Are you curious about the potential for cashback on your loan interest? Navigating the world of loans can be overwhelming, but understanding cashback offers could save you money in the long run. By exploring this option, you might find that you can keep more cash in your pocket while managing your finances effectively. If this piques your interest, keep reading to learn more about how to inquire about loan interest cashback!

Personal Information

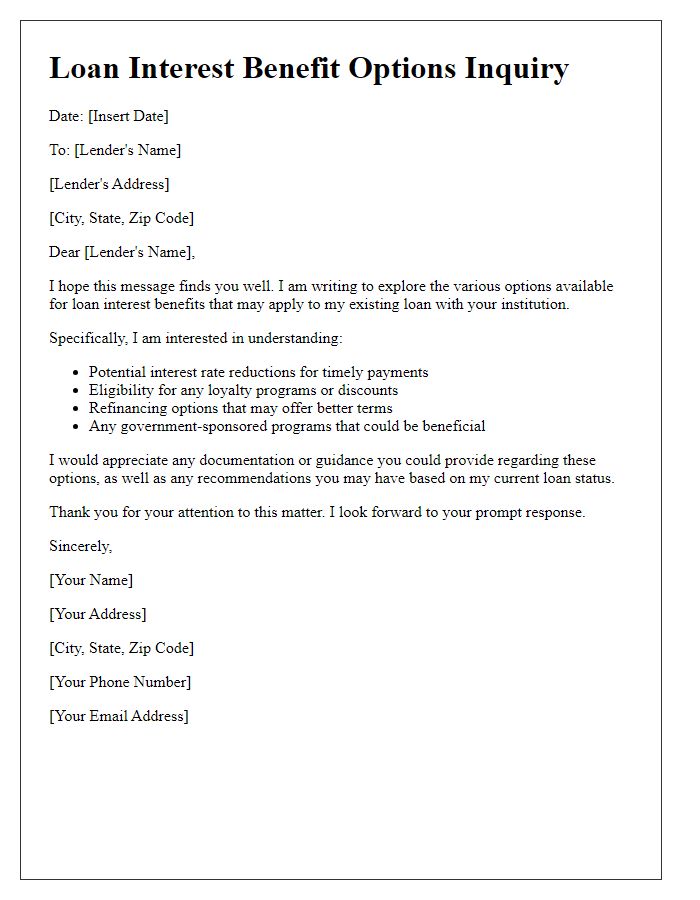

Inquiring about loan interest cashback opportunities can provide significant monetary benefits for borrowers. Such cashback incentives often apply to personal loans taken from financial institutions, like banks or credit unions, and can vary in amounts; usually ranging from 1% to 5% of the total interest paid over the loan's duration. Borrowers must provide personal information, including full name, address, and account number, to verify eligibility for such programs. Institutions may also require details about the loan, such as the amount borrowed, interest rate, and repayment term. It is advisable to check specific requirements and terms outlined by the lender to maximize potential cashback benefits.

Loan Details

Inquiries regarding loan interest cashback programs can often pertain to specific financial institutions, such as banks or credit unions, offering incentives to borrowers. A typical loan might include various details, such as the principal amount (often in thousands of dollars), the interest rate (usually expressed as a percentage), and the loan term (commonly spanning several years, like 15 or 30 years). Cashback offers could range from a specified percentage of the interest paid within a defined time frame, such as the first year of repayment. Some lenders may require borrowers to meet certain conditions to qualify for these cashback benefits, such as maintaining timely payments and the total amount borrowed. Additionally, regulatory compliance regarding disclosure of cashback terms may be stipulated under financial legislation, ensuring transparency for consumers, thus affecting the overall loan experience for individuals in search of favorable repayment options.

