a loan for real estate purchases, while "[Your Name]" personalizes the request, making it easily identifiable among various correspondence.

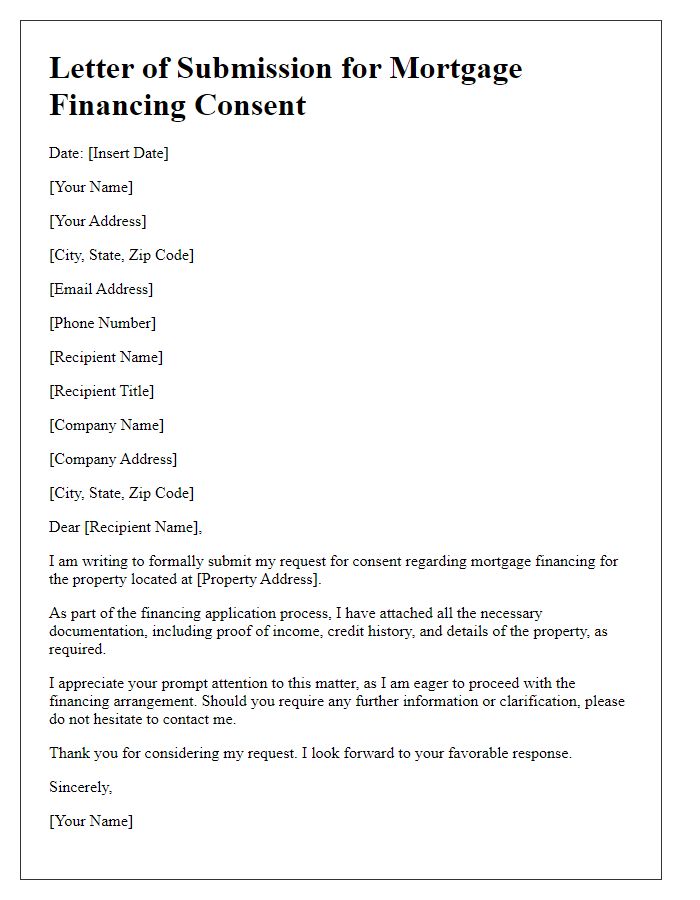

Borrower's Personal Information

Submitting a comprehensive mortgage loan approval request requires specific borrower personal information, which typically includes full legal name, date of birth, social security number, and current residential address. Additionally, details about employment status, including the employer's name, position, and annual income (which could be a critical figure such as $75,000 per year), provide lenders with essential financial context. Moreover, listing monthly expenses, such as current rent or any ongoing debts, along with bank statements from the past three months, facilitates a clearer evaluation of the borrower's financial stability. It is vital to ensure this information aligns with the data provided to credit bureaus, as discrepancies can hinder approval processes.

