Are you looking to get a loan payoff letter but unsure how to request one? Don't worry, it's simpler than you think! This article will guide you through the essential elements you need to include in your letter and provide a handy template to make the process even easier. So, let's dive in and help you take that next step towards financial freedom!

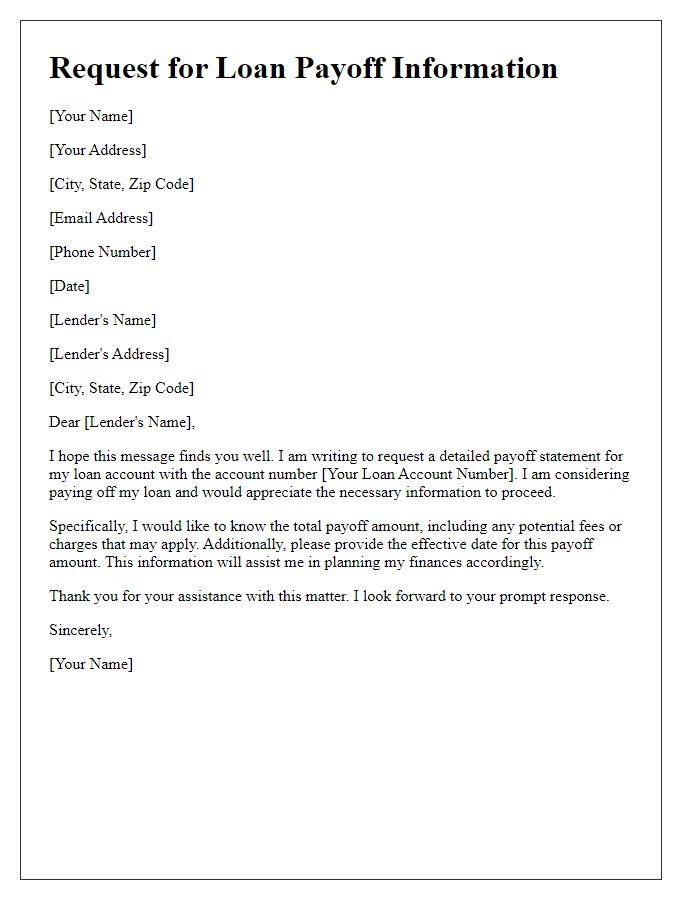

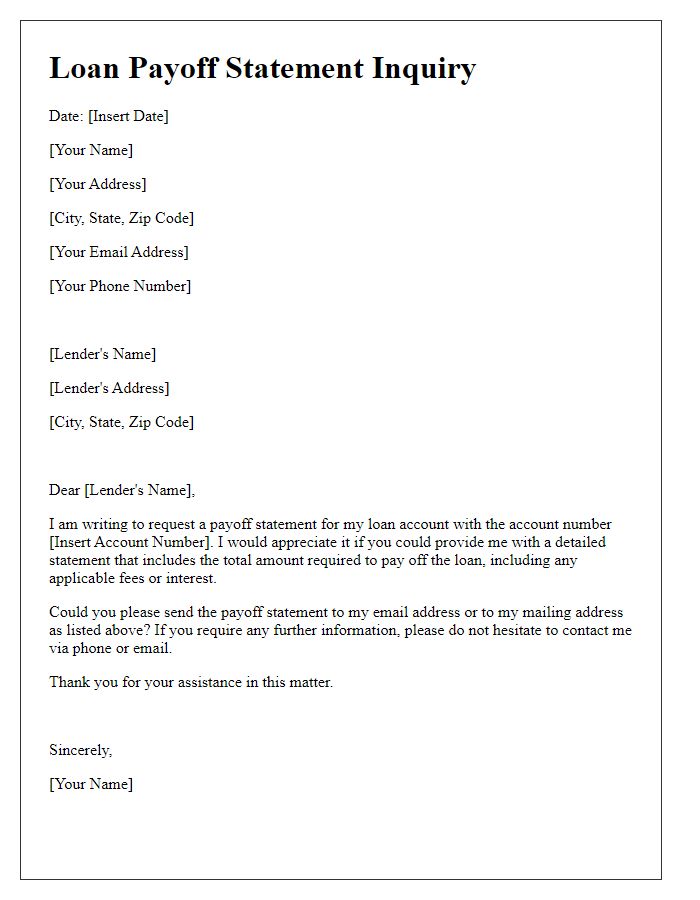