Inquiry Purpose

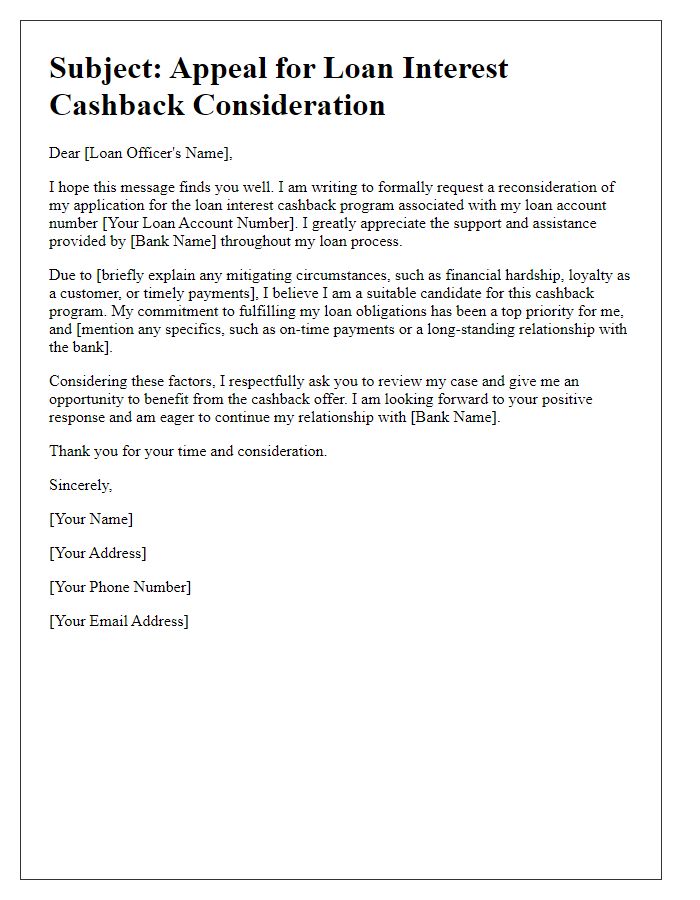

A loan interest cashback program is designed to provide borrowers with financial incentives, often rewarding them for timely payments on loans such as mortgages or personal loans. Cashback percentages can vary, typically ranging from 0.5% to 2% of the interest paid over a specified period. This program can significantly relieve the overall repayment burden, especially for large loans, where interest amounts might be substantial. Borrowers often inquire about eligibility criteria, application processes, and potential terms linked to specific lenders offering these cashback programs, such as banks or credit unions, to maximize benefits. Understanding the impact on loan amortization schedules and tax implications is also crucial for personal financial planning.