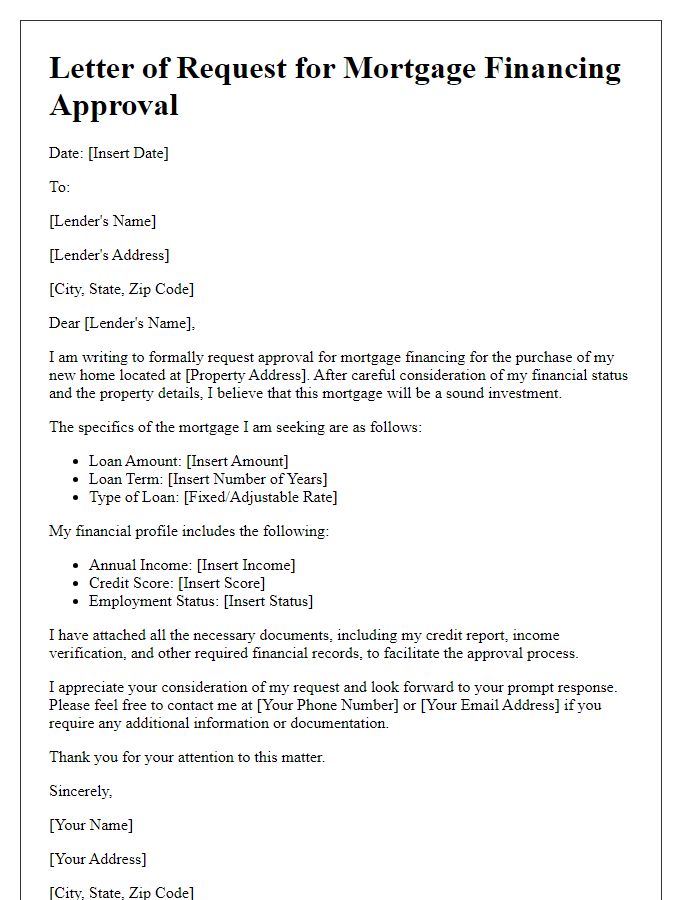

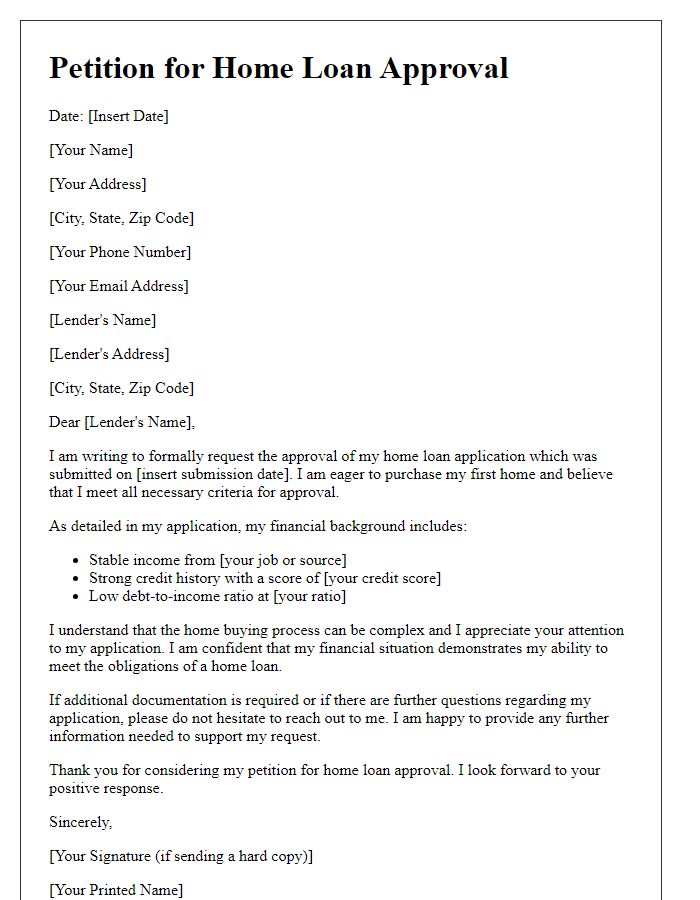

Loan Amount and Purpose

Crafting a mortgage loan approval request requires clarity and precision. Detailed information about the loan amount is essential, as typical residential loans range from $100,000 to $500,000, depending on the property location and market conditions. The purpose of the loan, whether for purchasing a new home, refinancing an existing mortgage, or funding renovations, significantly impacts the application. Additionally, demographic factors such as credit score (which ideally should be above 620 for favorable terms) and income (with lenders generally requiring a debt-to-income ratio below 43%) are critical in assessing eligibility. The applicant should also provide detail on the property, including its estimated value and uniqueness, to support the request.