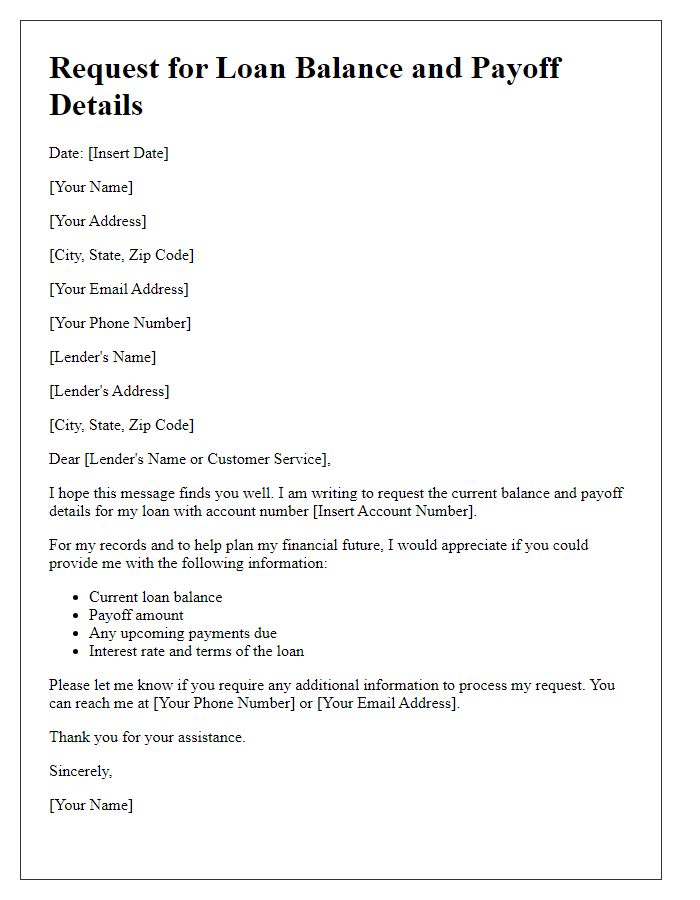

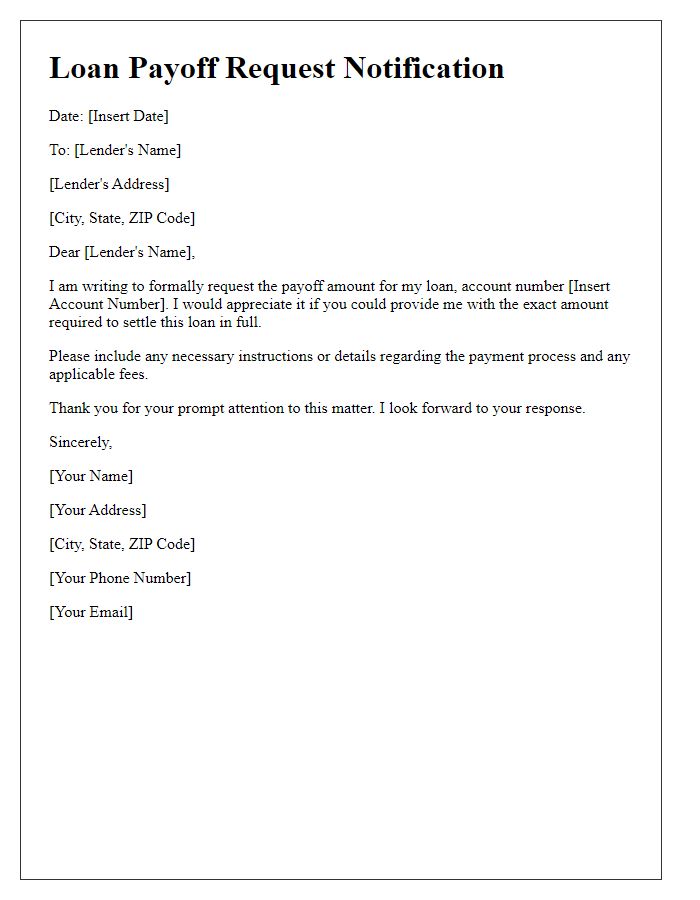

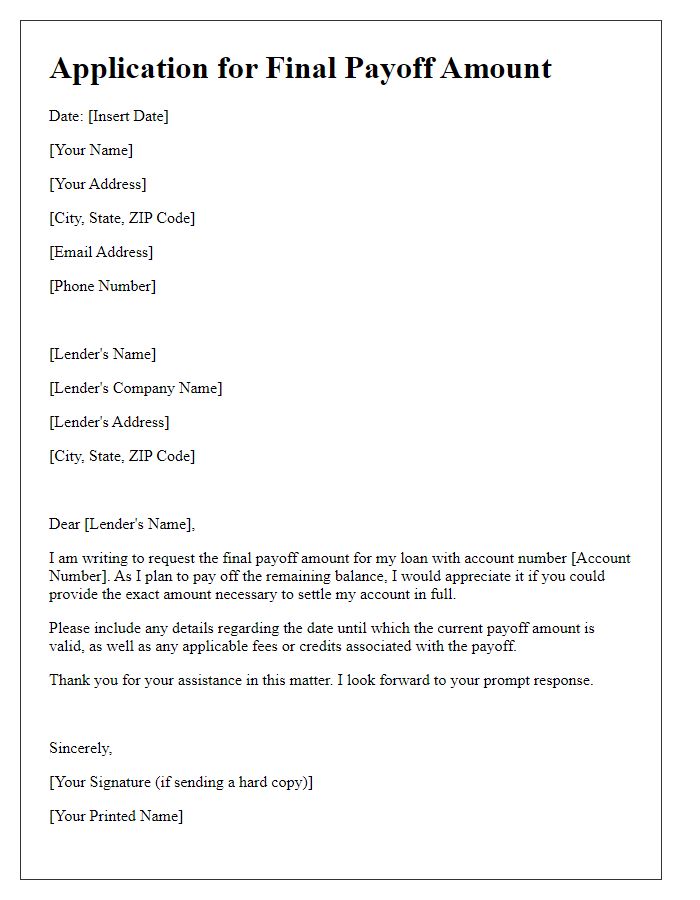

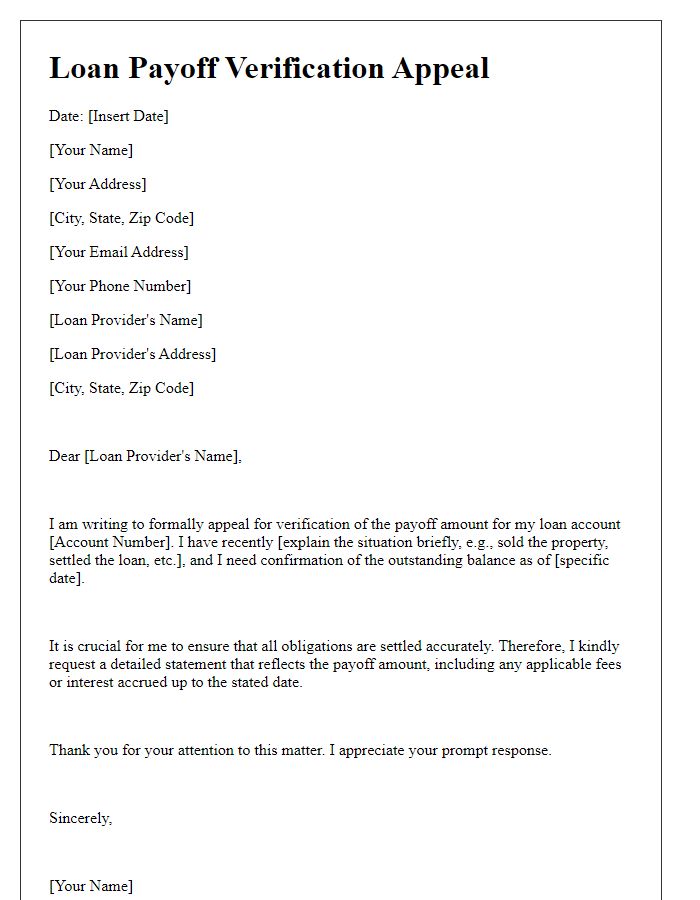

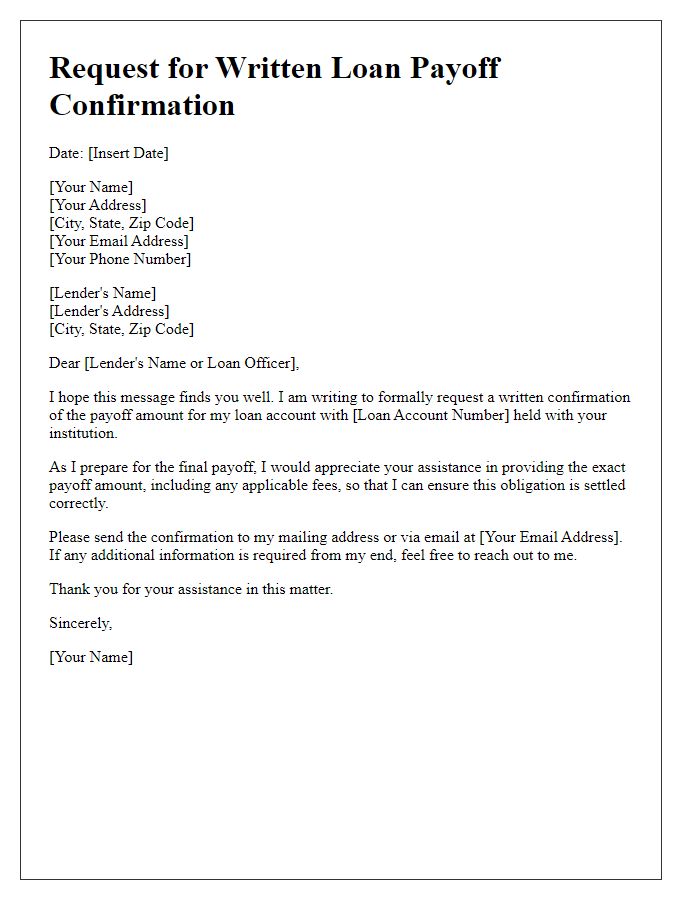

Borrower's Information

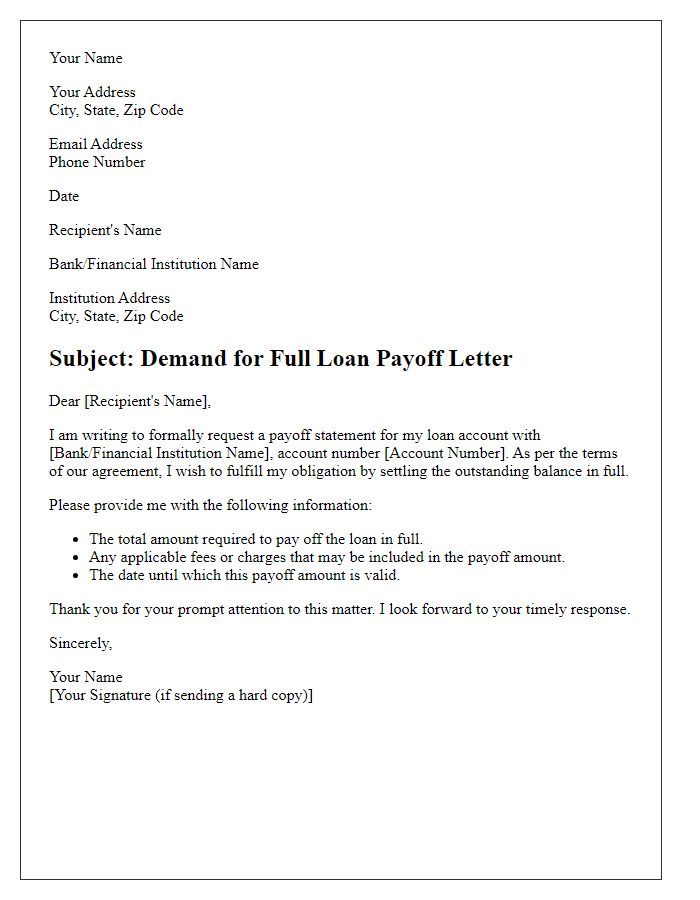

The loan payoff request is crucial for borrowers seeking clarity on their outstanding debt, particularly for personal loans or mortgages. Borrower's information includes