Are you feeling overwhelmed by the loan qualification process? You're not alone! Many individuals find themselves navigating the complex world of loans and paperwork, which can be quite daunting. In this article, we'll break down essential steps for successfully revising your loan qualifications, making the process smoother and more understandableâso keep reading to discover how you can turn the tide in your favor!

Applicant's Personal Information

Providing updated loan qualifications can streamline the application process for prospective borrowers. Personal information such as full name, current address, and date of birth are critical for identity verification at financial institutions. Income details, including annual salary figures and employment status, play a crucial role in assessing creditworthiness and repayment capabilities. Additionally, information regarding current debts, such as existing loans or credit card balances, provides lenders with insight into the applicant's financial obligations. Lastly, credit score metrics, typically measured on a scale between 300 to 850, are essential for determining loan eligibility and interest rates offered.

Loan Details and Purpose

Loan qualifications can require revision based on specific loan details and intended purpose, such as personal loans for debt consolidation or home improvement projects. Typical loan amounts, ranging from $1,000 to $100,000, can significantly impact qualification criteria. Lenders assess factors such as credit score, usually above 650 for favorable rates, and debt-to-income ratio, ideally below 36%. Employment history and income stability play crucial roles, with a minimum monthly income of $3,000 often necessary. Furthermore, the purpose behind the loan, like funding a small business startup or financing an education, influences lender decisions, highlighting the need for detailed documentation and a well-articulated repayment plan to demonstrate financial responsibility and viability.

Revised Loan Terms and Rates

Revised loan qualifications can significantly impact borrowers, particularly in relation to interest rates and repayment terms. Financial institutions may adjust these conditions based on current market trends or borrower credit scores. For example, a decrease in the Federal Reserve's interest rate, which could drop to 0.25% in some scenarios, often leads to lower mortgage rates. Additionally, lenders might revise loan-to-value ratios (LTV) from 80% to 90% for refinancing, making home equity more accessible for borrowers. Changes in qualification standards can help borrowers improve their financial health by aligning repayment schemes with their cash flow, thereby reducing default risks and fostering market stability.

Supporting Documents Requirements

Loan qualifications often require various supporting documents to verify applicant information. Commonly needed items include proof of income such as recent pay stubs (typically last two months) and tax returns from the previous two years. Financial assets must also be documented, including bank statements (usually last three months) and investment account statements. Additionally, lenders often request employment verification letters or contact information for supervisors. Applicants must also provide personal identification, typically a government-issued ID such as a driver's license or passport. Lastly, credit reports may be obtained with applicant consent to evaluate creditworthiness and assess risk.

Contact Information for Further Inquiries

To revise loan qualifications effectively, the key elements include precise contact information for further inquiries. Providing a dedicated phone number (e.g., 1-800-555-0199) ensures direct accessibility for potential borrowers. An email address (e.g., loansupport@financecompany.com) allows for written communication, where applicants can ask detailed questions about eligibility criteria and documentation requirements. Additionally, specifying office hours (e.g., Monday to Friday, 9 AM to 5 PM EST) helps applicants know when to reach out for support. Including a physical address (e.g., 123 Finance Rd, Suite 100, New York, NY 10001) can also establish credibility, offering a location for in-person consultations if needed.

