Are you feeling overwhelmed by your current loan payments and wondering if there's a way to ease the financial burden? You're not alone, as many homeowners seek loan modifications to create more manageable terms that fit their budget. In this article, we'll guide you through the essential steps of crafting an effective loan modification application letter, ensuring you present your case clearly and persuasively. So, let's dive in and explore how to take control of your financial future!

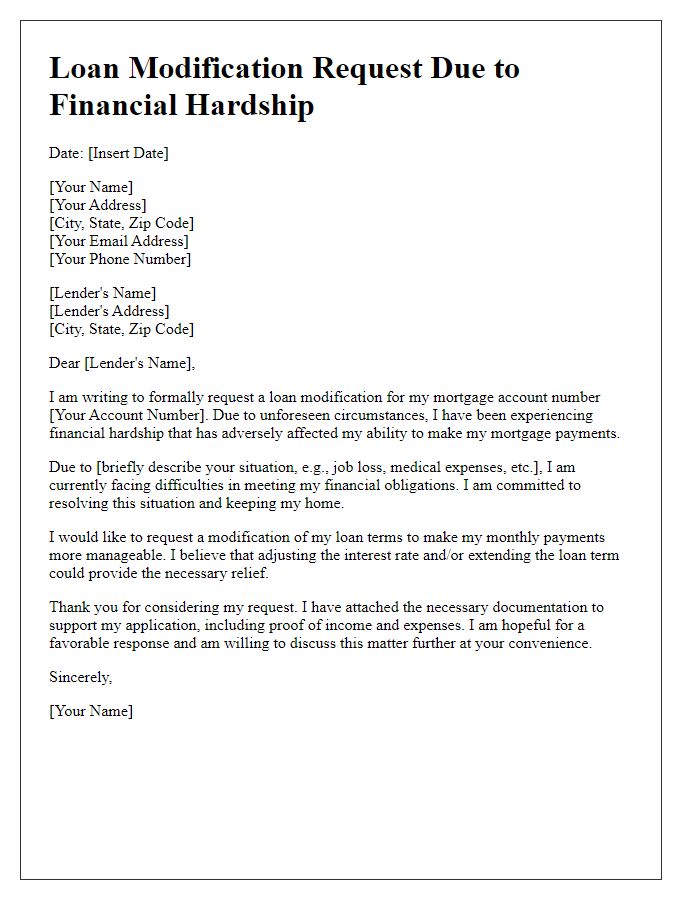

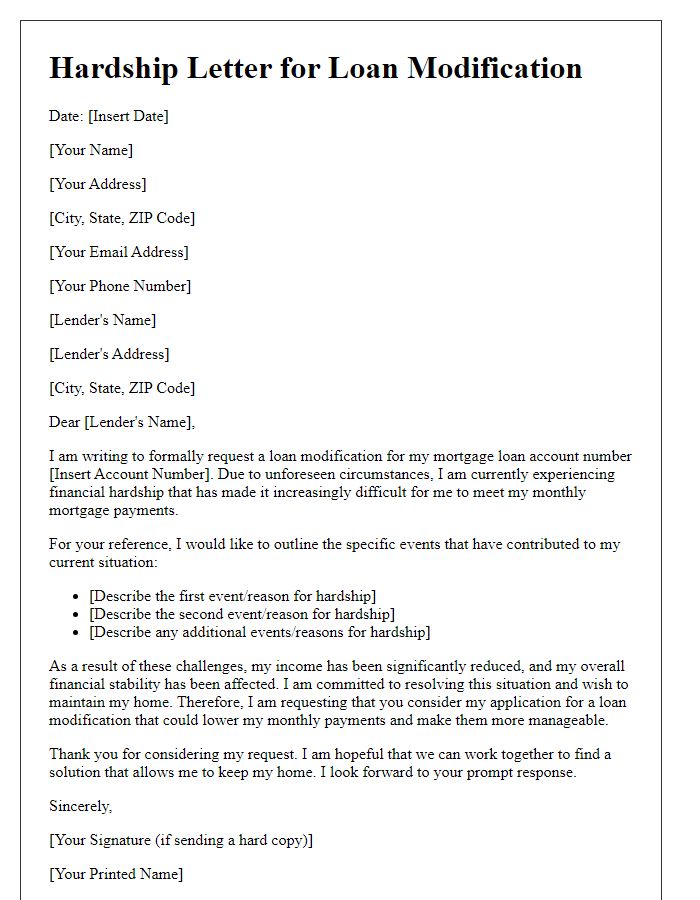

Borrower's financial situation and hardship explanation

Borrowers experiencing financial hardship often find themselves seeking loan modifications to make their mortgage payments more manageable. Financial situations might arise from job loss, medical emergencies, or unexpected expenses, leading to difficulties in monthly payment fulfillment. For example, a borrower could have faced a job loss since March 2020 due to the pandemic, resulting in a monthly income reduction from $5,000 to $2,500. This significant drop creates a financial strain, making it impossible to meet the $1,500 mortgage payment on a property located in Phoenix, Arizona. Describing personal circumstances, like a medical emergency costing $10,000, illustrates the urgency for financial relief. Such hardships necessitate a loan modification application to renegotiate terms, potentially reducing the interest rate or extending the loan term, making payments more sustainable given the new financial landscape.

Loan details and current terms

Loan modification applications involve detailed documentation of loan specifics, current terms, and pertinent financial information. The loan details often include the original loan amount, typically in the range of $150,000 to $500,000 for residential properties, and a loan number assigned by the lender which can help streamline the processing of the application. Current terms may involve the interest rate, which can fluctuate between 3% to 7%, depending on market conditions, along with the loan maturity date, which typically spans 15 to 30 years. Borrowers should also note payment frequency, usually monthly, and any changes resulting from previous modifications. It's essential to include the reason for the modification request, often due to financial hardship such as job loss or medical expenses, along with supporting documents like income statements and proof of ongoing financial obligations. This context aids in clearly presenting the loan situation to the lender, which is crucial for a successful modification outcome.