full name, important identification number (like Social Security Number), and contact details for effective communication. The name of the lending institution along with the loan account number should also be specified to ensure proper processing of the request. Additional details such as the loan type and original loan amount could help in pinpointing the exact details tied to the account. Timely submission of this information ensures quick processing and accurate payoff statements, essential for planning financial decisions.

Loan Account Details

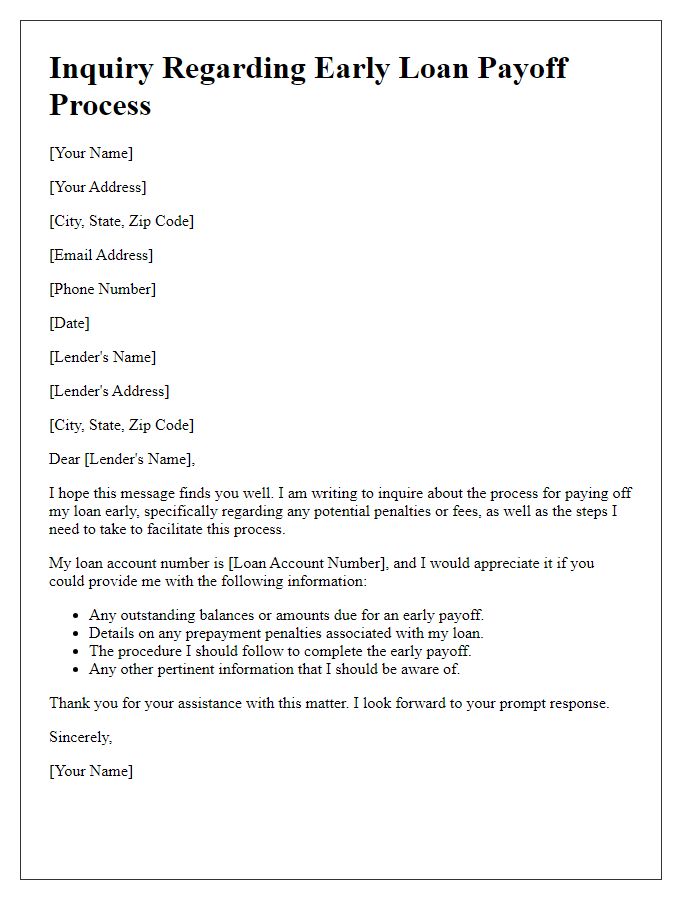

A loan payoff letter request typically includes essential loan account details, such as loan account number, original loan amount, current balance (as of a specific date), interest rate percentage, and payment history summary. Providing the loan servicer with your full name, contact information, and any other identifying information (like social security number or date of birth) ensures accurate processing. Furthermore, mentioning applicable dates--such as the desired payoff date and the timeframe of the requested statement--adds clarity to the request. Specifying whether requesting a precise payoff figure that includes the final interest calculation--critical for closing the loan accurately--can prevent confusion.

