Are you looking to maximize your potential tax savings? Requesting a loan interest deduction might just be the key to unlocking extra funds in your pocket come tax season. In this article, we'll break down a simple letter template that you can customize, ensuring your request is clear and effective. Join us as we explore the details and help you take the first step towards securing that deduction!

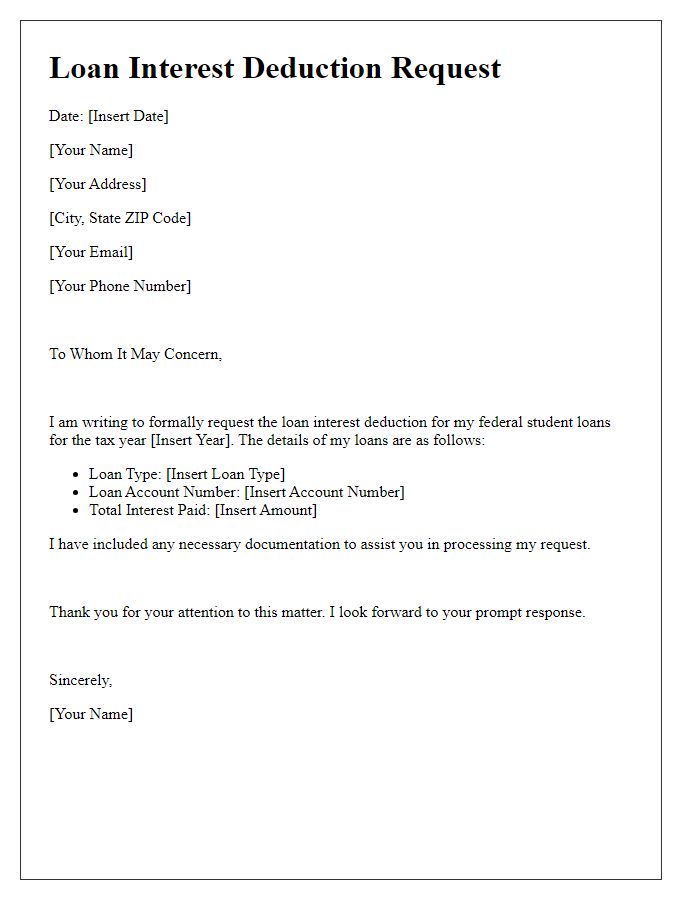

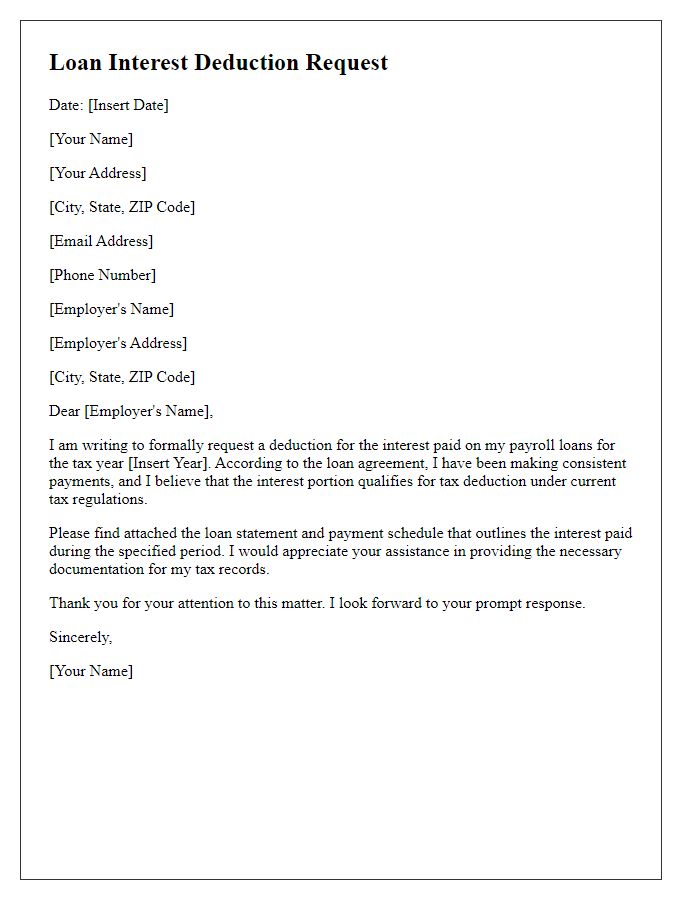

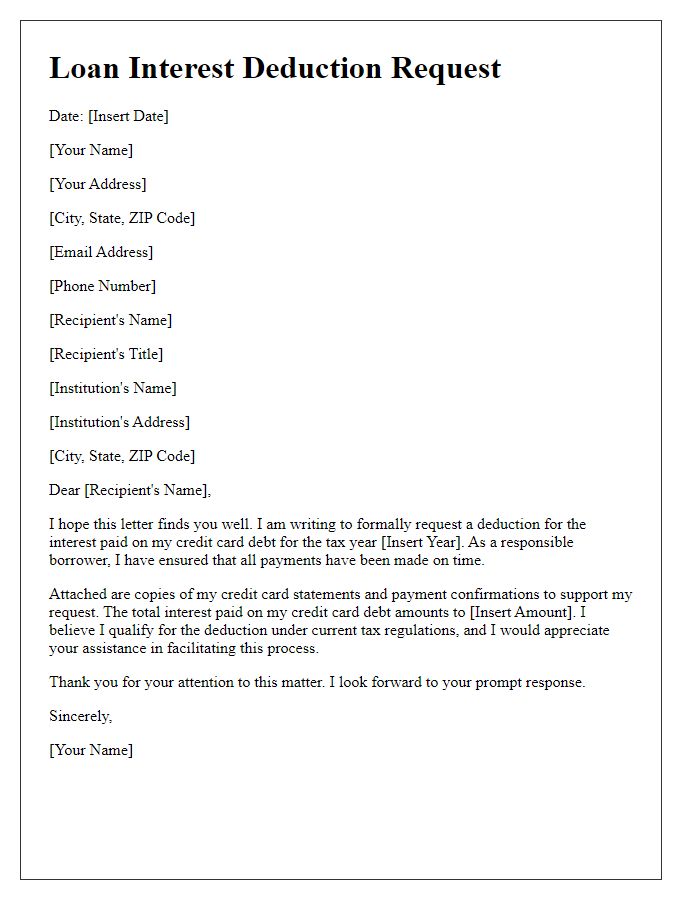

Borrower's Personal Information

Borrower's personal information is crucial for processing loan interest deduction requests. This information typically includes the full legal name of the borrower (such as Johnathan Smith), Social Security number (a unique identifier consisting of nine digits), and current residential address (for example, 123 Maple Street, Springfield, IL 62701). Additionally, it may involve specifying the loan account number (a unique sequence assigned to the borrower upon loan approval, like 4567890123) and the financial institution's name (such as Bank of America or Wells Fargo). Having accurate and complete personal information ensures smooth communication and expedites the deduction review process, adhering to Internal Revenue Service regulations.

Loan Account Details

Loan account details represent essential information for requesting a loan interest deduction from financial institutions or tax authorities. The loan account number, a unique identifier assigned by banks, typically consists of 10-15 digits. Loan type, such as home loan or personal loan, indicates the purpose of the borrowed amount. Interest rate, which may vary among lenders, usually ranges from 3% to 15% annually, depending on creditworthiness. Loan amount, often in thousands of dollars, signifies the principal sum borrowed. Loan disbursement date marks the moment funds become available, which may influence taxable interest calculations during a specific financial year. Additionally, providing repayment status, including the number of paid installments out of the total, can strengthen the request for a tax deduction on paid interest.

