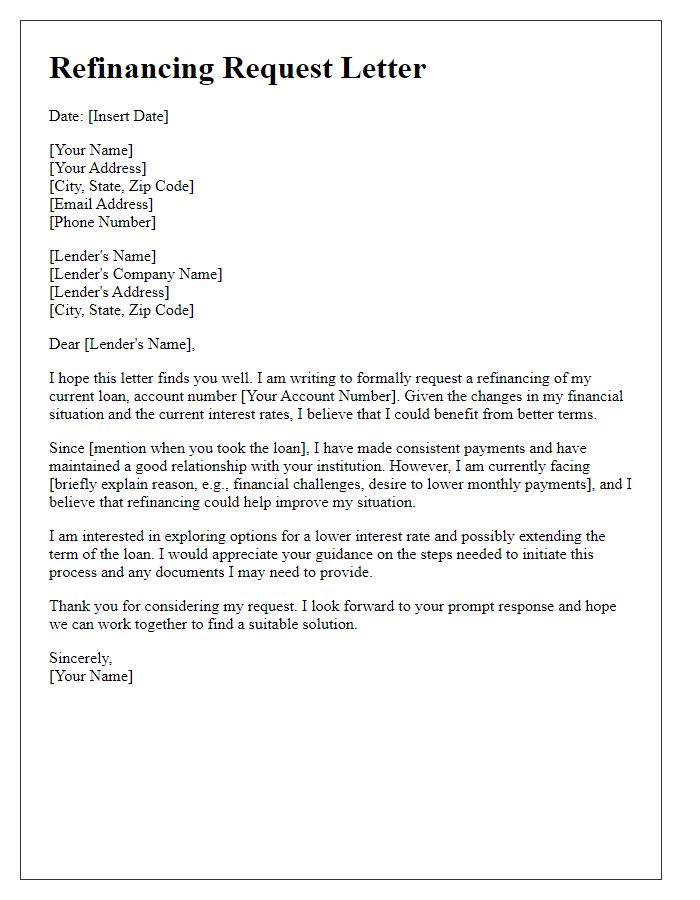

Are you considering refinancing your loan but unsure where to start? You're not aloneâmany people are navigating the same waters in search of better rates and terms. In this article, we'll break down a simple letter template to request your loan refinance, ensuring you make a great impression while clearly stating your needs. So, let's dive in and get you on the path to lowering those monthly payments!

