Are you contemplating taking out a loan with a friend or colleague? Navigating the world of peer-to-peer lending can be daunting, but it doesn't have to be! With a clear understanding of the process and some open dialogue, you can make informed decisions that benefit everyone involved. Dive into our article to explore essential tips and templates for crafting the perfect letter to request a peer-to-peer loan!

Personal and Financial Information

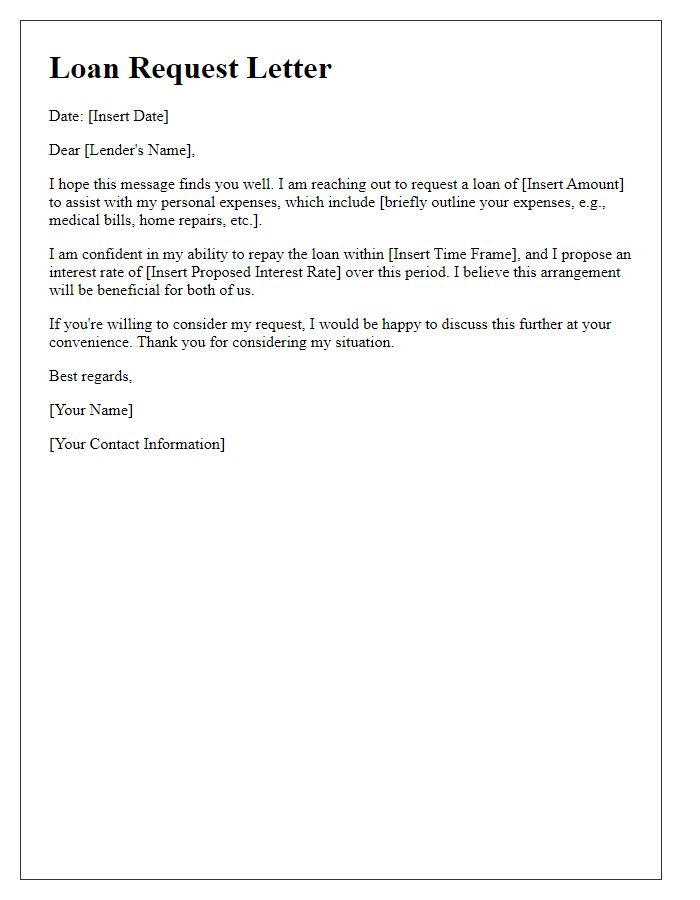

When applying for peer-to-peer loans, personal financial information, such as income and credit history, plays a crucial role in determining eligibility. Lenders, often individuals or institutions, seek data like monthly income figures, which can indicate repayment capacity, and existing debts, which assess overall financial stability. Credit scores, provided by agencies like FICO, serve as a numerical representation of creditworthiness, influencing lenders' decisions. Additional personal information, including employment details and residency status in places like New York or California, further establish trust and verification for personal identity. Borrowers should also consider their purpose, whether for consolidating debt, home improvements, or funding education, as clear objectives can enhance loan approval chances.

Loan Details and Terms

In peer-to-peer lending, specific loan details and terms are crucial for both lenders and borrowers to understand the agreement fully. Loan amount, for instance, can range from $1,000 to $50,000, determined by the borrower's creditworthiness and purpose, such as debt consolidation or home improvement. Interest rates, varying between 5% to 36%, depend significantly on the individual's credit score, typically calculated using models like FICO, which ranges from 300 to 850. Loan duration is another essential aspect, commonly set between 3 to 5 years, with options for monthly or bi-weekly repayments. Additional fees, like origination fees ranging from 1% to 5%, could impact the overall cost of borrowing. Clearly defined repayment terms ensure transparency, promoting a mutual understanding of responsibilities in the lending process.

