Are you in a tight spot and need a quick financial fix? Applying for an emergency loan can be a lifeline, helping you navigate unexpected expenses without falling into a financial abyss. In this article, we'll walk you through a straightforward letter template that simplifies the application process, ensuring you don't miss out on the immediate help you require. So, if you're ready to take control of your finances, read on to discover how to craft your compelling emergency loan application letter!

Clear subject line

Subject: Urgent Request for Emergency Loan Application An emergency loan application seeks immediate financial assistance during unforeseen circumstances, often requiring quick access to funds. Applicants should provide essential information such as total amount requested (typically ranging from $1,000 to $10,000), proof of income (recent pay stubs or bank statements), and details of the financial emergency (medical expenses, home repairs, or job loss). Specific documentation might vary by lender but generally includes identification (driver's license or ID card) and possibly credit history. Timeliness in submission enhances the chances of approval, particularly with rising interest rates (averaging between 5% to 36%), which could affect repayment terms.

Personal identification details

Emergency loan applications often require personal identification details crucial for verification and processing. Essential information includes full name (such as John Doe), date of birth (for age verification), social security number (to establish identity in the United States), current residential address (including city and zip code, e.g., 123 Main St, Los Angeles, CA 90001), contact information (such as phone number, e.g., (123) 456-7890, and email address), and employment details (including employer name and position). Providing accurate identification details ensures compliance with financial regulations and expedites the loan disbursement process.

Detailed explanation of the emergency situation

Emergency loans provide critical financial assistance during unexpected circumstances, such as medical emergencies, natural disasters, or urgent home repairs. Situations like hospitalizations can incur unexpected medical expenses, potentially exceeding thousands of dollars, leaving individuals in dire need of funds. Natural disasters, like hurricanes or floods, often result in extensive property damage, requiring immediate financial support for repairs to ensure safety and stability. Urgent home repairs, such as fixing a broken heating system during winter, can also create a critical situation where funds are needed swiftly to avoid further complications. In each of these instances, emergency loans serve to alleviate financial stress, allowing individuals to address their immediate needs without the burden of long-term debt.

Specific loan amount requested

When individuals seek financial assistance during unexpected crises, an emergency loan can provide crucial support. The specific loan amount requested may vary based on personal needs, circumstances, or financial obligations. For instance, an individual facing medical expenses might request a loan of $5,000 to cover hospital bills, while someone dealing with unexpected home repairs might seek $10,000 for urgent renovations. Such loans typically require rapid approval processes and may involve personal identification details such as Social Security numbers or bank account statements to verify income and establish repayment capability. Interest rates on emergency loans can differ widely, often ranging from 6% to 36%, depending on the lender's terms and the borrower's creditworthiness. Additionally, seeking loans from reputable sources, such as credit unions or recognized online lenders, can help mitigate the risks associated with predatory lending practices prevalent in the sector.

Repayment plan and assurance

In an emergency loan application, presenting a clear repayment plan is crucial for obtaining financial assistance. A viable repayment plan typically outlines the total loan amount requested, the repayment period, and the monthly installment amount based on interest rates offered by lenders. Including specific financial details such as current income, monthly expenses, and any existing debt obligations helps demonstrate the applicant's ability to manage repayments. It is essential to assure the lender of a commitment to timely payments, supported by a stable source of income, potentially from a job in a reputable company or consistent freelance work, and highlight any past credit history showcasing responsible borrowing. This comprehensive approach not only reassures the lender of the applicant's dedication to fulfilling their obligations but also establishes a foundation of trust necessary for securing the emergency funds.