Payoff Amount Request

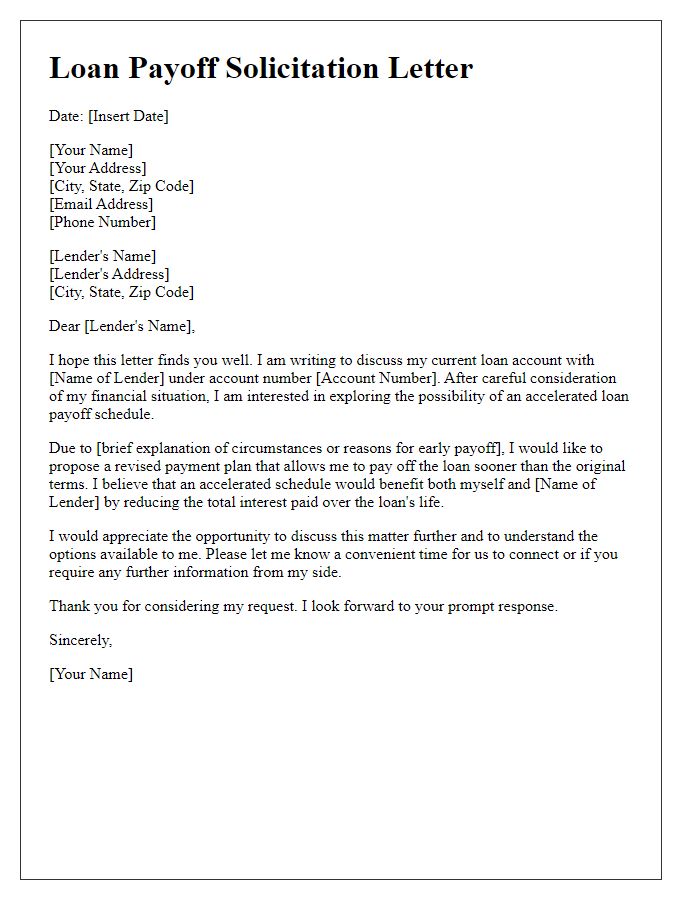

Payoff amount requests are crucial for borrowers seeking to settle their loans efficiently. This request usually occurs after making regular payments over a specific period, like 30 years for a mortgage. Borrowers may need the payoff amount for various reasons, such as selling a property or refinancing at lower interest rates, typically around 3-5%. Key details in the request include the loan account number, which helps lenders identify the specific loan, and the borrower's contact information for follow-up. Timely responses are essential, as payoff amounts may change daily due to accumulating interest.

Contact Information

Submitting a loan payoff letter request is an important step in managing financial obligations. Borrowers should include accurate contact information, such as full names, addresses, phone numbers, and email addresses, ensuring the lending institution can easily identify the account. This clarity helps eliminate any potential confusion regarding the loan details. Including the loan account number is critical, as it allows the lender to quickly locate the specific loan in question. Additionally, mentioning the specific loan type, such as personal, mortgage, or auto loan, provides context. Clear and precise communication contributes to smooth processing and timely receipt of the loan payoff details.

Preferred Payoff Date

A loan payoff letter request serves as a formal communication to a lending institution, seeking confirmation of the total amount owed on a loan, including interest and fees. This letter typically specifies a preferred payoff date, allowing borrowers to plan their finances effectively. An accurate payoff statement is crucial for avoiding any potential late fees or miscalculations. When submitting the request, include essential details such as loan number, account information, and the exact date (mm/dd/yyyy) when the payoff is intended to occur. Prompt processing of this request ensures that all parties have clarity on the final transaction and helps in the smooth completion of loan repayment.

Comments