Are you seeking clarity about your loan details? It can be overwhelming to keep track of changing terms, interest rates, and repayment options. Our updated loan information letter is designed to simplify everything for you, ensuring you're well-informed about your financial commitments. Dive into the details and explore how our new policies can benefit youâread on for more insights!

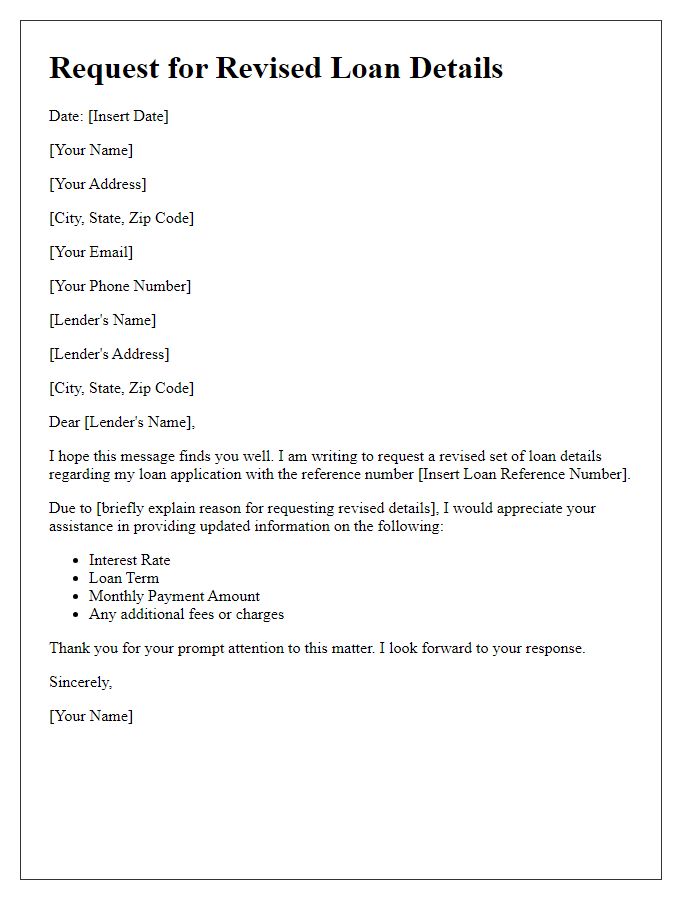

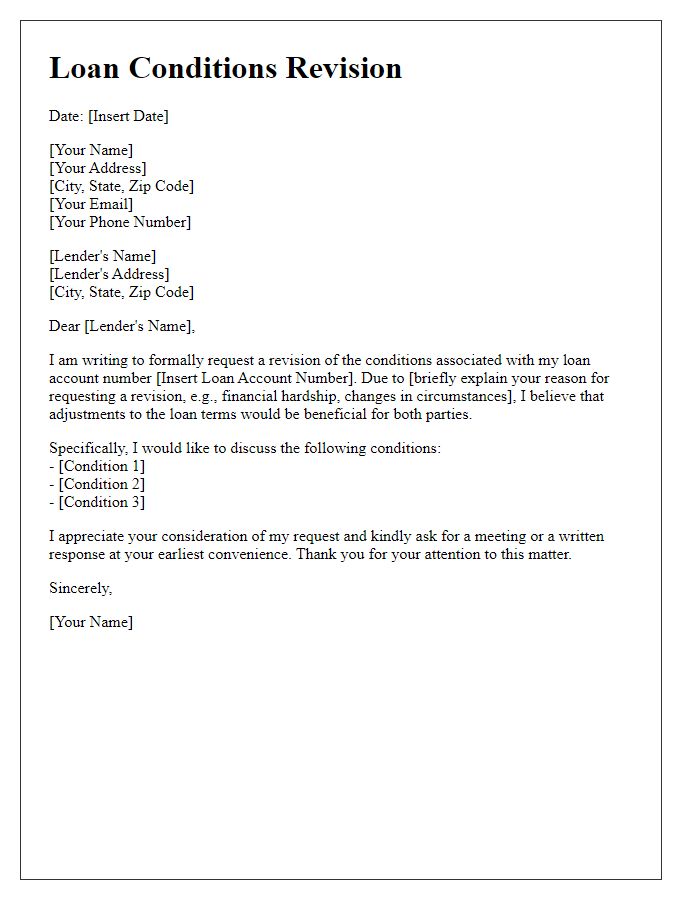

Personalization and Recipient Details

Updated loan information includes critical details such as loan amount, interest rate, repayment schedule, and any changes to terms or conditions. Personalization enhances communication effectiveness by addressing specific recipient needs and circumstances. Including the recipient's name, account number, and relevant dates in correspondence ensures clarity and establishes a connection. Updating recipients on financial matters facilitates transparency and fosters trust. Regularly reviewing and revising loan information, especially during significant events such as refinancing or interest rate changes, equips borrowers with necessary understanding for informed decision-making.