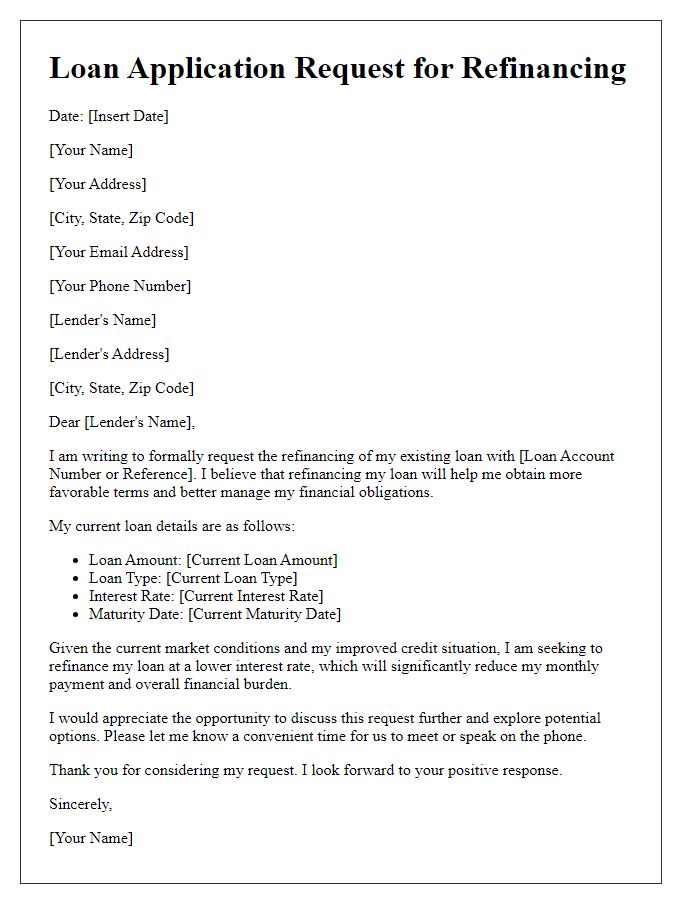

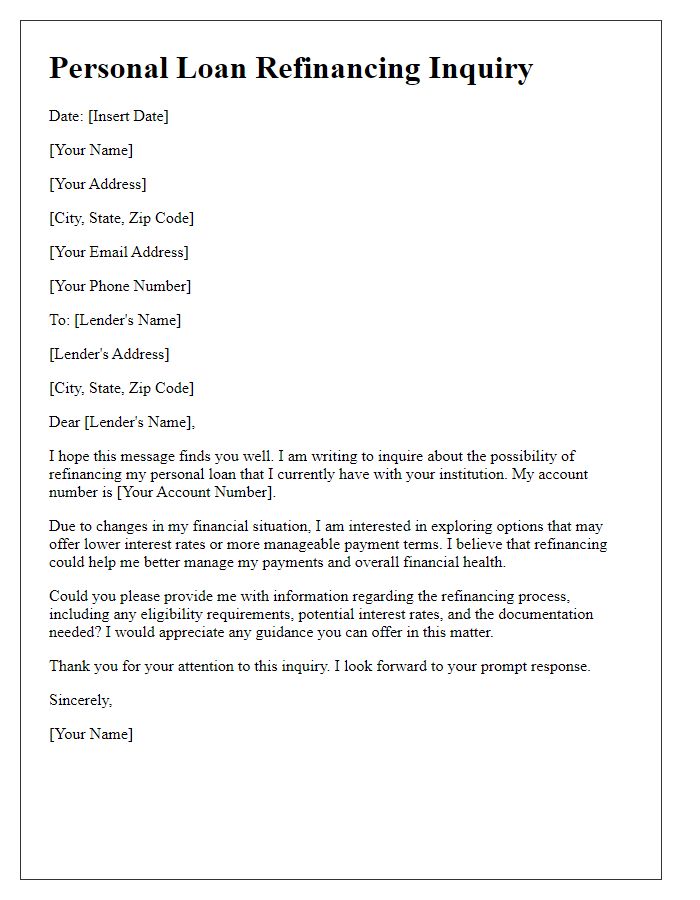

Loan Information

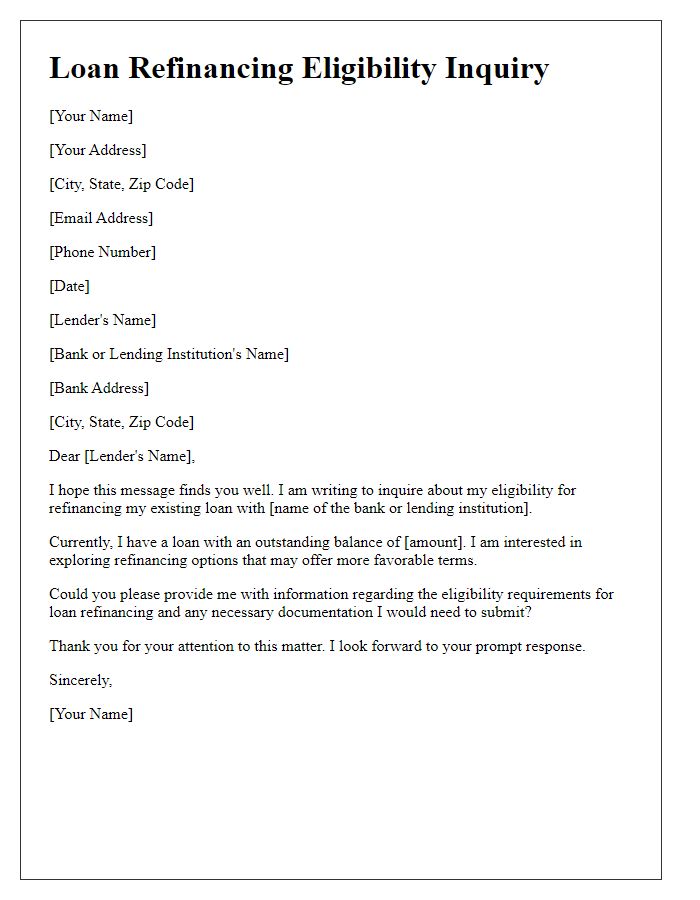

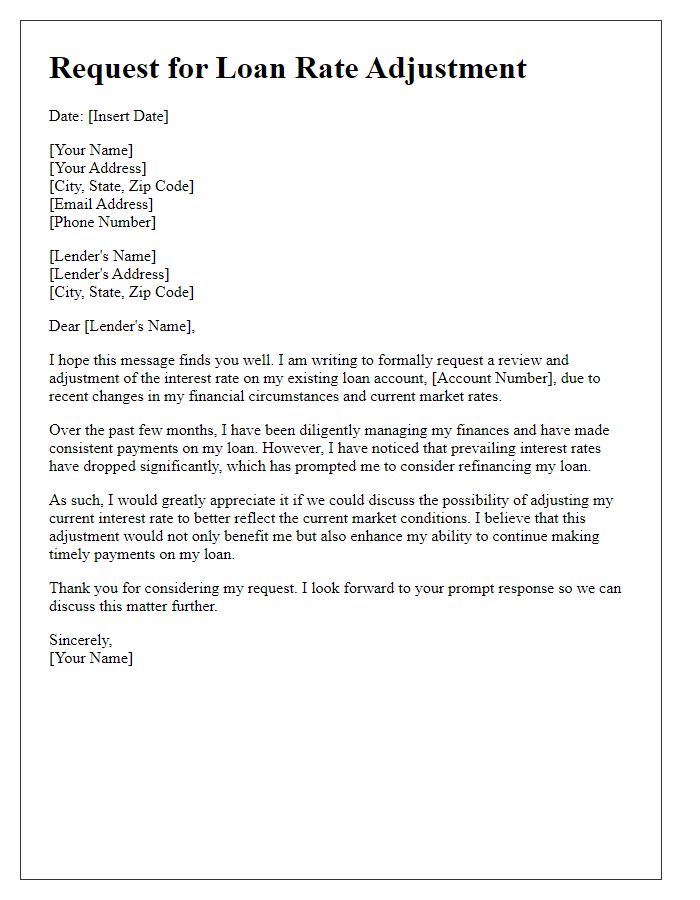

Refinancing a loan involves assessing financial metrics, loan types, and personal credit history. Borrowers, like homeowners seeking to reduce their interest rates or consolidate debt, typically explore options with local banks or online lenders. Interest rate reduction opportunities can vary, with average mortgage rates around 3-4% as of October 2023. A strong credit score, typically above 700, substantially increases eligibility for favorable terms. Additionally, documentation such as income statements, tax returns, and existing loan details, including the outstanding balance and repayment history, are crucial for lenders to evaluate the refinancing request effectively.