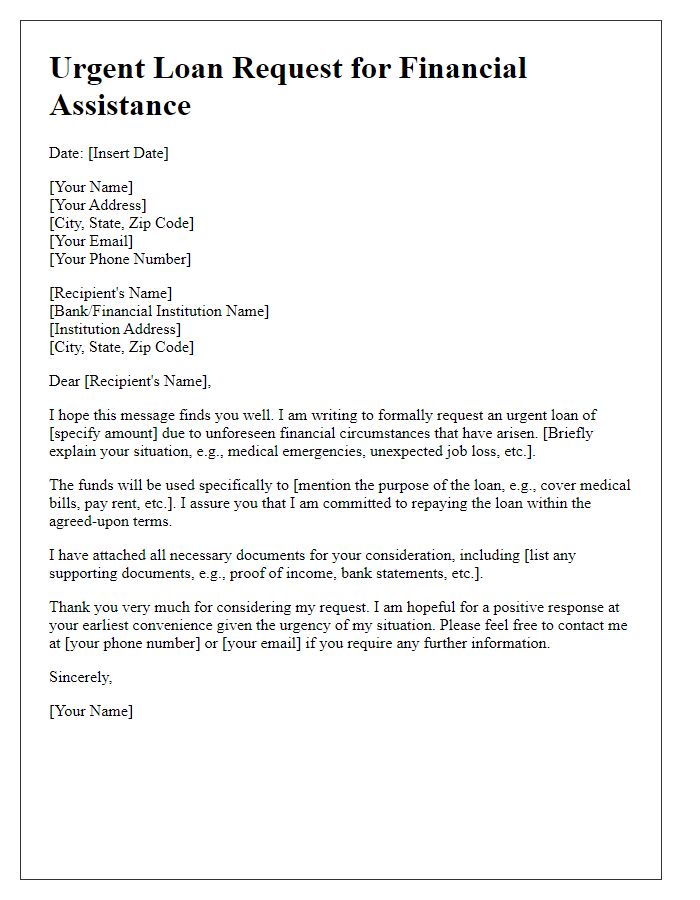

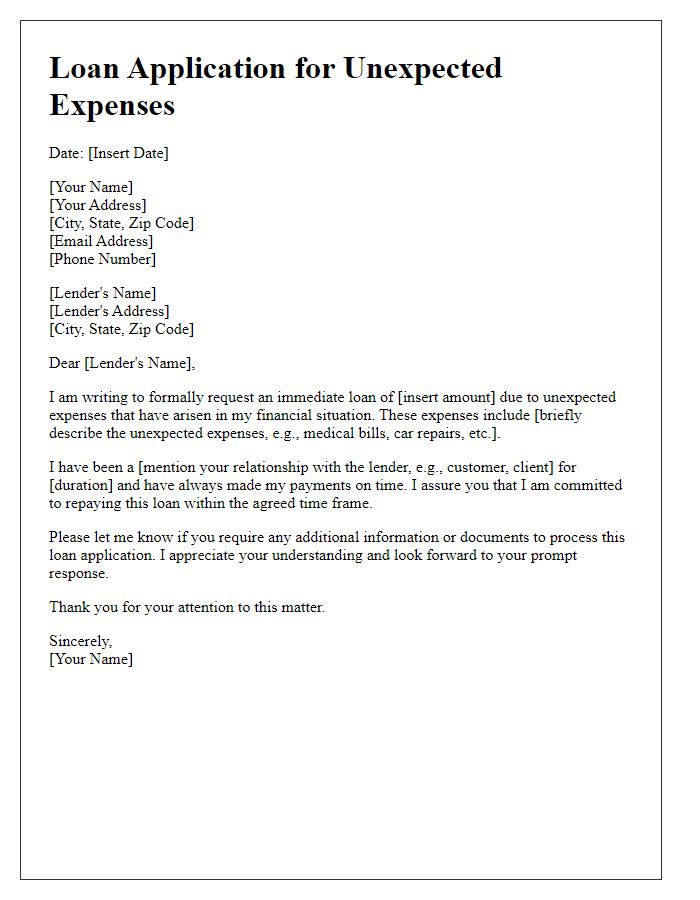

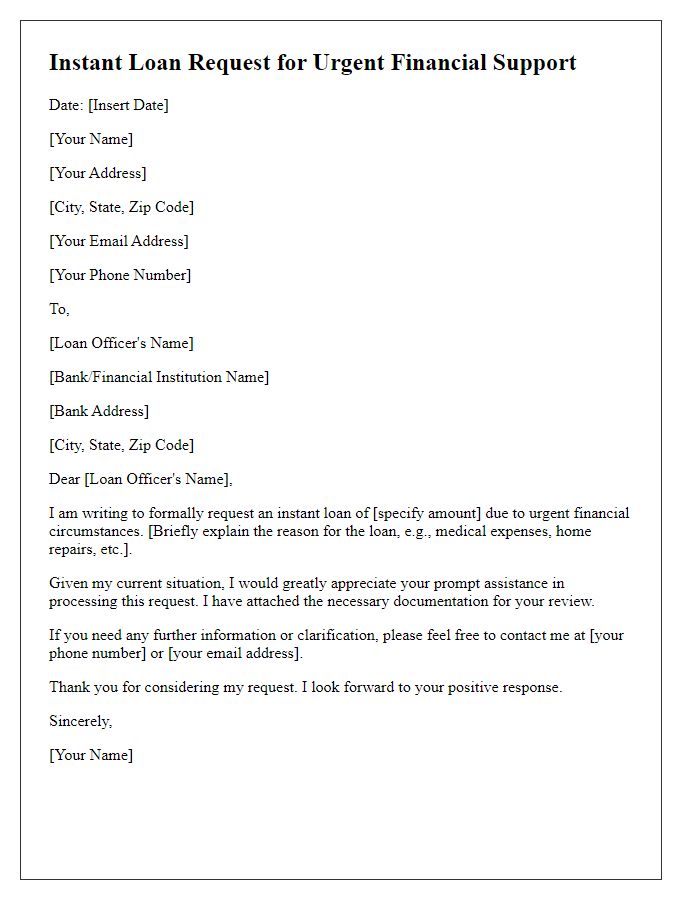

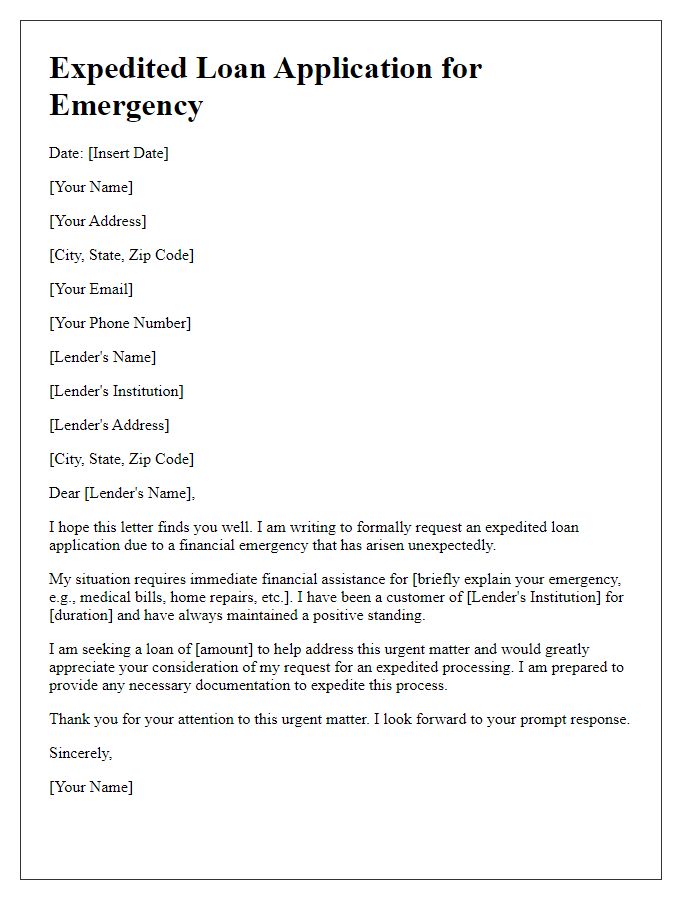

