Are you grappling with the complexities of student loan repayment? Navigating your options can feel overwhelming, but it doesn't have to be. Understanding the various repayment plans can empower you to make informed decisions for your financial future. Dive into our article to discover the best strategies for managing your student loan repayment!

Loan Account Information

Student loan repayment information is crucial for managing finances effectively. Key details to include: Loan Account Number (a unique identifier for tracking loans), Lender Name (the institution holding the loan, such as the U.S. Department of Education or private banks), Loan Type (federal loans like Direct Subsidized or Private loans), Current Balance (the total amount owed, which may vary monthly), Interest Rate (the percentage charged on the outstanding balance, impacting total repayment), Monthly Payment Amount (the scheduled payment amount necessary to pay off the loan), and Repayment Terms (conditions under which repayment occurs, including duration and grace period). Accurate and comprehensive documentation ensures a streamlined repayment process and helps avoid defaults.

Repayment Plan Options

Understanding repayment plan options for student loans can significantly influence a borrower's financial stability post-graduation. The Federal Student Aid website (studentaid.gov) presents various plans, including Income-Driven Repayment (IDR) options tailored to income fluctuations. Standard Repayment plans typically span ten years, allowing borrowers to pay fixed amounts, while Graduated Repayment plans start with lower payments that increase every two years. Extended Repayment options can extend repayment to up to 25 years, which may benefit those with significant debt, exceeding $30,000. Moreover, consolidation through Direct Consolidation Loans allows borrowers to combine multiple loans, potentially simplifying payments and offering alternative repayment schedules. Understanding these details can empower borrowers in making informed decisions about their financial future.

Financial Hardship Explanation

Navigating the complexities of student loan repayment can be particularly challenging for individuals facing significant financial hardship, often characterized by unforeseen circumstances such as unexpected medical expenses, job loss, or extensive personal debts. For instance, monthly income (averaging around $2,500 for entry-level positions) may be insufficient to cover basic living expenses (such as rent averaging $1,200 in urban areas), leaving individuals in a precarious financial situation. To alleviate this burden, borrowers can explore options like income-driven repayment plans, which can potentially reduce monthly payments to a manageable percentage of discretionary income, often assessed yearly based on federal poverty guidelines. Simultaneously, borrowers should consider requesting forbearance or deferment to temporarily pause payments if they encounter unexpected life events or economic downturns. This multifaceted approach is crucial for ensuring that financial decisions remain sustainable while adhering to responsible loan management practices.

Contact and Communication Details

A comprehensive student loan repayment plan requires clear communication channels for effective management. Borrowers should maintain updated contact information, including a primary phone number (preferably mobile, as of 2023, over 80% prefer this method for accessibility), an email address (with a focus on reliable providers like Gmail or Outlook), and a permanent mailing address (for official documents). Borrowers may also benefit from setting up an online account with their student loan servicer, such as Nelnet or FedLoan, for easy access to account details. Regular communication via monthly statements (usually issued by the 5th of each month) and effective responsiveness through customer service, whether via phone (often with wait times averaging between 10 to 15 minutes) or online chat features, is essential for staying informed and managing any potential repayment challenges efficiently.

Signatures and Authorization

The completion of the student loan repayment plan necessitates signatures and authorization from both the borrower and the lender. This document serves as a binding agreement to outline terms for repayment of federal or private student loans, such as those issued under the William D. Ford Direct Loan Program, which includes subsidized and unsubsidized loans. Borrowers are required to provide personal identification details, such as their Social Security Number and date of birth, as well as the total loan amount, monthly payment amounts, and interest rates specified in the promissory note. The lender must also include their official institution name, Federal Student Aid (FSA) ID, and authorized representative's signature, confirming acceptance of the repayment terms. This process is essential to ensure compliance with federal regulations and to establish clear communication between both parties throughout the life of the loan, which may span several decades.