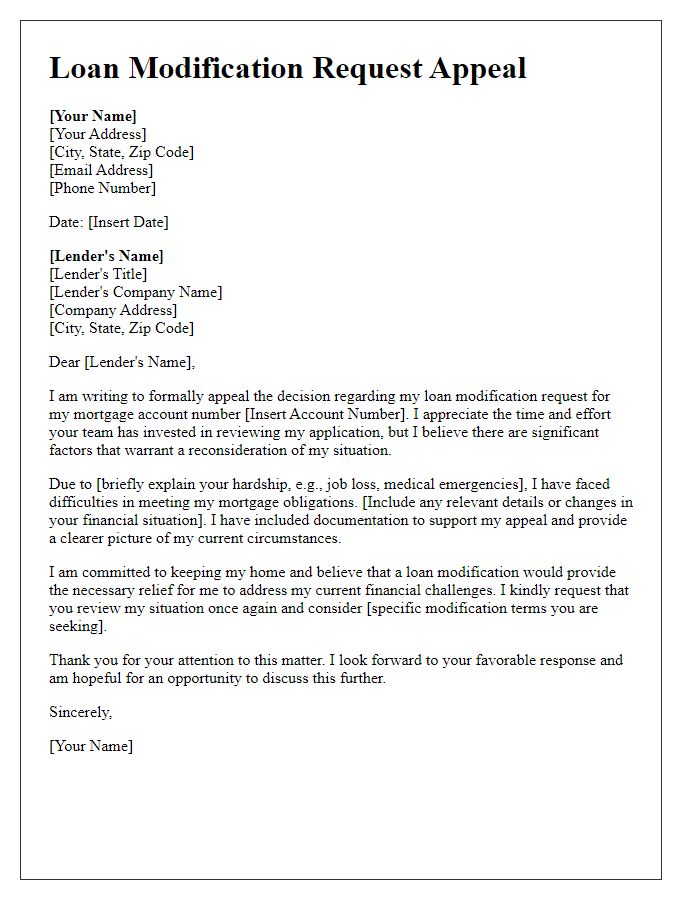

Requested new terms and reasons for modification

The loan modification application highlights essential details regarding the request for revised loan terms. Borrowers often seek modifications to secure lower interest rates (e.g., from 5% to 3%) or more manageable monthly payments, particularly during financial hardships. Common reasons include unforeseen circumstances such as job loss (affecting income stability) or medical emergencies that lead to increased expenses. Additionally, an increase in the cost of living (notably in urban areas like San Francisco) may prompt borrowers to adjust their loan terms. A well-structured application outlines specific reasons, desired terms, and the impact of these changes on the borrower's ability to continue making payments. Providing supporting documentation, including income statements and expenses, can strengthen the appeal for favorable loan modifications.

Supporting financial documentation and proof

A loan modification application requires comprehensive supporting financial documentation and proof to assess eligibility effectively. Detailed income statements, including recent pay stubs and tax returns from the previous two years, establish monthly earnings, critical for evaluating financial stability. Additionally, bank statements from the last three months provide insight into overall financial health and spending habits. Documentation of monthly expenses, such as utility bills and rental agreements, illustrates living costs that impact cash flow. A hardship letter, explaining the reason for modification requests--loss of employment, medical emergencies, or other significant events--offers context for financial difficulties. Including government-issued identification further validates the applicant's identity, ensuring an organized and thorough submission for loan modification consideration.