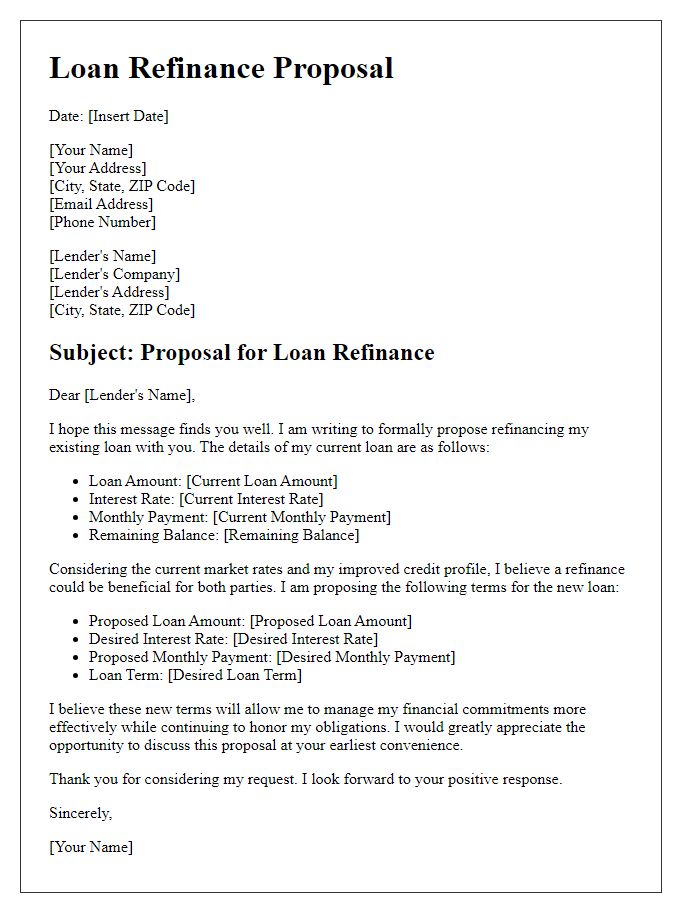

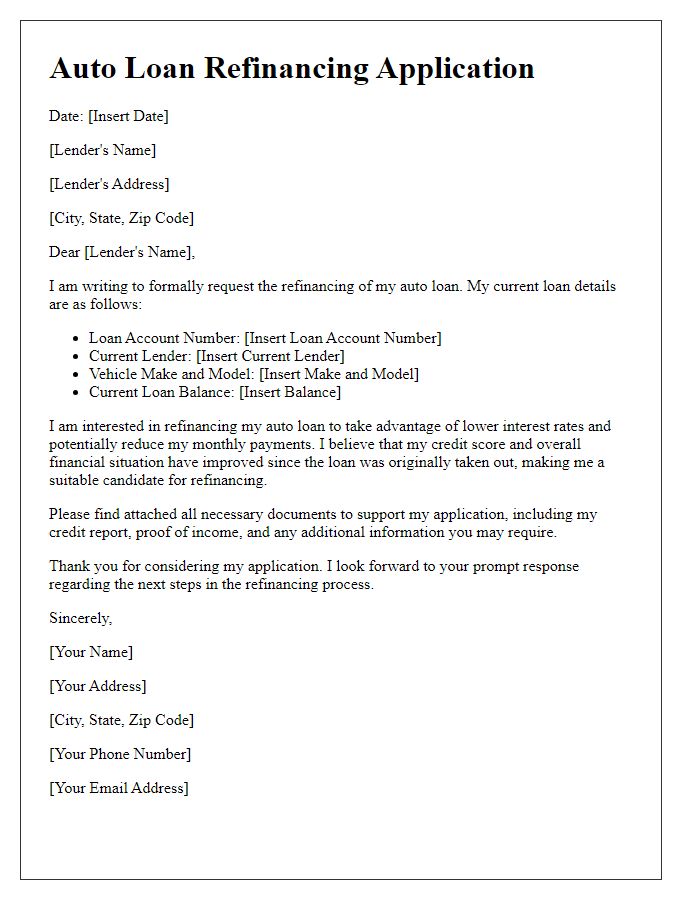

Financial Overview

A financial overview provides a snapshot of an individual's or organization's monetary status, encompassing annual income figures, existing debt levels, and asset valuations. For instance, a yearly income of $75,000 against existing debts totaling $20,000 can signify good creditworthiness when assessing refinancing opportunities. This overview often includes key metrics such as a credit score (ideally above 700 for favorable rates), monthly expenses (around $2,500), and savings (approximately $10,000 in emergency funds). The purpose of a financial overview is to present a compelling case for refinancing terms that may include lower interest rates and improved repayment conditions.