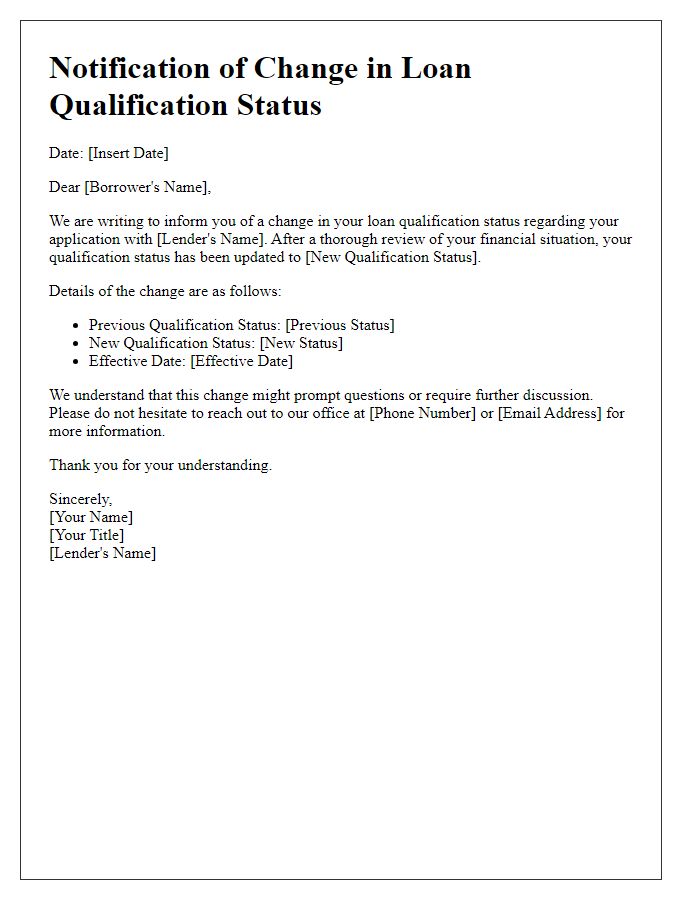

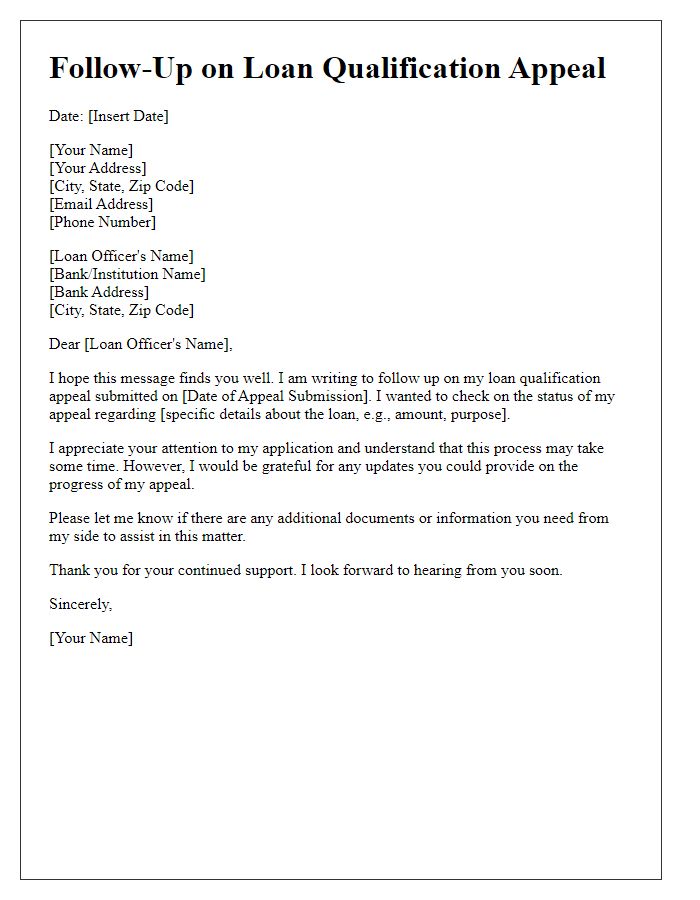

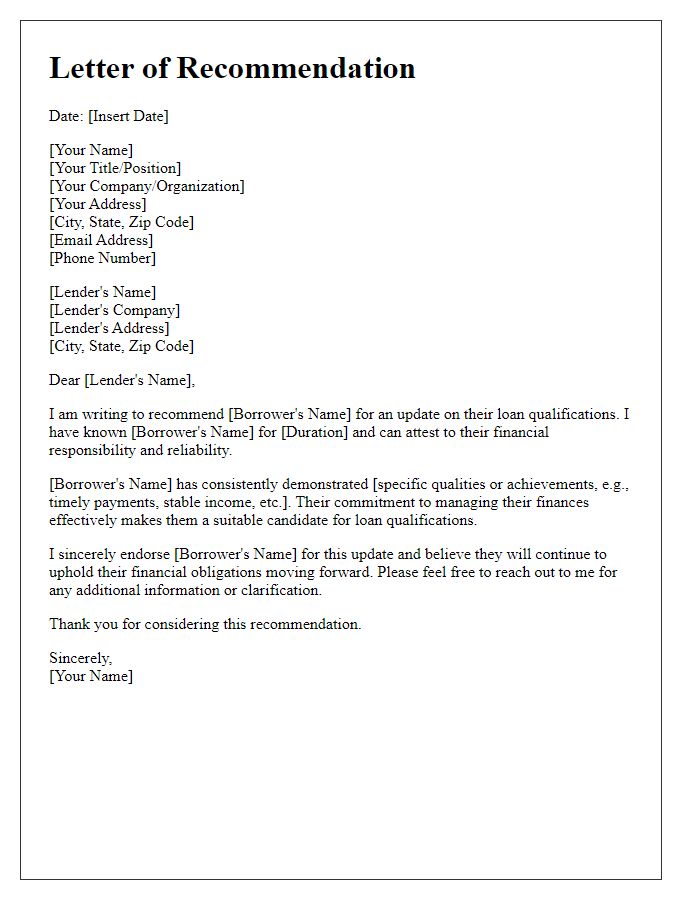

Letter Template For Revising