Letter Template For Emergency Loan Application Samples

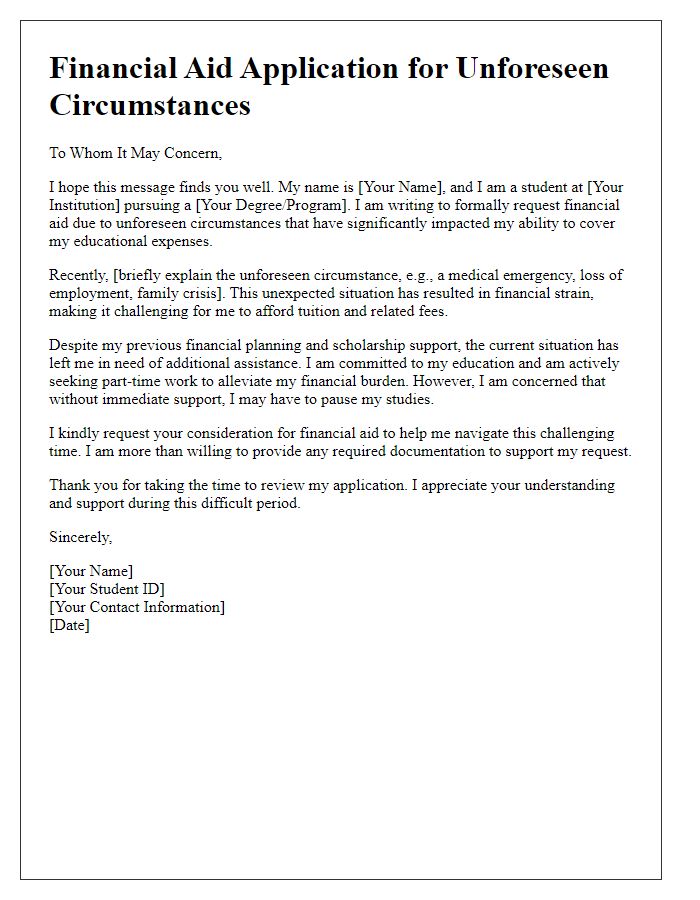

Letter template of swift financial aid application for unforeseen circumstances

Comments