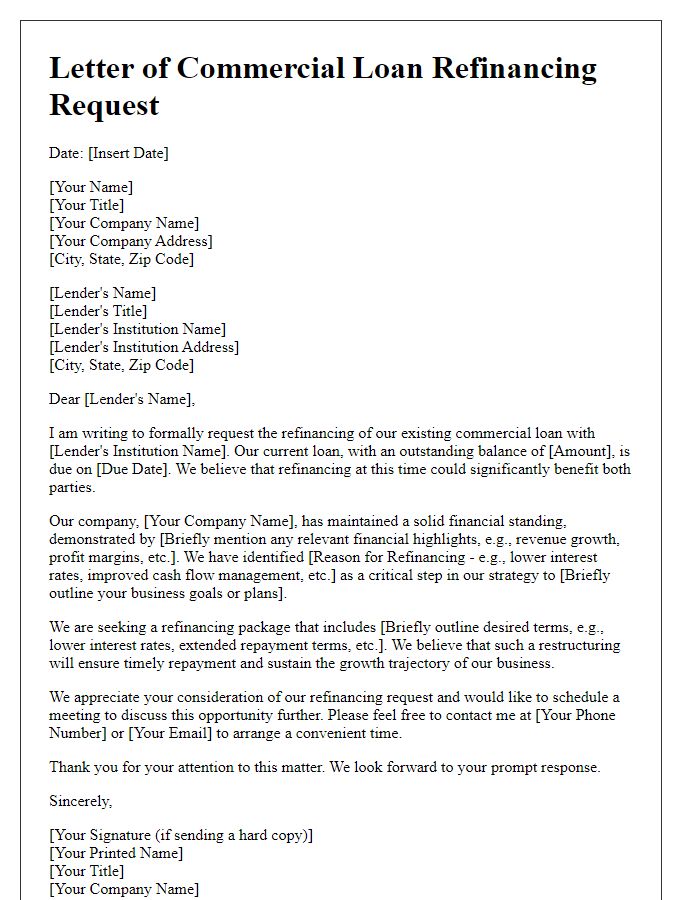

Reason for Refinancing

Refinancing a loan can strategically reduce monthly payments and optimize financial health. Homeowners often pursue this option to capitalize on lower interest rates, which can result in significant savings over time. For example, a 30-year fixed mortgage with a rate reduction from 4.5% to 3.5% on a $300,000 home can save approximately $150,000 in interest payments. Additionally, refinancing may allow homeowners to access home equity for improvements or consolidate higher-interest debt, like credit card obligations averaging 19% APR. Another compelling reason involves switching from an adjustable-rate mortgage (ARM) to a fixed-rate option, providing stability in monthly payments amidst potential rate hikes. Lenders such as Quicken Loans or Bank of America frequently offer competitive refinancing packages, making it essential to evaluate various terms and conditions.