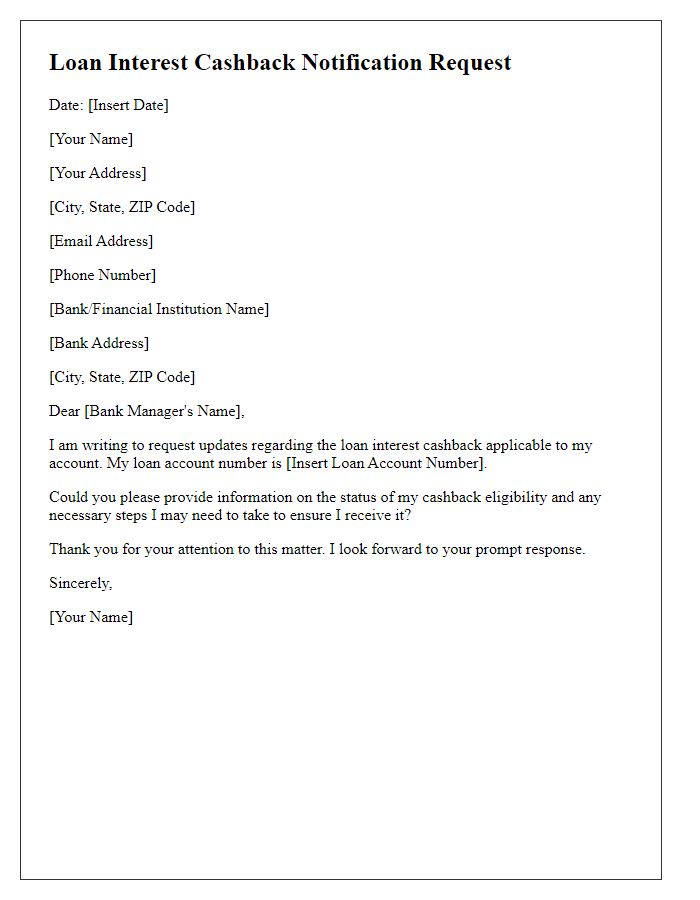

Contact Information

The inquiry for loan interest cashback typically involves contacting financial institutions for clarification or assistance regarding promotional offers or account benefits associated with loans. Loan interest cashback programs provide borrowers with cashback rewards based on the interest paid on their loans. Many financial organizations, including banks such as JPMorgan Chase and credit unions like Navy Federal, may have specific promotional periods during which these offers are valid. Additionally, eligibility criteria often include maintaining a good payment history or meeting certain loan conditions. Therefore, providing contact information, such as phone numbers (800-123-4567) or email addresses (support@bankname.com), enhances the efficiency of communication with the respective financial institution.

Call to Action

In the competitive landscape of personal finance, consumers are increasingly drawn to loan interest cashback programs, designed to enhance financial literacy and provide tangible benefits. Many financial institutions offer promotional cashback incentives that reward borrowers with a percentage (for example, 1-5%) of the interest paid on their loans, effectively reducing overall loan costs. Institutions like Bank of America or Wells Fargo might implement these programs during specific promotional periods, potentially in 2024, as a result of fluctuating economic conditions or increased competition in the lending market. Understanding the terms and conditions associated with such programs is crucial, including eligibility criteria, application processes, and redemption methods for cashback rewards. Engaging in inquiries with customer service representatives or visiting bank websites can yield comprehensive insights, allowing borrowers to make informed financial decisions.