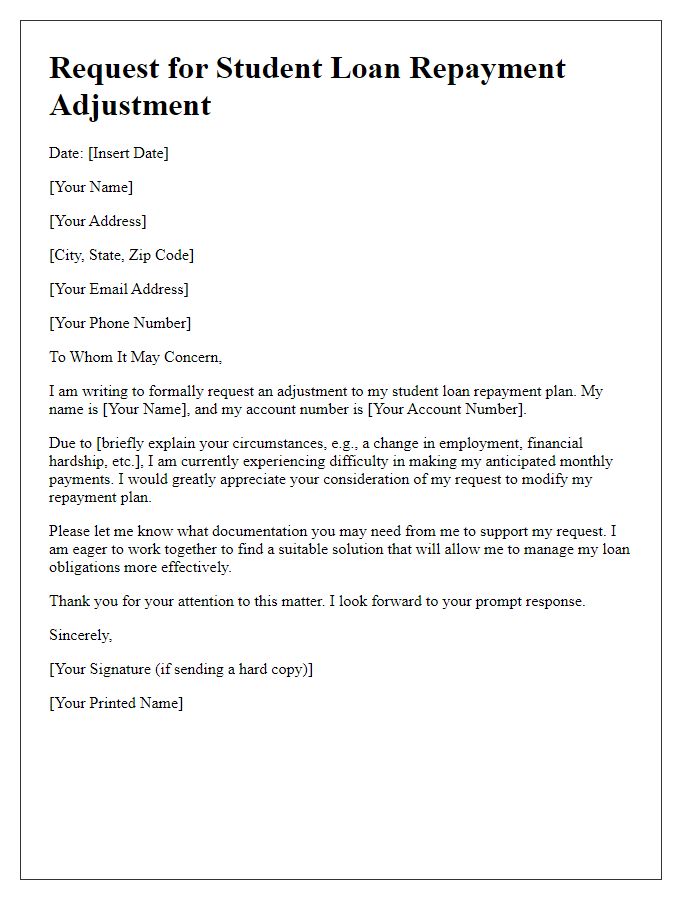

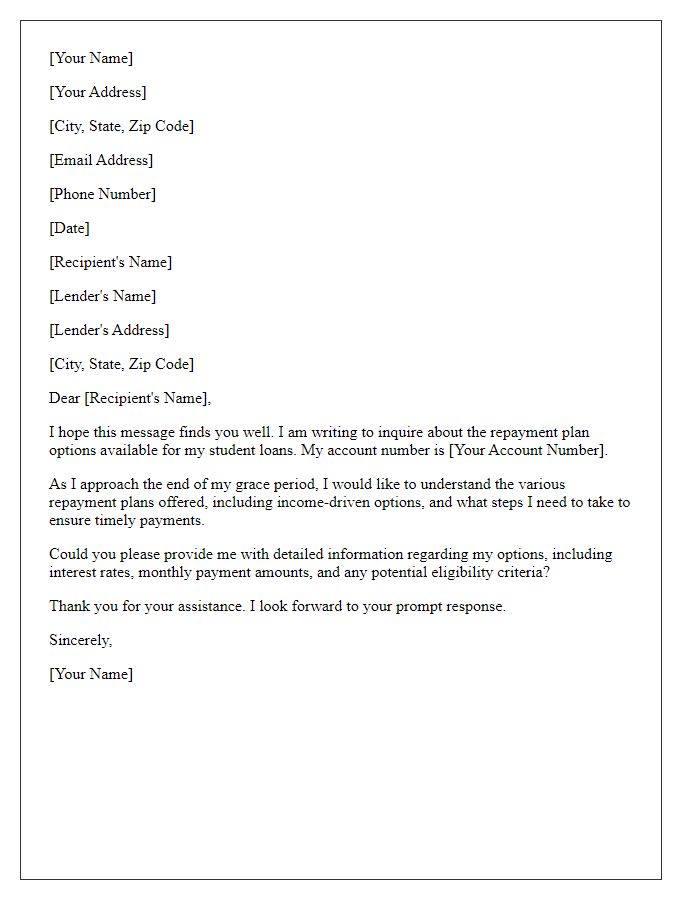

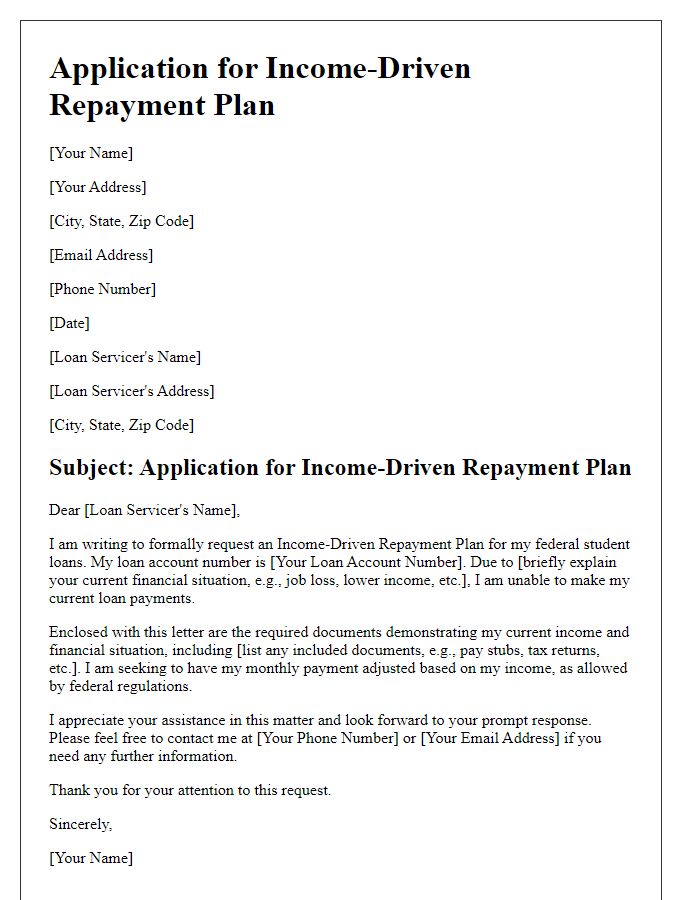