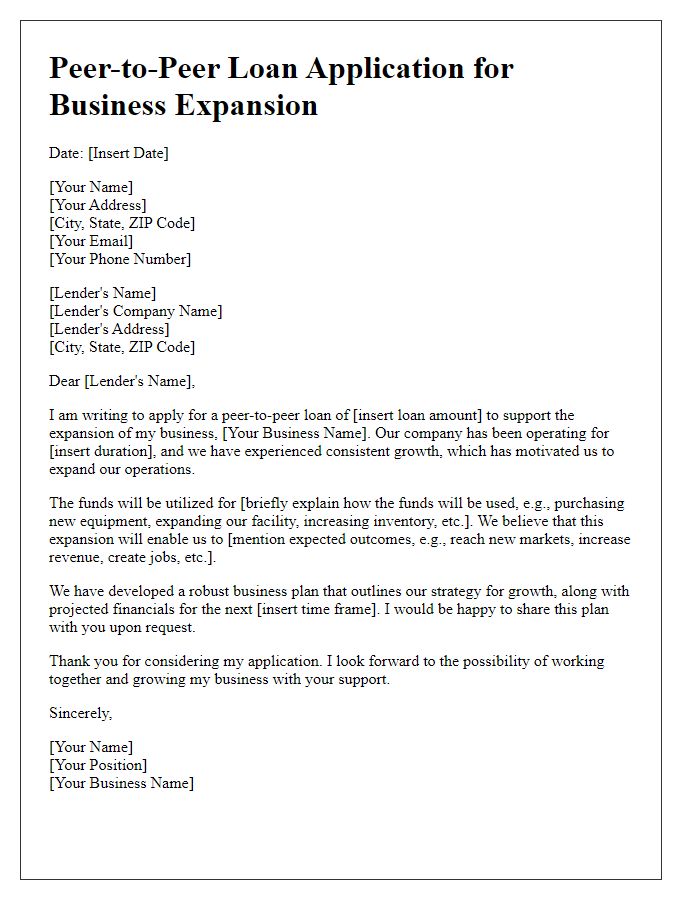

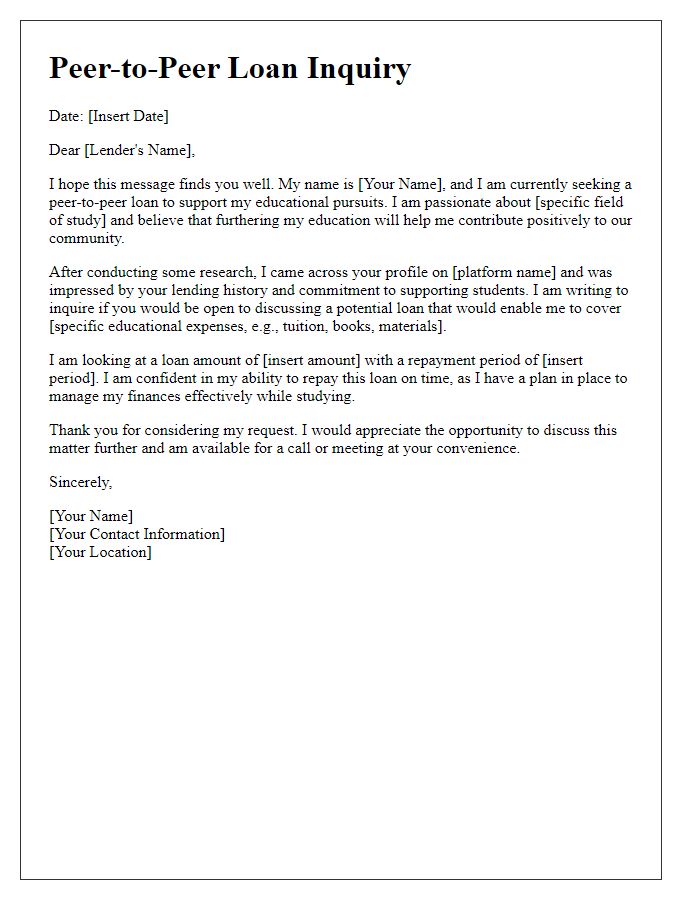

Intent and Purpose of Loan

Peer-to-peer loans, popularized by platforms like LendingClub and Prosper, facilitate individual borrowing and lending without traditional financial institutions. The intent behind seeking a peer-to-peer loan often revolves around consolidating debt, funding home improvements, or supporting education expenses, which can significantly enhance one's financial stability. The purpose of a peer-to-peer loan, typically characterized by fixed monthly payments and predetermined interest rates, allows borrowers to access funds directly from individual lenders, often resulting in lower rates compared to conventional bank loans. Additionally, personal testimonials from successful borrowers can provide insights into the benefits realized through these loans in transforming financial situations.

Repayment Plan and Timeline

Peer-to-peer loans require a well-structured repayment plan to ensure clarity and commitment. A suggested repayment plan might include a specified loan amount, for instance, $5,000, with an interest rate of 5% over a 12-month period. Monthly installments would total approximately $425, allowing for straightforward budgeting. Timeline milestones could detail the first payment due on January 1, 2024, with subsequent payments scheduled for the first of each month. Borrowers may consider incorporating an early repayment option, beneficial for both parties. Documenting this plan ensures mutual understanding and fosters trust in the loaning relationship.

Legal and Formal Agreements

Peer-to-peer (P2P) loans involve legal agreements between individual lenders and borrowers, often facilitated by online platforms like LendingClub or Prosper. These agreements outline terms such as interest rates, repayment schedules, and consequences for late payments. Legal documents, including promissory notes and loan agreements, ensure both parties understand their obligations and rights, typically adhering to state-specific lending laws. Proper vetting of borrowers through credit scores (ranging from 300 to 850) and income verification is crucial in minimizing risk. Clear communication about fees and penalties associated with missed payments further solidifies the understanding of the financial commitment. Legal frameworks vary across countries, ensuring compliance with regulations, such as the Consumer Financial Protection Bureau (CFPB) guidelines in the United States.

Comments