Navigating the world of loans can sometimes feel overwhelming, especially when it comes to understanding the fine print. Whether you're securing a mortgage, personal loan, or business loan, having a clear grasp of the terms is essential to make informed decisions. In this article, we'll break down the key components of loan agreements so you can approach your financial commitments with confidence. So, grab a cup of coffee and let's dive into the details together!

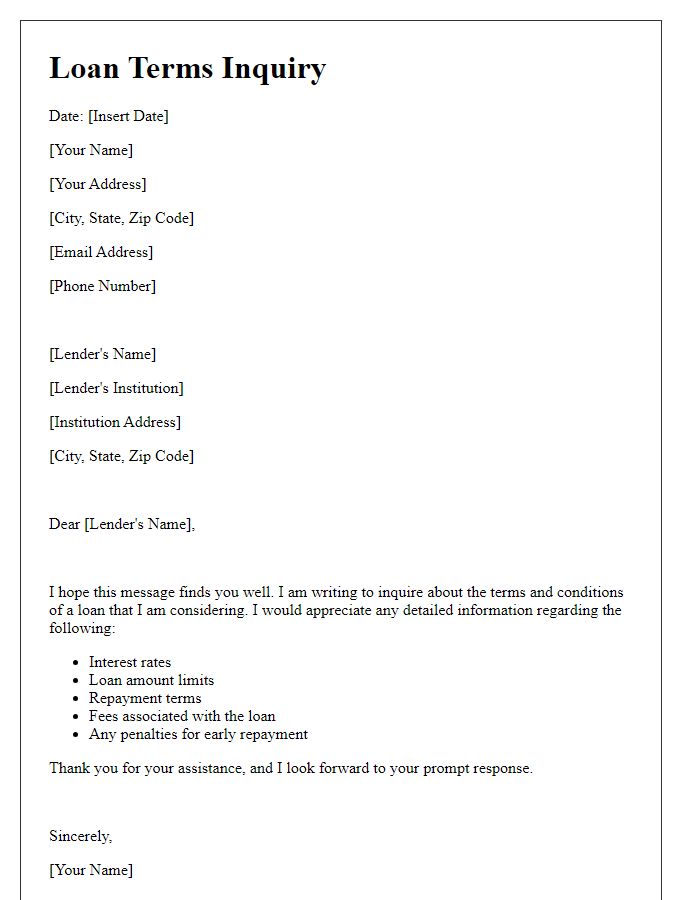

Borrower's Personal Information

Clarifying borrower personal information is essential in the loan application process to ensure accuracy and compliance with financial regulations. Typical categories include full name (first, middle, last), date of birth (specific day, month, year), social security number (nine-digit identification), current residential address (street, city, state, ZIP code), along with contact numbers (mobile, home) and email address (for communication). Employment information is crucial, detailing current employer's name, position or job title, and duration of employment (start date to present). Additionally, income documentation would require monthly or annual income figures (gross income), along with any supplemental income sources (bonuses, alimony, etc.) to ascertain the borrower's financial standing and repayment capacity.