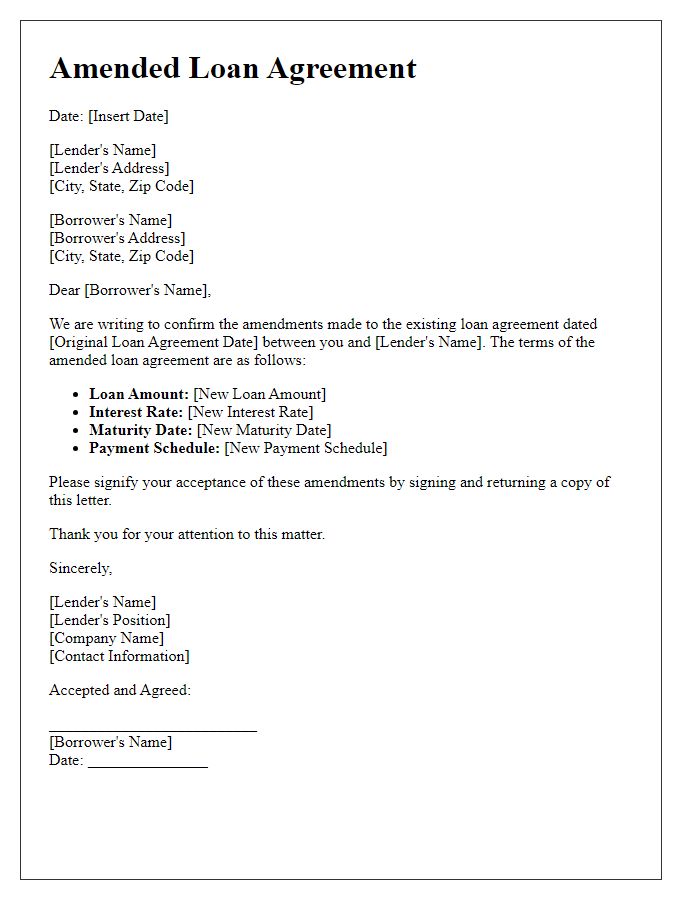

Loan Account Summary

A loan account summary provides a comprehensive overview of current loan details, including the principal balance, interest rate, payment schedule, and remaining term. Key figures, such as the total loan amount disbursed ($250,000 for a 30-year fixed-rate mortgage) and the current outstanding balance ($200,000 after five years of payments), highlight the financial progress. Important dates, like the next payment due date (January 15, 2024) and the loan maturity date (December 15, 2053), are crucial for maintaining an effective repayment strategy. Additionally, any changes in the interest rate (currently fixed at 3.5%) and applicable fees (origination fees of 1% of the loan amount) should be clearly indicated to ensure transparency. Enhanced details about payment history, including the number of payments made and late payment occurrences, contribute to a better understanding of the loan's management.