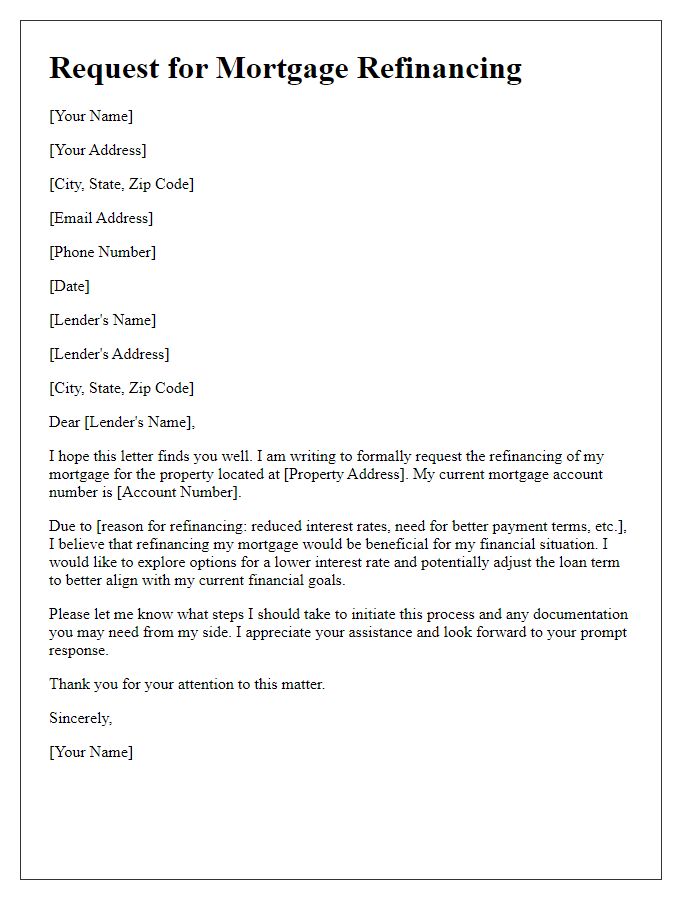

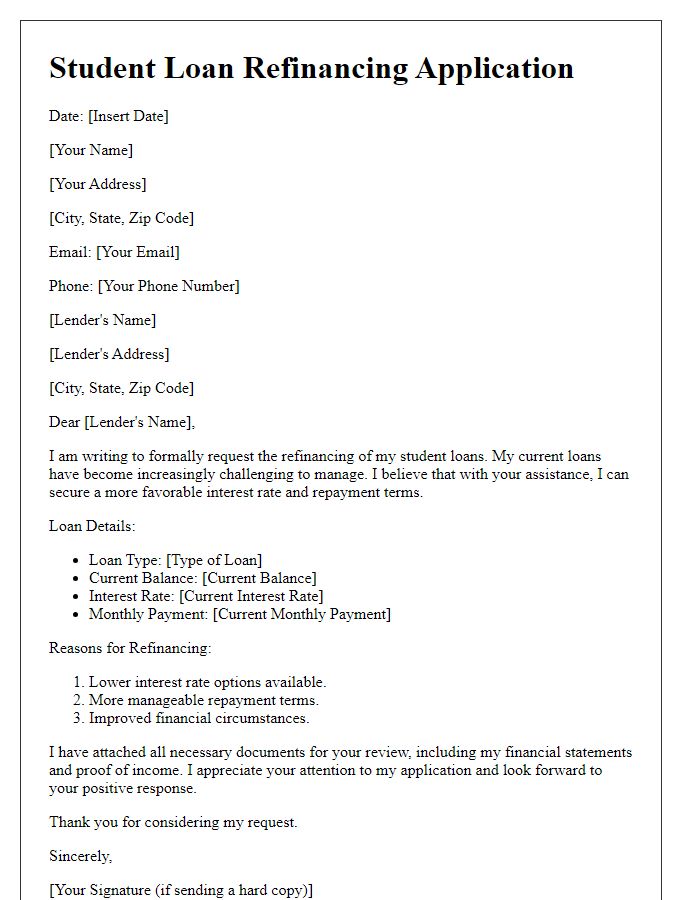

Supporting Documentation

To successfully support a loan refinancing request, essential documentation includes recent pay stubs (indicating income stability), bank statements (showing financial health), and tax returns (providing an overview of earnings over the past two years). Credit reports (detailing creditworthiness and outstanding obligations) should be included, alongside a current property appraisal (assessing the home's market value). Additionally, loan statements (showing existing obligations) and a personal statement (explaining the reason for refinancing and financial goals) can enhance the application by providing context and clarity to the lender. Personal identification documents, such as a driver's license or passport, are also vital for verifying identity and ensuring compliance with regulatory requirements.

Contact Information

Refinancing a loan can provide significant financial relief by lowering monthly payments and interest rates. Typical steps involve contacting a financial institution or mortgage lender. Key information includes personal identification details, existing loan balance, and loan account number. Detailed documentation like income statements, credit reports, and asset information may be required for approval. Financial institutions like Wells Fargo or Bank of America offer various refinancing options tailored to individual needs. Rates can vary based on credit scores and loan-to-value ratios, impacting overall costs. Engaging with a loan officer can clarify the refinancing process and potential benefits.

Comments