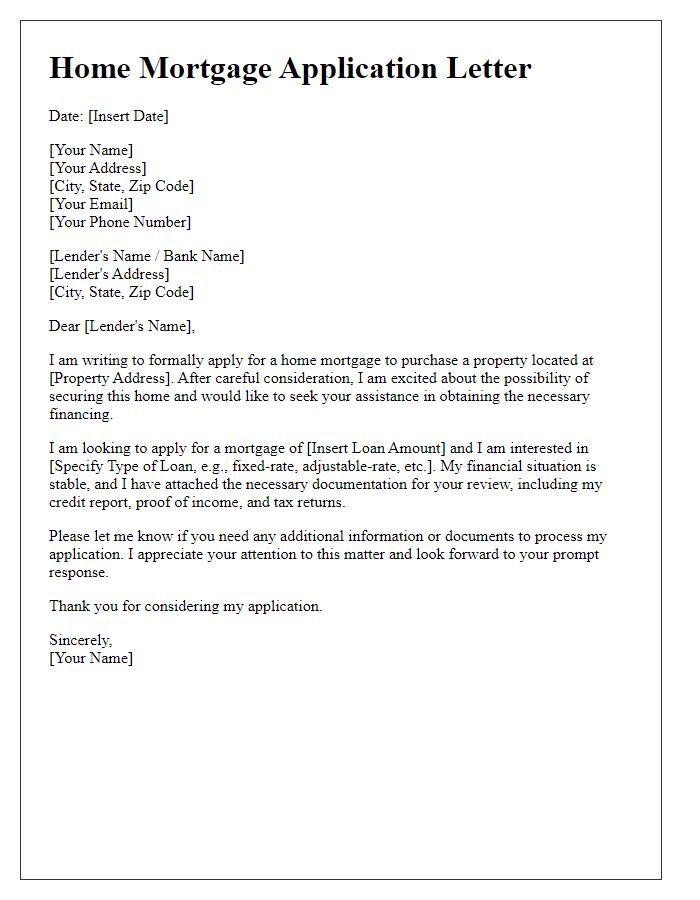

Financial Details and Documentation

When seeking mortgage loan approval, precise financial documentation plays a crucial role. Credit scores, typically ranging from 300 to 850, significantly impact loan terms and interest rates. Lenders often require income verification, which may include W-2 forms or tax returns from the past two years, ensuring a reliable source of income. Current employment verification, showing duration and position, supports financial stability. Assets, including bank statements from the past few months and proof of other investments, demonstrate savings capability. Debt-to-income ratio, calculated by comparing monthly debt obligations to gross monthly income, typically should not exceed 43% for favorable loan approvals. Each piece of documentation provides lenders the insight necessary to assess creditworthiness and set appropriate mortgage conditions.

