Are you finding yourself in the situation of having overpaid on your loan? It can be both confusing and frustrating to navigate the intricacies of loan repayments, especially when you realize you've paid more than necessary. Knowing how to request a refund can save you time and stress, and ensure you get your hard-earned money back. Stick around, as we'll guide you through a simple, effective letter template for requesting a loan overpayment refund!

Loan account details

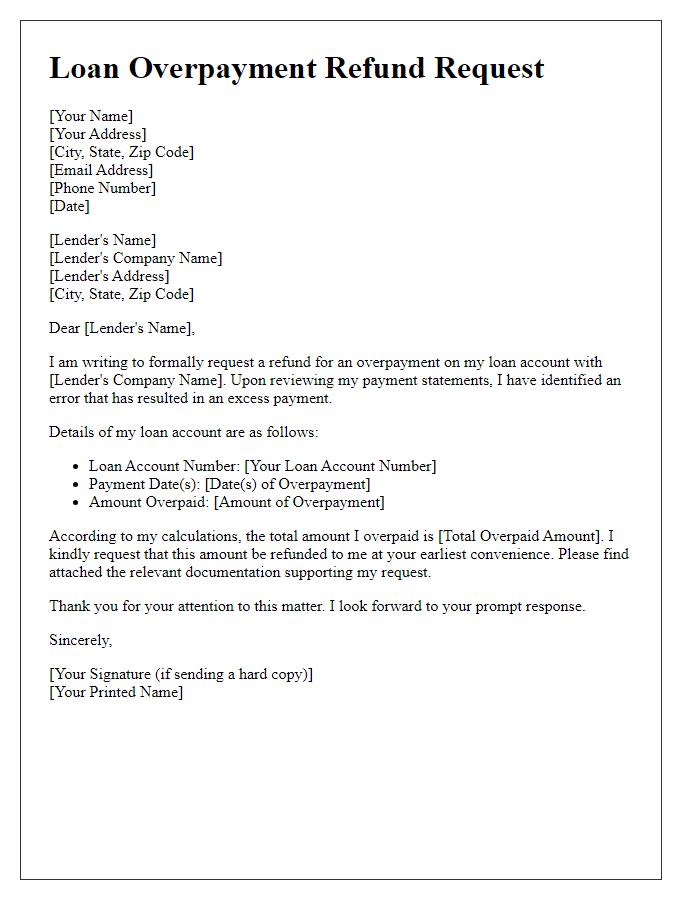

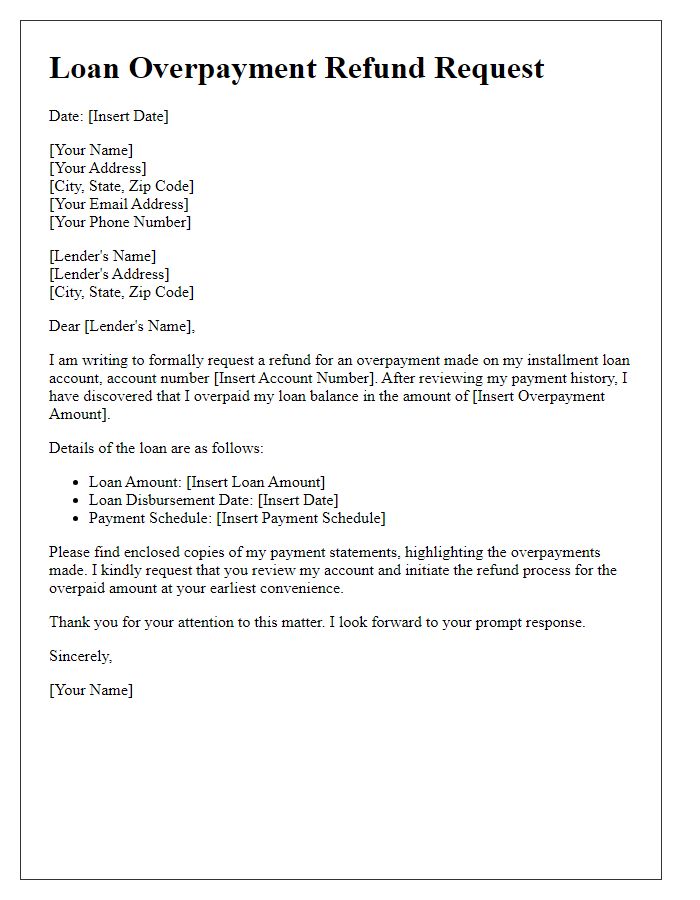

Loan overpayment refund requests often involve specific account information that facilitates the review process. The loan account number serves as a unique identifier for the loan in question, allowing financial institutions to quickly locate relevant documents and transaction history. Additionally, including the original loan amount, repayment schedule dates, and the total payments made can provide essential context regarding the overpayment. Details such as the loan provider's name and contact information are also crucial, as they ensure the request reaches the right department. These elements contribute to a clear and thorough request, increasing the likelihood of a prompt resolution.

Overpayment amount

In financial transactions involving loans, overpayment can occur when borrowers pay more than the amount owed, resulting in a credit balance. For instance, if a borrower pays $1,200 when the actual amount due is $1,000, the overpayment amount is $200. This excess payment often arises due to miscalculations, payment processing errors, or changes in loan terms. To rectify this, borrowers can submit a refund request to their lending institution, outlining details such as the loan account number, the exact overpayment amount, and any supporting documentation, like payment receipts. Utilizing clear communication is essential to expedite the processing of the refund.

Request for refund