Loan Qualifications Samples

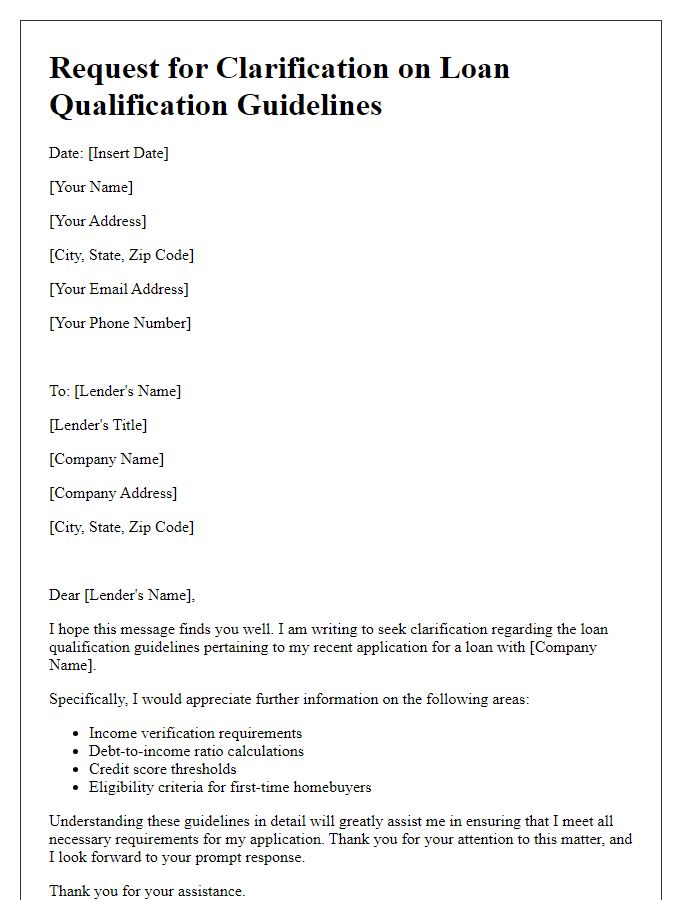

Letter template of clarification request for loan qualification guidelines

Comments