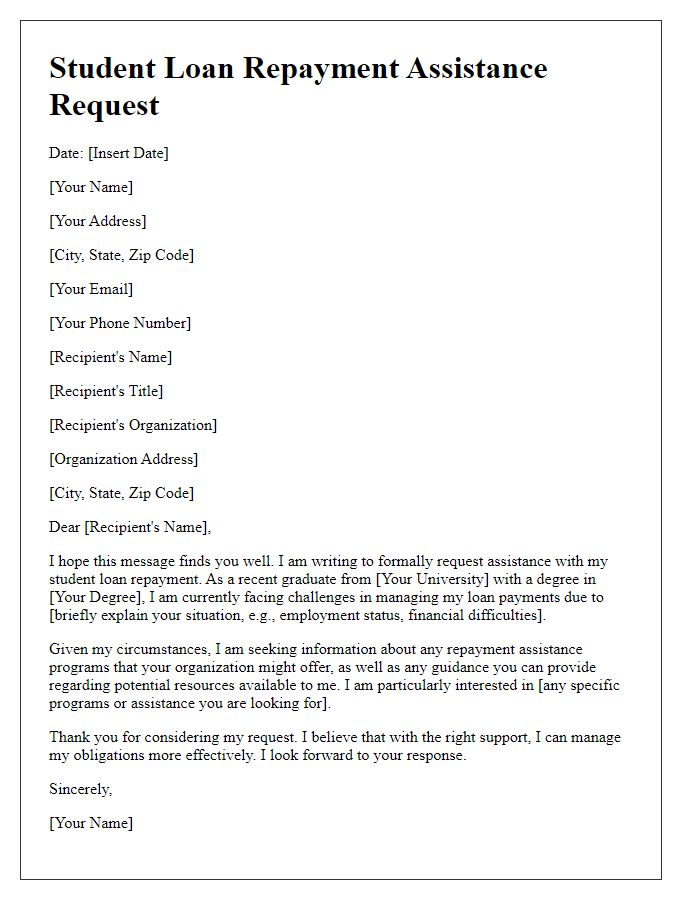

Letter Template For Student Loan Repayment Plan Samples

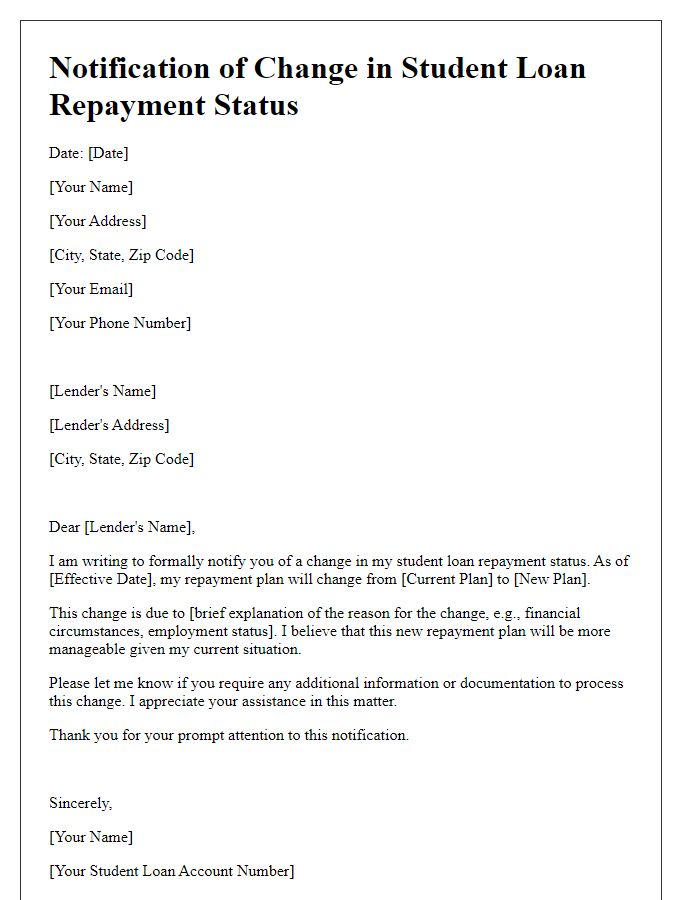