Loan overpayments can significantly impact financial planning for individuals and businesses alike. Borrowers often encounter situations where repayments, such as personal loans or mortgages, exceed the agreed-upon amounts due. In these instances, formal requests for refunds become essential to reclaiming overpaid funds. Accurate documentation, like repayment schedules and transaction records, is crucial for demonstrating the overpayment to financial institutions. Timely action after discovery of the discrepancy, typically within the statutory period, enhances the likelihood of favorable resolution. Engaging with customer service representatives and following institutional procedures ensures a smoother refund process. Proper follow-up can facilitate clarification and expedite the return of overpaid amounts, ultimately restoring financial balance for borrowers.

Contact information

Contact information for loan overpayment refund requests typically includes essential details such as the borrower's full name (important for identification purposes), the loan account number (specific for tracking the loan in question), the address associated with the loan (ensures correspondence is sent to the correct location), phone number (allows for direct communication regarding the request), and email address (provides an electronic method for updates). Additionally, it is advisable to include the date of the request, which can be relevant for processing timelines, and any relevant documentation, such as proof of overpayment (detailed account statements showing excess payments), to support the refund claim.

Supporting documentation

Loan overpayment refund requests require precise documentation to substantiate claims. Essential paperwork includes payment history statements detailing all transactions related to the loan, typically spanning the entire duration of the loan agreement. The original loan agreement, dated with signatures, must be included to illustrate terms of the loan repayment plan. Additional evidence such as bank statements reflecting the overpayment amount and any correspondence with the lending institution, particularly emails or letters discussing payment arrangements, is crucial. Supporting details about the loan account number, lender's contact information, and specific dates of payments enhances clarity and expedites processing of the refund request.