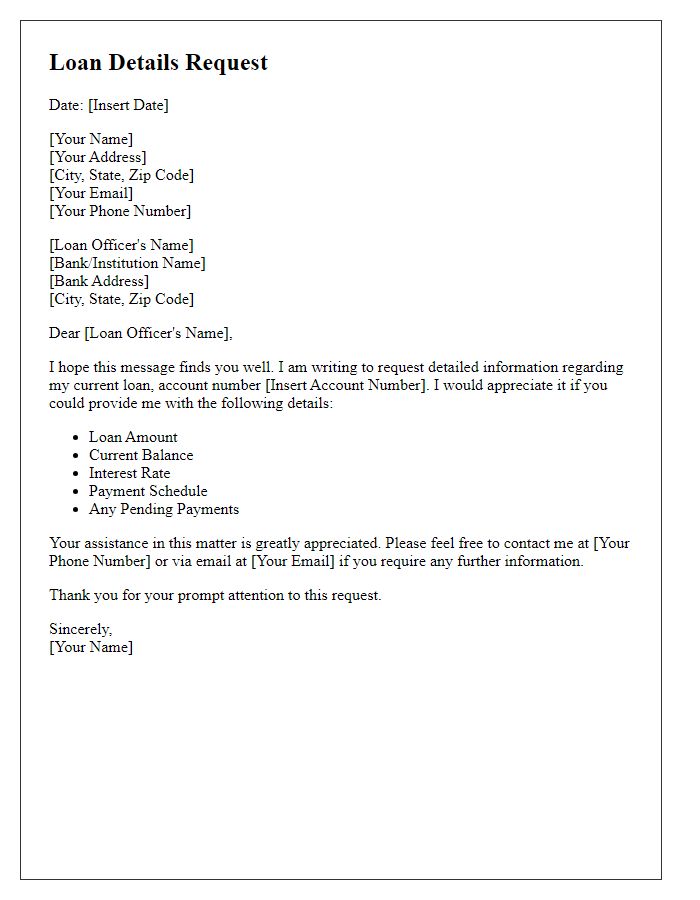

Loan Amount and Disbursement Details

Loan agreements often include critical details about the principal sum, which refers to the total loan amount borrowed, such as $50,000 for personal or business needs. Disbursement details dictate how these funds are released, commonly through a direct bank transfer, check issuance, or in installments. For instance, a borrower might receive an initial disbursement of 50% at loan approval, with the remaining balance provided upon meeting specific conditions, such as submitting financial documentation or completing a project milestone. Understanding repayment terms, including interest rates typically ranging from 5% to 15% based on credit scores, and the repayment period, which might last from five to twenty years, is essential for managing financial commitments effectively.

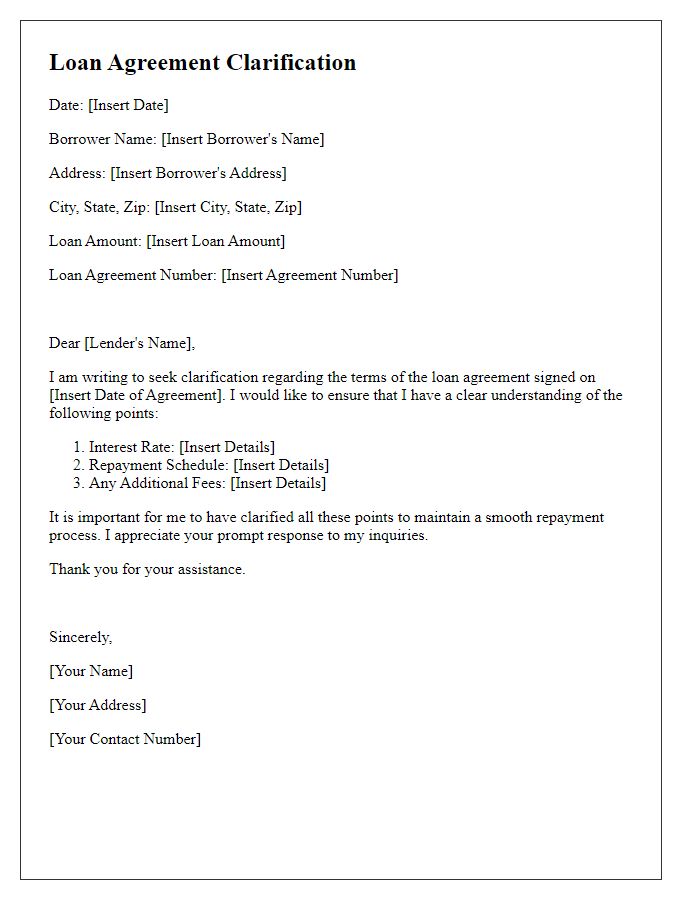

Interest Rate and Calculation Method

Loan agreements often specify critical factors such as the interest rate and calculation method. An interest rate, commonly expressed as an annual percentage rate (APR), can vary, with typical ranges between 3% to 15% for personal loans. The calculation method, such as simple interest versus compound interest, significantly impacts the total repayment amount. For example, simple interest is calculated based on the original principal over the entire loan term, while compound interest accrues on both the principal and previously accumulated interest, leading to a higher overall cost. Understanding these terms can ensure borrowers make informed decisions, particularly regarding loans from institutions like banks or credit unions.

Repayment Schedule and Due Dates

A clear repayment schedule is essential for managing loan commitments effectively. The schedule typically details due dates, which specify the exact days each payment is expected (often monthly), the total number of payments, and the amount of each installment. For instance, a loan of $20,000 with a 5% interest rate over a period of 5 years may entail monthly payments of approximately $377. This structure aids in budgeting and ensures borrowers are aware of their financial obligations. Furthermore, understanding the consequences of missed payments, such as late fees or increased interest rates, is crucial for maintaining a good credit score and avoiding potential default. The clarity of such terms can significantly influence a borrower's ability to adhere to financial commitments, ultimately impacting their overall financial health.

Penalties and Fees Conditions

Loan agreements often include various penalties and fees that borrowers must understand to avoid unexpected costs. Late payment fees, typically ranging from $25 to $50, apply if a payment is not received within a specified grace period, often 15 days after the due date. Prepayment penalties may be enforced when the borrower pays off a loan early, discouraging early payoff to ensure the lender recoups interest revenue; these fees can be a percentage of the remaining balance or a flat fee, depending on the lender's policy. Additionally, returned payment fees can occur if a borrower's bank rejects a payment, frequently amounting to $30 or higher. Understanding these conditions is critical for borrowers to manage their repayment strategies effectively and avoid unnecessary financial burdens.

Comments