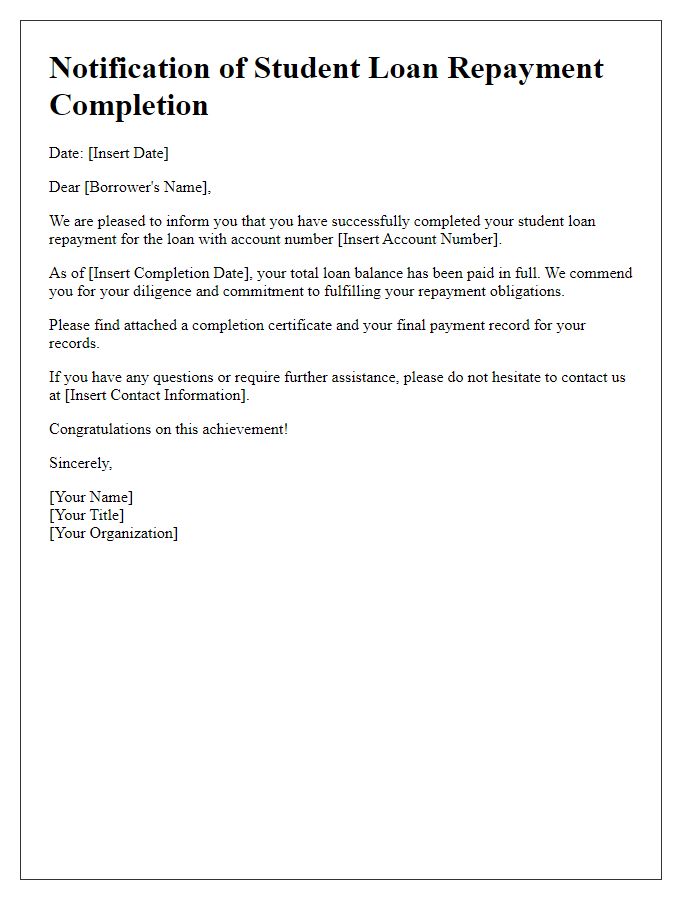

Letter template of Notification of Change in Student Loan Repayment Status

Comments