Letter Template For Loan Overpayment Refund Request Samples

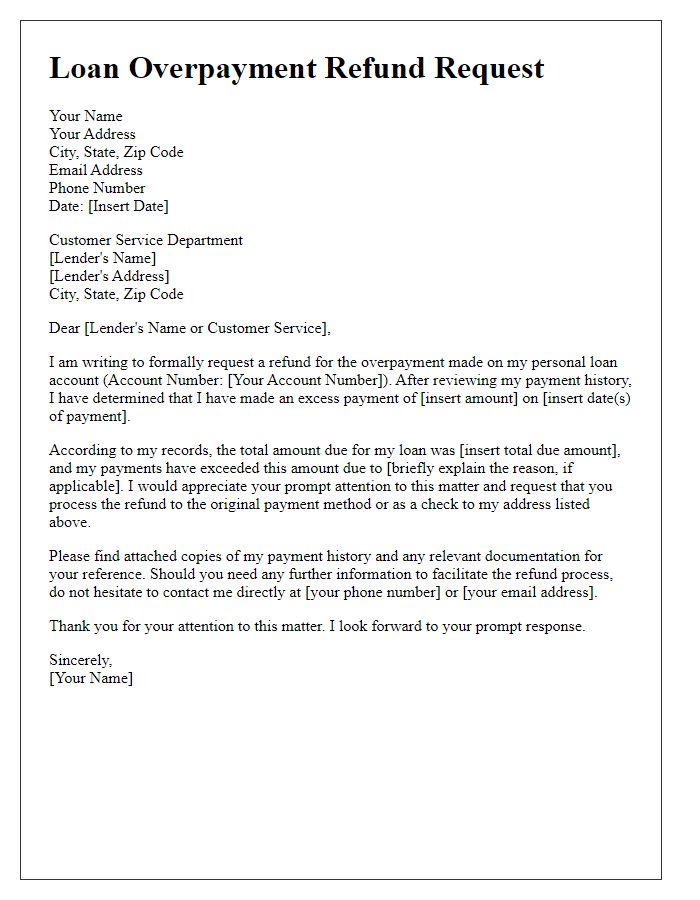

Letter template of loan overpayment refund request following loan closure.

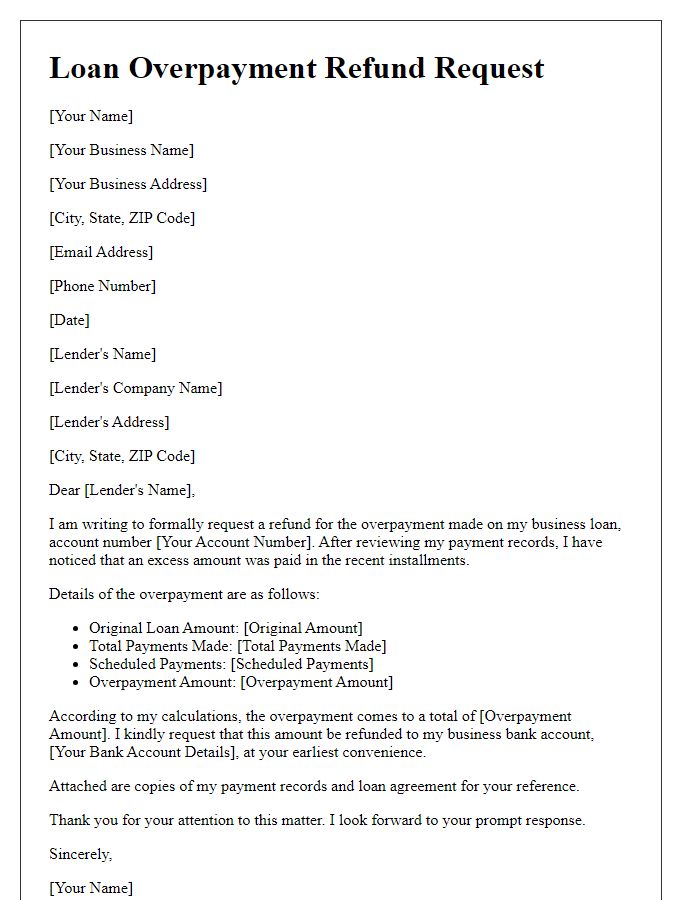

Letter template of loan overpayment refund request with interest calculation.