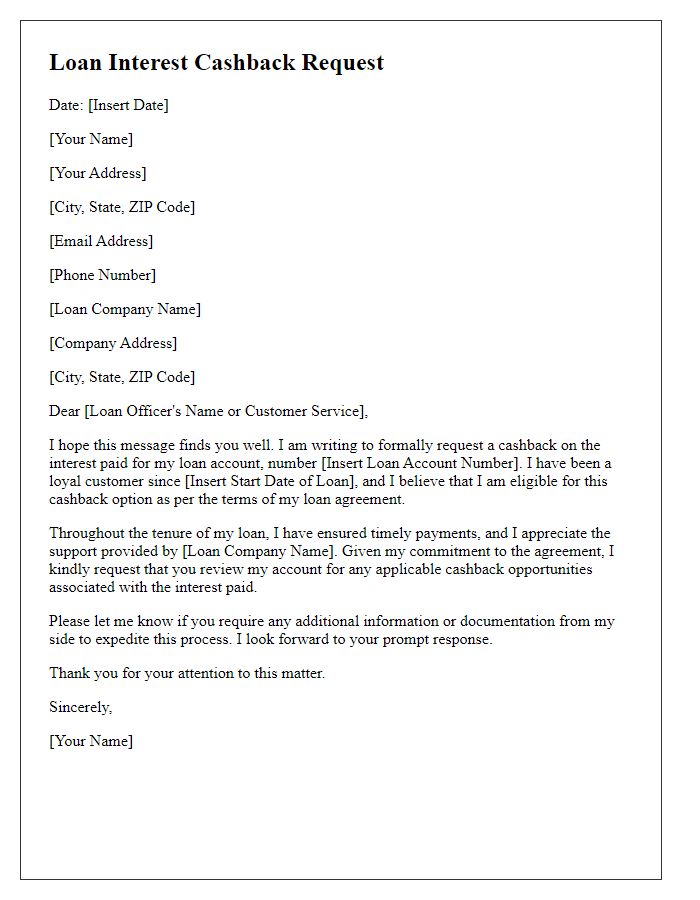

Letter Template For Loan Interest Cashback Inquiry Samples

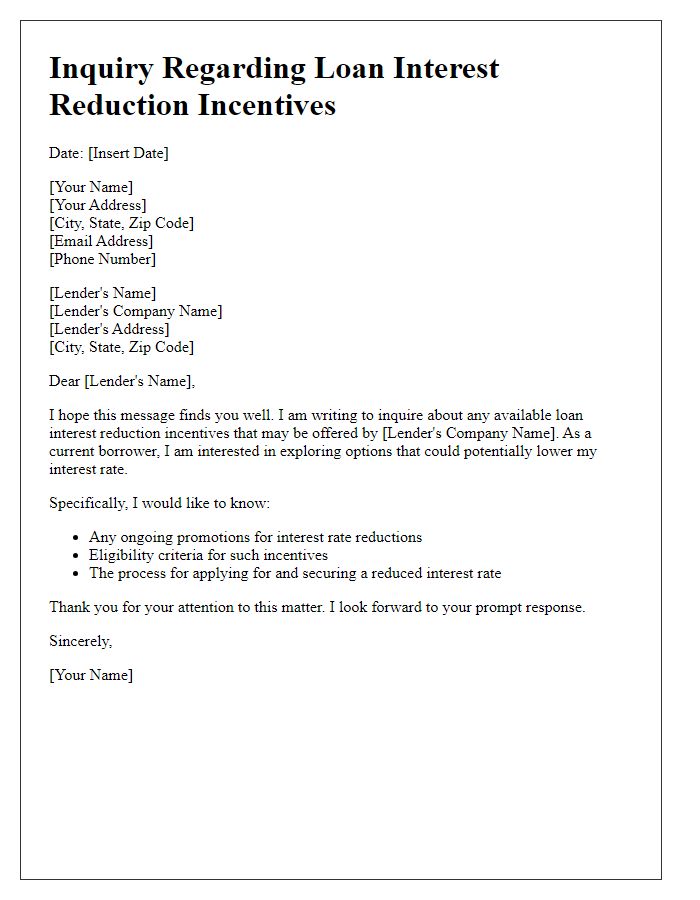

Letter template of inquiry concerning loan interest reduction incentives.

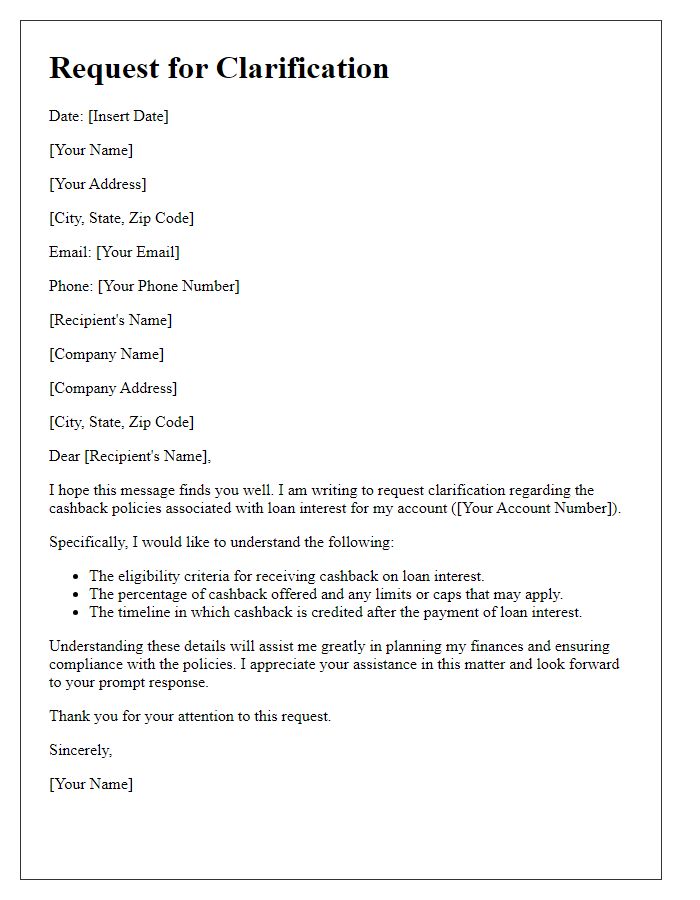

Letter template of request for clarification on loan interest cashback policies.

Comments