Reason for Interest Deduction Request

Loan interest deduction requests can arise from various situations, including unexpected financial hardship or changes in employment status. Homeowners seeking deductions for their mortgage interest often cite their primary residence located in cities like San Francisco or New York, where property values and mortgage rates can significantly influence annual interest payments. Taxpayers may wish to highlight specific loans, such as 30-year fixed-rate mortgages, which could accumulate a substantial interest amount over the years. Current tax codes, like the Tax Cuts and Jobs Act of 2017 in the United States, permit deductions under certain conditions, making it essential for requestors to articulate their reasoning clearly. Additionally, including supporting documentation, such as IRS Form 1098 that details interest paid, strengthens the request for deductions on qualifying loans.

Supporting Financial Documents

A loan interest deduction request typically requires supporting financial documents to substantiate the claim. Essential documents include the annual interest statement provided by the lender, such as the Form 1098 for mortgage interest, reflecting the total interest paid throughout the year (which can exceed several thousand dollars for home loans). Additionally, borrowers may need to submit documentation regarding other qualifying loans, such as student loans or personal loans, including bank statements and payment records that verify the interest paid. It is also advisable to prepare relevancy proof, like income statements or tax returns, to confirm eligibility for deductions based on income brackets. Furthermore, a completed IRS Form 1040 should accompany the request, indicating the taxpayer's overall financial position for the year. Each document must clearly contain identifying information, such as Social Security numbers and loan account numbers, to streamline processing and ensure accurate assessment by tax authorities.