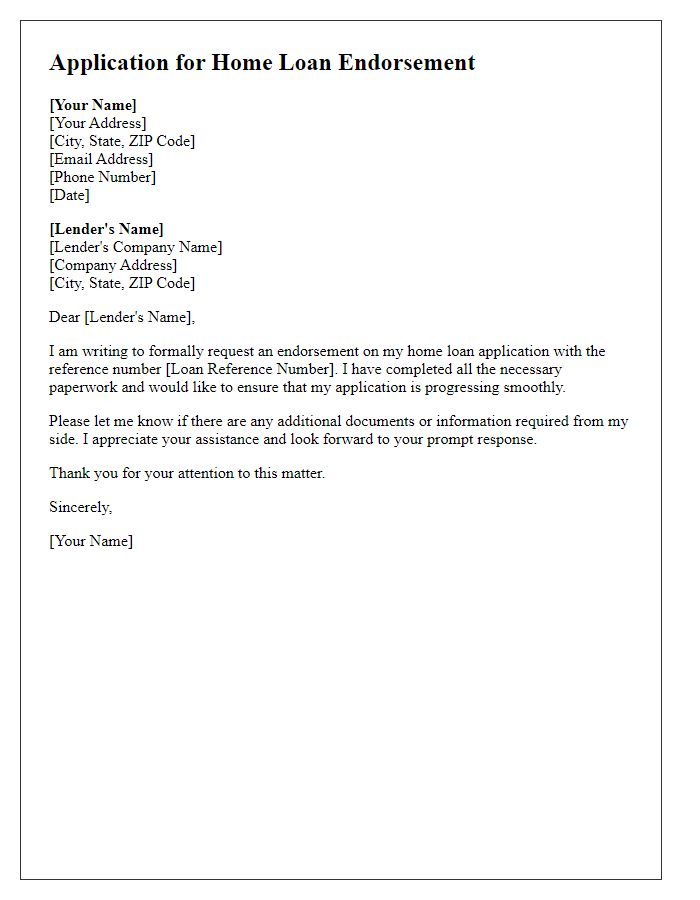

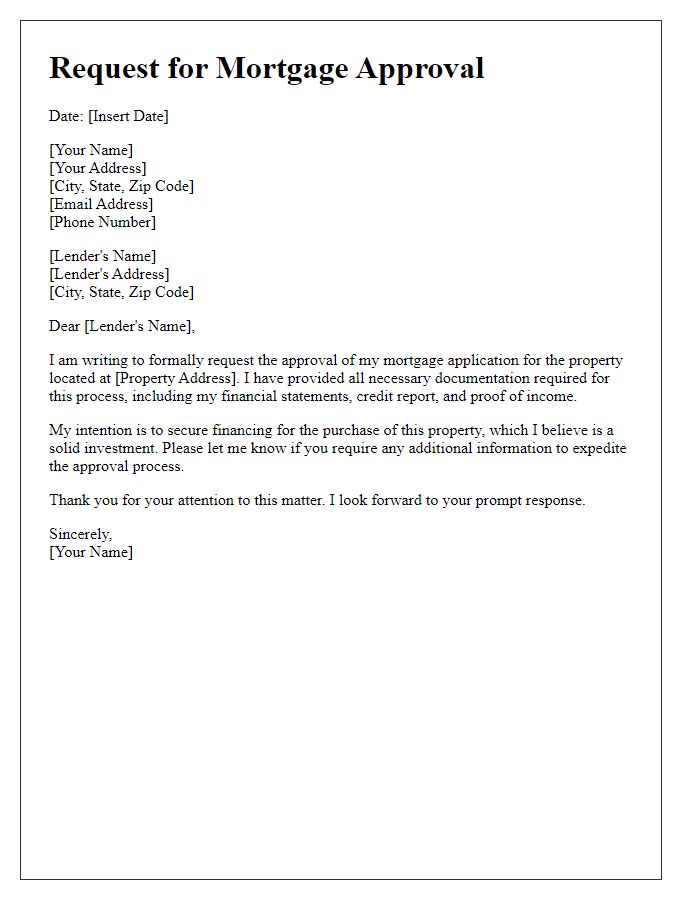

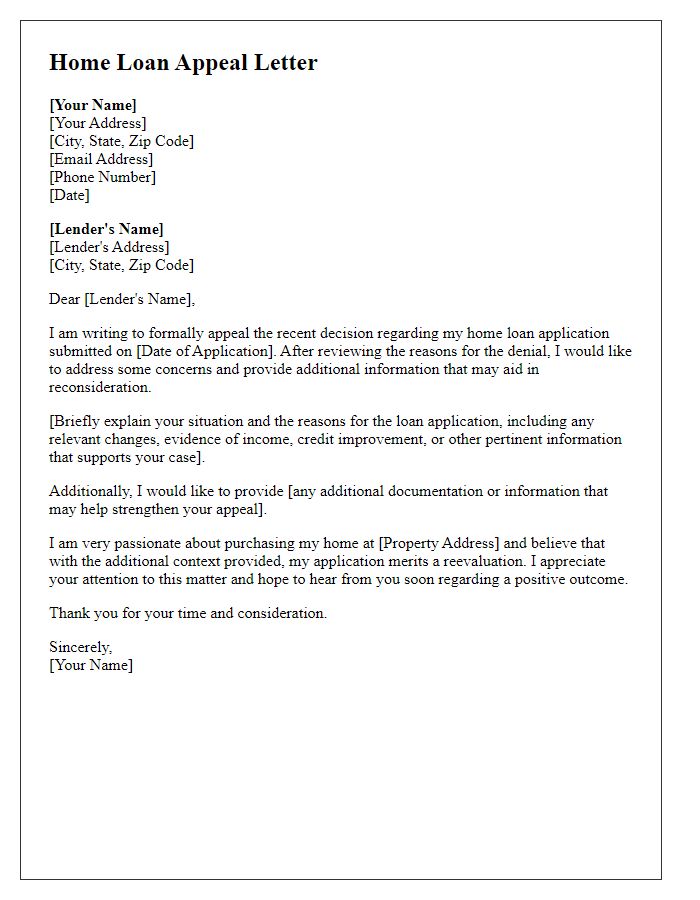

Professional Tone and Polite Closing

Mortgage applications involve detailed review processes and specific criteria that loan officers consider before approving requests. Each factor, including credit score (typically a minimum of 620 for conventional loans), debt-to-income ratio (ideally below 43%), and employment stability, plays a critical role in decision-making. Documentation required includes proof of income (such as pay stubs and tax returns), asset verification (like bank statements), and property appraisal reports (indicating value and condition). As of late 2023, regional lending requirements can vary significantly, depending on local real estate markets, so potential borrowers must stay informed about specific lender policies in their area. This thorough understanding of the mortgage approval process facilitates stronger applications and informed discussions with loan officers.

Comments