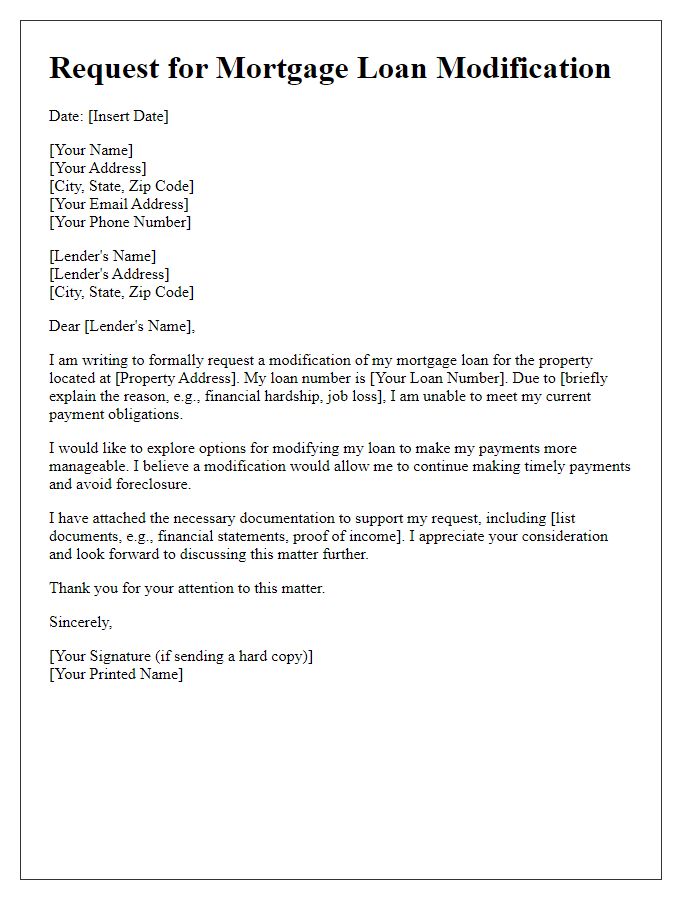

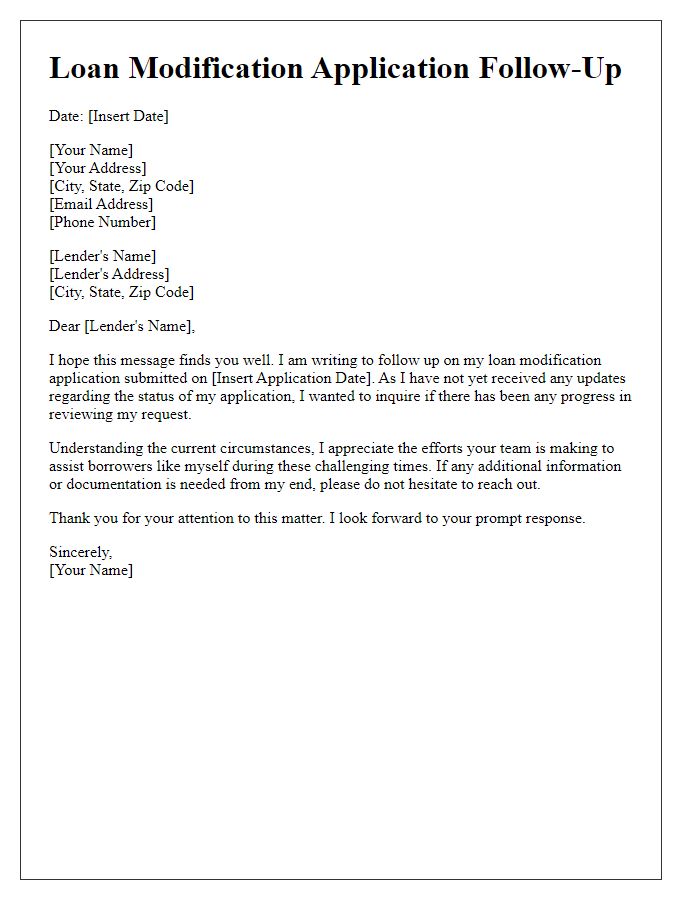

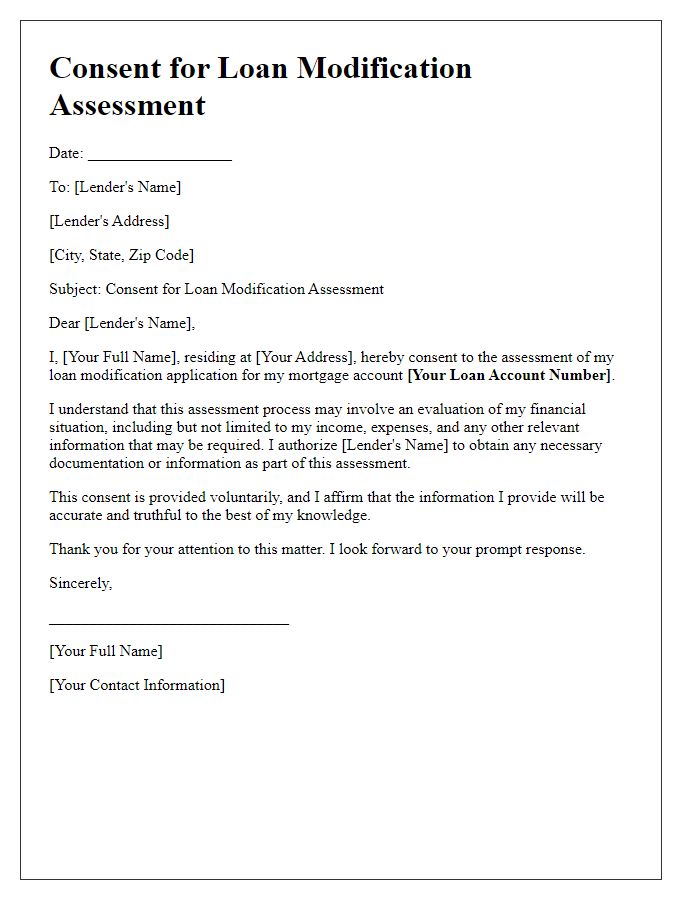

Contact information and authorization statement

A loan modification application requires accurate contact information to facilitate communication with the lending institution. Applicants should provide their full name, permanent address, email address, and phone number to ensure that all correspondence is directed appropriately. An authorization statement is essential, granting the lender permission to access necessary financial information, including income statements, tax returns, and credit reports. This statement should specify the duration of authorization and clarify that the applicant understands the implications of sharing such sensitive data with the lender, ensuring compliance with privacy regulations.

Comments