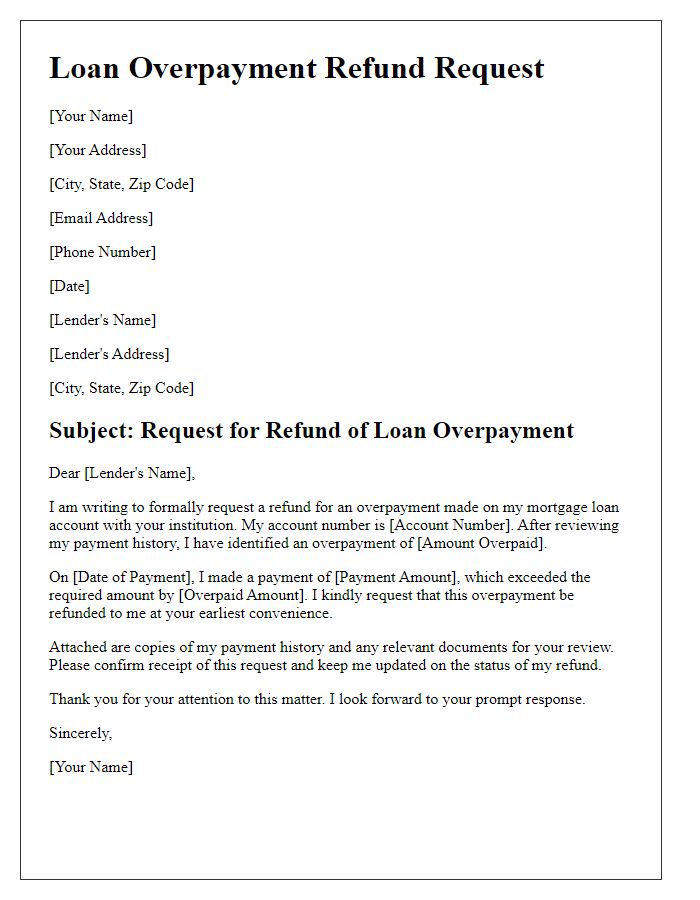

Letter template of loan overpayment refund request with supporting documents.

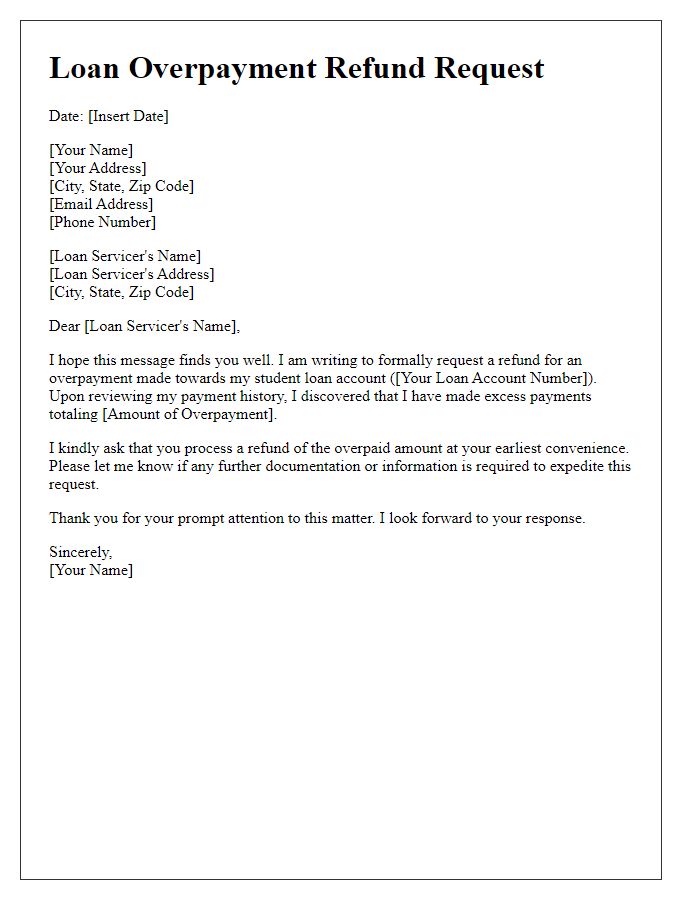

Letter template of loan overpayment refund request for a specific lender.

Comments