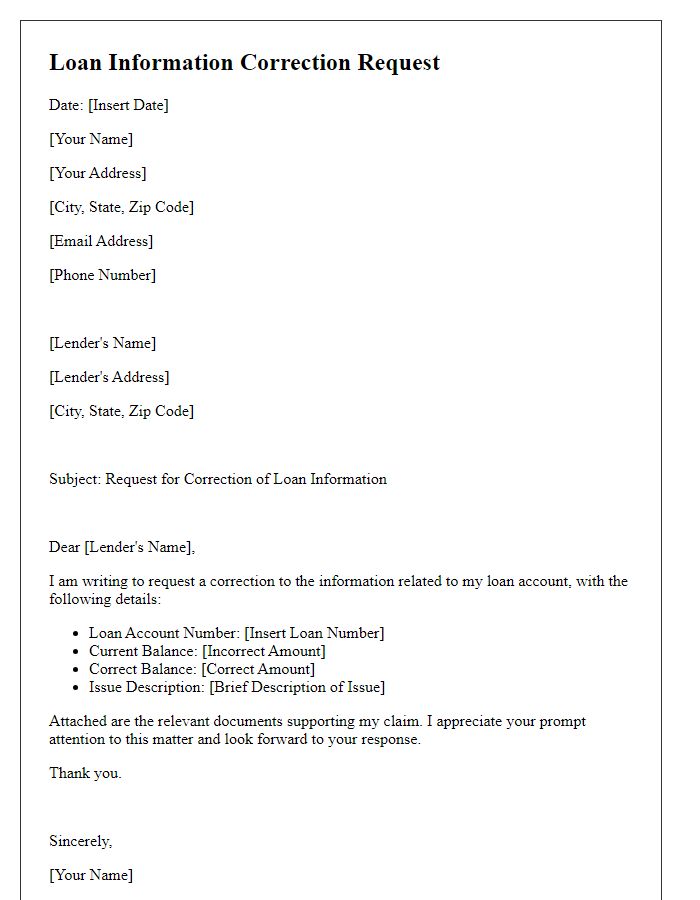

Changes and Updated Terms

Updated loan information reflects critical changes in terms affecting borrowers. The revised interest rate, now at 4.5% as of October 2023, replaces the previous rate of 5.2%, providing potential savings over time. The loan duration has been adjusted to a maximum of 30 years, ensuring lower monthly payments while increasing overall interest costs. New fees, including an origination fee of $1,500 applicable upon closing in major cities like New York and Los Angeles, may impact final loan amounts. Additionally, updated eligibility criteria necessitate a minimum credit score of 650 and documented income levels, ensuring better risk management and borrower reliability. Borrowers are encouraged to review these modifications to understand their new repayment responsibilities effectively.

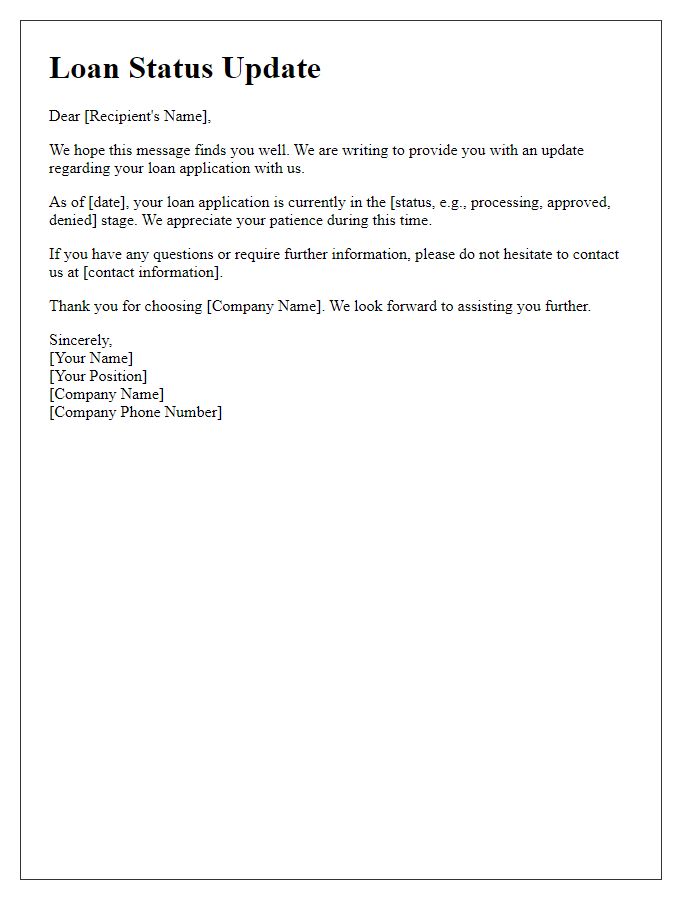

Contact Information for Inquiries

Updated loan information includes essential details regarding interest rates, repayment schedules, and outstanding balances. Loan servicers, financial institutions, or credit unions frequently communicate changes in loan agreements. For any inquiries or clarifications, borrowers should contact customer service via phone or email at designated contact points. Accurate contact details ensure efficient communication, allowing borrowers to address concerns related to their loans promptly. Notification of updated terms may also arrive through official letters or emails, highlighting the importance of maintaining current contact information with your lender.

Call to Action and Next Steps

Updated loan information requires immediate attention for borrowers to ensure clarity on terms and obligations. Recent changes (such as adjusted interest rates, repayment schedules, or new fees) can significantly impact monthly payments and overall financial planning. Borrowers should review all documentation carefully, noting critical dates for the first payment due or potential grace periods. Contact your loan officer or financial advisor for personalized advice and to discuss specific questions. Additionally, accessing the lender's online portal can provide real-time updates and tools for budgeting effectively. Timely action on these updates can prevent misunderstandings and promote a smoother repayment process.

Comments