Contact Information for Follow-up

Creating an effective loan interest deduction request involves clear communication and organization of your contact information for follow-up. For efficient processing, include your full name, a reliable phone number, and an email address that you check regularly. Additionally, consider specifying a preferred time for follow-up calls, such as weekday afternoons, and mention whether you are reachable at any alternative phone numbers. Providing your mailing address may also facilitate correspondence if necessary. Clear and concise contact details optimize your request's response time, ensuring that you receive assistance promptly regarding your loan interest deduction inquiry.

Letter Template For Loan Interest Deduction Request Samples

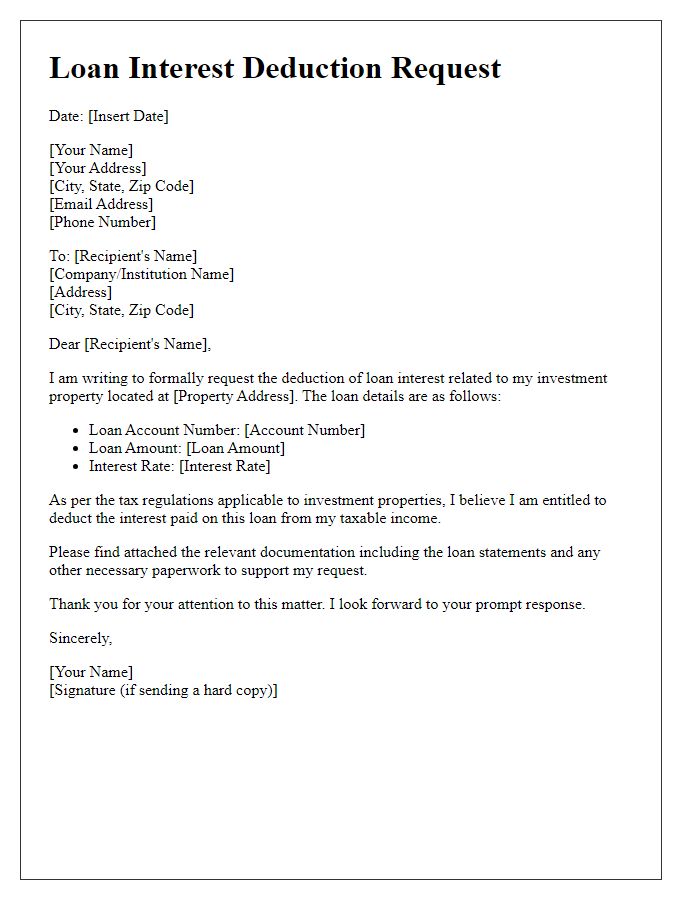

Letter template of loan interest deduction request for investment property.

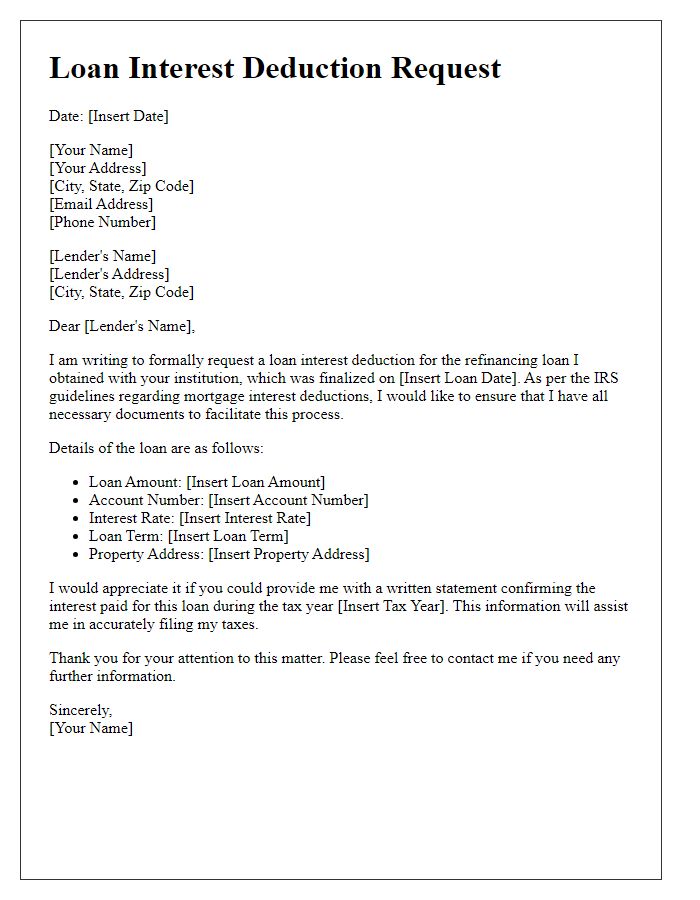

Letter template of loan interest deduction request for refinancing loans.

Comments